miniseries/E+ via Getty Images

Expedia Group, Inc (NASDAQ:EXPE) just reported its latest quarterly results highlighted by strong growth as the company benefits from what has been a busy travel season. Indeed, lodging bookings were a company record while total revenues exceeded pre-pandemic 2019 levels. On the other hand, shares have underperformed all year amid the broader market volatility along with concerns of an economic slowdown.

Taking a more optimistic outlook, we like EXPE at the current level which offers compelling value and is well positioned to rebound higher. The company presents overall solid fundamentals and we’re also encouraged by the success of recent initiatives including momentum from its business-to-business segment. Efforts to streamline costs are proving to be positive for margins which can accelerate earnings as part of the bullish case for the stock.

EXPE Earnings Recap

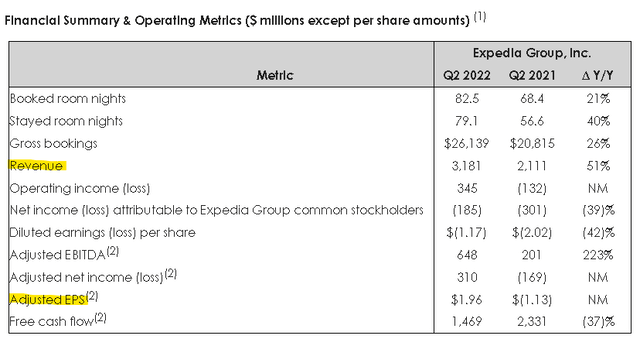

EXPE Q2 non-GAAP EPS of $1.96 came in $0.40 ahead of expectations, reversing a loss of -$1.13 in the period last year. Revenue of $3.2 billion, climbed 51% year-over-year and was $190 million above estimates. The story here considers that the comparable period last year faced deeper pandemic disruptions. Nevertheless, this was a solid quarter by nearly every metric.

A big theme for the company and the broader travel industry has been the trend of higher prices. In this case, Expedia is capturing a 9% higher stayed average daily rates ((ADRs)) over Q2 2021. Similarly, the company saw a 21% growth in revenue per ticket from its smaller air travel services segment. The topline contributed to an adjusted EBITDA of $648 million, more than tripling from $201 million last year, and 14% higher than Q2 2019.

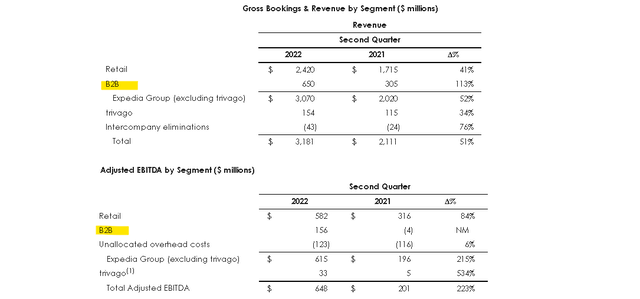

We mentioned the strength in the B2B segment for Expedia which refers to its Business Services Platform and Expedia Partner Solutions. Here the company offers support for private label and co-branded products to make travel arrangements. In other words, Expedia is leveraging its infrastructure into a wider distribution through third-party branded websites.

For example, consumers using JPMorgan Chase & Co. (JPM) credit cards with travel rewards for booking hotel reservations are technically going through Expedia and captured in this segment. There is a similar arrangement with American Express (AXP). We note that B2B has outperformed Expedia’s retail side in terms of growth while also driving margins higher. These trends are expected to continue.

The balance sheet has also been a strong point. Expedia ended the quarter with $5.6 billion in cash and equivalents against $6.7 billion in long-term debt with a leverage ratio under 1x. Notably, the company has paid down about $1 billion in debt since the start of the year and the expectation is for cash flows to remain elevated through Q3.

While the company is not providing financial guidance, management projected optimism for the rest of the year. The message is that demand has been strong with consumers still traveling beyond the headline-making macro challenges. From the earnings conference call:

Currently we are seeing a robust summer with Q3 lodging bookings pacing ahead of 2019. The same is true for pacing for the remainder of the year, but it’s still early with the majority of bookings for the back half of the year yet to be made.

EXPE Outlook

There’s a lot to like about EXPE as a leading online travel agency destination across a brand portfolio that includes recognized sites like “hotels.com,” “hotwire,” “Trivago,” “Orbitz,” and “Travelocity.” The company also controls “Vbro”, which is a marketplace for alternative accommodations as a competitor to AirBnb (ABNB).

The data we’re looking at suggests global travel has recovered quickly over the past year based on leisure, while certain lagging segments like business and long-haul international travel provide some runway for continued growth. In many ways, 2022 is still a transitional year for the company with a sense that global travel conditions will have a more the normalized full year in 2023.

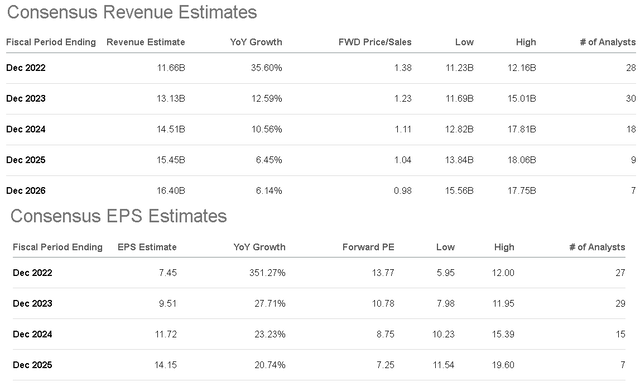

According to consensus estimates, the market is forecasting Expedia to reach $11.7 billion in revenue this year up 35% y/y while the EPS estimate of $7.45 is up 351% from the travel restart in 2021. Down the line, the momentum is expected to continue with a forecast for growth to average near 12% in 2023 and 2024, while higher margins support earnings momentum above 20%.

