MF3d

Published on the Value Lab 26/8/22

The iShares MSCI South Korea ETF (NYSEARCA:EWY) gets you exposed to IT hardware, specifically a host of chipmakers, as well as some consumer discretionary companies. Consumer discretionary is not what you want when you’re concerned about global recessions, and semiconductor inventories are signaling pain coming from consumer tech. YTD declines create some margin of safety, and PE is low, but the Won could continue to weaken as the USD gains and EWY directionally looks troubled. Ambiguous situation means we pass.

Breakdown of the EWY

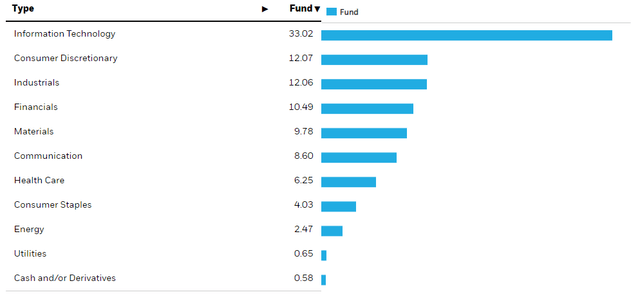

The sector breakdown of EWY is as follows:

Sector Breakdown (iShares.com)

The IT exposures aren’t the software exposures you’d be used to from the US, but it’s all chip makers like Samsung (OTCPK:SSNLF) and SK Hynix who make hardware for consumer tech. Samsung alone is 20% of the ETF, Hynix is 5%. Other exposures come from automotive in consumer discretionary as well as materials companies.

The danger areas in our opinion are in the IT and consumer discretionary exposures which together account for about 45% of the ETF’s exposure.

Remarks on Semiconductors

Foundries and fabs have been working at full capacity in trying to supply chips in this last year or two of the good’s boom, but rising rates, including domestically in South Korea where a tightening cycle has started, on top of demand destruction from inflation, has reared its head in consumer confidence. Corporate optimism may still be at high levels but consumer optimism absolutely isn’t. Some major brands have been relatively immune like the vaunted Apple (AAPL), but in general we are seeing quite the buildup of chip inventories. In fact, they are reaching 2016 levels, which preceded a multi-year period of oversupply that harassed the chip industry’s stocks for quite the while. This increase in inventory became more accentuated in April and has now rocketed.

This is a two-pronged issue for EWY. The first is that it signals issues coming for exports of chips upon which the South Korean economy and the Won massively relies. There is an FX risk here especially for US investors where the reserve currency status of the dollar advantages it profoundly to other currencies. Secondly, rising inventories simply means that the decline in consumer confidence is not only real, but has created a bulge in working capital that companies will have to work through. They are already dialing back on investments, which might be good for the company but spells out how bad cost push inflation has been for productivity dynamics.

Conclusions

The EWY has a PE of 8x, which is very low, but because it’s elevated by a strong 2021 and early 2022 in the LTM figures. The yield isn’t bad either at 2% although fees are on the high side at 0.57%. YTD declines reflect the late-stage expectations seen in the PE, where it’s gone down 25%. Markets seem to know what’s coming for the EWY and Korean semiconductor companies. Consumer discretionary is even more levered to the downturn than semi. While there might be a case for bottom-feeding here, we are at the cusp of what could be a serious downturn, with corporate expectations still not in line. The Won is also another lever for losses when investing for USD stock accounts. Overall, it’s too hard to call, and the direction could be bad. Pass.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment