mi-viri

“Science may have found a cure for most evils; but it has found no remedy for the worst of them all — the apathy of human beings.“― Helen Keller

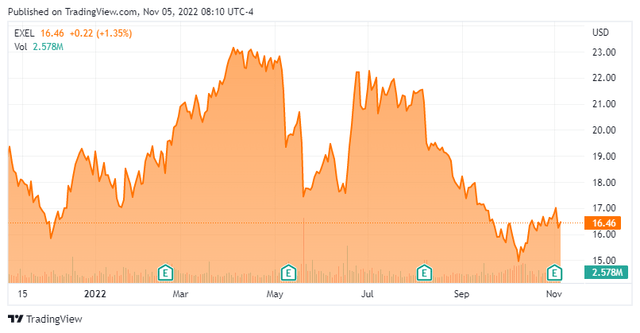

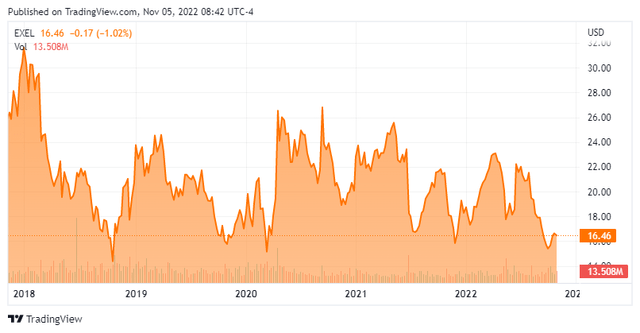

Mid-cap oncology name Exelixis, Inc. (NASDAQ:EXEL) delivered another quarter of solid numbers this week. As usual, the market largely yawned. The shares trade near the bottom of their long established range. Today, we dived into these new results and I outline how I profitably traded this stock for years now. An analysis follows below.

Company Overview

Exelixis is headquartered outside of San Francisco. The company is focused on forms of cancer that are especially challenging to treat. Thus far, the company has a couple of FDA-approved products. However, the vast bulk of revenues comes from its drug CABOMETYX. This blockbuster will continue to be the core revenue and earnings engine for the company for the foreseeable future. The stock currently trades for around $16.50 a share and sports an approximate market capitalization of $5.25 billion.

Third Quarter Results:

