bkindler/E+ via Getty Images

Introduction to EWG

iShares MSCI Germany ETF (NYSEARCA:EWG) is an exchange-traded fund enabling investors to gain exposure to German stocks (large- and mid-cap). The fund began on March 12, 1996, and today assets under management are $2.37 billion, indicating a reasonably high level of popularity. The fund’s expense ratio is 0.50%.

EWG invests in accordance with its benchmark index, the MSCI Germany Index. As of January 28, 2022, the fund had 61 holdings; that is significantly fewer than EWG’s U.S. counterparts (e.g., the SPDR S&P 500 Trust ETF (SPY), which holds the stocks of the 500 top U.S. companies). The fewer number of holdings is owing to the fact that while Germany is a developed country, the country’s equity market is not nearly as developed as the United States’ stock market.

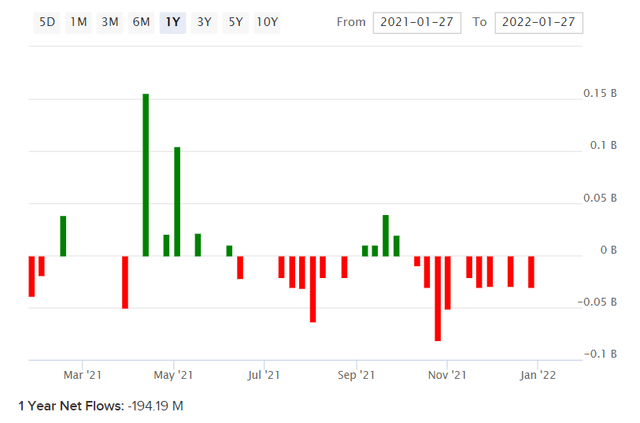

Recent EWG Fund Flows

Over the past year, fund flows have been negative, with sentiment (at least as expressed via EWG fund flows) evidently dragging, especially most recently.

It is always difficult to justify investing in mature equity markets outside of the United States, as U.S. stocks tend to perform very well. Generally speaking, the implied returns on offer must be high elsewhere, unless the implied returns in the U.S. market are dire (due to over-valuation, or other risks).

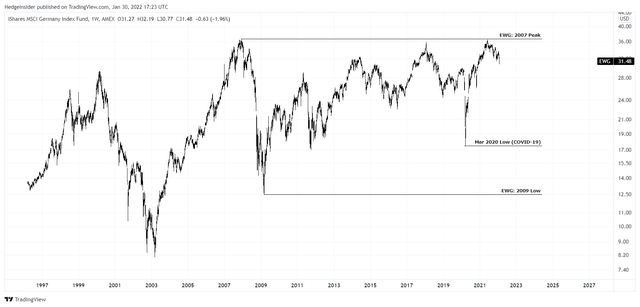

As illustrated below, EWG has not performed especially well; it is still trapped within a long-term trading range going back many years. EWG still hasn’t firmly surpassed its 2007 peak.

Also note that the current yield on the fund as calculated on a 30-day SEC yield basis is 1.45%. So, without significant capital appreciation, returns are likely to be low going forward. Still, German stocks are not priced as highly as U.S. stocks, with EWG’s price/book ratio (according to iShares) being circa 1.90x as of January 27, 2022.

Here is EWG plotted in terms of SPY: between 2003 and 2007, the upward slope shows EWG’s potential to out-perform U.S. markets (as proxied by SPY). But since the 2007 high, Germany has trailed U.S. equity market performance.

It is difficult to justify allocating towards EWG on the basis of the long-term prevailing trend. Nevertheless, it is worth reviewing the value of the fund, as there is always potential for short- to medium-term out-performance.

