Brandon Bell

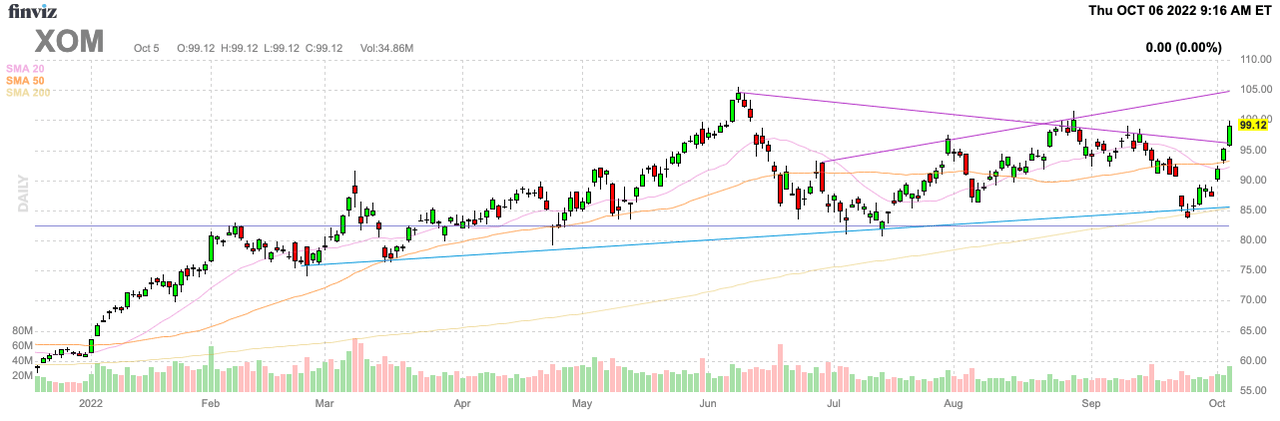

The news of the day supports Exxon Mobil (NYSE:XOM) rallying to new highs for the year. The OPEC+ production cut and the Biden Administration having no apparent interest in focusing on U.S. energy independence to solve the problems with higher energy costs is a positive for the stock. My investment thesis was more negative on the oil giant when the stock originally topped $100 due to plenty of supply sloshing around to meet demand, but the failed plans of the current administration are pushing energy prices higher.

Source: FinViz

Policy Mistakes

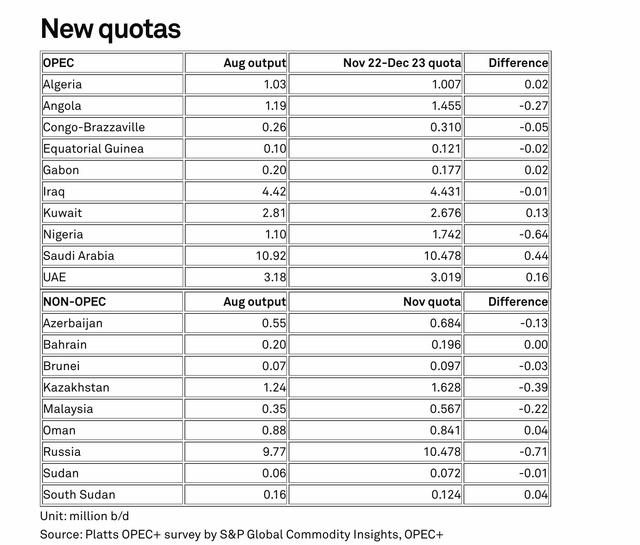

Even with Brent crude prices above $90/bbl, OPEC+ decided to cut production targets by 2 million b/d. The oil producing nations weren’t meeting previous production targets of 42 million b/d, so the cut is part symbolism and not actual production cuts.

S&P Global is estimating the OPEC+ group only cuts production by 800K b/d due to several countries not even reaching production at the new target levels. The real question is whether any OPEC country actually reduces production with Angola, Kazakhstan, Nigeria and Russia production levels in August far below new November targets.

