The Good Brigade/DigitalVision via Getty Images

The deflation of the Software-As-A-Service (SAAS) bubble has hit Everbridge (NASDAQ:EVBG) shares hard with the stock down over 80% from 2021’s all-time high. While the stock had a brief bounce in August on the news that the company may be exploring a sale, shares quickly declined as investors seem skeptical that a deal will be done. As we sit today, Everbridge shares trade at a rock-bottom valuation of just 3.5x revenue.

Background

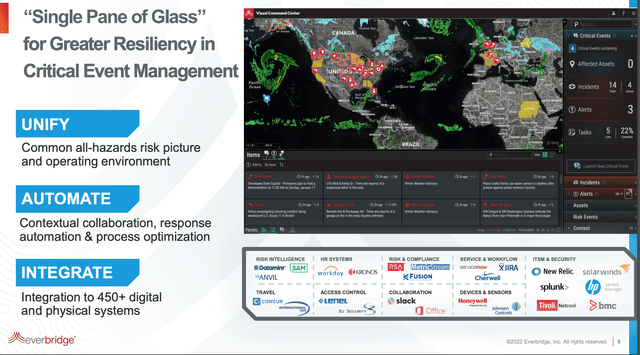

Overview (Investor Presentation)

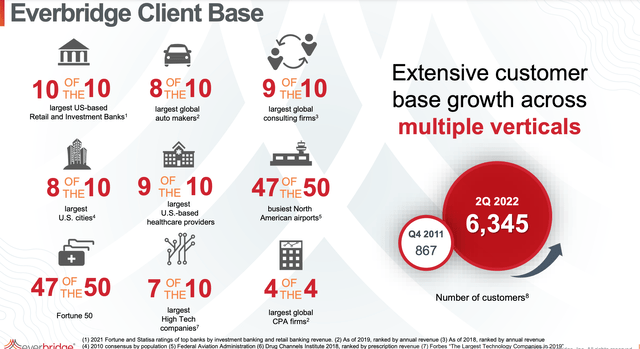

Everbridge is a SAAS business that is providing software solutions which facilitate mass notification and critical event management software in a world with increasing risks (natural disasters/weather, civil unrest, pandemic, active shooters, etc.). The software provides corporations and governments a centralized platform to manage employees and assets and respond during disruptive or potentially disruptive events. Everbridge has an impressive customer base with more than 6,300 customers and includes 47 of the Fortune 50. Everbridge is the leading player in the industry and its software integrates with most major HR/enterprise platforms (see above).

Everbridge Client Base (Investor Presentation)

Why is Everbridge a good business?

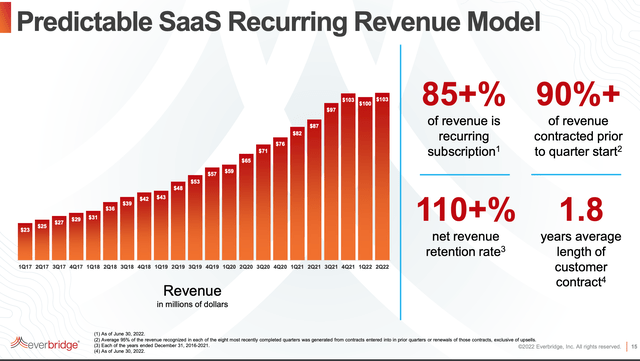

1. Like most SAAS companies, Everbridge’s revenue is recurring in nature which gives it a stable/growing revenue profile even during times of economic uncertainty. Everbridge’s software is viewed as an important organizational risk management tool and, once adopted, is unlikely to be displaced unless Everbridge really messes something up or a vastly superior solution emerges. This leads to low churn rates.

2. SAAS companies are generally able to upsell additional software products and add-on functionality to their customers which allows for continued growth in revenue from its existing customer base which is evidenced by net revenue retention above 110%.

Everbridge Metrics (Investor Presentation)

3. Entering employee/asset data, and training employees to use the software creates a switching cost for customers which provides Everbridge pricing power.

4. While profitability has been negligible to-date as the company has been spending aggressively to grow, like most SAAS companies, Everbridge likely has ample opportunities for cost cutting. I believe that the company will eventually produce 25-30% EBITDA margins.

Set Up

In December 2021, Everbridge’s CEO resigned. Subsequently an activist shareholder, Ancora, took a stake in the business and in May called for a sale of the company. In August Bloomberg reported that the company was exploring a sale of the company.

Ancora suggested that the company could be worth up to $70/share but stock market multiples (and SAAS multiples) have come down since then. I think $50-60 seems more reasonable in the current environment as I will discuss below.

Valuation – what might Everbridge fetch in a takeover?

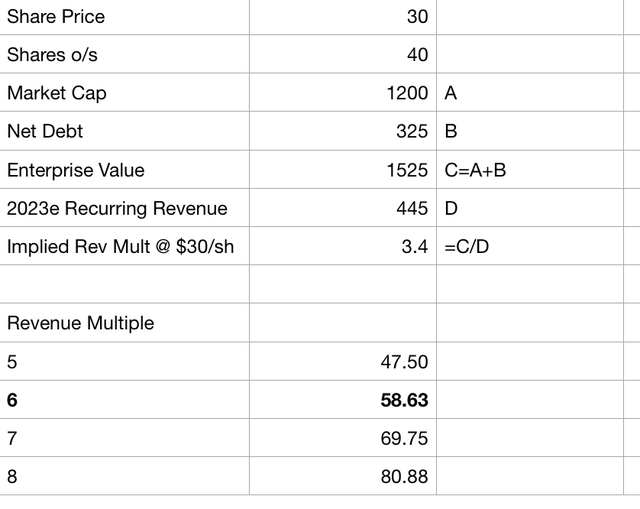

Everbridge is on track to generate ~$430 million in revenue in 2022, about $380 million of which is recurring. The company has been growing organically 18-19% per year. Looking ahead a couple of months to 2023 and assuming a 17% growth rate, I get to an estimated $445 million in recurring revenue for 2023.

Excluding some outliers during the 2020-21 bubble, SAAS companies with a similar growth profile have tended to sell for between 5-8x recurring revenue. As shown below, applying these multiples to Everbridge results in a range of $47-80 per share.

Author Valuation Model (Author Estimates)

With SAAS multiples having come down in public and private markets, I think that the buyer will end up paying 5-6x recurring revenue which suggests potential near-term gains of 60-90% for Everbridge shareholders if a deal materializes. Given that shares are selling for just 3.4x 2023 estimated recurring revenue, which is the very low end of the valuation range for SAAS companies, downside should be very limited if there is no deal.

Risks

1. Risk that no deal happens.

2. With a deteriorating economic environment, it is possible that my sales expectations for 2023 prove too optimistic.

3. SAAS stocks are incredibly volatile and have traded very, very poorly for the past year. It is possible that shares continue to trade lower.

Conclusion

With potentially significant near-term upside in the event of a deal and my expectation that downside is limited, I consider Everbridge to be an asymmetric investment proposition and have accumulated a small position in the stock.

Be the first to comment