bjdlzx

Lumen Technologies Inc. (NYSE:LUMN) announced this week that it has officially completed the sale of its ILEC assets to Apollo-managed funds, clearing the way for a total of $7 billion (including proceeds from the recently completed sale of its LatAm assets) to find its way onto Lumen’s balance sheet and opening a new chapter in the company’s development.

Lumen Technologies now has the opportunity to lay out a capital framework, which I expect it to do on November 2nd when it reports 3Q-22 results.

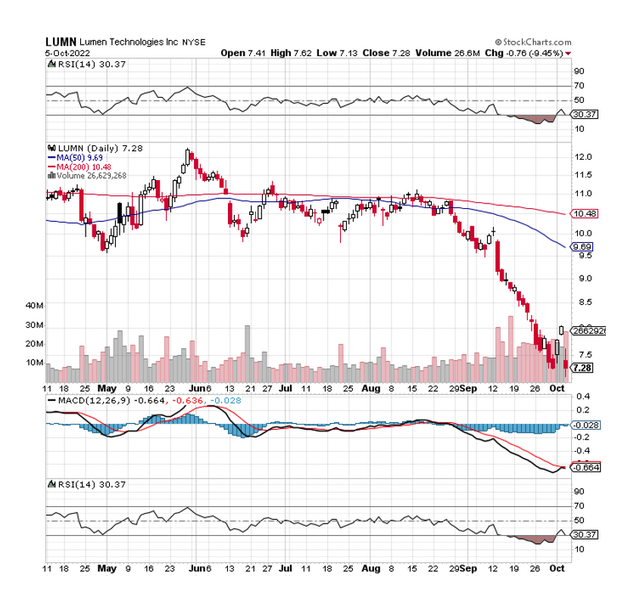

Furthermore, the recent selloff in Lumen Technologies has increased the stock yield to nearly 14.5%, indicating that the market anticipates a dividend cut.

Given that free cash flow risks are low and the valuation is extremely low, I think LUMN remains a top buy.

ILEC Transaction Just Officially Closed

Lumen Technologies’ ILEC transaction, which required the sale of incumbent local exchange carrier assets in 20 states, has been completed.

The deal, which is intended to streamline Lumen Technologies’ carrier operations, was announced more than a year ago and was finally approved in the third quarter.

According to a press release dated October 3, 2022, Lumen Technologies has now officially completed the transaction with investment funds managed by Apollo.

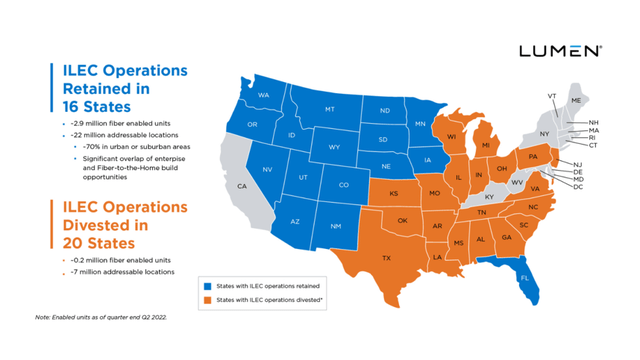

In August, the Federal Communications Commission of the United States approved the sale of Lumen Technologies’ ILEC assets. Lumen Technologies will keep its incumbent local exchange carrier assets in 16 states, totaling approximately 2.9 million fiber-enabled units.

ILEC Operations (Lumen Technologies)

How Is Lumen Technologies Using Its Cash Infusion?