EWG’s Cyclical and Sector Exposures

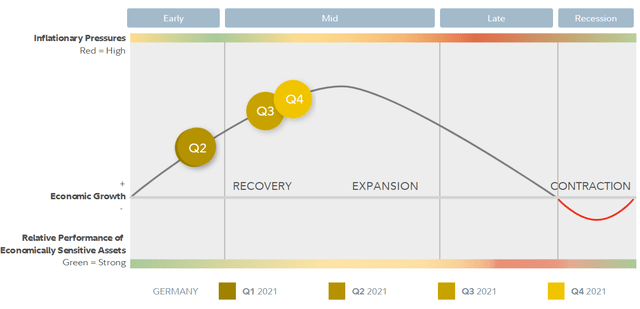

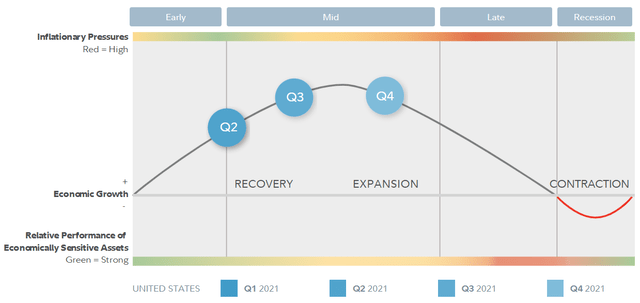

According to research from Fidelity, Germany is currently still in the middle stage of its current business cycle (as of Q4 2021). A continued recovery does open the way for cyclical outperformance.

That is in comparison to U.S. business cycle positioning, for instance; Fidelity suggests that the U.S. economy is likely maturing in its present business cycle.

With the United States ahead in its business cycle, and possibly four rate hikes this year, it is possible that European equity markets may attract some net inflows finally in 2022 (although this is not guaranteed).

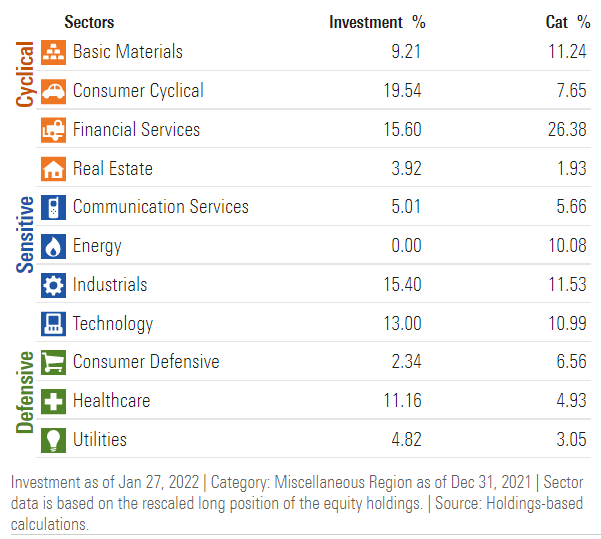

An important consideration, and reason for why EWG often under-performs more “exciting” markets, is that the fund (which characterizes the broader German equity market, by investing in the largest German companies) does not have as large Technology exposures as U.S. equity funds.

Morningstar.com

The fund is quite balanced though, and its so-called “Defensive” sector exposures (including Staples, Utilities, etc.) were only about 18% of the fund as of January 27, 2022. Economically “Sensitive” and “Cyclical” sectors represented the balance (according to Morningstar data). So, with a continued economic recovery, EWG’s portfolio is nicely balanced. But another factor is that the underlying return on equity of the fund is not incredibly impressive, “helped” by a heavier exposure to sectors like Financial Services as compared to typically more productive, faster-growing sectors (e.g., Technology).

Key EWG Portfolio Data

The higher exposure to more mature sectors like Financial Services means that EWG’s underlying portfolio ROE (on average) is unlikely to beat funds that are “over-weight” on Technology. This does also tend to mean that German stocks, on average, trade at lower prices/valuations, so there is a balance to be found. Still, the benefit of high-ROE stocks is that they can grow into optimistic valuations, whereas a fairly priced but lower-ROE fund will struggle to generate high long-term returns regardless.

