Michael Vi

While the upcoming loss of exclusivity for AbbVie’s (NYSE:ABBV) Humira drug is a significant headwind, I think the markets have overly penalized the company in terms of valuation. Management and analysts expect the company to return to growth by 2025. Meanwhile, investors are rewarded with a 4% dividend yield to wait. I would recommend investors accumulate shares that are attractively valued at 10x P/E.

Company Overview

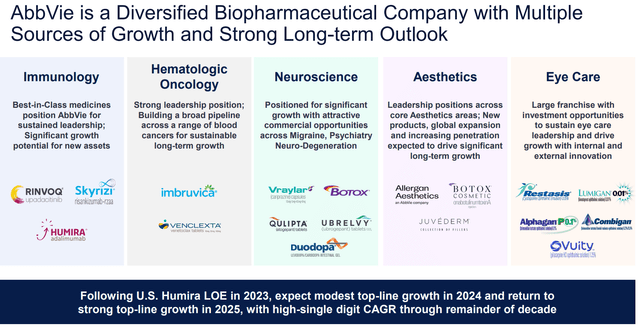

AbbVie is a global biopharmaceutical company with products spanning immunology, oncology, neuroscience, eye care, virology, gastroenterology, and aesthetics (Figure 1).

Figure 1 – AbbVie overview (ABBV investor presentation)

Robust Earnings Since Spin-out

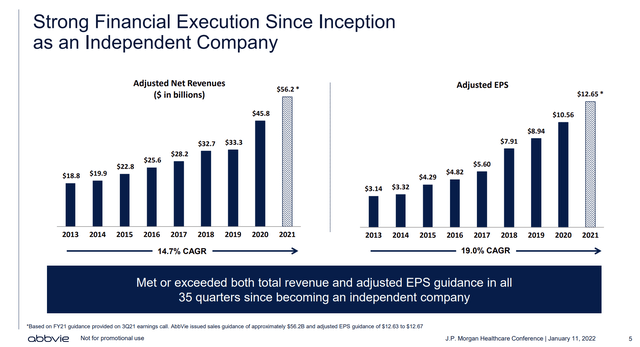

Since it’s spin-out from Abbot Laboratories (ABT) in 2013, AbbVie has delivered some of the strongest revenue and earnings growth in the pharmaceutical industry, with revenue growing at a 14.7% CAGR and adjusted EPS growing at a 19.0% CAGR (Figure 2).

Figure 2 – ABBV strong historical revenue and earnings growth (ABBV investor presentation)

Shareholders of ABBV have been well rewarded, with the stock returning 330% from its $35 spin-out price ahead of the S&P’s 167% price return (Figure 3).

Figure 3 – ABBV vs. SPX price returns (Seeking Alpha)

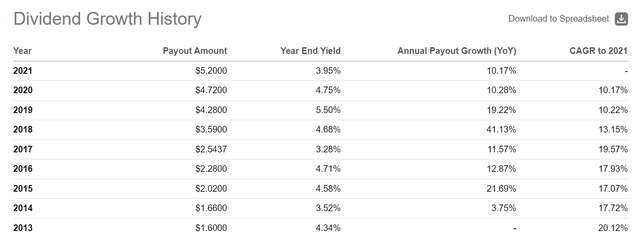

Furthermore, ABBV has paid cumulative dividends of over $32, and is currently yielding 4% (Figure 4).

Figure 4 – ABBV dividends (Seeking Alpha)

Based upon the latest guidance for FY 2022 (adjusted EPS guidance range of $13.78 – $13.98), the forward dividend rate of $1.41 / quarter appears well covered (41% adjusted EPS payout ratio).