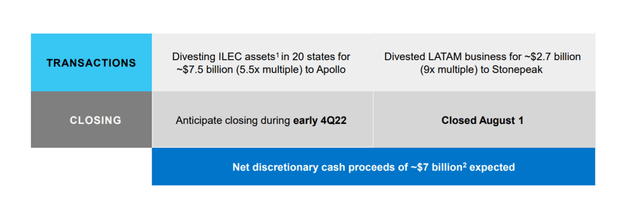

Lumen Technologies has scheduled its third quarter earnings presentation for November 2, 2022, providing an opportunity for management to substantiate future capital decisions, particularly with respect to the $7 billion that the company will receive from recent transactions (including proceeds from the $2.7 billion sale of its LatAm operations to StonePeak). Lumen Technologies will receive a total cash infusion of approximately $7.0 billion.

Cash Infusion (Lumen Technologies)

Lumen Technologies now faces a luxury problem in determining how to spend the $7 billion in cash proceeds from the recent transactions.

This will be the most important question for investors moving forward, as Lumen Technologies will need to present shareholders with a convincing plan for allocating its newly discovered wealth. Three areas compete for Lumen Technologies’ resources in particular:

- The balance sheet still needs to be repaired because the company had approximately $28 billion in long-term debt;

- Money must be spent on new growth opportunities (particularly in fiber); and

- Capital returns are likely to be high on investors’ wish lists.

Are Investors Worrying About A Dividend Cut?

If you look at Lumen Technologies’ dividend yield, which has recently risen to nearly 14.5%, you might think the market expects the telecommunications company to reduce its dividend payout.

Lumen Technologies, on the other hand, has more than enough free cash flow to cover its annual dividend of $1.00 per share. The current selloff appears to be exaggerated, and Lumen Technologies is on the verge of being oversold again, according to the Relative Strength Index.

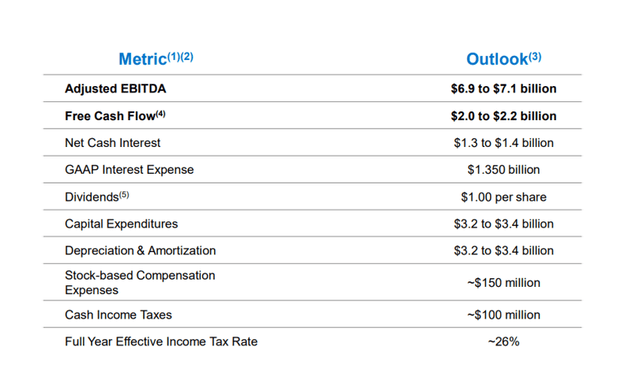

A dividend cut is unlikely, in my opinion, and would necessitate the company withdrawing its free cash flow guidance for 2022.

But why would Lumen Technologies want to withdraw its guidance when it generated $600-700 million in free cash flow in the third quarter and is about to receive $7 billion in cash this quarter?

Lumen Technologies is expected to generate at least $2 billion in free cash flow this year, and with $7 billion in cash on the balance sheet by the end of the fourth quarter, Lumen has more than enough cash to cover its relatively small (in absolute terms) quarterly dividend of $250 million.

Free Cash Flow (Lumen Technologies)

Lumen Technologies And The Risk Of A Lower Valuation

The fiber play is currently valued at only 3.6x free cash flow for 2022, implying a very high margin of safety given the company’s recent acquisition of so much additional firepower that it can use to repay debt, invest, and stabilize its dividend.

A withdrawal of guidance or a dividend cut, both of which I do not believe are likely, could be interpreted as reasons to lower Lumen Technologies’ valuation. I don’t see any practical reasons for this.

My Conclusion

Lumen Technologies is embarking on a new journey. With the finalization of the ILEC asset sale transaction, the company has a catalyst for a better balance sheet, additional investment capital, and the ability to return more cash to shareholders rather than less.

The earnings report due next month will most likely go into greater detail about how management intends to use its cash windfall. The 14.5% dividend yield is unreasonable given the low risk of Lumen Technologies’ free cash flow guidance being withdrawn.

Lumen Technologies is clearly trading at an extremely low valuation (3.6x free cash flow), and the stock remains at the top of my buy list.

Be the first to comment