pat138241/iStock via Getty Images

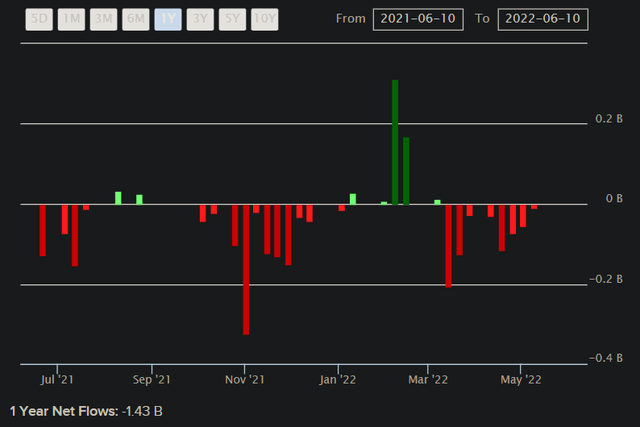

iShares MSCI South Korea ETF (NYSEARCA:EWY) is an exchange-traded fund that provides investors with exposure to mid- and large-cap South Korean equities. The fund had 112 holdings as of June 10, 2022, with assets under management of $3.58 billion. That follows a year of net outflows, as illustrated below, of over $1.4 billion.

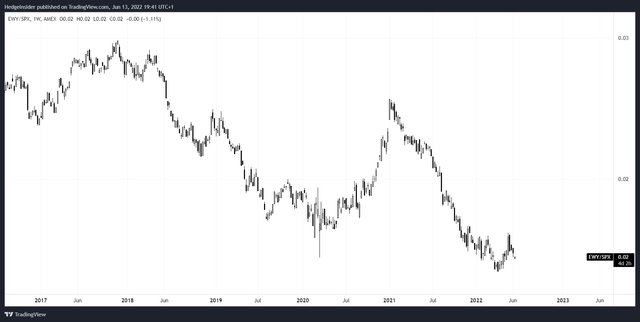

Global equities have been falling recently as risk sentiment has soured in light of elevated inflationary pressures and higher long-term interest rates. EWY is no exception. Perhaps it is more useful to measure EWY against the S&P 500 U.S. equity index to spot the relative change; this EWY/SPX ratio is illustrated below, and shows mostly long-term under-performance.

It is difficult to beat U.S. equities since they are home to most of the world’s most popular single names, especially in technology, while the U.S. equity market generally attracts investment flows across the world given the relatively high corporate productivity in the U.S. Also, the U.S. equity market is simply very large and therefore can withstand large equity inflows, though valuations are often pricier in the United States as a result. South Korea does not possess quite the same allure, yet it can still out-perform the U.S. market from time to time.

It is also worth noting that South Korean equities, being denominated in South Korean won (abbreviated KRW), naturally fall in USD terms as the USD/KRW exchange rate rises. USD/KRW has risen strongly from the start of 2021.

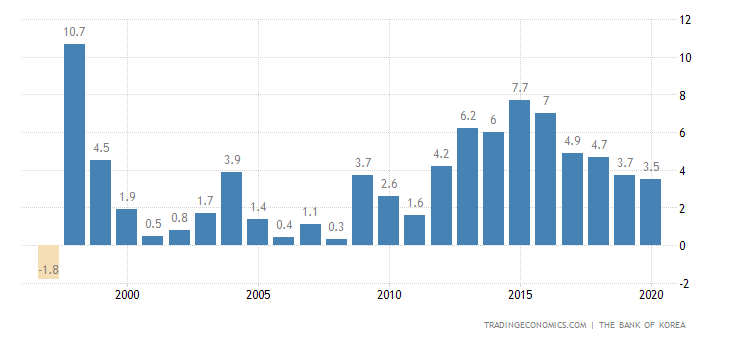

The South Korean current account (scaled by GDP) is also positive, implying potential currency under-valuation, although as illustrated below, the current account (relative to GDP) has softened somewhat over the past few years.

TradingEconomics.com

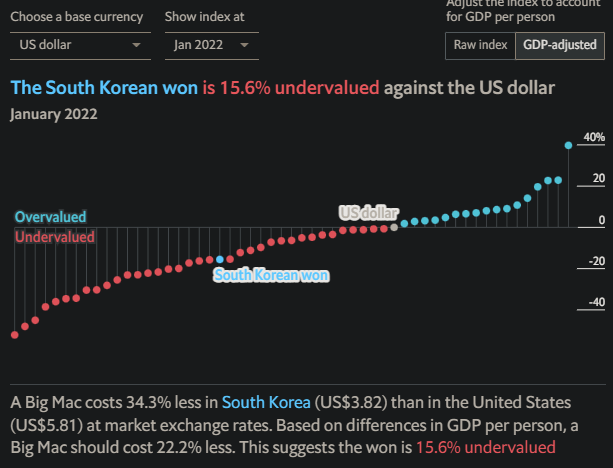

Meanwhile, The Economist’s crude but useful Purchasing Power Parity model suggests KRW is undervalued by 15-16% as of January 2022.

