sefa ozel

The Russian invasion of Ukraine is about to reshape global energy markets forever and there’s a case to be made that Exxon Mobil Corporation (NYSE:XOM) will be one of the major beneficiaries of this development. While in the first half of the year the company has already generated record profits thanks to the spike in prices for major commodities such as oil and natural gas, there’s an indication that Exxon has all the chances to continue to create additional shareholder value in the foreseeable future. Despite the constant talks about the upcoming global recession, which generally leads to the decline in demand and subsequent depreciation of oil and natural gas prices, the European and American sanctions against the Russian oil and natural gas industries are creating a lifetime opportunity for Exxon to expand its market share in various regions.

Some sanctions have already crippled Russia’s ability to scale its export of commodities to other markets, while the loss of major western providers of oil and natural gas equipment is making it impossible for Russia to increase the production of fossil fuels. As a result, Exxon is now in the position to greatly benefit from this situation, and this article will explain how those sanctions are acting as catalysts for Exxon by diminishing Russia’s growth opportunities in the commodities space.

The Decline Of Russia’s Oil Industry And The Rise of Exxon

Right now, Russia is one of the biggest exporters of oil and natural gas around the globe. Exports of oil and natural gas account for 60% of its overall exports, while revenues from oil and natural gas industries account for 39% of the country’s federal budget. Therefore, it made sense for the Western governments to target the Russian oil and natural gas sector in order to prevent Russia from funding its war in Ukraine.

As of now, the UK, USA, and Canada have already stopped importing any fossil fuels from Russia, and the European Union is about to do the same thing. After approving the sixth package of economic sanctions back in June, the European Union aims to fully cut as much as 90% of imports of Russian crude oil by the end of this year, while at the same time it also plans to stop importing most of the Russian oil products by February 5, 2023.

In addition, while countries such as Hungary and Slovakia got an exception and will be able to import Russian oil through the Druzhba oil pipeline that goes through Ukrainian territory, there’s a risk that the pipeline could get out of order at any time. Earlier this year there were explosions near the pipeline, while a couple of weeks ago Ukraine halted a flow of oil through the pipeline due to the inability to receive transit fees. While the transit issue has been solved, for now, Ukraine could always stop the transit of oil through Ukrainian territory if Hungary continues its anti-Ukrainian rhetoric, making it possible to fully stop Russian oil exports to the European Union.

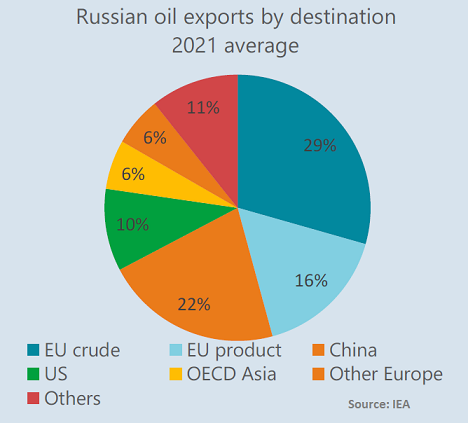

However, even if the oil continues to flow through Druzhba, even the expected 90% cut in oil imports will hurt Russia. In 2021, 61% of its oil and oil products exports were going to the EU, USA, and other European countries. Due to the implementation of the sanctions described above, Russia will lose most of those markets, as even Serbia, which is not a member of the European Union, has been saying that it won’t be able to import Russian oil due to those sanctions later this year.

Russian Oil Exports By Destination 2021 Average (IEA)

At the same time, while it’s true that Russia has been actively trying to replace the European and American markets by sending more supplies to India, there’s a risk that it won’t be able to fully replace the loss of the European and American markets. The problem for Russia is that most of its infrastructure that transfers the oil has been built to serve European customers. The country has no direct pipeline with India and as a result, it heavily relies on ships to transfer oil to India and other far-away markets.

However, there’s an indication that it won’t be able to scale the transfer of oil via ships in the foreseeable future as both the EU and UK are about to also implement a ban on insuring ships that transfer Russian oil by the end of this year. Considering that the European insurers account for 95% of the total ship insurance market, it becomes obvious that Russia will have a hard time transferring its oil anywhere in the world. Let’s not forget that a similar insurance ban was placed on ships transferring Iranian oil, which resulted in a decrease in Iranian oil production that lead to a decrease in export revenues.

