bjdlzx

(Note: This article was in the newsletter on June 22, 2022 and has been updated as needed)

Evolution Petroleum (NYSE:EPM) had long been occupied with the financial issues of the operators of its main asset. But now Denbury (DEN) appears to have resolved its financial issues to the point where the company can now concentrate on its own priorities.

Management went on shopping spree that appears to roughly quadruple production. Fast growth can be risky because the logistics of fast growth can overwhelm management to the point where quality control goes out the window and cost control is lost. But this management has purchased interests in projects with well-known operators. Therefore, that logistics risk does not exist in this case.

Instead, investors need to depend upon management’s judgment that the purchases were a good deal. This is a small company that purchased small interests to grow. Generally small interests in any project are less marketable because there is an operator in control. However, gains in value can be obtained if one of the larger interest holders wants to gain a majority interest in the project of if a project is completely purchased by the operator to save money. Otherwise, small non-controlling interests often remain at bargain prices. So, it is a lot harder for investors to determine if the company really did purchase at a deal price.

Helping the situation considerably is the fact that many regard the current situation as a buyers-market. The company purchased at a time when commodity prices rose. Nothing helps a purchase look like a deal better than higher than expected commodity prices. Those higher-than-expected prices immediately after a purchase have a considerable effect on the return-on-investment due to the time value of money. More money back sooner limits the potential damage a later downturn can do to any expected profit. It also increases the upside potential.

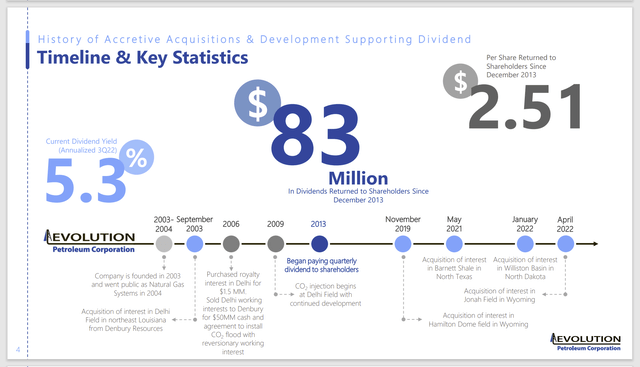

Evolution Petroleum Company Business History (Evolution Petroleum June 2022, Corporate Presentation)

The concern of the market would be about the purchases made over the last two years. Those purchases increased the production of the company considerably in a short period of time. The board of directors and the founders to have considerable experience in building and selling companies.

But the market is concerned about the balance going from no debt with a large cash position to more debt than the previous cash position. That is a major change in financial strategy. Management has released guidance that keeps the debt ratio under 1. Such a ratio would imply that management can keep the debt ratio conservative enough to remain a non-issue for the foreseeable future.

Management is off to a good start by announcing the latest debt balance of $21 million with an $8 million cash balance. That put a lot of initial worries “to bed”. However, there will be some market concerns until the new arrangement has a couple of years reported.

The risk of course, is that a commodity price downturn makes the debt a very material issue. Mitigating that risk is a whole lot of industry insiders that have either gained control of companies through either proxy fights or reverse mergers (that I follow). After these insiders gained control, many of them have continued to purchase still more. That tells me, that at least this management is properly synchronized with the thinking of a lot of experienced industry people.

Sometimes recoveries abort prematurely as was the case in 2018. That appears unlikely to happen because the speculative lending that quickly entered the industry in 2018 brought about a premature pricing decline (and then suffered big losses). So, the speculative money that brought about rapid industry production increases is gone.

Instead, there are lenders and the bond market, that demand some very conservative financial ratios and a sound reason to finance an acquisition. Here, the projected debt ratio of less than one is probably a very sound financing proposal. The reputation of the various operators is another risk reduction strategy to an otherwise higher risk shopping spree.

The Best Bargain

Management purchased some natural gas production at what is turning out to be bargain basement pricing assumptions.

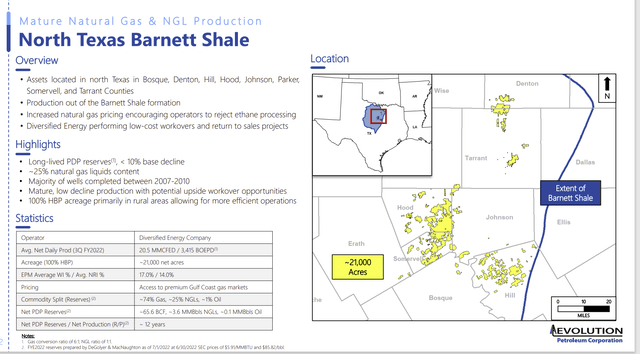

Evolution Petroleum Barnett Shale Purchase Characteristics. (Evolution Petroleum August 2022, Corporate Presentation)

Current prices, even with the latest pricing volatility, will likely allow this purchase to be paid back far faster than was assumed at the time of the purchase. Rising prices “go straight to the bottom line” with very minimal deductions (like increasing royalty) because the production and transportation costs were paid for at the lower prices. This purchase is likely to be a cash flow bonanza for the company for a very long time to come.