TheEconomist.com

Since January 2022, USD/KRW has risen a further 7-8%. Meanwhile, the 10-year yield spread between U.S. and South Korean bonds is negative and stable.

So, overall, USD/KRW is probably overvalued, and therefore there could be some constructive FX pressure on EWY, favoring upside with a stronger South Korean won. Timing FX moves reliably is practically impossible, but the point is, there should be some FX tailwinds at this juncture (supporting EWY in USD terms).

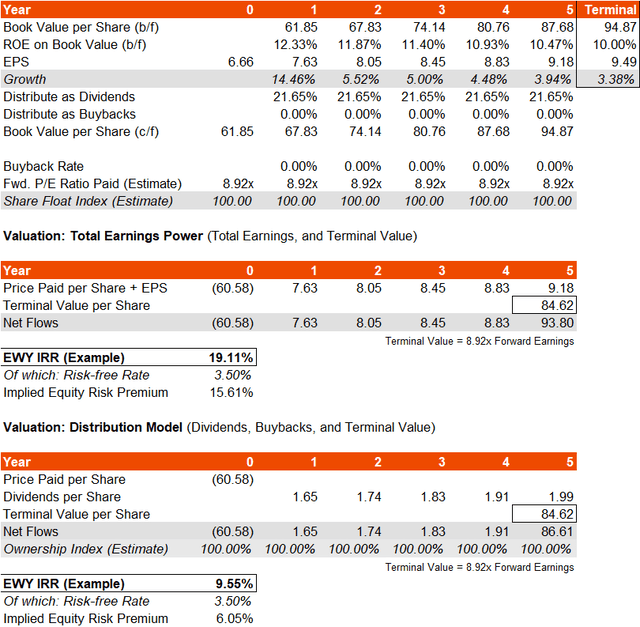

EWY itself seeks to replicate the performance of its chosen benchmark, the MSCI Korea 25/50 Index, which is itself a weighting-capped version of the regular MSCI Korea Index. Data is only available from MSCI for the latter index; in the factsheet to May 31, 2022, the trailing and forward price/earnings ratios were 10.21x and 8.92x, respectively, with a price/book ratio of 1.10x. The indicative dividend yield was 2.12%, implying earnings distributions of circa 22%. These numbers also imply a forward return on equity in aggregate of about 12%. Morningstar meanwhile estimate three- to five-year average earnings growth at around 10.96% for EWY more specifically, with a forward price/earnings ratio of 8.60x and a price/book ratio of 0.90x (albeit as of June 9, 2022, more recently).

If I rely on the MSCI numbers in the first instance, and assume a drop in the return on equity of over 12% down to 10% over the next few years as the portfolio “matures”, and assuming no buybacks for the moment, with a risk-free rate of circa 3.5% (the South Korean 10-year is currently yielding about 3.6%), my three- to five-year average earnings growth rate is lower than Morningstar’s at 6.6-8.2%, but my implied IRR is very high at over 19%.

However, the IRR is lower (circa 9.6% per annum) if we only value dividend distributions without assuming any buybacks.

Bear in mind South Korean inflation was 5.4% in May 2022, so earnings growth trailing off to 3% or so over the next few years is not unreasonable. The first year’s estimate of 14.46% in the table above is based on MSCI’s best guess for the next year for the MSCI Korea Index constituents in aggregate (and therefore a reasonable proxy for EWY’s portfolio; a similar number was found by referencing Morningstar). So, even with not an unrealistic earnings growth trajectory, and a return on equity falling to 10% in year six (our terminal year), and holding the earnings multiple the same, EWY offers an attractive IRR.

If we were to value EWY today on a terminal earnings multiple, we might assume an equity risk premium of 5.5% at most (which would be elevated for the U.S. market, but perhaps fair for a perceivably riskier or at least less popular equity market such as South Korea’s), and a risk-free rate of probably no more than 4% long term. Further, we would assume at least a 2% nominal earnings growth rate to perpetuity. So, the net discount rate would be the sum of these, or 7.5%. Dividing 1 over 7.5% gives us a forward P/E multiple of 13.33x, and this is also potentially a conservative multiple. Therefore, even today, you could argue EWY is due for circa 49% upside based simply on earnings multiple expansion (13.33x versus the current 8.92x).

All considered, given potential FX tailwinds and a likely undervalued forward earnings stream, and high uncertainty implicitly priced into the earnings multiple, I think EWY (i.e., South Korean equities) remain undervalued. The large outflows over the past year is also symptomatic of a high embedded equity risk premium which I think deserves to contract.

Be the first to comment