Looking Beyond The Near-term Growth Slowdown

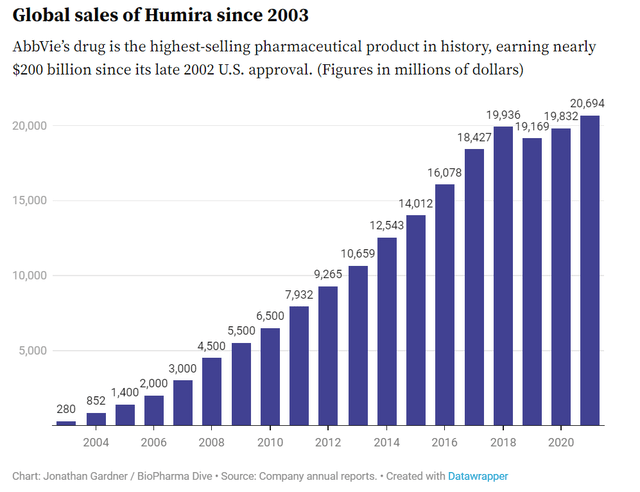

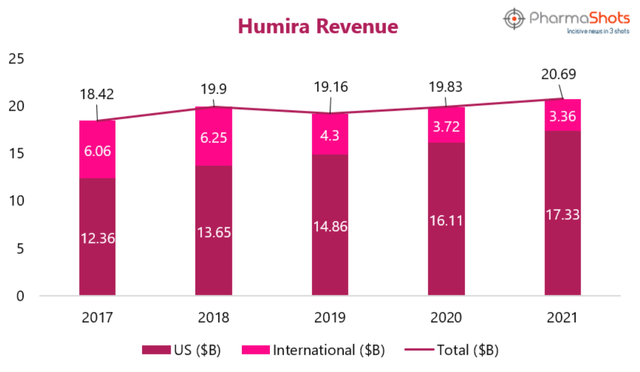

The biggest headwind for AbbVie is the upcoming loss of exclusivity (“LOE”) for its blockbuster drug, Humira, with biosimilars set to launch in 2023. Humira, a drug to treat rheumatoid arthritis, Crohn’s disease and other autoimmune diseases, is one of the most successful drugs ever, with 2019 sales of $19.2 billion and regularly topping the best-selling drugs lists. Since its launch in 2002, Humira has delivered nearly $200 billion in revenues to AbbVie (Figure 5).

Figure 5 – Humira sales (biopharmadive.com)

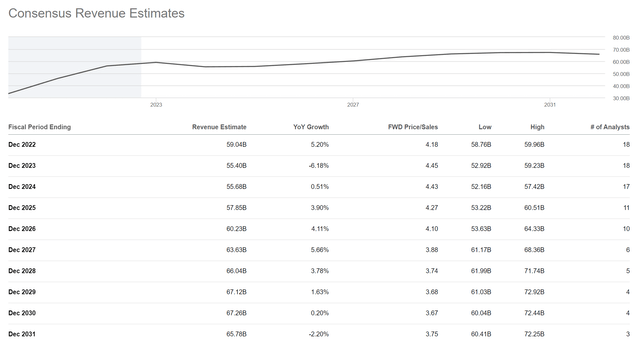

Consensus revenue estimates already reflect this headwind, with revenues expected to decline by 6% in 2023, and stay flat in 2024, as AbbVie comps the loss of Humira exclusivity (Figure 6).

Figure 6 – ABBV revenue estimates (Seeking Alpha)

In fact, it can be argued that consensus estimates may be too conservative for AbbVie’s revenue post the LOE on Humira. From recent earnings calls and presentations (for example, Figure 1 above), AbbVie management has been talking about high-single-digit (“HSD”) revenue growth CAGR from 2025 to 2030, whereas consensus estimates from Figure 6 above show revenue estimates only growing at low-single-digit (“LSD”) CAGR for those years.

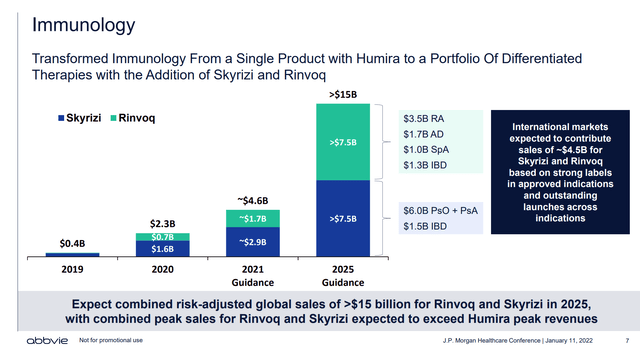

One example of potential growth from AbbVie’s pipeline are the drugs Skyrizi and Rinvoq used to treat psoriasis and severe rheumatoid arthritis respectively. AbbVie believes these two therapies can combine for $15 billion in sales by 2025, significantly offsetting the LOE of Humira (Figure 7).

Figure 7 – ABBV expects new therapies to offset Humira (ABBV investor presentation)

The 2019 purchase of Allergan, which makes the therapeutic Botox in addition to other drugs, also help backfill revenues. In 2018, the last fiscal year before the merger, Allergan generated revenues of $15.8 billion.

AbbVie Isn’t Giving Up Humira Without A Fight

Although AbbVie has negotiated with 9 manufacturers for the launch of Humira biosimilars in 2023, the company still holds key manufacturing patents that do not expire until 2034. Biosimilars, unlike ‘small molecule’ generic drugs, are not identical to their reference drugs. Biologics are ‘large molecule’ drugs that can be sensitive to changes in the manufacturing processes. All told, AbbVie has over 100 patents on Humira formulations and manufacturing processes in addition to the core patent, which could delay manufacturing and uptake of the biosimilars.

Furthermore, biosimilars of Humira are already available in Europe since 2018, yet Humira’s international sales remains fairly robust (Figure 8).

Figure 8 – Humira sales (pharmashots.com)

One other tactic AbbVie has been employing is a patient support program called Humira Complete, which spans assistance with injection training, help with getting insurance coverage, and providing nurse advocates. Through Humira Complete, AbbVie hopes to convince patients and insurers that the higher priced Humira drug is worthwhile, compared to biosimilars.

