We Are

It is unlikely to come as a surprise to anyone reading this that one of the biggest problems facing most of us today is the incredibly high level of inflation that is prevailing in the United States. This has caused many people around the country to take on second jobs or look for other ways to obtain the growing amount of money that they need to cover their bills and other household expenses.

Fortunately, as investors, we have some other options available to us to boost our incomes. One of these is to invest in income-producing assets. Some of the best assets in this category are closed-end funds that are focused on the generation of income. These funds provide easy access to diverse portfolios that have both professional management and the ability to use a variety of strategies that allow them to pay out yields that are well beyond those of the underlying assets.

In this article, we will discuss one of these funds, the Eaton Vance Tax-Advantaged Dividend Income Fund (NYSE:EVT). As of the time of writing, this fund yields 8.61%, which is clearly well above the yield of most other things in the market. It should thus be fairly obvious how this fund could provide a boost to anyone’s income. I have discussed this fund before, but more than a year has passed since then so obviously a lot has changed. This article will therefore focus specifically on these changes as well as provide an updated analysis of the fund’s financial performance. There are certainly some reasons to have confidence in the fund’s ability to be a core holding in an income-focused portfolio, which we will also discuss here.

About The Fund

According to the fund’s webpage, the Eaton Vance Tax-Advantaged Dividend Income Fund has the stated objective of providing its investors with a high level of total return. This is not exactly surprising since equities are by their very nature total return instruments. After all, we are hoping to get both dividends and capital gains when we purchase stock in the market. As the name of the fund implies, it invests in dividend-paying common and preferred stocks in order to generate income that it then passes through to investors. The fact that it can buy both common and preferred equities is good for this purpose because of the characteristics of each of these different equity types. In short, common stocks tend to appreciate as the underlying company grows and prospers. In addition, many dividend-paying companies increase their dividends as earnings increase, which we can expect to happen in inflationary environments. Preferred stocks do not generally have variable dividends nor do they significantly benefit as the issuing company grows its profits. However, preferred stocks do typically have much higher yields than common equities and they do not generally decline as much as common equities during less-than-favorable market environments. Thus, the inclusion of preferred stocks should both provide a bit of an income boost and reduce the overall volatility of the portfolio. This is something that could be comforting to investors that are concerned about the preservation of principal, which is typical of most retirees.

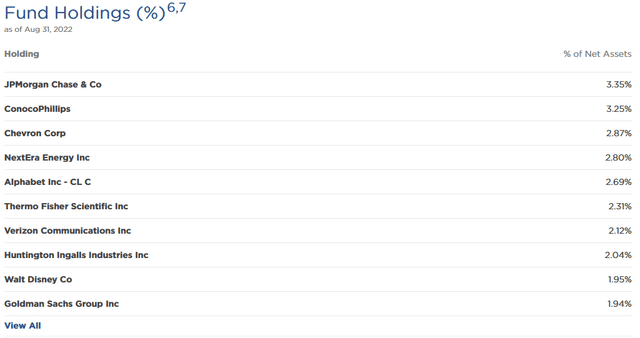

Dividend-paying common stocks tend to be a very popular investment theme, especially among those that are depending on their portfolios to pay their bills. This is generally reflected in the reader statistics here at Seeking Alpha. As such, most readers are likely familiar with many of the companies that comprise the largest positions in the fund. Here they are:

We see several changes here since we last looked at this fund. These include Johnson & Johnson (JNJ), Medtronic (MDT), Bank of America (BAC), Fidelity National Information Services (FIS), and Truist Financial (TFC) being replaced by ConocoPhillips (COP), Chevron (CVX), NextEra Energy (NEE), Thermo Fisher Scientific (TMO), and Huntington Ingalls Industries (HII). I certainly do not have a problem with most of these changes. In particular, the addition of the two traditional energy companies to the largest positions list is a welcome change considering that energy is one of the only sectors in the economy that has delivered a positive return so far this year. This is especially nice to see considering that these companies replaced some of the financials that were previously heavily weighted in the fund and financials have underperformed the S&P 500 index (SPY) over the trailing twelve-month period. This is a clear sign that the fund’s management is keeping a close eye on the prevailing trends in the market and adjusting the portfolio accordingly. This is something else that should be appealing to those that are concerned with the preservation of capital.

