wichayada suwanachun/iStock via Getty Images

I recommend EverCommerce (NASDAQ:EVCM) as a buy. As businesses globally digitize their operations and services, the demand for software solutions grows by the day. EVCM is a company that offers software solutions to small and medium businesses that offer services to people. With such a specific niche of clients and a global digital migration, EVCM has a huge potential for revenue growth.

Business

EVCM is a company that offers software solutions to businesses offering home services, healthcare services, fitness services, and wellness services. Their software helps businesses with operations management, customer engagement, payment processing, and marketing solutions so that they can run more efficiently and make more money.

EVCM’s specific solutions serve the specialized demands of the businesses they serve. The specialized solutions improve their market penetration due to the convenience they offer businesses.

More and more SMBs adopting modern software solutions

I believe it is inevitable for more SMBs to adopt modern software solutions as the world moves towards digitization for more efficiencies. This is important for EVCM, as the U.S. SMB total addressable market (TAM) is very attractive, with only 9% of SMBs fully digitizing their operations. Some of the key factors I believe are pushing SMBs toward digitization are:

- Consumers’ preferences: Customers globally are yearning for digital experiences. These digital solutions also help businesses optimize their growth, be more efficient, and boost customer engagement. The win-win situation provides a good reason to adopt digital solutions.

- Ease of access: A large number of businesses and services are now available online. This means that they can be accessed remotely. Because more and more people want services they can access from anywhere, digitization is a must for any business to grow and succeed.

- Market penetration: Digital solutions allow businesses to reach their customers and potential customers globally in an easy and effective way. Digital marketing, for example, allows for specialized targeting. This allows businesses a broader market reach and gives them a boost in revenue.

- Digital adoption trend: SMEs across the world have seen more digital adoption in the past three years. More businesses are moving toward digitizing their operations because it makes their business run better and makes payments and tracking easier and safer.

Cost-effective vertically tailored solutions to address core markets

Unlike serving large companies, addressing the SMB market requires very cost-effective solutions, as there are a lot more SMBs than large companies. To this end, I believe EVCM has done a great job constructing the necessary solutions. They offer a number of tailored solutions that follow a similar process to provide value to end users, which include the key steps of any business like marketing, customer engagement and retention, and billing and payment.

In my opinion, it is paramount to offer solutions on each of these steps as it streamlines clients’ operations with no gaps in the value chain. This is also where, I believe, EVCM differs from peers who offer general digital solutions to service businesses. EVCM’s solutions are highly specific and tailored towards the needs of a particular business. This approach allows for the continuous improvement of their solutions or the introduction of a new solution based on customer experience and feedback.

To put things simply, SME businesses, unlike their large counterparts, are price sensitive. As such, they seek affordable and efficient solutions.

S-1

Mobile native integrated SaaS-based solutions

There is another competitive advantage that I believe deserves highlighting. EVCM’s solutions are full range in that they cover all operational functions, from internal functions to end-user functions, which offer a smooth user experience and improved operational efficiency.

Why is this important? Services from other players offering similar solutions lack connection, which lowers operational efficiency. With a full range of solutions, SMBs can reduce the cost of complex on-premise infrastructure by using EVCM’s digital solutions. This way, they can better utilize their limited workforce in other operations, thereby simplifying and optimizing their operations, which ultimately improves SMB’s perception of the EVCM value proposition.

In addition, EVCM’s software solutions are also accessible remotely to users and business owners. Given that we are moving more toward a remote work environment, I find this extremely effective, as technicians and service professionals can use EVCM’s mobile applications in the field even if they don’t have a cellular or wireless network.

Opportunities to expand into new verticals and increase monetization

Based on my research, it is extremely important to have an appropriate go-to-market strategy when targeting the SMB market. In my opinion, due to EVCM’s place in the SMB service ecosystem, robust customer relationships, and in-depth understanding of its clientele, it is well-positioned to leverage customer lifecycle insights to discover complementary solutions that boost their clients’ bottom lines. By constantly evaluating opportunities to create or acquire solutions, EVCM can expand its market share, boost customer loyalty, and fuel its rapid expansion.