In addition to all of this, major western oil and gas equipment providers such as Baker Hughes (BKR) and Halliburton (HAL) have voluntarily left the Russian market after Russia’s invasion. This will have a negative effect on the country’s ability to drill more oil in the future. EIA estimates that due to the sanctions along with the loss of western oil and gas equipment providers, Russia’s production is going to decline from 11.3 million barrels in Q1’22 to 9.3 million barrels by Q4’23. On top of that, Russian oil already trades at a deep discount in comparison to Brent, and once the sanctions are implemented later this year, there’s a high chance that the discount will widen while Russian export revenues will fall due to the inability to successfully redirect its oil to non-European customers.

Considering all of this, the main question at this stage is how all of those developments would benefit Exxon. The answer is quite simple. In 2021, the EU has imported 2.2 million barrels per day of oil and 1.2 million barrels per day of oil products from Russia. Once Russian oil and oil products mostly leave the European markets, Exxon will have the opportunity to fill the void and supply Europe from its own global sources. In addition, by having a considerable refining capacity on the continent, the company will be able to continue to generate meaningful returns in the following quarters due to the possible refinery capacity shortage that would come with the ban on Russian crude.

At the same time, as Russian oil leaves the market, there’s a possibility that we’ll continue to be in a situation where the demand outweighs the supply, especially if the ship insurance ban is successful. In this scenario, the oil will continue to trade at relatively high prices, allowing Exxon to continue to make excessive returns for months to come, as buyers will be looking for non-Russian supplies.

The Changing Natural Gas Market And The New Opportunities For Exxon

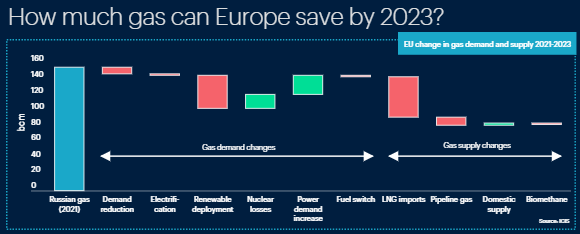

In addition to oil, there are currently efforts by the EU to fully stop relying on the imports of Russian natural gas. Out of 210 bcm of natural gas that Russia exports annually, around 155 bcm of natural gas has been going directly to European consumers mostly through different pipelines. While the European Union didn’t sanction the imports of Russian natural gas, it nevertheless began to decrease its reliance on it after Russia’s unilateral decision to abruptly change its contracts with European customers and decrease the flow of natural gas due to alleged political reasons.

The latest estimates suggest that by 2023 the EU will be able to decrease its reliance on Russian natural gas to just ~70-80 bcm annually, and fully stop importing it in the following years:

Europe’s Potential Natural Gas Profile By 2023 (ICIS)

At the same time, earlier this year the EU implemented sanctions against the Russian LNG sector by banning the exports of crucial LNG-related equipment that’s required for the expansion of the Russian LNG industry. As a result, the Russian Ministry of Economic Development expects no growth in exports of LNG in the following years, while Bloomberg’s report suggests that we should expect a tight supply and a high demand for natural gas in the following years. This is because Russia can’t simply begin to send all of its natural gas to China or India due to the lack of necessary infrastructure and the inability to scale its LNG exports as a result of sanctions.

Thanks to this, Exxon is likely going to continue to generate record profits in the natural gas business due to the high prices for natural gas in Europe and Asia. At the same time, as the LNG market is expected to be tight in the following years due to Russia’s inability to scale its LNG industry as a result of sanctions on the equipment, Exxon will be able to rapidly expand its presence in the natural gas business at Russia’s expense. The company is already ramping up its LNG portfolio and Exxon’s CEO Darren Woods said some encouraging words about this during the latest conference call in late July:

We’ve got the Golden Pass project here in the U.S., which will allow us to export LNG from the U.S. into Europe. And so we’ve got Mozambique, and that’s coming on the back end of this year. And of course, we’ve got work going on in PNG. And so bringing more LNG supplies to help offset some of the Russian gas going into Europe will be another really critical step forward and the diversification of supplies for Europe.

