Milos Dimic/E+ via Getty Images

Note: Figures are provided in US$ unless noted otherwise.

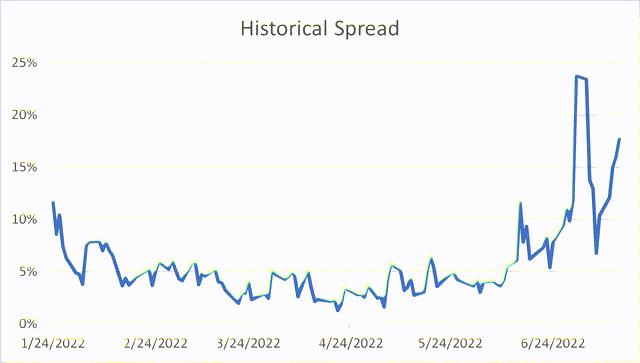

On January 24, Enerflex (OTCPK:ENRFF) (TSX: EFX) announced an all-stock acquisition of Exterran Corporation (NYSE: EXTN), valuing each EXTN share at 1.021 EFX common shares. The merger spread has fluctuated in the 0%-5% range only to spike to 24% on July 1. Aside from the general market volatility, this is puzzling as no announcements have been made by either company. Moreover, potential risks – ongoing legal dispute and regulatory approval delays – were already known two months ago. The spread has shrunk slightly to 18%. Still, I believe this is an attractive opportunity given sound strategic rationale, likely EXTN shareholder approval and a low chance of regulatory issues. Plenty of cheap borrow available for hedging.

The setup has two main uncertainties:

-

Due to a delay in merger-related regulatory filings, in May the timeline was moved from Q2-Q3 to H2’22. The problem, however, is in the sheer number of different approvals that need to be received from numerous countries rather than increased likelihood of regulatory pushback (see below).

-

In March, EXTN announced a former employee in Mexico was awarded ~$119m in a dispute related to severance pay – a significant amount given the company’s market cap. EXTN has appealed the order. Positive factors – this is a Local Labor Board dispute rather than a court case and EXTN is confident in a successful appeal.

Business and Strategic Rationale

Both companies operate in the natural gas equipment and services industry. EFX focuses on natural gas compression equipment while EXTN’s primary expertise is processing equipment (EXTN sold its compression equipment business in 2020). Both businesses have the segments:

-

Equipment sales.

-

Contracted energy infrastructure.

-

After-market services.

The important thing here is that contracted infrastructure and after-market services provide recurring revenues as natural gas compression/processing equipment is rented, operated and regularly maintained. EXTN has had a very high recurring gross profit share – 82% in FY2021. Meanwhile, EFX’s management has for a long time targeted a higher revenue share from these recurring contracts to reduce the cyclicality of its revenues. In recent years, EFX’s recurring gross profit share has risen significantly – from 20% in 2019 to 68% in 2021. In this context, the acquisition seems highly synergistic and fits EFX’s strategy.

Another benefit for the buyer – access to EXTN’s high-margin cryogenic applications, which EFX has apparently wanted to develop ever since 2013.

Also, the merger is expected to have sizable synergies, mostly in lower overheads, estimated at $40m compared to $360m-$400m in 2023E adjusted combined EBITDA.

Shareholder Approvals

EXTN shareholder approval seems likely. Major equity holder Chai Trust (~25%) agreeing to vote for the merger is a very positive sign. The management, who has already approved the merger, owns another ~3.5%. Given that the transaction values EXTN in line with EFX (while EXTN is ~3 times as levered), approval from institutional shareholders (Dimensional Fund Advisors, Morgan Stanley, Vanguard and others) should be in the cards. Adding up the stakes of these equity holders, the count easily exceeds the 50% threshold.

Meanwhile, EFX shareholder approval is more uncertain. EFX share price plunged 21% on the merger announcement, possibly showing negative shareholder reaction to excessive leverage taken by EFX after the merger. Expensive acquisition price is another possible point of concern. To address these, the company has put a lot of effort behind communicating with shareholders in the form of presentations/calls/interviews and highlighting synergies, higher future FCF/dividends and decreasing leverage. It should be noted that natural gas prices have declined in recent months and the markets are pricing a recession – not the perfect time to take on additional leverage. So far, however, shareholders have not publicly voiced any concerns on the transaction.

Regulatory Outlook

While there could be further delays, regulatory antitrust approval is unlikely to be an issue:

-

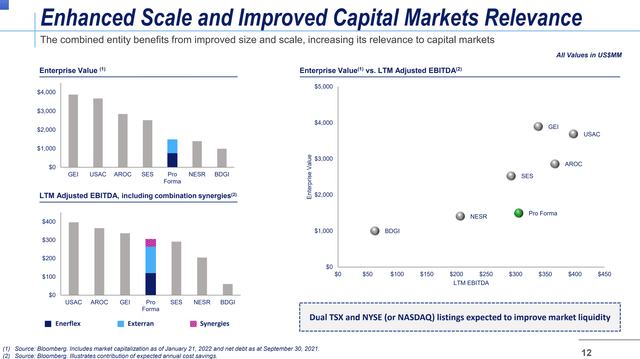

US and Canada regulators are not expected to oppose the merger – EXTN receives only ~2% of revenues in North America. In addition, the combined company will remain small on relative terms (see Peer table below).