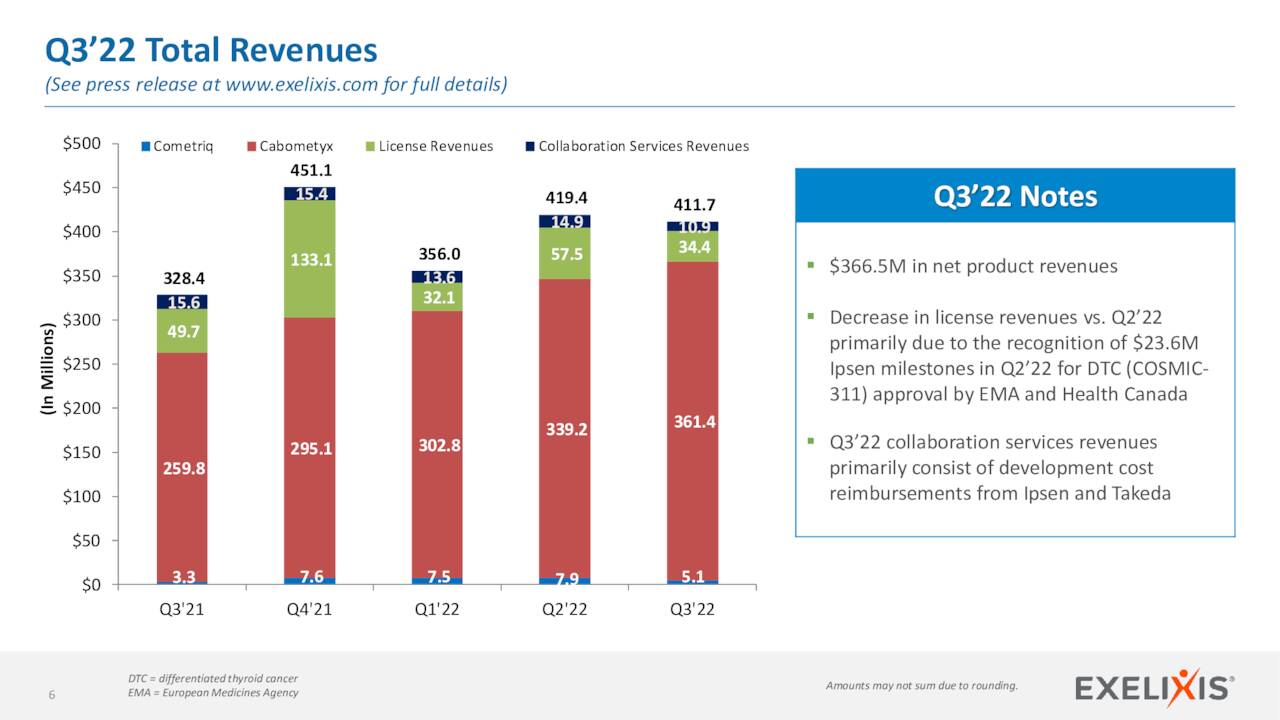

On November first, the company posted third quarter numbers. Exelixis made 31 cents of Non-GAAP profit as revenues rose just over 25% to a tad north of $411 million. Both top and bottom line numbers nicely beat expectations.