The Future Of Exxon In This New Reality

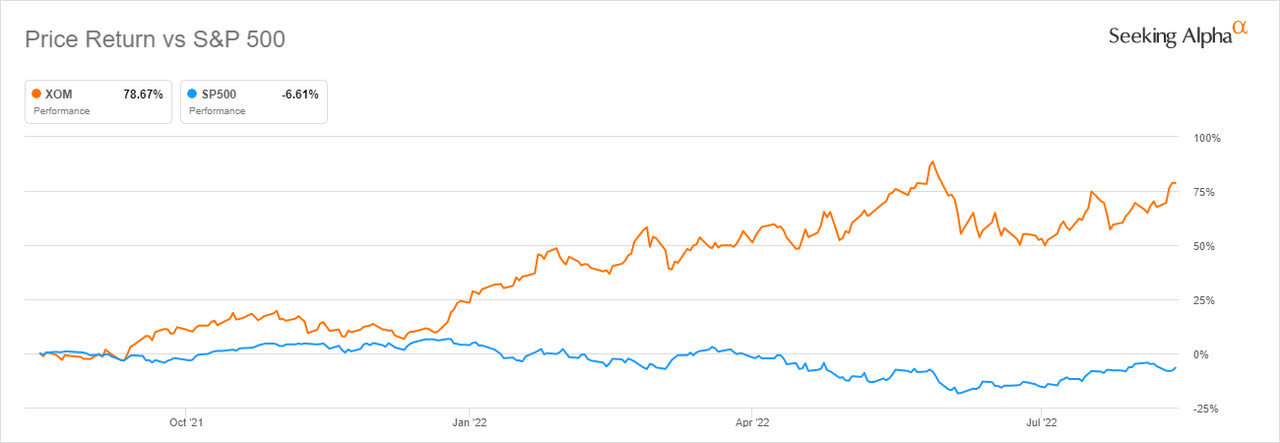

Just like Russia, Exxon was also able to generate record profits in the first half of the year due to high prices for oil and natural gas. The latest earnings report showed that in Q2 the company’s revenues increased by 70.8% Y/Y to $115.68 billion and were above the street consensus by $4.01 billion, while its non-GAAP EPS was $4.14, above the estimates by $0.25. Thanks to such a great performance, Exxon’s stock was able to avoid losing billions in value in comparison to stocks from other industries and has greatly outperformed the S&P 500 index in the last 12 months.

Exxon’s 12-Month Returns Against S&P 500 Index (Seeking Alpha)

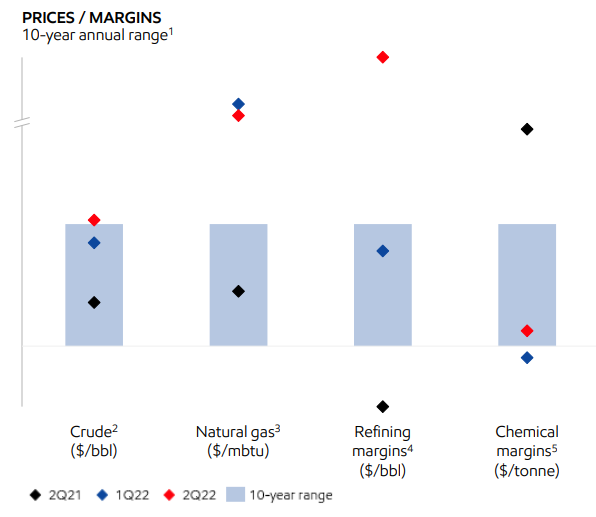

At the same time, even though crude, natural gas, and refining margins are currently above the 10-year range, the successful implementation of the sanctions could create a scenario in which those margins will continue to be at the current levels. After all, the western sanctions act as a catalyst for Exxon since they indirectly help it to expand its presence in different businesses in various regions across the globe at Russia’s expense, and help it to benefit from the current high-price environment at the same time.