The fact that such a large number of the fund’s positions are different than we saw last year may lead one to believe that the fund has a high turnover. A high turnover can be concerning because trading stocks or other assets costs money, which is billed to the fund’s shareholders. This is one reason for the popularity of index funds since their minimal trading allows them to keep expenses at very low levels and thus pass through more of the fund’s returns to investors. This does not, of course, mean that a fund that does change its assets in response to the market will necessarily underperform the benchmark index but it does make things somewhat more difficult for management as they need to generate sufficient returns to both cover the added expenses and still beat the market. With that said, the Eaton Vance Tax-Advantaged Dividend Income Fund only has a 30.00% annual turnover, which is remarkably low for an equity closed-end fund. Thus, we might not be seeing trading so much as certain stocks performing much better than others in the market and thus making their way onto the largest positions list.

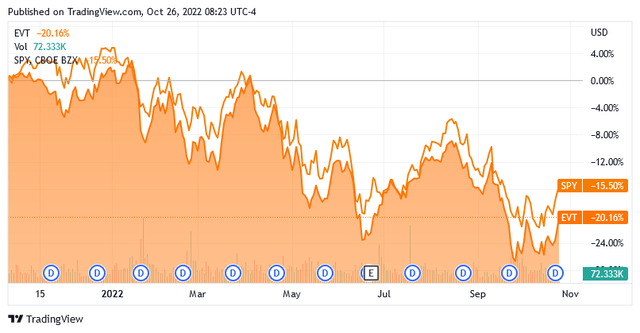

Unfortunately, the Eaton Vance fund has underperformed the index over the past twelve months, although the two did track each other remarkably well:

As we can see, the fund has generally tracked the S&P index fund except that it fell further during market corrections than the index fund did. This may be caused by the fund’s distributions as it has to deal with steady outflows that the index fund does not have. With that said, after accounting for the Eaton Vance fund’s substantially higher distribution yields, someone invested in this fund would have a higher total return than someone invested in the index. This is particularly true if that person was reinvesting the distributions. This is still a sign that we want to take a very close look at the fund’s success in covering its distributions though, which we will do later in this article.

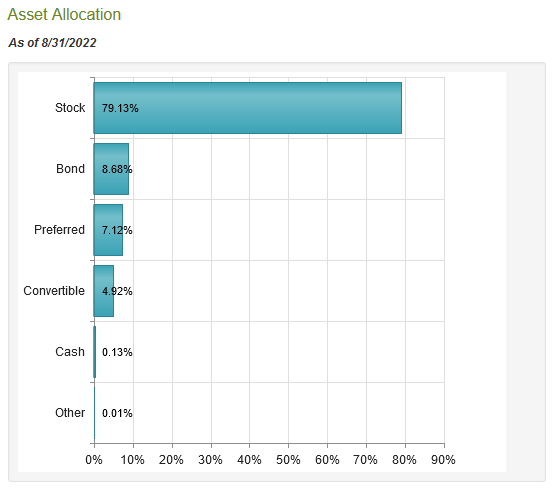

Earlier in this article, I mentioned that the fund could invest in both common equity and preferred stock. Apparently, it can invest in bonds as well, although it specifically states that it is an equity fund. Nevertheless, 8.68% of the portfolio is invested in bonds and 7.12% is invested in preferred stock:

