Dimitrios Kambouris/Getty Images Entertainment

The investment thesis

Two of the most visionary minds of our age, Bill Gates and Warren Buffett, diverge starkly on the issue of big oils. And both put their money (quite a bit) behind their opinion.

Bill Gates has been quite vocal about our green energy future for a while. He recently commented in a briefing at the COP26 climate summit in Glasgow, Scotland, that, “Some of these giants will fall. You know, 30 years from now, some of those oil companies will be worth very little.” And he also published a book to detail his vision for our energy and climate future (an area in that I share a common interest with him). And do not let his software background fool you – he now is as much a world-class expert (if not more so) on energy issues than on software issues. And whether you agree with his view or not, he is putting serious money behind his opinion. He has invested billions of dollars in a multitude of companies and funds to back technologies like cheaper nuclear energy, decarbonization, energy storage, et al.

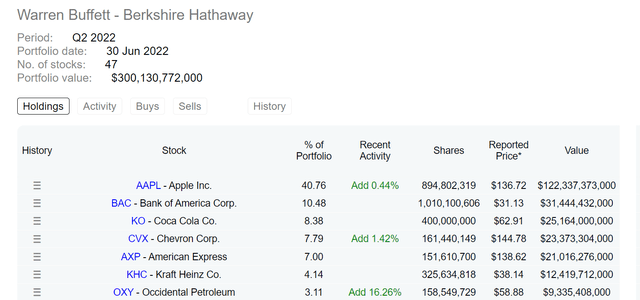

On the other hand, his old friend Warren Buffett holds a different opinion. Although Buffett is less vocal about this opinion on big oils, his actions speak equally loudly. In the latest disclosure filed for Berkshire Hathaway Inc.’s (BRK.A, BRK.B) equity holdings, he kept adding to his already-large positions on big oils as you can see from the following chart. He added 1.4% to his Chevron Corporation (NYSE:CVX) position, now the 4th largest position in his equity portfolio. He also added more than 16% to his Occidental Petroleum Corporation (OXY) position, now the 7th largest position. The CVX and OXY position now total over $32B. And do not forget that besides these stock holdings, Berkshire also operates Berkshire Hathaway Energy and recently purchased the natural gas transmission and storage assets of Dominion Energy.

Great minds think alike, and Gates and Buffett certain think alike in many areas. But what is even more interesting is when they do not, such as on the issue of big oils.

In this article, I will side with Buffett on this one. I will analyze Exxon Mobil Corporation (NYSE:XOM) and CVX to argue for their role in our energy future in the long term, and also for their very favorable odds to reward shareholders at the same time. And you will see that XOM and CVX can provide a healthy return to shareholders in the next 10 years even under some of the following drastically conservative assumptions:

- We will only consider the worth of their proven oil and gas reserves

- And ignores all the other profit drivers, such as their downstream operations, green energy initiatives, and ongoing explorations.

XOM and CVX: the current worth of their old energy

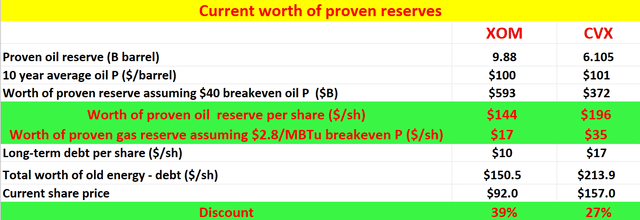

Now, let’s evaluate XOM and CVX as investments. The businesses are quite complicated and have many intricacies. XOM’s business alone could take up the space of a few books. Here to simplify the thesis and to make the argument on the drastically conservative side, I will assume everything XOM and CVX current have are worthless except their proven oil and natural gas reserve.

It is a dramatic simplification (have I warned you about it already?). But it helps to see the essence of the thesis and leaves us a really wide margin of safety. In reality, they both have a sizable downstream segment that contributes to a substantial fraction of their income, and their ongoing exploration will surely discover new reserves, and they also have new initiatives in the new energy space.