Prices/Margins Ratio For Exxon’s Businesses (Exxon Mobil)

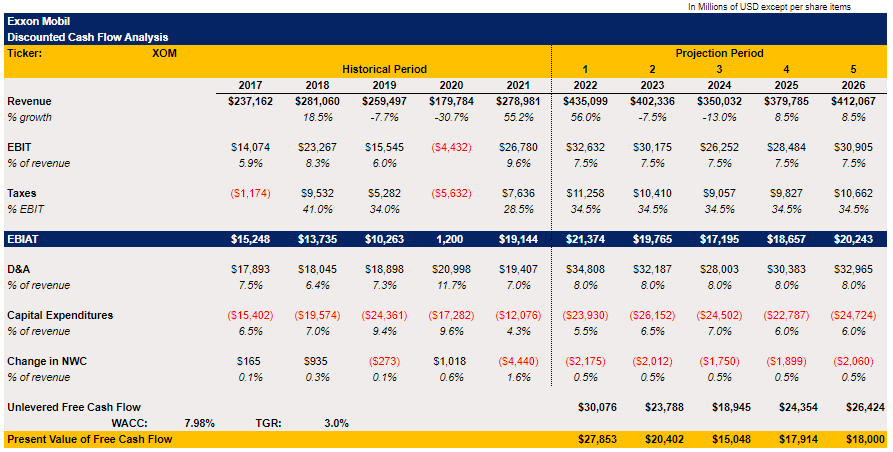

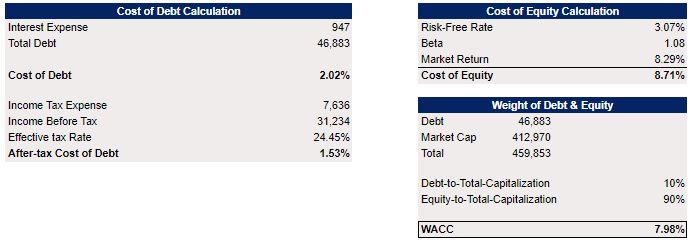

Given all of those developments, I decided to create my own DCF model to find out what Exxon’s fair value should be in the current environment. For the revenue forecast, I’ve used the street consensus, which suggests that we’ll see a ~56% increase in Exxon’s revenues in 2022 and a minor Y/Y decline by ~7.5% in 2023. After that, I’m assuming an additional Y/Y decline in revenues in 2024 and then a subsequent normalization and growth in 2025 and 2026. The EBIT, taxes, D&A, capital expenditures, and change in NWC expectations are mostly in-line with historical averages of previous years. The terminal growth rate in the model is 3%, while the WACC is 7.98%.

Exxon’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author) Exxon’s WACC Calculations (Historical Data: Seeking Alpha, Assumptions: Author)

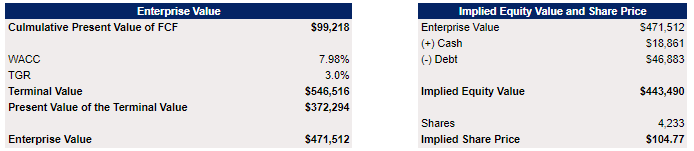

With all of those assumptions, the model shows that Exxon’s enterprise value is $471.5 billion, its implied equity value is $443.5 billion, and its fair value is $104.77 per share, which represents an upside of ~7% from the current market price.

Exxon’s Fair Value Calculations (Historical Data: Seeking Alpha, Assumptions: Author)

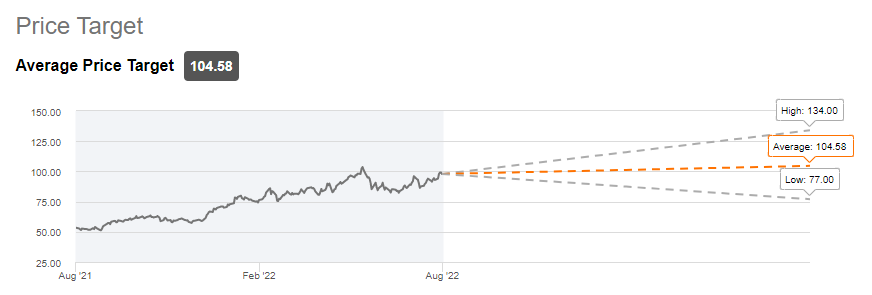

My model is in line with the current street consensus price target, which stands at $104.58 per share. However, as I’ve already stated earlier, there’s a possibility that margins for fossil fuels continue to be at the current record levels, which will make it possible for Exxon to continue to generate record profits for much longer than we currently expect. In such a scenario, my assumption could be considered conservative at best, and the upside for the company’s shares could be even more significant.