November Company Presentation

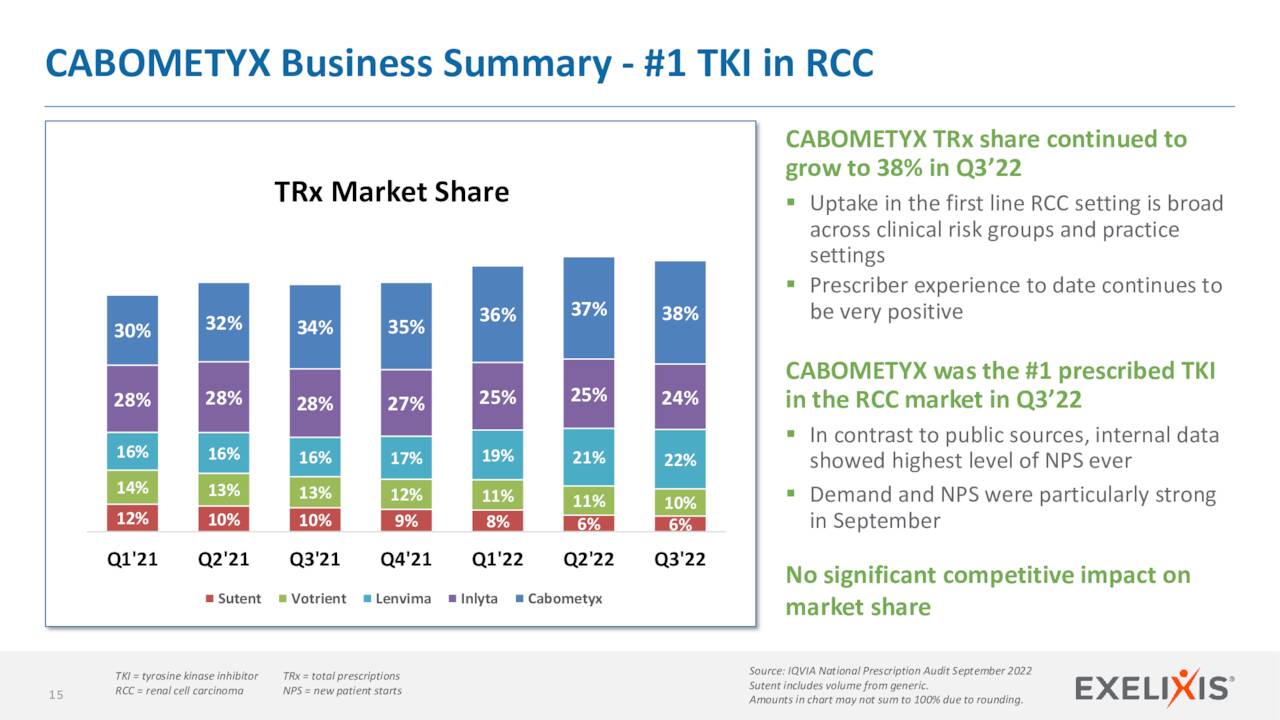

As can be seen above, revenues from Cometric contribute little to the top line but are relatively stable. License and milestone payments from the company’s collaboration partners is lumpy but meaningful. Meanwhile, the net product sales from CABOMETYX continue to enjoy steady and impressive growth and were up 39% on year-over-year basis in the third quarter. CABOMETYX has also made steady progress garnering market share as well.

November Company Presentation

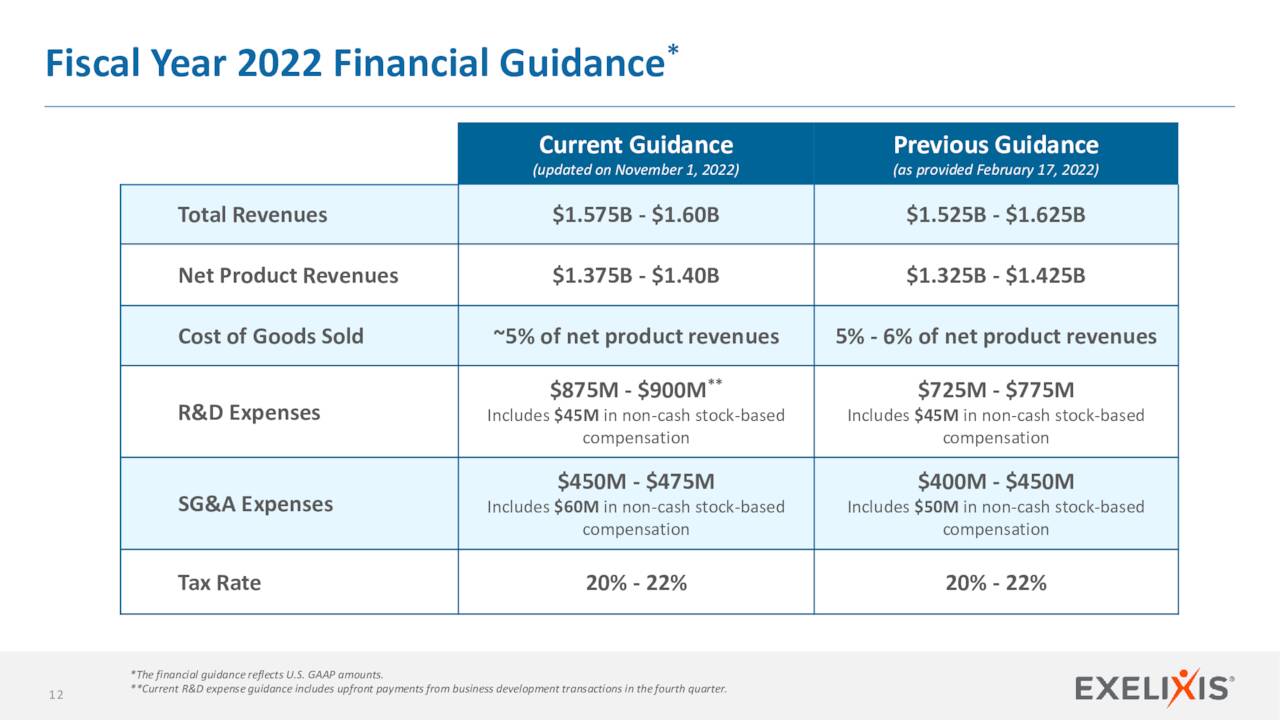

Management revised its guidance to slightly up its full year revenue guidance and significantly up its R&D expense projections.

