Zolnierek

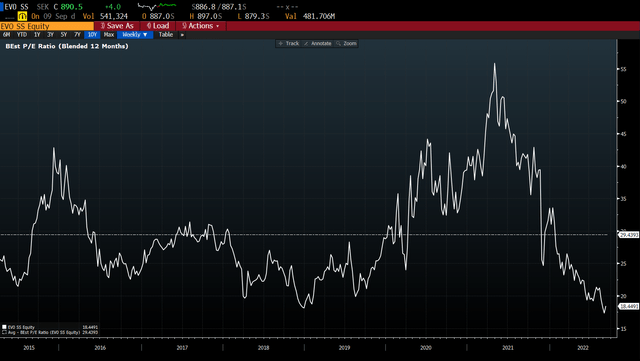

Evolution AB (OTCPK:EVVTY) is the leading B2B online casino content provider. It is well positioned to capture share from the offline gaming industry and enhance its scale advantage, thereby driving high revenue growth. The growth is supported by its strong competitive position (size and distribution capacity) and huge TAM. From an investor’s perspective, I believe the current valuation (18x forward earnings) looks cheap historically, especially when EVVTY is five times larger than the last time it traded at this level.

Business overview

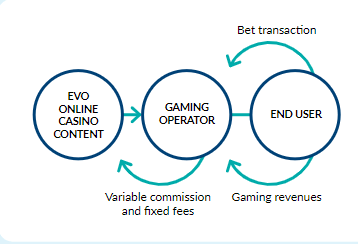

EVVTY innovates, develops, and produces content for online casinos on a B2B basis. EVVTY content can only be accessed through an operator’s interface, which includes important parts of the gaming experience like player authentication, account management, and the user interface.

The products are then marketed and sold to end users by gaming operators. The majority of the largest online gaming operators in Europe and North America are Evolution’s customers, as are a growing number of land-based casinos that have begun to offer games online.

EVVTY mainly operates in Europe (~62% of FY21 revenue) and Asia (27% of FY21 revenue), while the remaining 11% comes from North America.

EEVTY filing

Economic model

The majority of EVVTY’s revenues consist of commission fees for both live and Random-Number-Generated (RNG) casino games, which are paid monthly by operators. The commission is calculated as a percentage of the operators’ winnings, generated via the company’s casino offering. Through commissions, EVVTY is able to benefit from the growth of the online casino market as a whole.

Investment thesis

Capturing tons of shares in a huge market

EVVTY’s services are available globally, and its products meet global demand. The global TAM for the gaming market is enormous, estimated to be EUR359 billion in CY21 (measured in gross gaming revenues). 25% of that amount comes from online gaming, which has steadily done better than land-based gaming in recent years.

From a commercial standpoint, online casinos provide an opportunity for online operators to differentiate themselves through innovative gaming options and to reach new players through customization. Traditional land-based casinos can overcome the limitations imposed by physical facilities by shifting a portion of their operations online. So, the growth of the market is a result of technological progress, which shows that there is still a lot of room for traditional offline experiences to move online.

As such, strong demand from gaming operators and their end users is driving online casino growth. Live casino, where EVVTY has a strong presence and a leading position, is a key product that allows operators to differentiate themselves in the market by allowing them to completely customize both the backdrop and the content. Over the past years, live casino gaming has been growing significantly faster than traditional casino games, and now represents >33% of total online gaming globally.

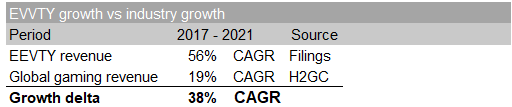

From 2017 to 2022, EVVTY has consistently captured a larger share of the online gaming market than the overall market. Given the trend toward online gaming and EVVTY’s scale advantage, I believe this growth will continue.

Own model

Aside from strong demand, the spread of mobile technology facilitates the distribution of online gaming, resulting in increased overall market growth. EVVTY is well positioned to capitalize on this tailwind because its products are designed to provide users with easy access to live casino games across all major platforms. In 2021, 69% of the money made from games on EVVTY’s platform came from mobile devices.

Economies of scale

There are few entry barriers in this industry. Any player can create and distribute their own game. The ability to scale to success is the barrier here, resulting in a low barrier to entry but a high barrier to success. Scale is critical because it provides economies of scale, which EVVTY benefits from as the market leader.

Scale economies are primarily manifested as a cost advantage in personnel costs. The most expensive aspect of operating in this industry is personnel costs (EVVTY employs >15,000 employees as of 2Q22), which are primarily related to staffing and recruitment within operations, as well as IT and product development. Scale enables EVVTY to amortize all personnel and other fixed costs across its large pool of players, resulting in the lowest cost per unit compared to non-scaled players (i.e., new entrants). An example from a game perspective can be seen in Live Casino games. Live casinos are very complicated products that need more than just a technical solution to be profitable and work well. They also need a certain volume of customers and excellent operational excellence.