Exxon’s Average Price Target (Seeking Alpha)

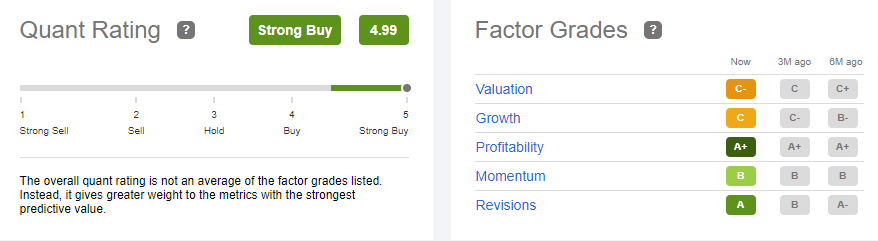

Seeking Alpha’s quant rating shows that I could be correct with my thinking, as it gives Exxon a strong buy rating, which shows that the stock indeed has more room for growth in the current environment.

Exxon’s Quant Rating (Seeking Alpha)

Risks

There are three major risks regarding my bullish thesis on Exxon. The first one is the probability that sanctions could be dropped. There are already calls by former European officials, who for years have been on the Kremlin payroll, to strike an energy deal with Russia at Ukraine’s expense. At this stage, I don’t see it happening, but there’s always a risk that due to high energy costs in Europe, civil unrest might erupt, which could result in a change of course by some governments. However, to fully drop all of the sanctions, all members of the European Union must agree to this and it’s unlikely that countries such as Poland, Finland, or the Baltic States will vote for this. Therefore, I don’t see sanctions against Russia dropping anytime soon.

The second risk is the inability of western governments to properly implement all of those sanctions. Currently, Russia, with the help of third parties, is running a scheme with ‘dark tankers’ where different ships engage in ship-to-ship transfers in an open sea in order to hide the origin of the oil. Sometimes such schemes are uncovered, but those who engage in them don’t face major consequences. To fix this, the State Department needs to designate Russia as a state-sponsor of terrorism, which will make it not worth it for other parties to engage in such activities with Russia at any price. Not only has Nancy Pelosi supported this action, but there’s already an approved resolution in the Senate, which calls the State Department to designate Russia as a state sponsor of terrorism. If that’s not going to happen, then there’s always a risk that some sanctions could become ineffective, which could undermine my whole bullish thesis for Exxon.

The third risk is the possibility that Exxon could fail to grab Russia’s oil and natural gas market share in Europe and abroad, as other companies and even countries also have the same opportunity to expand their presence at Russia’s expense. While it’s true that thanks to its dominant position in the oil and gas industry it’s much easier for Exxon to reach new deals, the EU has been actively souring supplies from Azerbaijan, North Africa, and the Middle East, where Exxon doesn’t always have an upstream production in place. Therefore, while Exxon will likely continue to benefit from higher prices for fossil fuels for a while, there’s no guarantee that it will be able to solely capture a significant portion of Russia’s market share in various markets across the globe.

The fourth risk is a major global recession, which aggressively destroys the demand for fossil fuels. It has already become unbearable for some Europeans and Americans to deal with higher energy prices and considering the latest hawkish speech by the Fed Chairman Jerome Powell, there’s a possibility that the downside from a possible global recession could outweigh all the positives that come with Russian sanctions for Exxon. This is something that investors need to be aware of as well.

The Bottom Line

By targeting Russian oil and natural gas industries, the western sanctions are indirectly helping Exxon to expand its worldwide presence at Russia’s expense and also helping it to continue to benefit from the high prices for fossil fuels. We still have a few months before those sanctions are implemented and the effects are seen, so there’s still an opportunity for investors to decide whether to add Exxon’s stock to their portfolio given the latest developments.

Be the first to comment