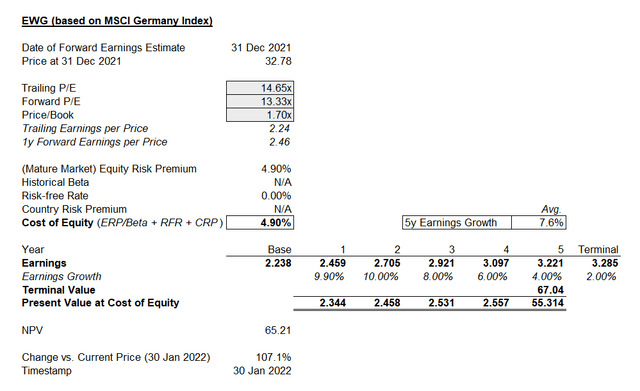

EWG’s benchmark index’s most recent factsheet, as of December 31, 2021, had a trailing price/earnings ratio of 14.65x, a forward price/earnings ratio of 13.33x, and a price/book ratio of 1.70x. The implied return on equity was therefore 12.75% on a forward basis. That compares to the United States’ MSCI counterpart, the MSCI USA Index, of 22.66% as of the same date. The delta indicates higher U.S. corporate productivity, but the price/book for the U.S. market was also much higher (5.05x, vs. Germany’s 1.70x).

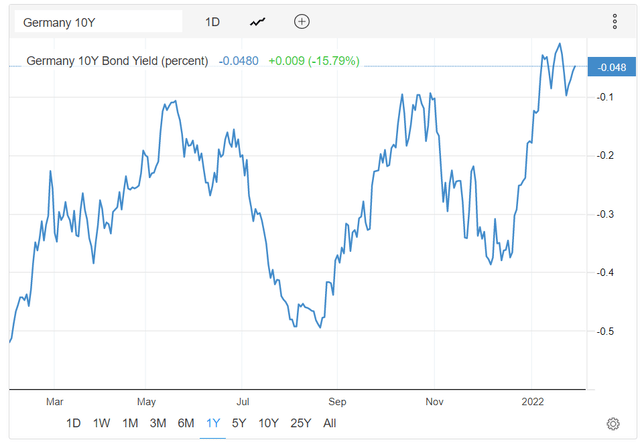

The forward earnings yield implied above is also quite high, at about 7.5% (at 2021 year-end). For a country with a 10-year yield still negative (see below, at -5 basis points), that’s arguably exceptionally high.

Morningstar consensus earnings growth expectations (three- to five-year basis) are also good, at 13.34% currently.

Cost of Equity Estimate for EWG

Since EWG is only exposed to Germany, calculating a fair cost of equity is relatively simple; a sum of the mature market equity risk premium, the country risk premium (over and above the base ERP), and the German 10-year yield (i.e., the long-term “risk-free rate”).

Professor Damodaran currently recommends a mature market ERP of 4.90%, with a German country risk premium of zero (Germany is a politically stable and economically mature country, so this is a fair assumption). As noted, the German 10-year is currently nominally negative, but we will just assume that the risk-free rate is ‘zero’ for this analysis (to err very slightly on the conservative side of things).

Basic Valuation for EWG

In spite of Morningstar’s optimistic earnings growth assessment of over 13% per year over the next three to five years, we will shoot for roughly half of this, going down to about 2% in the terminal year (which is still higher than long-term inflation rates in Germany). This is definitely erring on the side of conservatism though, as it would assume that both inflation rates will settle down from their higher-than-average rates as of recent (5.3% in December 2021, year-over-year) and real earnings growth (if inflation meets 2% in the terminal year in this analysis; year six) will be ‘zero’ in the terminal year.

The result is that the fund is massively undervalued based on a cost of equity of 4.90%. What it really implies then, based on this conservative earnings growth trajectory, is that EWG’s implied cost of equity is at least 9.91%.

EWG has recently sold off along with other major equity markets, but the fact that the fund offers an implied return of almost 10% in a country where long-term rates are still negative is very surprising. From a valuation perspective, while Germany might not be an exciting place to invest, I would say it still demonstrates itself as being a viable alternative for U.S. investors looking for safe international diversification.

And if more optimistic earnings forecasts prove correct (and/or realized inflation rates under-perform expectations), EWG could easily generate a realized IRR of more than 10% over the next few years.

Be the first to comment