Emirhan Karamuk/iStock Editorial via Getty Images

Two days ago, Exor (OTCPK:EXXRF) released its half-year report. Since April, our internal team had an outperform rating on the holding company. Mare Evidence Lab’s buy case recap was based on the following:

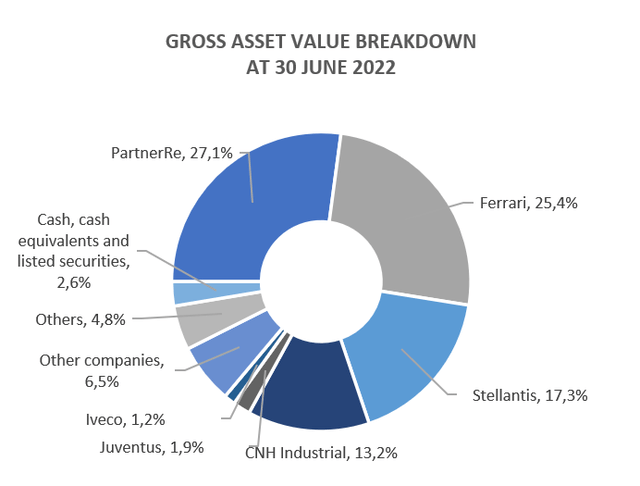

- Given our analysis of Ferrari, Iveco, and Stellantis (all rated with a buy), we are positive on Exor’s portfolio (if we are excluding PartnerRE, the three companies represent 60% of the company’s total investment). In addition, over 2022, our internal team has initiated coverage on many fashion companies around the world, and we view Christian Louboutin as a positive catalyst;

- With our recent update, we are optimistic about Exor’s latest acquisition in the healthcare sector;

- We see the ongoing buyback as a supportive incentive to reduce the current NAV discount.

Exor’s Gross NAV (First Semester (Exor Corporate Website))

Before analyzing the Q2 performance, it is worth mentioning that Exor will leave the Italian Stock Exchange and will align the company’s stock exchange with its legal Dutch holding structure. Thus, the delisting from Piazza Affari is expected at the end of September, precisely on the 27th. On the other hand, the listing on the Amsterdam Stock Exchange has been planned since mid-August.

Half-year Performance Comment

Starting from the bottom, the Dutch holding company delivered a net profit of €265 million versus the €838 million recorded a year before. Behind the net decrease of almost 70%, there are unrealized capital losses of PartnerRe’s bond portfolio that were approximately €1 billion. This negative result was only partially offset by the good performance of subsidiaries Ferrari and Stellantis. The outcome appears even more alarming if we consider that the profit recorded in the first half of 2021 included a non-recurring loss of €507 million deriving from the deconsolidation of the former FCA, following the merger with PSA. Debt was up 15% compared to the year-end results. This was due to various reasons: 1) €746 million payment to the Italian fiscal authority, 2) new investments, 3) dividend payment of around €100 million, and 4) ongoing share repurchase for another €100 million. This was partially offset by the dividend received. Even if Juventus accounts for a tiny part of Exor’s portfolio, the football club closed the half-year performance in negative territory (-€119 million) and management expects a worse result in H2.

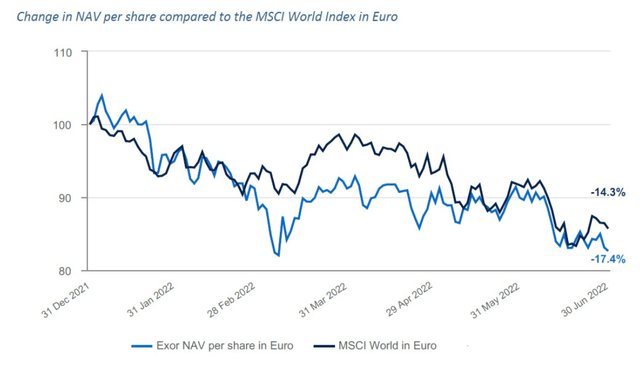

To sum up, the NAV was down by 17% compared to the year-end results, reaching €25.5 billion versus €31 billion recorded at the end of last year.

Exor NAV Evolution (NAV Per Share Change)

Conclusion and Valuation

The half-year figures only partially tell the truth. 2022 is a year full of events. In fact, over the last few months, Exor has completed a series of operations that will reshape the company’s portfolio. Starting from the sale completion of PartnerRe, this positive capital gain will only be seen in the next quarter’s account, and it is coming with a net gain of $3.2 billion. This cash is already being used to invest in large companies (as Exor’s main philosophy). Aside from the recent healthcare investment, Exor has acquired a minor equity stake in an Indian startup called Ultraviolette Automotive. This company is developing electric motorcycles with a battery-powered moped. According to local media, after the capital increase, Exor will hold about 3.5% of Ultraviolette’s capital (for a total investment of $10 million), which suggests that its valuation exceeds $300 million. A high value for a startup that is still at zero in the revenue item, but justified by the great growth prospects of two-wheeled electric mobility in India (and also 65 thousand orders). Ultraviolette’s goal is to make electric motorcycles accessible to a wide audience of Indian consumers while maintaining high performance. As expected, Exor’s fund will be used by the company to increase production and finance expansion into foreign markets.

Regarding the valuation, the NAV per share stood at €109.41 against the €132.41 recorded in December 2021. The net asset value discount is above Exor’s historical average (25% versus 40%). Given our recent follow-up on Volkswagen, we should say that the German car company is also trading at a 36% discount, in line with Exor. However, even if we applied this discount, Exor is still a buy. With the ongoing macroeconomic challenges, we are not surprised to see this negative stock price reaction, however, Exor’s portfolio and its latest diversification are positive catalysts that will support share price evolution.

Be the first to comment