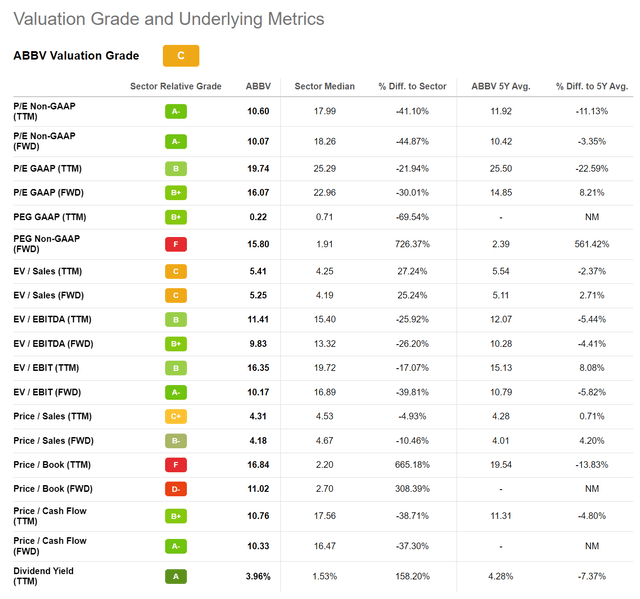

Valuation Attractive

Due to the expected loss of exclusivity of Humira, AbbVie’s valuation remains at rock bottom levels. ABBV is currently trading at 10.1x non-GAAP Forward P/E, vs. the sector median of 18.3x and S&P 500 at 17.0x.

Figure 9 – ABBV valuation (Seeking Alpha)

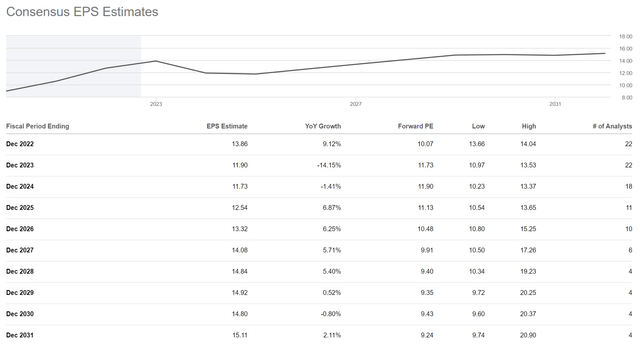

While the pending LOE of Humira is a key risk, the discount appears too large. Note, analysts widely expect 2023 and 2024 earnings to decline, but only by 14.2% and 1.4% respectively, so an 8 turn P/E multiple discount seems excessive.

Figure 10 – ABBV EPS estimates (Seeking Alpha)

Pfizer As A Case Study

Pfizer (PFE) could be an interesting case study for investors interested in AbbVie. In 2011, Pfizer also faced a loss of exclusivity with its blockbuster drug Lipitor. Lipitor is a statin drug used to prevent heart attacks and is one of the highest selling drugs of all time. At one point, Lipitor accounted for a quarter of Pfizer’s sales, and it was 14% of Pfizer sales in 2011, the year it lost exclusivity.

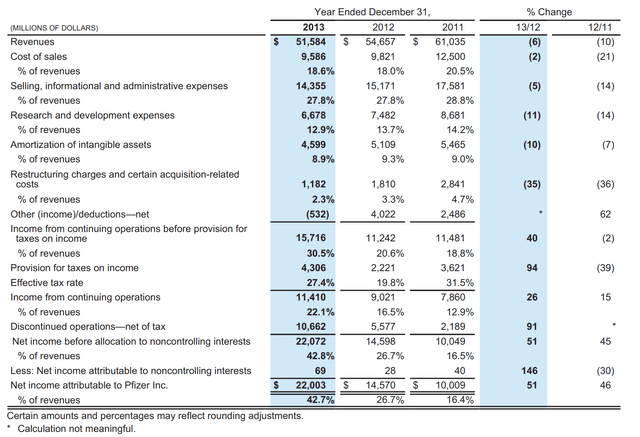

Although Pfizer’s sales declined by 15.4% over the 2 years from 2011 (Pfizer lost exclusivity on Lipitor and several other drugs in that time frame), the company was able to actually grow pre-tax income from continuing operations, from $11.5 billion in 2011 to $15.7 billion in 2013, as Pfizer reduced expenses to offset lost sales.

Even adjusting for the impact of other income / deductions and restructuring charges, adj. pre-tax income was $16.4 billion in 2013 vs. $16.8 billion in 2011, roughly flat despite the large reduction in revenues (Figure 11).

Figure 11 – PFE financial summary from 2013 (PFE 2013 10K)

Risk

The biggest risk to AbbVie is a faster than expected decline in the Humira business. While management and analysts seem relatively sanguine about the potential risks, it is definitely something to keep an eye on.

Furthermore, AbbVie is currently being sued by some officials and insurers for anti-competitive practices with respect to Humira. Although AbbVie has won the latest round in the lawsuit, given the dollars involved, investors should not be surprised if additional lawsuits emerge over time.

Conclusion

In summary, while the upcoming loss of exclusivity for AbbVie’s Humira drug is a significant headwind, I think the markets have overly penalized the company in terms of valuation. Management and analysts expect the company to return to growth by 2025. Meanwhile, investors are rewarded with a 4% dividend yield to wait. I would recommend investors accumulate shares on pullbacks and put their faith in management that has delivered 400%+ total returns in the past decade.

Be the first to comment