Darren415

While ETFs are popular in all sectors, their case in the cannabis space is even more compelling. Thankfully, we have a number of well-managed cannabis funds. AdvisorShares is among the most experienced cannabis ETF managers, and in this article, we’ll review their offerings and discuss why now may be the right time to begin accumulating cannabis stocks.

The Value of Cannabis ETFs

ETFs offer more value than normal in the cannabis space for two primary reasons. First, cannabis is a complicated plant and the regulations surrounding it are even more complex. When investing globally, each country treats the plant differently. Germany’s impending legalization will look completely different than Columbia’s regulations.

Even within the US, regulations are state-specific. We now have 37 states, plus Washington DC, that offer some form of medical or adult-use cannabis. No two states have the same laws or tax treatment. These complications make it necessary to understand every state’s rules and discern which operators have the highest probability of success.

On top of the regulatory complications, the second major challenge that ETFs can help with is that the most desirable cannabis stocks (US multi-state operators aka MSOs) are not allowed to list on primary US exchanges. This largely has to do with federal illegality, though there is potential legislation that would allow uplisting without legalization. Instead, US plant-touching operators typically go public on the Canadian Securities Exchange (CSE) and have a dual listing on the US OTC Exchange.

(Oddly, Canadian cannabis companies can list on US exchanges, which is one thing that accounts for the absurd valuation of Tilray and others. I wrote about it in an article titled “The Stupid State of Cannabis Stock Listings.”)

Many investors cannot get approval for OTC stocks, they may not be available on their trading platform (including Robinhood), or they have custody challenges. As a solution, there is now a handful of cannabis ETFs that offer exposure to the best US MSOs, are offered on major exchanges, and are available on almost all platforms.

AdvisorShares Pure US Cannabis ETF (MSOS)

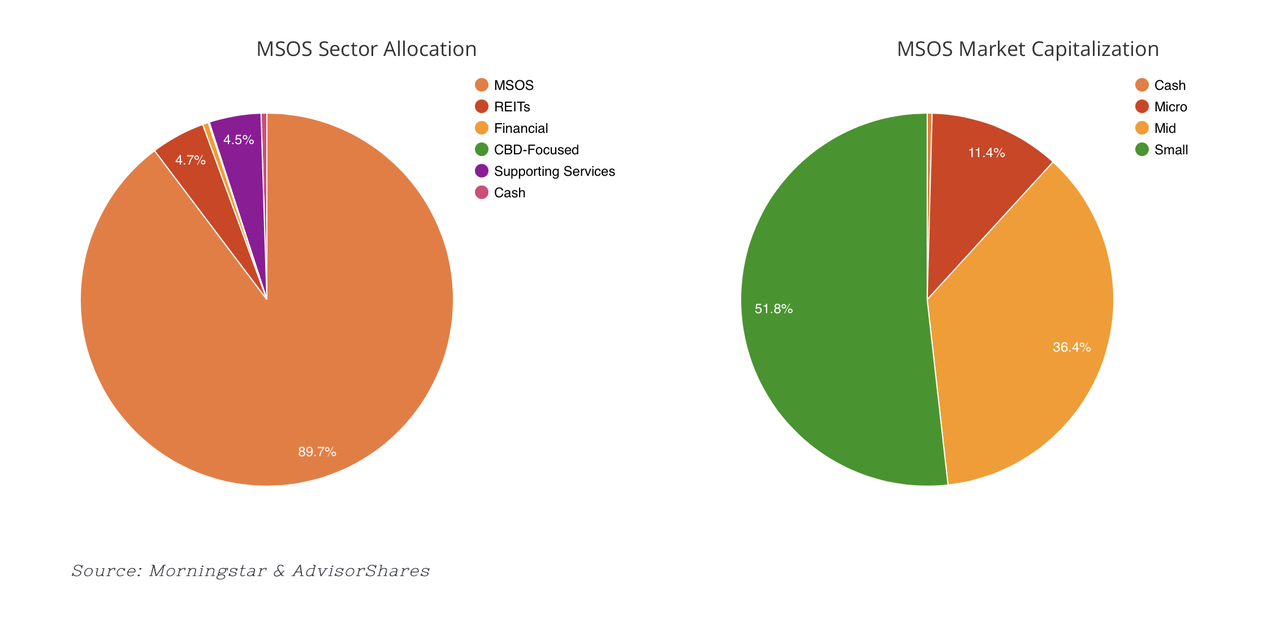

MSOS is the largest cannabis ETF with approximately $650 million in assets. It was the first ETF to have an exclusive focus on US cannabis stocks, with the majority of the assets in dominant multi-state operators. The core MSO positions are complemented by investments in ancillary stocks, US-based REITS, and CBD companies. As of 07/30/22, over 90% of the assets were in US plant-touching operators.