November Company Presentation

This is due to the work the company is doing to advance its early stage candidates as well as expand the potential target market for its blockbuster drug CABOMETYX.

November Company Presentation

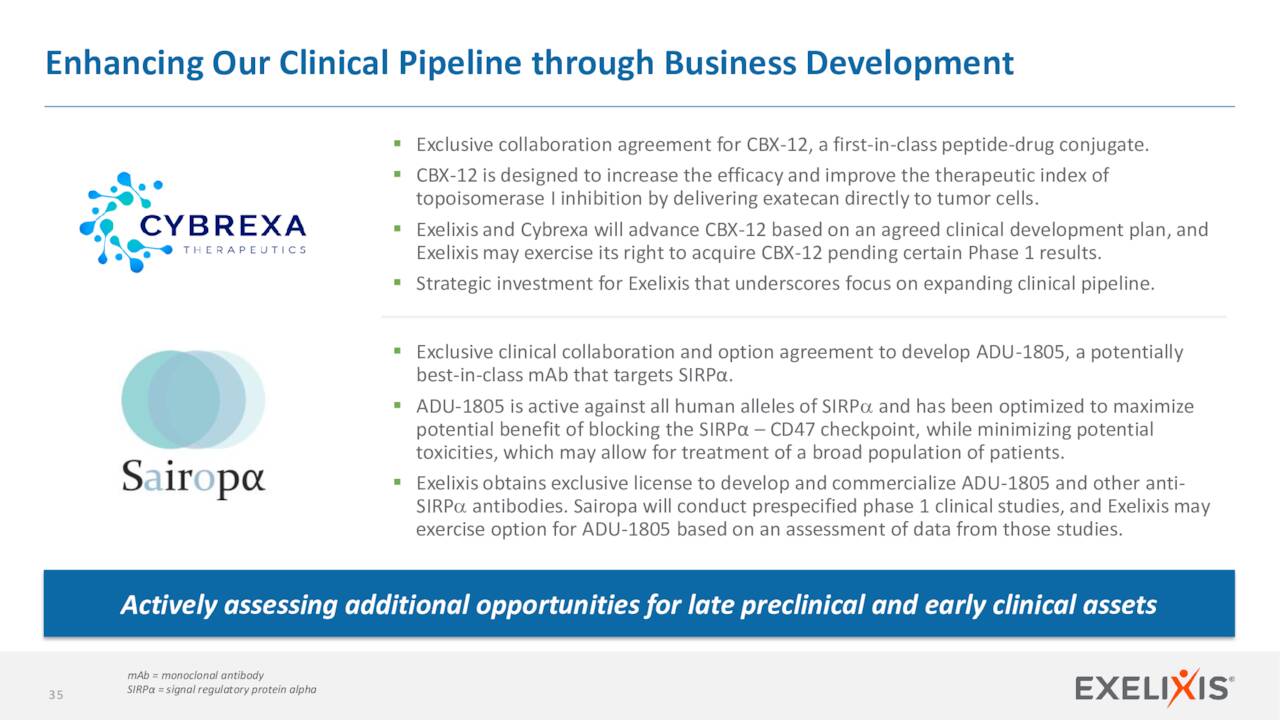

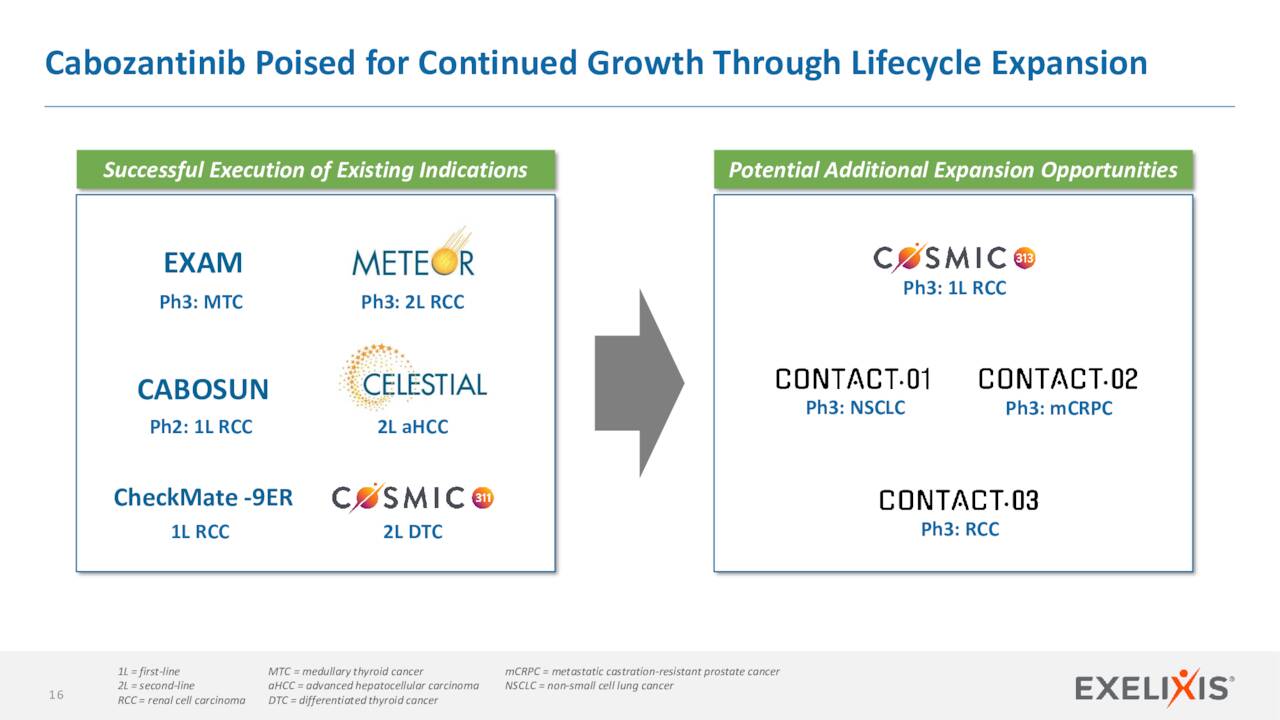

We won’t dwell on the other compounds Exelixis has in its pipeline in this article. They are all early stage efforts and mostly being done within collaborations. CABOMETYX is already approved for six different indications in the U.S. and the company continues to work methodically to expand their franchise drug’s potential markets. We will touch on some of the key trials ongoing to expand CABOMETYX’s reach.