CEF Connect

This could be another reason for some of the underperformance that we see here. The Federal Reserve has been aggressively raising interest rates this year in an effort to combat the high level of inflation that the country is currently suffering from. Unfortunately, both bonds and preferred stock tend to move inversely of interest rates, which has resulted in fixed-income assets getting crushed so far this year. Anyone that is invested in U.S. Treasuries or any other bond fund can attest to this. After all, as of the time of writing, the iShares Core U.S. Aggregate Bond ETF is down 17.33% over the trailing twelve-month period. This is much more than the decline that we have seen in the stock indices over the same time period. Thus, the Eaton Vance Tax-Managed Dividend Income Fund may be getting hurt by the fixed-income securities that it holds in the portfolio. The presence of these assets is still nice for diversification purposes, particularly if the economy continues to worsen and stocks begin to get hurt much more than they have already.

As my regular readers on the topic of closed-end funds are likely well aware, I do not generally like to see any individual asset account for more than 5% of a portfolio. This is because this is approximately the level at which an asset begins to expose the fund to idiosyncratic risk. Idiosyncratic, or company-specific, risk is the risk that any possesses that is independent of the market in aggregate. This is the risk that we aim to eliminate through diversification, but if the asset accounts for too much of the portfolio, then this risk will not be completely diversified away. Thus, the concern is that some event may occur that causes the value of a given asset to decline when the market does not, and if it accounts for too much of the portfolio then it may end up dragging the whole fund down with it. As we can see above though, this is not really a problem here as no individual asset exceeds the 5% threshold. This is actually much better than some of Eaton Vance’s other closed-end funds. As I have noted in a few other articles, its option-income funds in particular tend to have a very high weighting to a handful of mega-cap technology stocks. This one appears to be much more diversified though, which is very nice to see overall.

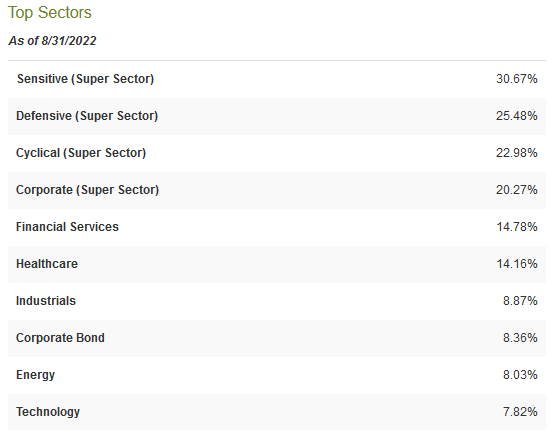

The fund’s overall diversity extends across sectors too. In fact, it does not appear to be heavily weighted toward any individual sector as we can see here:

CEF Connect

This is actually much more diverse than the S&P 500 index. The S&P 500 has a 26.49% weighting toward technology and a 15.05% weighting toward healthcare. As we can see just by looking at the above numbers though, the Eaton Vance Tax-Advantaged Dividend Income Fund does not have any individual sector weighted so heavily. This is something that we should be able to appreciate as it overall makes the fund a better option for diversification than the overall market.

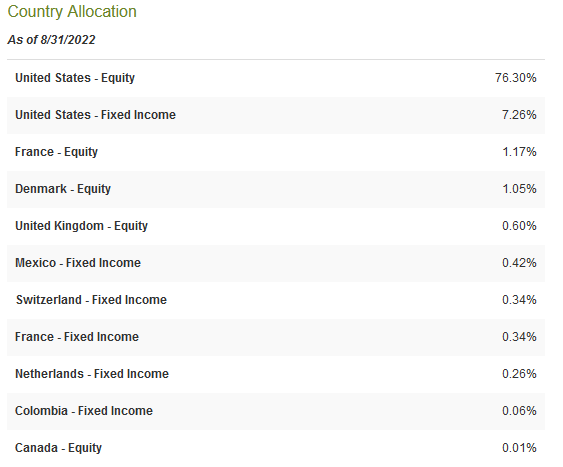

One thing that is important to keep in mind is that the Eaton Vance Tax-Advantaged Dividend Income Fund does not have much international exposure. In fact, as we can see here, fully 83.56% of the fund’s assets are invested in the United States:

CEF Connect

It is important for a portfolio to have international diversification because of the protection that it provides us against regime risk. Regime risk is the risk that some government or other authority will take some action that has an adverse impact on a company that we are invested in. We witnessed an excellent example of regime risk back in 2021 when the incoming Biden Administration unilaterally canceled the permits for the construction of the Keystone XL pipeline and caused all of the money that had been previously invested by TC Energy (TRP) into its construction to be wasted. The only realistic way to protect ourselves against this risk is to ensure that only a relatively small percentage of our portfolios are invested in any individual nation. As we can see, this fund is not really doing a good job of diversifying into foreign nations. This should be taken into account when assembling the rest of your portfolio in order to ensure sufficient international diversification.

Leverage

As stated in the introduction, closed-end funds like the Eaton Vance Tax-Advantaged Dividend Income Fund are frequently able to use a variety of strategies that allow them to pay out much higher yields than the underlying assets in the portfolio possess. One of these strategies is the use of leverage. Basically, the fund borrows money and then uses that borrowed money to purchase dividend-paying stocks and other income-producing assets. As long as the return that it generates on the purchased assets is higher than the interest rate that it needs to pay on the borrowed funds, this strategy works quite well to boost the overall portfolio yield. The fund is able to borrow at institutional rates, which are much lower than retail rates, so this will often be the case. However, the use of debt is a double-edged sword. This is because leverage boosts both gains and losses. Thus, we want to ensure that the fund is not utilizing too much debt since that would expose us to too much risk. As a general rule, I do not like to see a fund’s leverage above a third as a percentage of its assets for this reason. The Eaton Vance Tax-Advantaged Dividend Fund clearly meets this requirement as it currently has a leverage ratio of 20.66% of its assets. Thus, it appears to be striking a good balance between risk and return.

Distribution Analysis

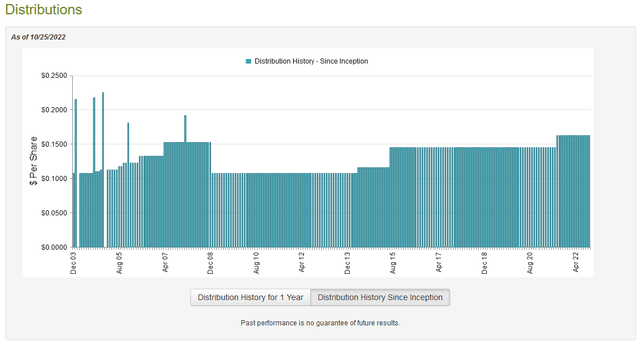

As stated earlier, the primary objective of the Eaton Vance Tax-Advantaged Dividend Income Fund is to provide its investors with a high level of total return. However, it aims to do that primarily through dividend income and capital gains paid to the investors in the form of distributions. In addition, the fund invests primarily in dividend-paying stocks and other assets so it is clearly attempting to generate income. As such, we can guess that it will likely pay out a relatively high yield to its investors. This is indeed the case as the fund pays a monthly distribution of $0.1626 per share ($1.9512 per share annually), which gives it an 8.36% yield at the current price. The fund has not only been remarkably consistent about this distribution over time but in fact, it has been growing its distribution since 2009:

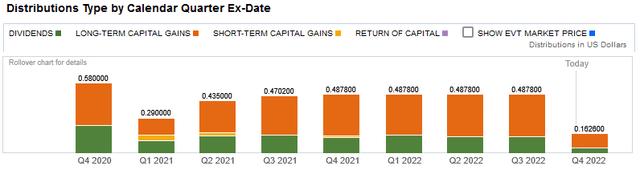

This makes this one of the only closed-end funds that have successfully grown its distribution over time, although it has not delivered annual increases like some of the companies that it is invested in have. The fact that the fund does seem to make an effort to grow its distributions is fairly nice to see given the current inflationary environment. This is because inflation is steadily reducing the number of goods and services that can be purchased with the distribution that the fund pays out. This can make it seem that an investor is getting poorer and poorer. The fact that the fund increases the amount of money that it supplies to its investors means that it helps to offset this fact over time and makes it easier to maintain a consistent lifestyle. Another thing that may be attractive to those investors that are looking for a safe and secure source of income is that the distributions are entirely classified as dividend or capital gains income without a return of capital component:

The reason why this could be nice to see is that a return of capital distribution can be a sign that the fund is returning the investors’ own money back to them. This is obviously not sustainable over any sort of extended period. We seemingly do not have to worry about that here, but as I pointed out in a previous article, it is possible for these distributions to be misclassified. Thus, we want to investigate the fund’s finances and its ability to maintain these distributions as part of our analysis. After all, we do not want to find ourselves the victims of a distribution cut since this would result in a reduction of our incomes and probably cause the fund’s share price to decline.

Unfortunately, we do not have an especially recent report to consult for this purpose. The fund’s most recent financial report corresponds to the six-month period ending April 30, 2022. Thus, it will not include any information detailing how the fund performed during the especially volatile market environment that prevailed during the summer months. However, it should still show us how well the fund performed in the first few months of the year, which is the period of time that saw the Federal Reserve begin its recent interest hiking campaign. During that six-month period, the Eaton Vance Tax-Advantaged Dividend Income Fund received a total of $24,961,435 in dividends and $8,947,638 in interest from the assets in its portfolio. When this is combined with a small amount of income from other sources, the fund had a total of $35,448,328 in income. It paid its expenses out of this amount, leaving it with $22,710,054 available for investors. This was nowhere close to enough to cover the $71,980,081 that the fund paid out in distributions, which may concern some investors at first glance.

However, a closed-end fund like this has other methods that it can use to generate the money that it needs to cover the distributions. The most common of these is capital gains. Unfortunately, the fund failed to accomplish the generation of money through this method during the six-month period. The fund had a total of $66,468,078 net realized gains but this was more than offset by $241,051,889 net unrealized losses. However, it is worth noting that the fund did manage to cover its distributions through realized capital gains and dividend income although it did still see its assets under management decline by $218,294,460 during the period. The distribution probably is sustainable though as long as the fund can keep generating realized gains. This does get more difficult if it keeps suffering losses, though.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund, the usual way to value it is by looking at the net asset value. The net asset value of a fund is the total current market value of all the fund’s assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to buy shares of a fund when we can acquire them at a price that is less than the net asset value. That is because such a scenario implies that we are acquiring the fund’s assets for less than they are actually worth. That is unfortunately not the case here. As of October 24, 2022 (the most recent date for which data is currently available), the Eaton Vance Tax-Advantaged Dividend Income Fund has a net asset value of $22.85 per share. However, the fund trades for $23.49 per share. This gives it a 2.80% premium to net asset value at the current price. This is admittedly not a particularly large premium but it is still higher than the 0% premium that the fund has traded at on average over the past month. It therefore might make sense for the fund’s price to come down a bit, especially because it rarely makes much sense to buy any closed-end fund at a premium.

Conclusion

In conclusion, dividend income strategies tend to be reasonable ones to use during inflationary times. This is because many companies are able to increase their revenue and earnings during such times and this could result in both growing dividends and a rising stock price. The Eaton Vance Tax-Advantaged Dividend Income Fund seeks to capitalize on this and it has clearly enjoyed some success as it is one of the few closed-end funds that has managed to consistently increase its distribution over time. Unfortunately, the fund has somewhat underperformed the S&P 500 during the volatile market that we currently have and it trades for a fairly expensive price. It could prove to be a reasonable addition to a portfolio should the price drop a bit, though.

Be the first to comment