Drs Producoes

Published on the Value Lab 1/9/22

The iShares MSCI Brazil ETF (NYSEARCA:EWZ) looks to be a solid and low P/E pick on an economy that has pretty minor incremental FX risk and strong exposures in both a recession and to the energy environment. There are political risks as the left and the right fight it out over who will lead the country next, and Petrobras (PBR) is always in their sights, as well as populist agendas over the oil price. But those look priced in, and earnings yields here are superb. We believe in an oil and commodity supercycle that will benefit EWZ.

EWZ Breakdown

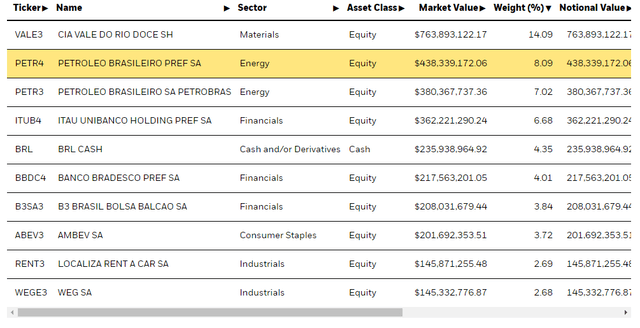

Let’s quickly break down the ETF by looking firstly at the top holdings.

Holdings (iShares.com)

The ETF isn’t that diversified with less than 50 holdings, so a pretty major chip is placed on Vale (VALE). We discussed iron ore. Order books are climbing in the steel industry, and China woes can’t get worse. They are actually stimulating. This will create some protection for iron ore prices. Moreover, miners like Vale trade closely with iron ore prices, so that’s certainly been priced in as of today. We like the incremental direction in iron.

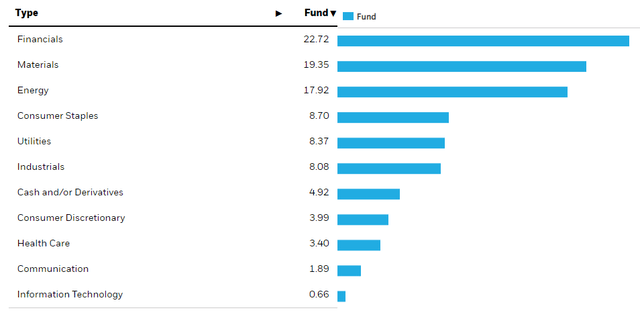

Below that are various structures of shares in Petrobras which ultimately all rely on the oil price. Like Vale and other companies that sell on USD denominated markets, the EWZ actually is fairly insulated from BRL risks, except for consumer staples and financials, which together account for 30% of the sector exposures. We can comment on consumer staples now to say that we like them, they are definitely recession-resistant.

Sector (iShares.com)

On the matter of oil, it remains underinvested. Part of the political rhetoric in Brazil is of keeping Petrobras state-owned and investing more in renewable energy and refineries in an effort to reduce energy costs in Brazil. We don’t love this. We think it’s wasted dollars in CAPEX right now, especially with material costs being so high, to invest massively in a renewable transition which won’t be a drop in the bucket for years. Refinery is another matter, but it takes at least 3 years to build out capacity there. While it might be wise as much of the margin in energy is in refinery right now, and will likely have the most immediate effect on consumers, we’re happy with the cash printing going on now on very low PEs with short payback periods. Regardless, underinvested oil means that prices will stay pretty high likely for the foreseeable future. Demand destruction limits haven’t been hit, and while macro slowdowns aren’t great, baseline prices of oil have surely risen with Russian supply dislocations affecting western markets.

Financials is also not such a weak spot. Rates continue to climb in Brazil as they address inflation with force. It remains relatively low, and higher rates mean better net interest incomes. On the other hand, being ahead of the rate hike cycle means we may be closer to resumed accommodation, especially if the economy hits major speedbumps. Financials are also exposed more to BRL risks for foreign investors. But we have faith in the BRL. It has staved off most incremental declines against USD thanks to the commodity-heavy exports of the country and due to nice local real returns. FX isn’t a major factor at all for EWX investors with much cash earned in USD to begin with, and the BRL being a decent FX exposure.

Conclusions

Political risk is the main thing to worry about, and it’s one of the reasons why PEs remain so low at below 6x for this ETF, in addition to large exposures to late-stage multiple commodity companies.

What are the political risks? Bolsonaro and Lula are battling it out. Bolsonaro is trying to throw Petrobras under the bus for the fuel inflation, but he’s getting blamed for it. Price controls are a risk for the company. If Lula wins, which appears increasingly likely, he will stop moves to privatise Petrobras and may force its hand into renewable investments and refining investments. Cash flows will be affected by these substantial likely outlays. Moreover, his mandate to keep state influence will likely also be a bit of a problem for prices. Unfortunately, there will be populism and where Petrobras should be profiting, as well as other oil exposures, politicians could get in the way of your holdings.

There is also the general commodity risk to consider for the EWZ. With substantial commodity exposure including to iron ore, it renders the ETF a little more volatile. If you think commodities are surely doomed right now and can’t be buoyed much further by logistics bottlenecks, supply displacement and speculation, then the EWZ seems less attractive. We think inflation in these commodities is an inevitable consequence of economic disintegration, and the hard assets that yield these commodities distinctly higher in value. Therefore, we like the ETF.

Be the first to comment