The big uncertainty, which has likely weighed on shares of EXPE, is on the macro side. One concern that the pent-up demand for leisure travel this year reverse going forward from the combination of high inflation, rising interest rates, and slowing economic growth pressuring consumer spending.

To the upside, our take is that consumer spending can remain resilient and even outperform expectations. The latest July U.S. payrolls report, coming in stronger than expected and with a record low unemployment rate helps to brush aside fears of a deeper economic deterioration. Similarly, we can point to the sharp decline in gas prices over the last several weeks as likely helping to cool of inflationary trends as another positive in the economy.

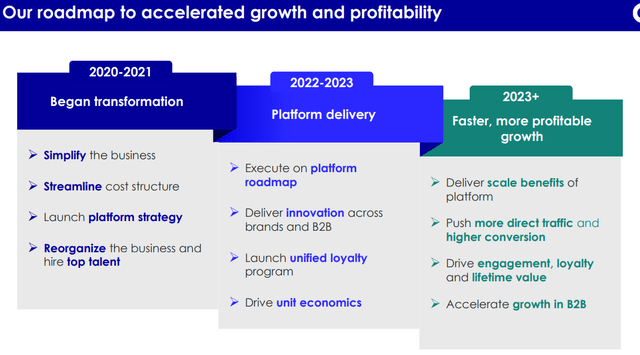

Putting it all together, we’re bullish on Expedia’s outlook with a view it can outperform expectations. The success in its platform innovations and B2B initiatives should further add to earnings growth momentum. Management’s focus is to drive unit-level economics and deliver more profitable growth going forward.

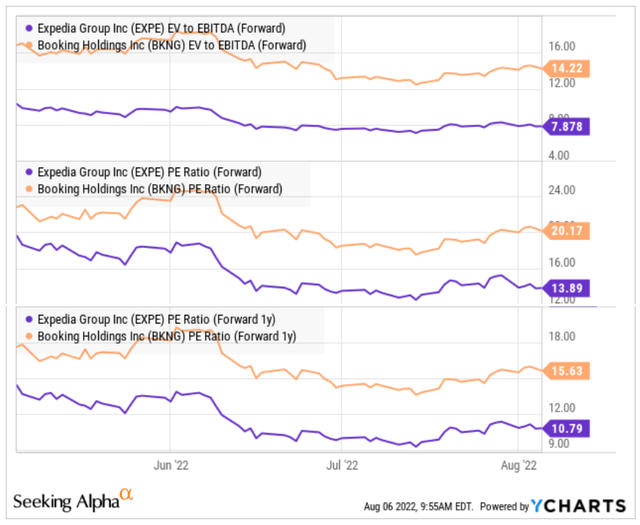

As it relates to valuation, EXPE trading at a 14x forward P/E multiple, or 8x EV to forward EBITDA ratio represents a deep discount to a perennial competitor and online travel leader Booking Holdings Inc. (BKNG). In this case, Booking benefits from its larger global scale and what has been strong profitability historically. That said, we believe this spread is unjustified making Expedia simply undervalued in the context of its latest trends considering its recent trends and positive outlook. The 1-year forward P/E of 10.8x for EXPE based on its 2023 consensus EPS looks cheap next to BKNG at 15.6x.

Keep in mind, that the U.S. represents nearly 75% of Expedia’s business in terms of where customers are located. This is a strong point for the company compared to BKNG which has more exposure to customers originating out of Europe where economic conditions are more volatile.

EXPE Stock Price Forecast

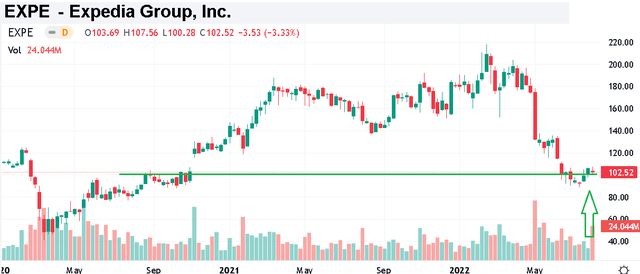

With EXPE off by more than 50% from its high in Q1, the good news is that shares appear to have found some support around the $100 level. As long as the stock is able to hold the recent low of just under $90.00, our call is to position for more upside. While the highs of Q1 are likely out of reach for the foreseeable future, a breakout above $120 should put the bulls back in control supporting a sustained rebound

Final Thoughts

We rate EXPE as a Buy with an initial price target of $145 representing a 15x multiple on the current consensus 2023 EPS. This level would narrow the current valuation spread to converge with BKNG which we believe is warranted based on Expedia’s current operating and financial momentum.

Down the line, the next few quarters will be key for Expedia to confirm a trend of firming margins and successful execution. The main risk to consider would be a further deterioration of economic conditions, forcing a reset of earnings expectations. Monitoring points include booking levels as well as the average daily rates.

Be the first to comment