Alina555

Investment Thesis

Everi Holdings (NYSE:EVRI) develops gaming products and technology solutions for many countries. It was founded in the year 1998 and is headquartered in Las Vegas, Nevada. They reported a strong quarterly result. I will analyze their financial performance and future growth potential in this thesis. In my view, they are currently undervalued and constantly posting solid financial results, which makes it a great buying opportunity.

About EVRI

EVRI is in the gaming industry and operates in two segments: Games and Fintech. In the Games segment, they create entertaining game content, gaming systems, and gaming machines for the casino and digital gaming industries. In the Fintech segment, they provide trusted financial technology solutions that power the casino floor and financial services. Their financial services include funds dispensed, credit cards, check the warranty, and many more. Their business has expanded in several countries like Canada, the United Kingdom, the Caribbean, Central America, Asia, and of course, the U.S.

Financial Analysis

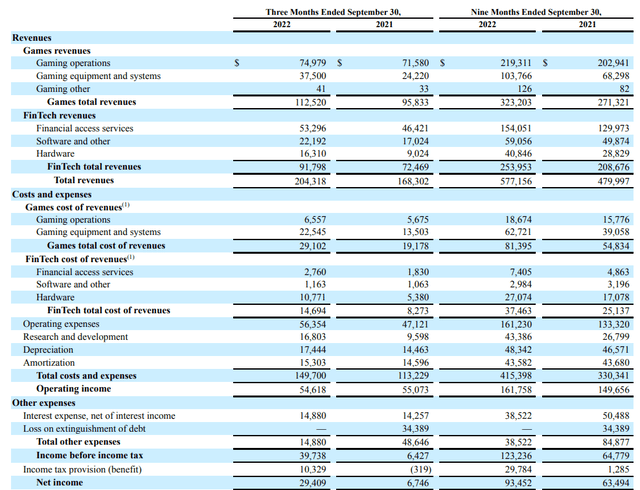

EVRI recently posted its Q3 F22 results, and in my opinion, it’s pretty impressive. They beat the market revenue estimates by 4.6% but missed the market EPS estimates by 7.7%. They reported an all-time quarterly record total revenue of $204.3 million, an increase of 21% compared to the Q3 FY21. I think the outperformance in both Games and Fintech segments led to increased revenues. Talking about the Fintech segment, the revenues grew by 27% to $91.7 million compared to the same quarter of last year, especially the hardware revenue in the Fintech segment grew by 81%. I think the main reason behind the Fintech revenue increase was the $11 billion of funds delivered to casino floors. The Games segment revenues grew by 17% to $112.5 million compared to the corresponding quarter of last year. I think the reason behind this increase was the increase in the shipments of gaming machines which increased to 1841 units, and the increase in the installed game base.

Seeking Alpha

Due to the outperformance of both segments, their net income rose by a staggering 335%, which is quite impressive. Their reported net income for Q3 FY22 was $29.4 million. Their diluted EPS for the Q3 FY22 was $0.30, a significant rise of 328.5% compared to the corresponding quarter of last year. Overall, the financial performance of the company in this Q3 FY22 was quite impressive.

Technical Analysis

TradingView

Currently, the stock is trading at $14.70, which is 44.5% down from the all-time high of $26.6. The stock is clearly in a downtrend, and in the weekly time frame, it is forming lower highs and lower lows formation over the last 1.5 years, which is considered a bearish formation. But after correcting more than 44%, the stock has reached close to a solid support level of $13.8, and the stock is also around its 200 ema, which is at $15. In my opinion, we can see a reversal from this level. Considering its strong fundamentals, the stock can take support from the level of $13.8 and change the trend. So technically, I think EVRI is a good buy right now because it is trading at a discounted price and is at a strong support level.

Should One Invest In EVRI?

Seeking Alpha

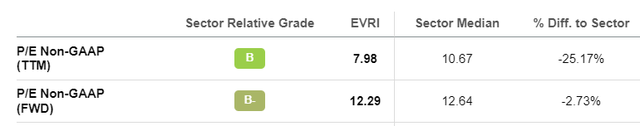

EVRI has a P/E (TTM) ratio of 7.98x compared to the sector P/E (TTM) ratio of 10.67x, which shows that the company is currently undervalued and has a lot of growth potential in them. They have revenue growth (YOY) of 26.35% and Diluted EPS growth (YOY) of 176%, which shows the growth aspects of them are promising.

Seeking Alpha

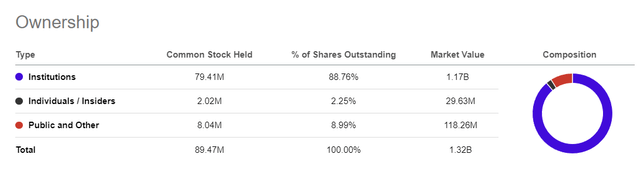

The shareholding pattern of EVRI looks perfect. The Institutions hold 88.7% of the shares of the company; generally, when institutions hold a majority of the stake in a company, then there is less volatility in price fluctuations in the share. The shareholding pattern shows us that institutions trust EVRI, and it is a positive sign for retail investors like us because it shows that they are safe to invest in. During the Q3 FY22, EVRI repurchased 0.9 million shares of its common stock under its $150 million share repurchase program. This reflects the management’s confidence in their company, and I think this repurchase indicates that we can see an increase in the share price of EVRI in the near future. Now talking about the revenue, they have estimated the annual FY22 revenue of $774.8 million, which is 17.3% higher than the FY21 revenue. Their growth trajectory looks positive, and I am sure they will perform better in the upcoming quarters. Recently EVRI was named to the Nevada top workplaces list for the second consecutive year. EVRI India offices also got the second annual certification as a great workplace. This shows the positive working environment in the company, and it helps improve the management’s efficiency.

RISK

Business Dynamic in Nature

The gaming industry is very competitive, and a company’s success depends upon its ability to develop and sell new games and products. The gaming devices and products market is highly competitive and will increase in the future. Some of their competitors have an advantage over them, like better marketing and better name recognition. To keep up with the competition, they must develop better products than their competitors. Suppose their products or financial services do not appeal to the patrons or their customers. In that case, they might lose business to their competitors, which can severely affect their financial performance in the future.

Bottom Line

In my view, EVRI is a perfect buy right now. They are trading at a lower P/E ratio and are undervalued compared to industry standards. Strong financial performance in recent quarters and management’s optimistic guidance for FY23 show their potential for future growth. In addition, EVRI is trading at a discounted price 44% lower than its all-time high. Fundamentally they are looking strong, so after analyzing all the parameters. I assign a buy rating on EVRI.

Be the first to comment