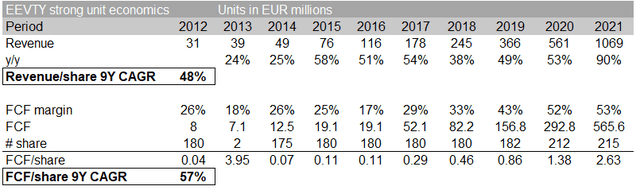

Strong unit economics

EVVTY’s profit margins are incredible. The company generates a lot of cash, which means it can fund both organic growth and M&A. Organic growth and strategic acquisitions have contributed greatly to growth. Over the last nine years, revenue has grown at a CAGR of 48%, while FCF/share has grown at a CAGR of 57%.

This financial advantage in profit margins and growth allows EVVTY to crush competitors either through sheer pricing power, replicating the product or operating model, or acquiring them. I believe EVVTY’s margins will improve further as it scales up, further enhancing the company’s leadership position.

Innovative ability supports growth

The key pillar of the strategy to establish leadership is innovation. Aside from the core offerings, EVVTY continues to offer variations on the originals as well as new games in order to attract players. In 2019, EVVTY changed the way live casinos work, which shows that it can come up with new ideas.

A live casino is a product that allows operators to differentiate themselves in the market because it allows for extensive customization of both the backdrop and the content. As a result, both operators and end users will have a one-of-a-kind experience.

With the introduction of in-house developed game shows, EVVTY transformed the live casino domain. This game category has been a powerful conversion tool in attracting new player types to live casino, such as first-time live players and those who do not typically play live casino. With these game shows, which combine live casino, RNG, and augmented reality technology, EVVTY has been able to reach a much larger audience and solidify its position as the most innovative company in the gaming industry.

Experienced management with a long-term focus on growth and market share

Management has demonstrated their know-how in this industry through the financial performance of EVVTY. Their focus on growth has been clearly communicated:

- To continue organic growth in new markets by leveraging the existing proven platform and overall offering leadership.

- To pursue strategic acquisitions aimed at expanding the product portfolio.

What makes me believe the management team has experience is their focus on growth and market share rather than short-term profitability. This is evident from comments made by management during the 3Q20 earnings call when asked by an analyst regarding expanding EBITDA margin.

“We have always stated that there will be a trade-off between margin and revenue, we will always expand revenue and go for market share and continue to expand. I mean, a euro earned or a dollar earned is always a euro or a dollar earned. So the percentage margin is just the figure. So we want to expand and we will continue doing so…” Martin Carlesund, CEO

Valuation

Generally, it is impossible to forecast the precise growth rate of any high-growth company, especially in a hugely growing industry. I think the best way to see into the future is to look at the business from a qualitative point of view (as described above) and see if it can keep growing like it has in the past.

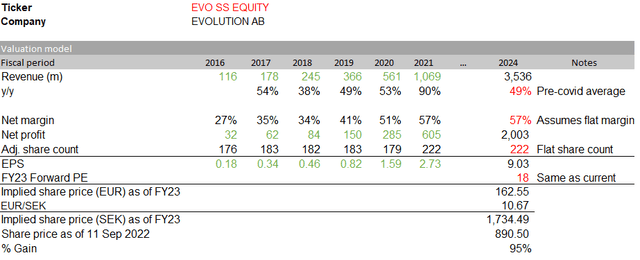

My model assumes EVVTY can continue growing at the same high pace it did in the past (pre-COVID). As stated in my thesis, I think EVVTY’s market position improves as it acquires market share. I left margins flat moving forward just to be conservative as I believe management would reinvest excess profits to capture market share (the right long-term strategy). If EVVTY does as I expect, we can expect ~100% upside by FY23, assuming the 18x forward PE (near 7-year trough).

Risks

Regulation

60% of the group’s revenues continue to come from unregulated markets. National regulations are being adopted by an increasing number of nations. As a result, gaming operators, and in some cases, providers, are required to apply for and obtain country-specific licenses, pay applicable local taxes, and submit to national oversight. That said, the GGR produced by EVVTY’s clients ultimately determines EVVTY’s revenue. So, restrictions on products (like stake caps), bans on certain products, and changes that impact how end users act (like deposit/loss caps, advertising restrictions, or blocking payments) all have an indirect effect on EVVTY.

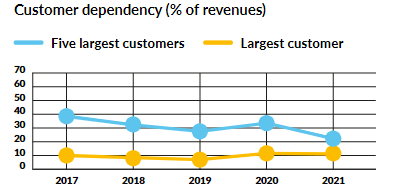

Concentration of customer revenue

As of FY21, EVVTY has a high customer revenue concentration (>20%). Even though it has decreased since 2017 over the years, it still accounts for a sizeable portion of the business. It is crucial to remember that this is a high-fixed-cost business; if 20% of revenue is lost through churn, that could easily account for more than 20% of FCF.

EVVTY FY21 filing

Rounding up

EVVTY is a long at the current valuation. The market has priced EVVTY near its 7-year trough, which is senseless given the business is almost five times larger than the last time it traded at this level. EVVTY is the market leader and should continue to scale as it captures market share from the offline gaming market. As the business rides through the near-term macro headwinds, it should continue to perform as expected.

Be the first to comment