-

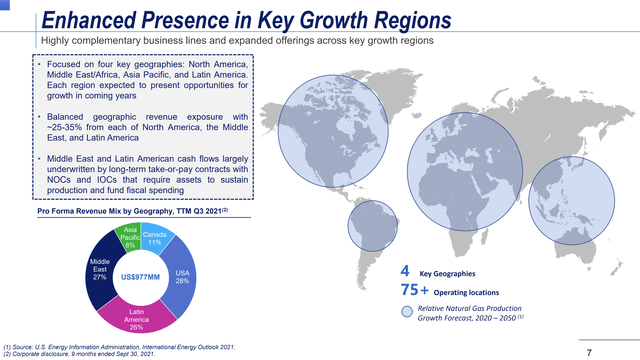

There is some uncertainty surrounding antitrust approval in other countries, particularly in Asia. However, combined company revenues from Asia-Pacific are estimated at only 8%. Pro-forma revenues from other regions – Middle East and Latin America – are expected to be well-diversified and reach 25%-35% of total revenues in each.

-

EFX management has also signaled confidence on the regulatory front. A recent quote from the CEO:

We’ve done a lot of due diligence in preparing for the deal in this announcement today to try to digest that. We don’t see any roadblocks from the regulatory front. It doesn’t mean that we don’t have to do work. But we’ve done a pretty thorough analysis of the regulations in the different countries within which we operate – within which we operate. And we feel good about our ability to pass those regulatory hurdles in the next 4 to 6 months.”

The company noted that some unspecified approvals have already been received.

Enerflex-Exterran Merger Presentation, January 24, 2022

Valuation

Direct comparison with industry peers is slightly complicated as they are larger than both EFX/EXTN and operate somewhat different businesses. For example, AROC and USAC focus on natural gas compression equipment, unlike EXTN, while GEI operates oil storage facilities and a refinery. Having said this, EFX uses these peers in its merger investor presentation (see below). On an EV/EBITDA basis, both EXTN and EFX are valued similarly among themselves but undervalued relative to other competitors. Leverage-wise, combined company’s net-debt-to-EBITDA is in line with larger peers.

|

EXTN |

EFX (C$) |

EXTN-EFX |

BDGI ($C) |

AROC |

USAC |

GEI (C$) |

|

|

Market Cap ($bn) |

0.1 |

0.5 |

0.7 |

1.0 |

1.2 |

1.7 |

3.7 |

|

Net Debt ($bn) |

0.6 |

0.2 |

0.7 |

0.1 |

1.4 |

2.0 |

1.4 |

|

EV ($bn) |

0.7 |

0.7 |

1.4 |

1.1 |

2.6 |

3.7 |

5.1 |

|

EV/TTM EBITDA |

4.7 |

4.4 |

– |

13.9 |

8.1 |

9.3 |

12.0 |

|

EV/2022E EBITDA* |

4.3 |

4.5 |

4.1 |

9.2 |

7.6 |

8.9 |

10.7 |

|

2021 Gross Margin |

44% |

23% |

– |

21% |

53% |

69% |

4% |

|

2021 Operating Margin |

-* |

6% |

– |

-* |

18% |

22% |

3% |

|

Net Debt/TTM EBITDA |

4.0 |

1.4 |

2.5 – 3.0* |

1.5 |

4.3 |

5.1 |

3.4 |

Note: 2022E EBITDA estimated using guidance midpoint. EXTN (elevated D&A) and BDGI 2021 (elevated SG&A) operating margins were negative. Combined EXTN-EFX leverage is from 2023E projections.

Enerflex-Exterran Merger Presentation, January 24, 2022

Legal Dispute

Here are details on the ongoing dispute with the Local Labor Board from EXTN’s 10-Q report:

On February 24, 2022, the Local Labor Board of the State of Tabasco in Mexico awarded a former employee of one of our subsidiaries approximately $119 million in connection with a dispute relating to the employee’s severance pay following his termination of employment. In March 2015, one of our subsidiaries terminated the employment of this employee and paid him the undisputed portion of his severance pay, as determined by the Local Labor Board. This former employee subsequently filed a claim with the Local Labor Board alleging that he is entitled to additional compensation.

We believe the order of the Local Labor Board is in error and the employee’s case is without merit. More specifically, we believe that the Local Labor Board’s errors include, but are not limited to, failing to follow established Mexican law, ignoring undisputed factual admissions of the former employee, and improperly disregarding a higher court’s prior ruling. As a result, we have appealed the order. While we have determined it is reasonably possible that we will incur some loss with respect to this matter under applicable accounting standards (ASC Topic 450, Contingencies), the Company believes that the ultimate resolution of this matter will not be material to the Company.

No further information has been provided by companies nor available on the Labor Board’s website. EFX management’s wording in May was admittedly quite strange:

We are currently monitoring this dispute.”

However, from the quote above, EXTN is assured that this will only incur insignificant losses. Given that the dispute has been ongoing since 2015, EFX was surely aware of it before agreeing to buy EXTN and probably the dispute is unlikely to get resolved till merger completion. A positive sign is that EFX management seems still committed to pursue the transaction as of the last quarterly update.

Conclusion

In my view, this is an interesting setup as the strategic rationale, low regulatory risk and target shareholder approval all appear to be there. On top of that, the spread has widened to 18%. If the merger closes as expected (before the end of ’22), the annualized return stands at ~39%. Risks – legal dispute, EFX shareholder approval and further delays – remain but in my opinion are limited. At current prices I am willing to play risk arbitrage here.

Be the first to comment