Under this dramatic simplification, the table below shows how things stand with XOM and CVX at this moment. XOM currently has a proven oil reserve of 9.88 billion barrels and CVX 6.1 billion barrels. With a 10-year average oil price of $100 per barrel, the proven oil reserve itself is worth $593 billion for XOM and $372B for CVX assuming a breakeven oil price of $40 per barrel. Here I have to clarify that analysis of the so-called breakeven price is more an art than a science. A lot of it depends on how you define the concept itself. Let me just quote a few numbers to illustrate the degree of ambiguity. XOM’s extensive operations in the Permian Basin feature the lowest production cost only around $15/barrel. And its production cost in Guyana is about $25/barrel. XOM’s CEO Darren Woods commented that the overall oil production cost is about $35 per barrel. So here I will use $40 to be on the more conservative side.

All told, the proven oil reserve would be worth $144 per share for XOM and $196 per share for CVX.

Then both businesses also have proven natural gas reserves. The discussion of natural gas is a bit more involved than the more frequently discussed oil business. A full discussion merits a separate article by itself. So here I will just directly get to the end results. Assuming a 10-year average gas price of $5/MBTu and a breakeven gas production price of $2.8/MBTu, the proven natural gas reserve is worth about $17 for XOM and about $35 for CVX on a per-share basis.

Now as you can see, just the current wroth of their proven oil and gas reserve is already substantially above their current stock prices, leaving a margin of safety of 27% for CVX and 39% for XOM.

Energy outlook for 2050

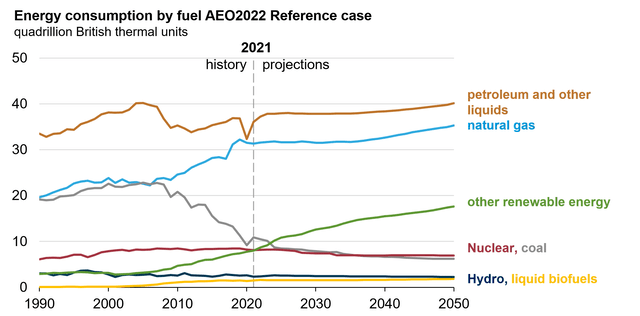

Next, let’s see if their above “old energy” will become less worthy in the future. Here, I will be quoting the energy outlook projected for 2050 by the U.S. Energy Information Administration (“EIA”) in the 2022 Annual Energy Outlook (“AEO”). the AEO is released recently at the Bipartisan Policy Center in March. It is a dry stack of slides with lots of numbers. But I highly recommend it to all investors interested in both old energy and new energy. It helps to level set our energy reality now and in the foreseeable future. It also helps to clarify some of the popular misconceptions (e.g., renewable energy is growing fast and it will take over soon). The following summary of the report is directly quoted from the AEO below:

- Petroleum and natural gas remain the most-consumed sources of energy in the United States through 2050, but renewable energy is the fastest growing

- Wind and solar incentives, along with falling technology costs, support robust competition with natural gas for electricity generation, while the shares of coal and nuclear power decrease in the U.S. electricity mix

- U.S. crude oil production reaches record highs, while natural gas production is increasingly driven by natural gas exports

The chart below shows more specifics. In summary, yes, renewables will be growing fast (the green line below). But do not forget that: A) they start from a small base; and B) our overall energy demand will be growing too. As a result, the demand for our “old energy,” petroleum and natural gas, would keep growing too.

So, I really do not see a decline in demand for petroleum and natural gases. Then next, let’s see if their prices would decline.

XOM and CVX: will their old energy be worth less going forward?

My view is no, for several reasons.

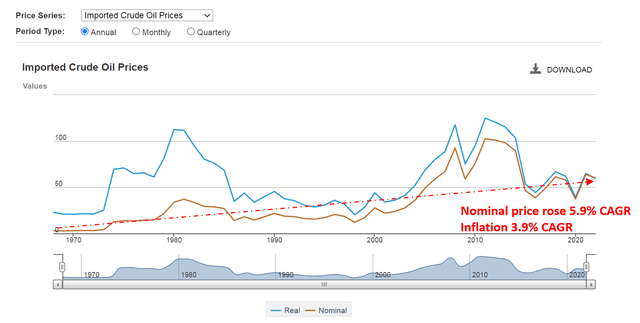

First, I expect oil and gas prices to at least keep up with inflation in the long term. As shown in the next chart, the nominal oil prices over the past 50+ years have been rising at 5.9% CAGR – this is the rate combining both real price appreciation and inflation. Over this same period of time, inflation has been 3.9% CAGR on average. So as a result, oil prices have consistently beaten inflation by a whole 2%.

