Scott Olson/Getty Images News

Exelon Corporation (NASDAQ:EXC) is based in Chicago, listed in the American Fortune 100 energy companies, and is the largest electric parent company in the United States. Through its multiple subsidiaries, the company is able to compartmentalize its operations, including a total of 11 segments that are each managed through one of its subsidiary companies. The growing electricity demand continues to drive the need for viable and reliable solutions. What is often overlooked is the need for a larger structure to support power generation and supply.

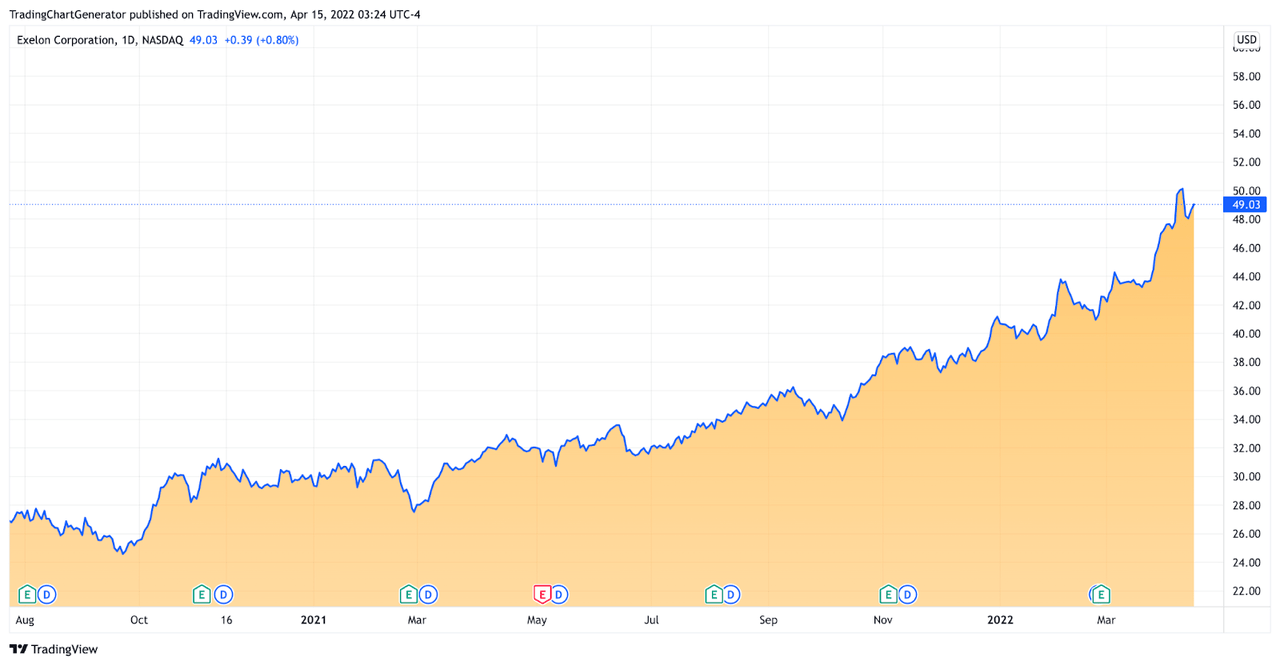

tradingview.com

Exelon is at the heart of US energy provision and a crucial element in ensuring demand does not overtake supply. In this article, we will discuss why investors may be keen on investing in what is, in truth, a fairly stable company.

