recep-bg/E+ via Getty Images

Investment Thesis

BlueLinx (NYSE:BXC) faces a confluence of macro factors. There are rapidly rising rates and a high inflationary environment. However, I believe that those significant headwinds are now starting to flatline.

On the other hand, there’s a bear discussion that these macro headwinds have only just started to be reflected in the economy, and their impact on 2023 is still unknown.

On the other hand, I maintain that at approximately 3x trailing free cash flows, even if free cash flows over the next twelve months fall by more than 60%, that would still leave the stock trading at less than 7x depressed free cash flows.

Despite recognizing all the uncertainty in this name, I’m bullish on BlueLinx Holdings. Here’s why.

Revenue Growth Rates Fizzle Out

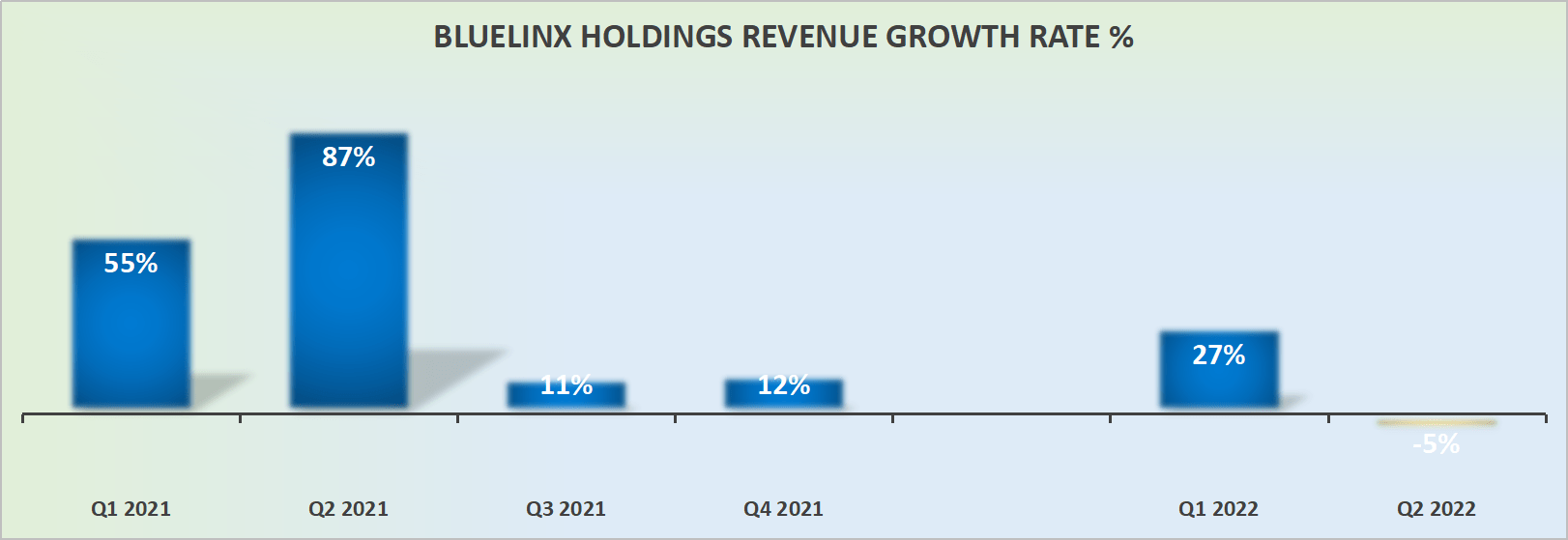

BXC revenue growth rates

Most investors considering BlueLinx have come to understand that the big challenge for the company isn’t so much about its upcoming Q3 results. Or even, for that matter about its Q4 results.

The serious question facing this investment is how will 2023 shape up, in light of rapidly rising interest rates.

Something that we’ll now turn to discuss in the next section.

The Bear Case Facing BlueLinx Holdings

The bear case is both simple and unavoidable. In a higher interest environment, demand for housing is going to slow down, which will have a knock-on impact on BlueLinx’s revenue growth prospects.

Now, let’s add some further nuances to this bear case. We are facing such a rapid rise in interest rates that it puts the US economy in unchartered territory.

Furthermore, these rate hikes will take some time to percolate through the economy. So, the bear case is that the impact of the raised rates hasn’t yet been felt in the economy. Hence, the impact on BlueLinx has not had a chance to make itself evident.

What’s more, the bulk of the progress that BlueLinx has made in the last several quarters, which I previously asserted was ”impressive”, has already been reflected in its operating margin.

That being said, as you know, operating leverage works both ways. When revenues are increasing against a largely fixed base, the comparables with the prior year are astonishing.

And the same will happen in reverse. When revenues come down by 20% to 30% y/y, given a large amount of fixed costs, this will see its EPS numbers tumble more than 40% y/y.

