jetcityimage/iStock Editorial via Getty Images

In August, at the aggregate level, chemical companies’ stock price performances were in line with the European market index signing a minus 4%, albeit with significant differences (K+S was the best performer with a +15%, whereas Evonik (OTCPK:EVKIF) was the worst with an -8%). Here at a Lab, it is not the first time that we comment on the European energy price development and how this will negatively impact many sectors; nevertheless, we have identified a few European chemical companies with revaluation margins from current prices such as BASF (OTCQX:BFFAF) and Evonik, and those that are instead overvalued compared to the fundamentals, for instance, Arkema (OTCPK:ARKAY).

All in all, our internal team believes that Evonik is an excellent business with superior returns in the Smart Materials/Specialty Additives divisions. Despite that – looking to the Wall Street analyst’s main objection, the greatest threat is Evonik’s ability to achieve top-line growth through the economic cycle. Cross-checking the company’s track record, Evonik was able to achieve that on three occasions out of the last six years. This advises that acquisitions will continue to play an important role in the company’s future. We already investigated that in our last publication called Evonik portfolio optimization positions them further into specialty chemicals.

Aside from the M&A, other implications specific to the German player that we support (versus market expectations) are:

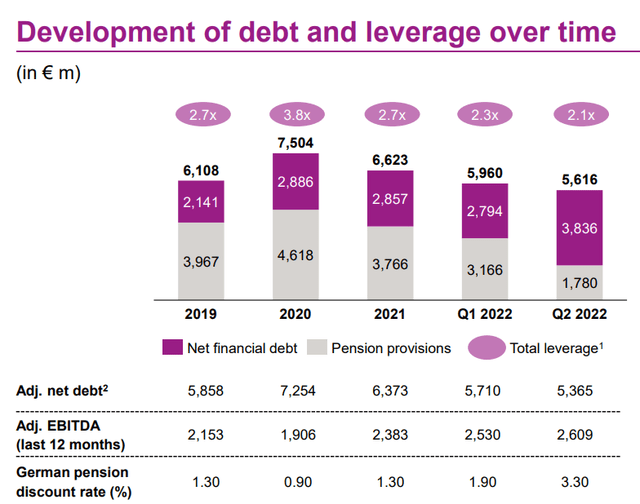

- Evonik’s net debt position that is still important compared to its closest peers. However, we should recognize that the company delivered a solid performance in the last few years (fig. 1);

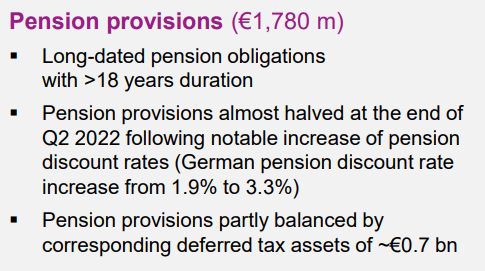

- Pension liability that with the current rise in interest rate (coupled with inflation expectation) was significantly reduced;

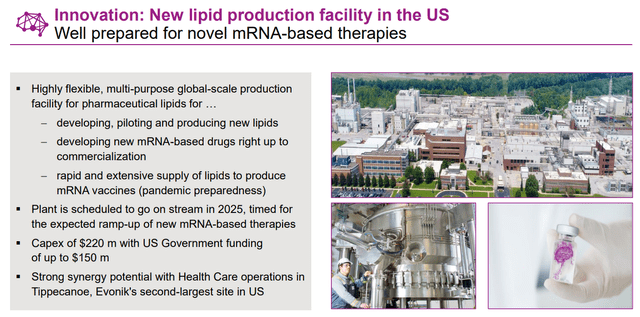

- The Healthcare division will drive the company’s profitability in the second half of the year, but also in 2023. It is important to highlight that Evonik chemicals were used to fabricate the COVID-19 vaccine, and even if the pandemic is easing around the World and analysts are discounting that (we believe that in wintertime, new waves will come again). In addition, new lipid production will serve for m-RNA medicines development (Fig. 3). Within our pharmaceutical universe coverage, Sanofi (SNY) and Pfizer (PFE) are working on that.

Evonik debt development (Evonik company presentation September (Fig. 1))

Evonik pension provision (Evonik company presentation September (Fig. 2))

Evonik new facility (Evonik Q2 results (Fig. 3))

Conclusion and Valuation

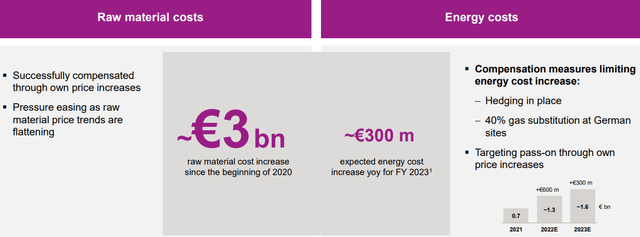

Here at the Lab, we are confident that Evonik’s end-market demand is still solid, especially across the Smart Materials/Specialty Additives segment. The Nutrition and Care division is also backed by higher methionine pricing; however, our main concern is related to energy/gas prices in the second part of the year. Free cash flows were already impacted by higher working capital requirements in H1, and we are forecasting reverse trends starting from next year. During the Q2 results, Evonik left its outlook unchanged for 2022, and it is confident to sustain a positive pricing delta with the extra cost associated with the energy shocks. In our buy case recap – just the lower pension deficit results in a stock price increase of almost €3. Based on a 6x multiple on a 2023 EBITDA forecast, we derive a target price of €23 per share versus the current stock price of €17.5, and so Evonik is currently a buy target opportunity.

Be the first to comment