Industry Overview

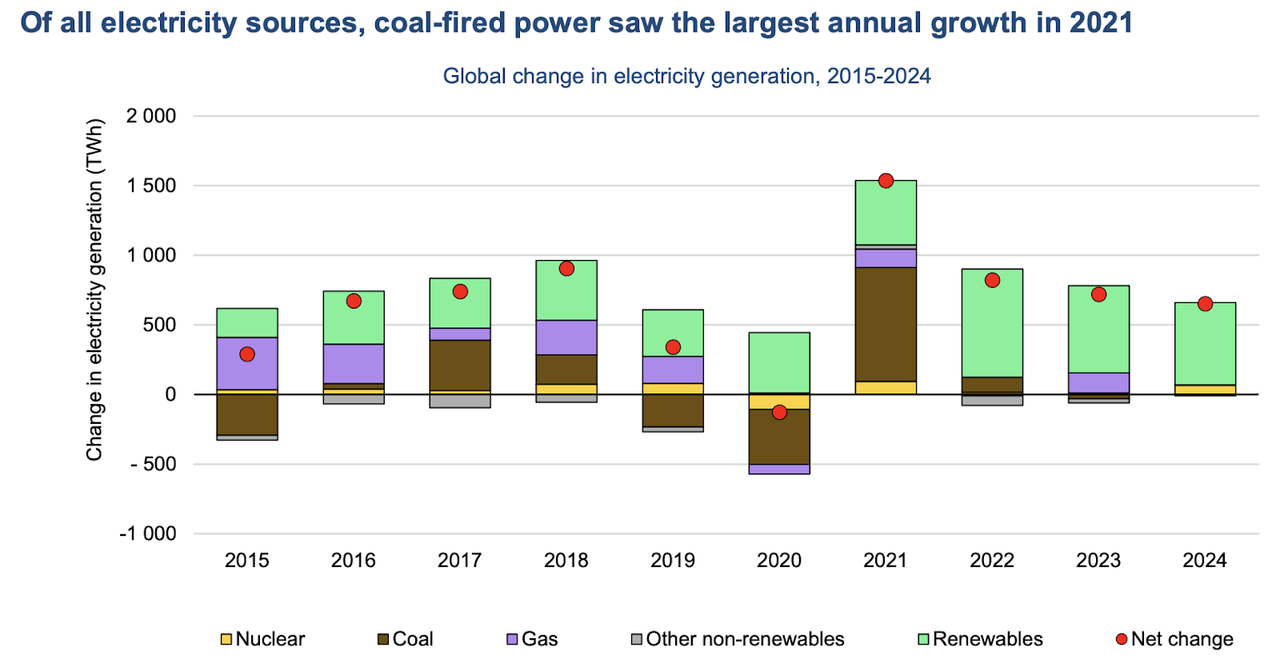

Energy production continues to grow as it functions as the sort of bloodstream of economies worldwide. Different segments within the market have experienced different levels of growth, and as Exelon is mainly a provider of nuclear energy solutions, we will take a look at growth in the segment and what to expect in the near future. Compared to other energy sources, including the rise rapid rise of renewable energy, nuclear energy finds itself one of the slowest growing of all. In fact, when looking far enough, the segment has actually seen a decline over the last two decades. This has begun to slowly pick up in recent times as its reputation as a safe energy source is slowly being restored with factual information, apart from comparisons with far less environmentally friendly solutions. Paradoxically, the growth rates for non-renewables were higher than renewables in 2021, with coal growing by 9%, compared to the total 6% from renewables. The overall demand for electricity is expected to grow at an annual rate of 2.7% from 2022 to 2024. Risk factors that could affect this growth rate do exist, but it would need to take the level of a global pandemic, such as what has been seen in recent times, to cause any significant decrease.

iea.blob.core.windows.net

Exelon finds itself both in need of supplying energy for a market with an ever-expanding appetite while also restricted by the growth of its specific segment. Despite this, the company saw greater area-specific growth, reporting a 115.99% increase in income by the end of the third quarter in 2021.

This is in stark contrast to the 38.4% income growth the rest of the industry saw in the same period. The company also reported higher profitability with a net margin of 13.79% before the end of the year. So how did Exelon perform financially during 2021?

Financials and Recent Results

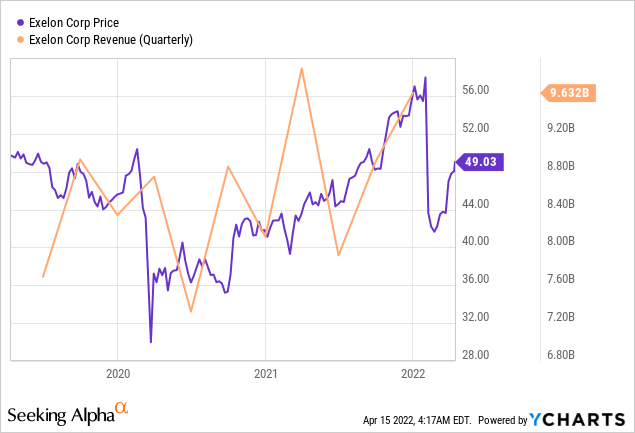

Exelon experienced quarterly growth in revenue from $8.9 billion in the third quarter to $9.6 billion by the end of 2021. Despite this growth, profit actually reduced over the quarter, with gross profit declining by over $1.8 billion during the final three months. This came as the company faced a substantially higher cost of revenue, slightly over $2.5 billion more than the previous quarter, offsetting the increase in revenue. It is still encouraging to note that revenues rebounded after experiencing a momentary dip mid-year. Another positive factor is the company’s annual growth rate, which reported $36.35 billion in revenue, compared to the $33 billion reported in 2020. An increase in prices helped catapult the company’s revenue in the final quarter to help it edge past its progress in the previous year.