November Company Presentation

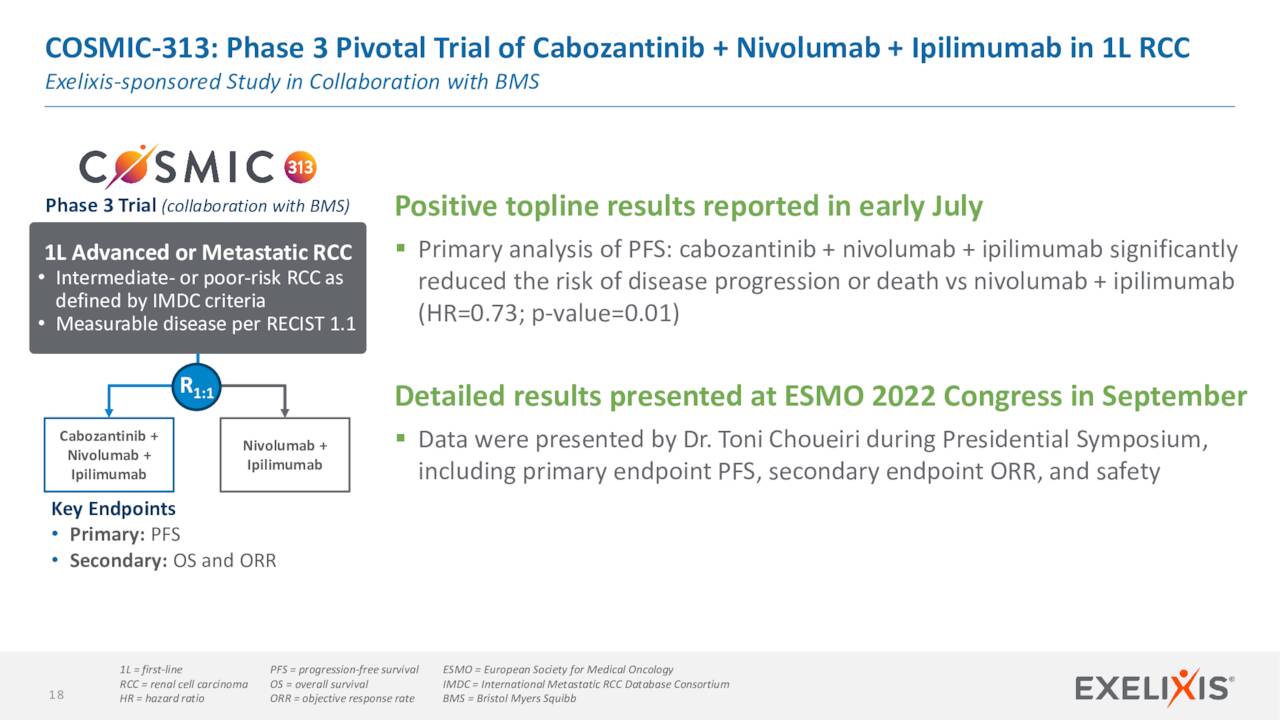

The compound is in a registrational trial called COSMIC-313. This study is evaluating CABOMETYX in combination with nivolumab and ipilimumab in intermediate and poor risk renal cell carcinoma. A pre-specified interim analysis for the secondary endpoint of overall survival (OS) did not demonstrate a significant benefit for the cabozantinib arm compared to the control arm. The trial is continuing to the next analysis of OS.