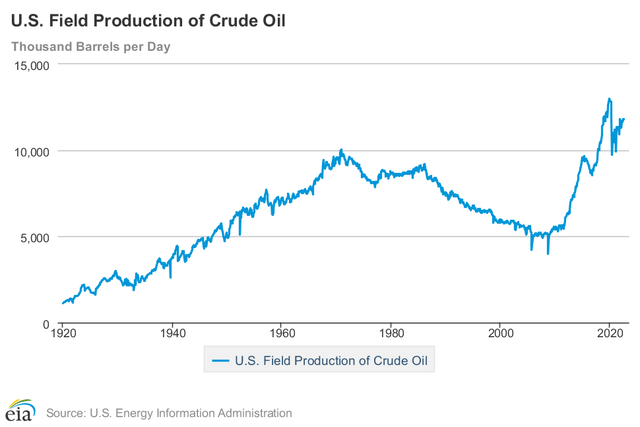

Regardless, the biggest issue is the apparent unwillingness of the Biden Administration to focus on programs to boost domestic production and focus on energy independence. U.S. oil production is near record levels, but production hasn’t matched the 13.0 million b/d peak pre-COVID level and drilling rigs remains far below prior levels in a clear sign the industry isn’t trying to aggressively ramp up production.

According to the EIA, the current U.S. oil production is at 11.8 million b/d in July 2022. The monthly production number is actually above all levels prior to 2019, but the last few months prior to COVID lockdowns had the U.S. at production of close 13.0 million b/d.

The good news for Exxon Mobil is the unwillingness of the industry to aggressively drill for more oil and natural gas. The U.S. drilling rig count is still below 800 rigs when the peak levels in 2019 were above 1,000 rigs and topped 2,000 rigs drilling for oil and natural gas back in 2011.

The easy solution is for the Biden Administration to immediately push the industry to start ramping up production to fill any holes left by OPEC+ cutting production. Instead, the only real solution offered by President Biden is more releases from the strategic reserves and a lengthy shift to unreliable alternative energy.

The strategic reserves now hold an estimated 416 million barrels of oil, the lowest level since July 1984. The U.S. has already sold 155 million barrels with a goal of reaching 180 million barrels leaving the country with a strategic weakness.

Short Term Positive

All of this news is potentially positive for Exxon Mobil in the short term. The stock has struggled to rally much beyond $100 due to these benefits only accruing over the short term.

A new political structure in the U.S. after the midterms in November and an end to the war in Ukraine could clear up a lot of the supply issues keeping oil prices high. Exxon Mobil would suffer from the normal cycle where oil prices fall far below $80/bbl during a recession.

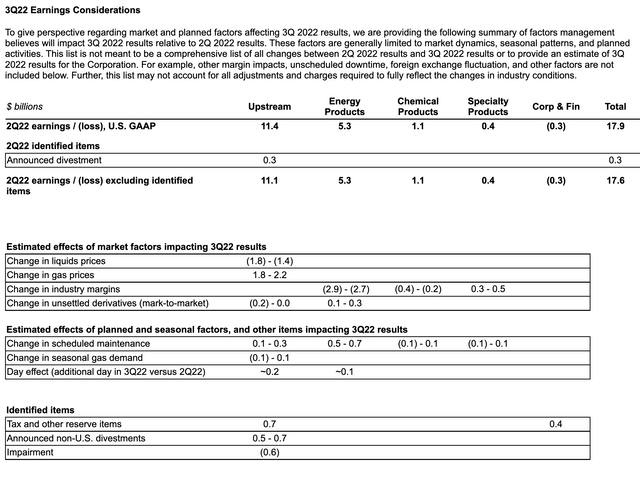

The Q3’22 updated guidance probably provides a good sign of more normalized profits. Exxon Mobil reported Q2’22 profits of $17.6 billion and is now guiding towards a reduction primarily due to a $2.8 billion dip in energy products margins. The changes in liquids and gas prices mostly offset each other in the quarter.

Source: Exxon Mobil SEC filling

Reuters listed the Q3 average energy prices at still historically elevated levels. U.S. natural gas prices rose to $8.47/MMBtu, up from $7.17/MMBtu in Q2. Brent crude prices slipped to $98/bbl from an average of $109/bbl in Q2.

Exxon Mobil earned $4.14 per share last quarter and analysts have the energy giant earning $3.47 this quarter, which appears about in line with updated numbers. The energy giant is definitely on pace for annual earnings topping $12 per share.

Takeaway

The key investor takeaway is that Exxon Mobil could easily rally from here with energy prices staying higher for longer. The current administrations politics and OPEC+ cuts sets up the Q3’22 earnings closer to a baseline in the current environment providing the ability of the stock to rally above $100. Long term, energy supplies will eventually rebound to push supplies lower.

Investors definitely will want to cash out on the next rally, but Exxon Mobil appears to have more upside in the short term.

Be the first to comment