ycharts.com

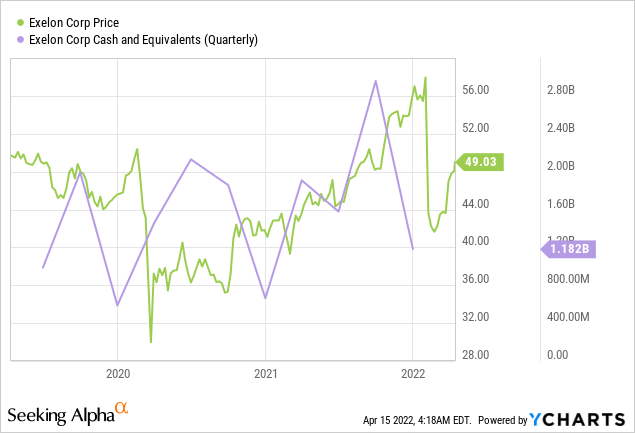

Exelon experienced an interesting first quarter, which saw the highest quarterly revenue for the year while also falling short of expectations and reporting a -$0.06 earnings per share. The company managed to bounce back by the second quarter and continue to register positive EPS growth. The company finally reported $2.82 in earnings per share for the fiscal year. This marked a decline from the $3.22 reported in the previous year. This 12.4% decline was attributed to the aforementioned mid-year dip when the company faced the impact of higher net unrealized losses on equity investments. Exelon will hope to bounce back by the time it reports earnings from the first quarter of 2022. The company ended its year on a high note with approximately $1.2 billion in cash and cash equivalents. Compared to the $663 million reported in December of 2020, this marks an overall improvement, substantially improving the company’s outlook in the current year.

ycharts.com

Looking ahead, the company expected earnings per share in the range of $2.18 – $2.32 for the fiscal year. The company expects to see the same level of growth but could possibly be offering a conservative estimate based on potential risk factors that could slightly offset that growth. Those risk factors are minimal, however, but not to be ignored. While the energy sector is experiencing rapid growth, and the nuclear energy segment remains relatively stable, Exelon should experience fast enough growth to cover any slight hits it might take throughout the year.

Risk Factors

A number of risks, both internal and external, could shape how the company performs over the year. These include a potential reduction in demand for nuclear-power electricity, a real threat facing the industry, causing reduced revenue while doing very little to reduce the costs involved in the production of electricity. Additional policy and tax changes could directly target how the company does business and take major cuts from its earnings. However, such risks are not abrupt and are likely to occur gradually over the long term. There may be policies that could take immediate effect and shake the market considerably. Still, any such concerns can be dismissed, as any rapid change might also affect the crucial supply of energy. As the Russia-Ukraine situation worsens, the energy industry continues to prove the most difficult to work around, causing global concern about potential energy shortages. However, even amidst the current crisis, the nuclear energy supply has been exempted from the bans implemented on Russia. Exelon really doesn’t have cause for concern in this regard, with its supply across the United States largely unaffected by these changes. In fact, the company may stand to benefit from some policy changes, as alternative sources are procured and more independent energy production is pursued.

Exelon is also faced with potential threats from cyberattacks. The modernization of energy production has recently made it a target of both private and state-sponsored conflicts. This has added to the need for better security, and though the probability of suffering an impactful attack is minimal, it does mean added investment to avoid any possible incidents.

Key Takeaways

Exelon announced a major investment plan at the beginning of January 2022, detailing its targets all the way through to 2025. This includes a $29 billion allocated to capital investments in order to achieve a rate base growth of 8.1% and EPS growth of up to 8% by the end of that period. These investments are intended to ensure the company meets customer needs from and beyond the projected period of time. There are a number of environmental concerns Exelon will need to address. However, with their robust ESG plan, this also seems to be a concern the company is well prepared to address. Several factors are out of Exelon’s hands, but if the company keeps up with the impressive growth rate, it is well on track to reward bullish investors, making Exelon a solid buy in its current state.

Be the first to comment