November Company Presentation

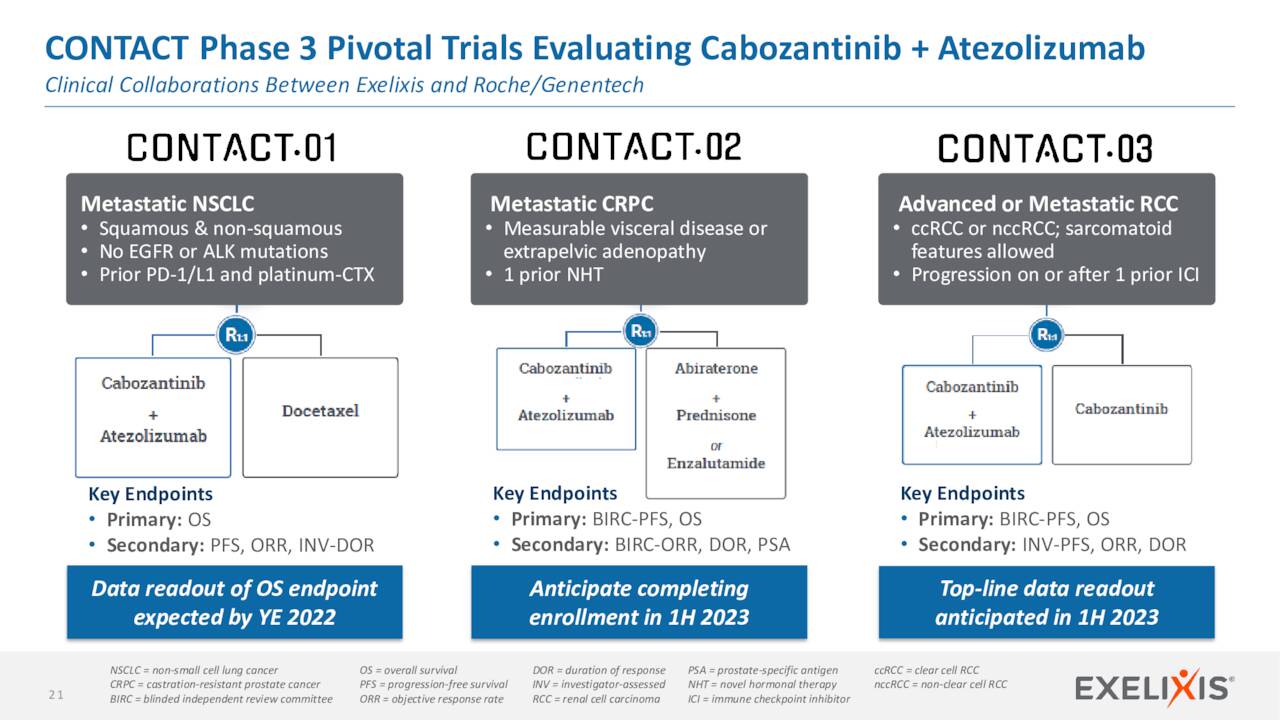

CONTACT-01, a Phase 3 pivotal study sponsored by Roche, is evaluating CABOMETYX in combination with atezolizumab versus docetaxel in patients with metastatic non-small cell lung cancer who have been previously treated with an immune checkpoint inhibitor and platinum-containing chemotherapy is ongoing. The final analysis of the primary endpoint of OS is on track to occur before the end of this year.

The company also has a Phase 3 pivotal study which is also sponsored by Roche called CONTACT-3. This study is evaluating CABOMETYX in combination with atezolizumab versus docetaxel in patients with metastatic non-small cell lung cancer who have been previously treated with an immune checkpoint inhibitor and platinum-containing chemotherapy. Topline date from this trial is scheduled to be out sometime in the first half of 2023.

November Company Presentation

Finally, another Phase 3 trial named CONTACT-2 evaluating CABOMETYX in combination with atezolizumab in metastatic castrate-resistant prostate cancer should start enrollment in the first half of 2023.

Analyst Commentary & Balance Sheet

Only around three percent of the outstanding float in EXEL is currently held short. Insiders have sold just over $7 million worth of shares collectively in 2022. Since third quarter results hit, a half of dozen analyst firms have reiterated Buy or Outperform ratings on Exelixis. The majority of these had minor downward price target revisions. Price targets proffered ranged from $21 to $29 a share. Stifel Nicolaus ($21 price target) and Morgan Stanley ($22 price target) maintained Hold ratings on the shares.

The company ended the third quarter with $2.1 billion in cash and marketable securities on its balance sheet. This is $200 million more than where the company started 2022. The company did just agree to another collaboration deal where it will pay a $60 million upfront payment.

Verdict

The current analyst firm consensus has the company earning nearly 60 cents a share in FY2022 as revenues rise in the low teens to $1.6 billion. Similar revenue growth is projected in FY2023 where the median earnings estimate is $1.10 a share.

The stock looks reasonably valued at 15 times next year’s consensus EPS. However, if you equate for its huge cash hoard, the stock is selling at nine times forward earnings and two times sales. In addition, the company is spending a huge amount to develop its pipeline for the future and expand its potential target market for CABOMETYX. Take the roughly $875 million the company will spend on R&D this year out of the equation, and Exelixis would be a massively profitable company with huge cash flow.

That makes Exelixis a logical buyout target and it certainly has the ‘ammo‘ to make some strategic acquisitions itself. Unfortunately, this rarely gets reflected in the stock price with has been range bound between $16 and $26 a share for years now. However, that lends this stock as a good covered call candidate every time it trades near the floor of its trading range, as it is now. The options against this equity are highly liquid and nicely lucrative. And that is how I have profitably traded this name for years now and I plan to continue to do so.

“Politeness is organized indifference.”― Paul Valéry

Be the first to comment