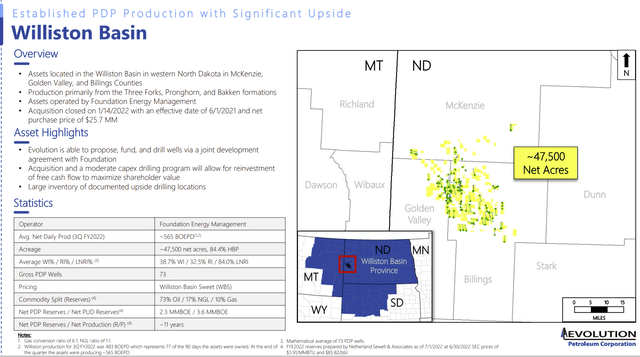

Evolution Petroleum Williston Basin Operating Characteristics (Evolution Petroleum August 2022, Corporate Presentation.)

On the other hand, this purchase appears problematic. Anytime you see a 50% (or more in this case) return in this kind of pricing environment, then you know you have high-cost production. Someone probably lost a lot of money on this acreage in the past. The job of Evolution Petroleum management is to not add to those losses. Usually, a buyer in this situation can do fairly well as long as they are careful about expanding production.

Shareholders need to assume that management knew what it was doing when they purchased these properties (and that management did indeed get a good deal for the purchase price).

Since the wells are high cost, then drilling can only happen during times like the current when commodity prices are robust. Usually, management can hedge that well production to assure a payback plus a minimum profit goal. The well then produces until revenues no longer cover cash costs. This production could even be shut-in during times of very weak commodity prices.

Debt Strategy

Evolution has long been associated with relatively high operating costs. That is ok as long as the debt strategy matches the known high costs.

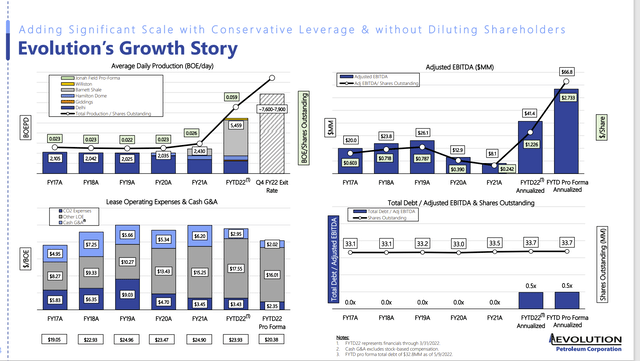

Evolution Petroleum Financial Growth And Debt Strategy (Evolution Petroleum August 2022, Corporate Presentation.)

Management is forecasting a huge upward spike in EBITDA. Of course, much of the industry is happily guiding higher as well. The key here is to keep the debt levels low enough so that when the next inevitable downturn happens, that debt ratio shown above remains conservative. Right now, I like the chances of management doing just that. As noted, management has already repaid some of that debt shown above.

This management has in the past prioritized balance sheet strength. Therefore, the distribution has to be looked at as opportunistic and variable. Management would not hesitate to cut that distribution in a minute, if the cash was needed for something more important. Therefore, income investors that need dependable income can look elsewhere.

The Future

The lessening of dependence upon one project has been a long overdue goal. Now investors are going to find out if management purchased bargains or busts. Cash flow will be generous for the time being. The important consideration will be the financial performance during the next industry downturn.

Management has diversified into a significant amount of natural gas production. That may prove to be significant because natural gas is an important raw material for plastics used in the green revolution and is also an important source of hydrogen for the growing hydrogen market. That makes the outlook for this production extremely bright.

Management does not have a lot of consolidation issues associated with the shopping spree because each project has an operator. Management does have to keep flexibility available to be able to participate in each project as desired. Right now, everything about the company appears positive.

However, the small size, and the lack of management depth make this one risky compared to the larger companies I follow. This is true even though management has reduced a lot of small company risks that are typical in the upstream industry. For that reason, this company may not be suitable for conservative investors. But it has a lot to offer those willing to assume reduced smaller company (upstream) risks.

Be the first to comment