Source: U.S. Energy Information Administration (EIA)

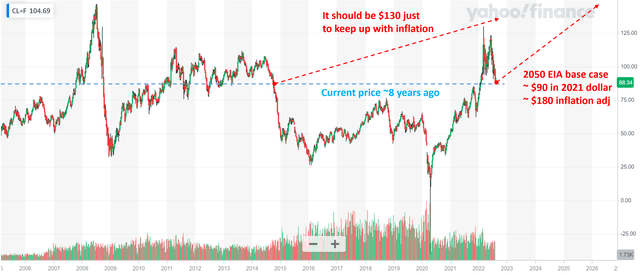

Second, the recent oil price rally is actually overdue and now might be the starting point of a new oil commodity cycle under the current inflationary environment. As aforementioned, the oil price has consistently beaten inflation in the past until it stopped for the past 10 years or so as you can see from the following chart. Crude oil price is now where it was 8 years ago even after its recent surges. As a result, a rally in oil prices is overdue. The oil prices have more catch-up to do in the future. It should be at about $130 now to just make up the inflation in the past decade or so.

Finally, there are plenty of other industrial and civilian uses for petroleum besides burning them. They are ubiquitously applied in an incredibly wide range of chemical processes to make things that our daily life rely on. As argued in our earlier article, it will take old energy to make new energy in the forms of materials, manufacturing processes, electricity generation, et al.

All told, as a base case, EIA’s 2022 Annual Energy Outlook projects the Brent crude oil price by 2050 to be $90 per barrel in constant 2021 dollars. Assuming inflation of 2.5% per year, this would translate into an oil price of $180 per barrel by that time, more than double the current price.

Margin of safety and risks

If my above analyses are inaccurate, I believe the inaccuracies are on the conservative side for the reasons touched on earlier. To reiterate, this analysis only considers their current oil and gas reserves and ignores all the other profit drivers. In essence, the analysis is a form of asset valuation and ignores their future earnings (also ignores all other assets except oil and gas reserves).

Although investment in XOM and CVX does involve their own risks, both in the short term and long term.

- The Ukraine/Russian conflict is a big near-term uncertainty. The duration and eventual outcomes of the conflict (as with any geopolitical conflict) are totally uncertain. It could generate substantial impacts on both the global overall financial markets and the energy stocks in unpredictable ways.

- Furthermore, the pace and degree of the post-COVID economy recovery are also uncertain. However, the pandemic is far from over yet and uncertainties like the delta and omicron variants still exist. These uncertainties could impact the demand-supply dynamics. You can see from the AEO chart above how much a dip in oil demand has been created by the COVID pandemic in 2021.

Conclusion and final thought

There is little doubt that our world needs to move away from fossil fuels as quickly as possible. So ultimately, the thesis here is not to bet against our green energy future, which will and must happen. My bull thesis on oil stocks like XOM and CVX is more about the timeframe, the old energy’s role in our new energy future, and also the old energy companies’ ability to adapt in the meantime. In essence, the thesis is a sort of valuation-arbitrage and time-arbitrage. More specifically:

- Valuation-arbitrage. It is no secret that oil stocks are cheaply valued now. As analyzed in this article, just the current worth of their proven oil and gas reserve is already substantially above their current stock prices, leaving a margin of safety of about 27% for CVX and almost 40% for XOM. The margin is even wider if you consider their other profit drivers (such as their downstream operations, green energy initiatives, and ongoing explorations).

- Time-arbitrage. “Old energy” will still remain the world’s largest energy source in the next 30 years or so. It will take energy to make new energy. And the new renewable energy sources, which include solar and wind, will “only” grow to meet the world’s demand increase. Furthermore, there are plenty of other industrial and civilian uses for petroleum besides burning them, and I am sure we will only find more such applications. It is unlike we will de-carbon anytime soon, and it is even less likely that we will de-materialize. These additional applications serve as a hedge for the worth of XOM and CVX’s petroleum and gas reserves.

Be the first to comment