Despite my succinctly summarizing the bear case, this should not make it any less weighty. Those concerns are very much real, and valid, with both the magnitude and the lasting impact unknowable.

Indeed, despite this new management team doing everything they can to navigate the ship, the fact remains that they too are navigating this period with poor visibility.

And now, in the next section, I’ll further discuss BlueLinx’s holding free cash flow movements.

A Spotlight on BlueLinx’s Free Cash Flow Potential

Before discussing BlueLinx’s free cash flow potential, I’ll momentarily turn to discuss its balance sheet.

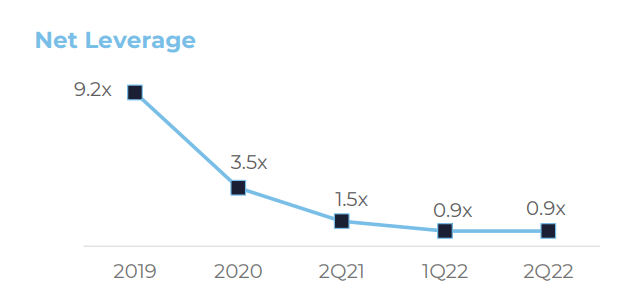

BXC leverage

In my previous articles I’ve noted that BlueLinx is in much better shape today than it was a very years ago, and highlighted that its net debt to EBITDA is down so significantly, readers have pushed back that this is because BlueLinx is making abnormally high EBITDA. That this is not a through-the-cycle EBITDA.

And while I don’t agree with that perspective I can’t earnestly show evidence to the contrary to support my own argument. That being said, what I can declare is that today, BlueLinx doesn’t have any significant debt maturities:

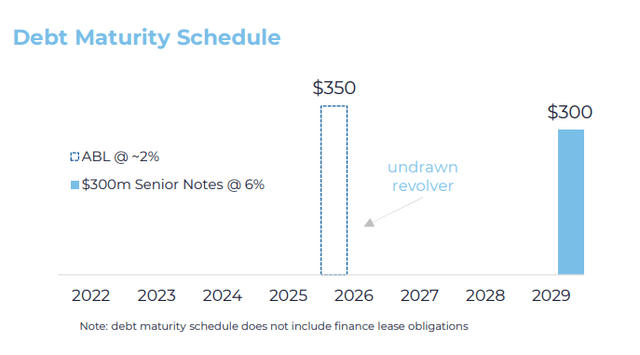

BXC August presentation

As you can see above, BlueLinx holds $350 million of an unused, undrawn, and available revolver.

And its next material debt stack is at the end of the decade. That means that whatever is happening right now in interest rates will have minimal effect on its debt that isn’t due for more than six years!

Next, consider how lumber prices appear to be bottoming out.

Trading Economics

The spot market for lumber prices came down very quickly in Q1, and the early part of Q2, but I believe the graph above speaks for itself that lumber prices are now consolidating around $480 mbf.

And this leads me to now discuss its valuation

BXC Stock Valuation — 7x Next Year’s Free Cash Flow

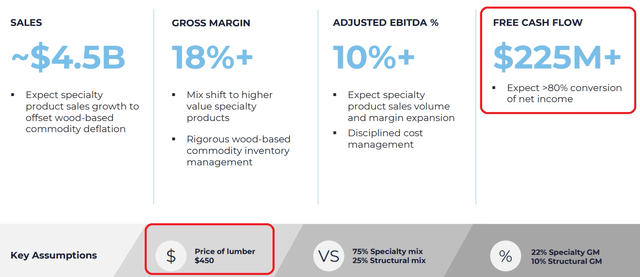

BXC August presentation

As you can above, BlueLinx uses as its key input, $450 mbf for the price of lumber. And as we’ve discussed, lumber prices right now are more than 5% higher.

Consequently, this insight supports BlueLinx’s free cash flow estimate of $225 million through the cycle.

And if we were to assume that its free cash flow in 2023 gets cut by 60% y/y, that would mean that in 2023 BlueLinx’s free cash flow would get compressed down to $90 million.

That would put BXC priced at 7x next year’s depressed free cash flow potential. A multiple that I believe is simply too cheap to be ignored by the market.

The Bottom Line

In one line, this is the summary, BlueLinx Holdings continues to make positive free cash flow and the stock is holding up, despite all the macro concerns.

At a more nuanced level, there continue to be both valid and substantial concerns that as BlueLinx exits Q4 2022 and looks ahead to H1 2023, the comparison with the same period this year will be brutal.

What’s more, given the rapidly rising interest rates have not, as of yet, had a chance to run through the economy, the ultimate impact of these higher rates is still to be felt.

Nevertheless, all considered, I believe that if BlueLinx’s free cash flow falls by 60% y/y, the business is still only priced in the worst case around 7x next year’s depressed free cash flows.

Hence, I believe that when all is considered, this stock is attractively priced.

Be the first to comment