sturti/E+ via Getty Images

Evolution AB (OTCPK:EVVTY) engages in the development, production, marketing, and licensing of live gaming and slots to the gaming operators around the world, with its largest footprint in Europe and the United States.

How it works is the company runs a variety of live games from a casino table, allowing participants to make bets on it via their devices.

While it has been offering immersive virtual gaming via its RNG unit for some time, the company has primarily been working on the overall environment in that segment at the temporary expense of limited focus on growth. It now feels it’s prepared to accelerate growth in that market, which could be a strong catalyst for the company if it’s able to execute on its strategy.

Since its live business is positioned for a solid, long-term growth trajectory, if RNG can increase its percentage of revenue while the Live unit grows, it’s going to be a significant tailwind for EVVTY.

In this article we’ll look at some of its recent numbers, the implications of the recent increase in its share price, and the long-term growth opportunities ahead of it.

Some of its recent numbers

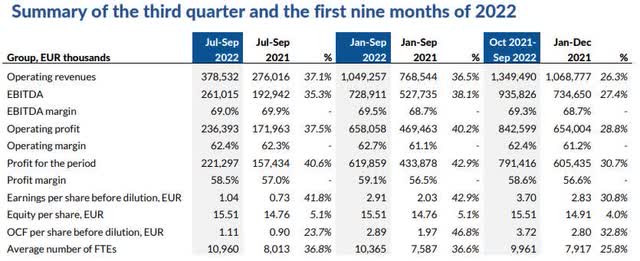

As I report the numbers below, take note they’re being reported in euros.

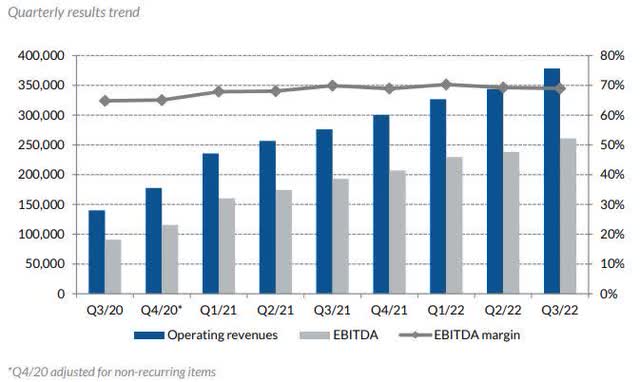

Revenue in the third quarter was €379 million, up 37.1 percent from the €276 million in revenue generated in the third quarter of 2021. Revenue for the first nine months of 2022 was €1.05 billion, up 36.5 percent from the €768 million in revenue generated in the third quarter of 2021.

Of the revenue generated in the reporting period, Live Casino accounted for €310.4 million and RNG games accounted for €68.1 million.

EBITDA in the third quarter was €261 million, up 35.3 percent from the EBITDA of €193 million generated in Q3 2021.

EBITDA margin in the reporting period was 69 percent, down from 69.9 percent year-over-year.

Operating profit in the third quarter was €236 million, up 37.5 percent from operating profit of €172 million in the third quarter of 2021.

Earnings per share were €1.04, up from earnings per share of €0.73 last year in the same quarter.

EVVTY had cash and cash equivalents of €320 million at the end of the third quarter and were debt free.

Recent initiatives

Among the recent launches of the company were a new studio in Connecticut, several live dealer customized studios in Michigan, the construction of a second studio in New Jersey, and live Craps in Pennsylvania and New Jersey.

The company pointed out it has no idea where the next iGaming legislation will be passed in the U.S., but it pointed out it has a large catalog of products ready to serve whatever market opens up.

My thought on this is iGaming is going to be similar to the U.S. marijuana industry in that it’ll be on a state-by-state basis that iGaming is legalized and adopted, not at the Federal level. It appears management, by its commentary agrees with that, but investors who might get overly optimistic about something happening at the Federal level concerning legalizing iGaming, could make investing decisions based upon something that is not likely to happen, especially anytime soon.

Another positive catalyst was it was the first quarter Nolimit was consolidated into the company, The company believes Nolimit will be an important piece of the puzzle of reaching its goal of becoming the leading provider of online casino to the market.

As for RNG, the company, as mentioned above, wanted to put the proper infrastructure in place before focusing more on developing games for the platform. Now that the infrastructure is in place, the company has plans to accelerate the number of games it offers for end users.

With the company believing RNG will be an important part of its business, the quarters ahead will tell us whether or not they’ve accurately identified demand, and if so, how quickly and effectively they’ll move to meet it. If the company can increase RNG’s revenue as a percentage of overall revenue while boosting revenue in its other segment, the company would do very well in the quarters ahead.

Nolimit City will be part of the growth strategy for the RNG segment. By increasing the number of studios, the company has had to hire more talent. It has already added 3,600 more employees year-over-year and plans to continue to do so as it continues to expand in America, Armenia and Spain.

Hiring quality people is one the key things the company is looking at as it continues to grow.

Geographic growth

Starting the U.K., it grew at a modest pace in the quarter, up 8.4 percent year-over-year. The company noted that at one time the U.K. was the largest market it operated in. Now it represents only 5.5 percent of total revenue.

I mention this in my early remarks on geographic growth because it’s not necessarily from a weakening market, but rather, a testimony to the fact the company is successfully expanding other global markets, which are raising overall revenue as a percentage of the total.

Revenue from the European market grew at a 12 percent clip. EVVTY considers this the most mature market it operates in, and revenue as a percentage of overall company revenue fell from 51.4 percent in 2021 to 42 percent in 2022. Just like the U.K., that is attributed to an increase in sales from other international markets. Europe and the U.K. continue to grow, but at a much slower rate than new markets EVVTY is expanding into.

In the strong North American market revenue grew 57 percent year-over-year, and in Asia markets were up 6 percent.

Other markets, including Africa and Latin America are growing at a 62 percent rate for the quarter. Latin America is the key driver there.

Looking at its geographic footprint and the growth opportunities in many parts of the world, EVVTY has a long way to go before it loses its growth momentum.

Conclusion

With the tremendous opportunities ahead for the company, EVVTY has a lot of wind at its back for long-term growth. Yet with that opportunity comes the need for more expenditures, which could weigh on the company, but assuming it generates revenue growth at similar margins as today, it will, over time, be a significant catalyst for the top and bottom lines of Evolution AB.

It won’t be a straight line it moves in, as increasing expenditures will have different levels of impact from quarter to quarter, but further out it will level off and should average close to what it is in this period of, which means it will likely become a highly profitable company over the long term.

In the near term, while things still look pretty good, the company is coming off a run from about $70 per share in mid-September 2022 to over $105 per share as I write. That suggests to me a lot of its current performance is already priced in, and the stock could be due for a pullback. Where it trades today is a fairly hefty price.

Assuming the stock takes a breather and corrects, it would be at that time that investors should consider taking a position in the company.

Finally, be aware that EVVTY is a thinly traded stock, and getting in and out could be difficult if taking a significant position in the company.

Be the first to comment