There is a lot of room for expansion thanks to EVCM’s large customer base. As EVCM becomes more embedded in its customers’ daily business operations, it will be in a better position to take advantage of additional cross-selling and up-selling opportunities. The reason EVCM is able to do this is because their vertically integrated SaaS solutions cover the full spectrum of customer engagement. I think EVCM will be able to increase wallet share and improve retention if it keeps developing, acquiring, and transforming its solutions.

2022 Q3 earnings

The way I see it, Q3 earnings were OK. It was, of course, not the result I was hoping for. EVCM’s Q3 revenue was 1% lower than expected, and its EBITDA margin was 19%, down from 20%. In terms of Q4 guidance, management anticipates $157-$159 million in revenue and $32-$33 million in EBITDA.

Management noted increasing macroeconomic headwinds, particularly in its marketing services solutions segment, as well as a $0.2 million FX headwind in 3Q and $0.5 million in 4QE, which is concerning but not unexpected. The company has not provided formal revenue guidance for 2023, but management has stated that if the current macrodynamics continue, EVCM can expect revenue growth in line with what it is currently experiencing (which is not great because it is 3% lower than what the Street expected previously).

However, not all news is bad. One key bullish indicator is that the EVCM payments business, as well as the underlying software systems of action, are thriving, with payment volumes increasing by 22%. Furthermore, there was no change in churn or NRR, and there was a 30% increase in customers using multiple solutions. These are strong qualitative factors that indicate continuous momentum. In addition, I believe the management team is clearly aware of the importance of cash flow in that they intend to reallocate spending strategically to its most productive business areas, while also instituting cost controls.

Lastly, one of the best pieces of news from the earnings call, in my opinion, is that EVCM increased its willingness to spend $100 million on a stock repurchase program, citing it as an excellent way to increase shareholder value. In addition, the company entered into a $200 million notional interest rate swap agreement to convert a portion of the term loan from variable to fixed rate.

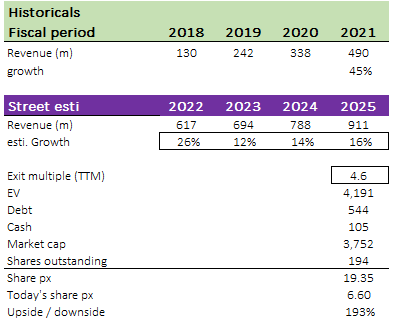

Valuation and model

I believe there is a lot of upsides over the next three years based on the Street estimates of revenue. I expect EVCM to continue growing at high rates as it continues to capture more share in the SMB space; however, growth should slow eventually as the Street expects given fewer low-hanging fruits to capture. That said, the TAM is huge; hence, the growth runway is long.

My key input is the exit multiple that EVCM should trade at in FY25. EVCM currently trades at 4.6x TTM revenue, 3x below its average. EVCM might trade back to 7x, but that is something that nobody will know. I have assumed it would continue to trade at 4.6, and this is justified by lower growth in FY25.

Author’s own calculations

Risks

Expanding into adjacent markets might not materialize

One of my bull thesis points is that EVCM can continue to roll out new modules to enter more markets, which will increase its TAM. However, EVCM might not have the financial muscle or technological resources to design and develop secure software solutions for newly specified industries.

Intense competition

The dynamic nature of the software solutions industry makes it difficult to cope with changing customer needs or the introduction of new products and services. Also, the low startup costs for companies that want to offer software solutions will bring in a lot of competitors, both big and small. With both new and old competitors who have different financial and technological resources, EVCM might be slower to respond to changes in the market or with customers than its competitors.

Summary

To conclude, I believe EVCM is undervalued. EVCM has already positioned itself as a market leader in offering SME software solutions. These solutions are self-improving, as feedback is used to improve them or come up with new ones. With a broad customer base, EVCM has the opportunity to optimize revenue growth by cross-selling or upselling. It is for these reasons that I believe that EVCM will be a profitable investment.

Be the first to comment