Dan Ahrens is the portfolio manager. He has spent two decades in the financial services industry and previously launched and managed the Vice Fund for USA Mutuals. Today, he manages seven AdvisorShares ETFs: MSOS, YOLO, VICE, BEDZ, EATZ, DRONE, and PSIL.

MSOS is actively managed in what I would call a low-turnover approach. Jungle Java on Twitter tracks the daily trades, and while there are often changes, they tend to be more liquidity-driven moves as money is either added or redeemed from the fund.

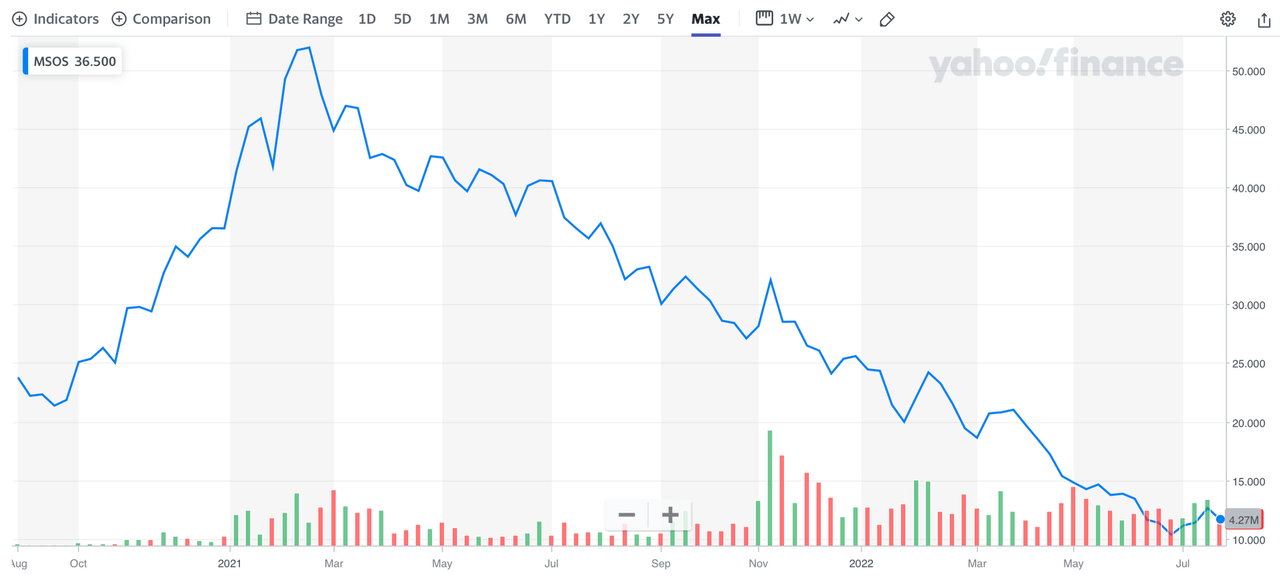

Performance since inception has been very volatile and is in a major downtrend since February 2021. The cannabis industry lacks appropriate benchmarks to compare performance, but on an absolute basis, it has suffered. Given the opportunity set, I see performance as within expectations, but certainly disappointing.

I recommend this ETF for investors seeking exposure to the premium US plant-touching multi-state operators. It is overweight the biggest names, with the more robust track records and proven management teams. It will be volatile and is best for aggressive investors with a long time horizon (3-5 years at least).

MSOS has a net expense ratio of 0.73%, making it about average in the cannabis ETF universe. It trades on the NYSE Arca exchange under the ticker MSOS.

Coming Soon: AdvisorShares MSOS 2X Daily ETF (MSOX)

On August 8th, AdvisorShares is launching an ETF designed to deliver 2x the daily return of MSOS. I have not gotten into the details, but the basic concept is that you will get 2x the return of MSOS, minus any financing costs for the leverage and fees from the fund.

For those looking for more information, here is a link to the prospectus.

AdvisorShares Pure Cannabis ETF (YOLO)

YOLO is the first actively-managed cannabis ETF domiciled in the United States. The fund has a global mandate, with the majority of the assets in the US and Canada. Like MSOS, it is actively managed and handled by the same team with Dan Ahrens as the lead portfolio manager.

This is the most diversified of the three AdvisorShares offerings. Currently, it holds 27 names, and the largest weighting is 36% in AdvisorShares MSOS ETF (which holds 29 underlying exposures). The management fees are waived, so there is no double-dipping, and they feel it is a more efficient way to get exposure to a basket of MSOs. In addition to MSOS, they have one additional position in Terrascend, bringing the total MSO exposure to 40%.

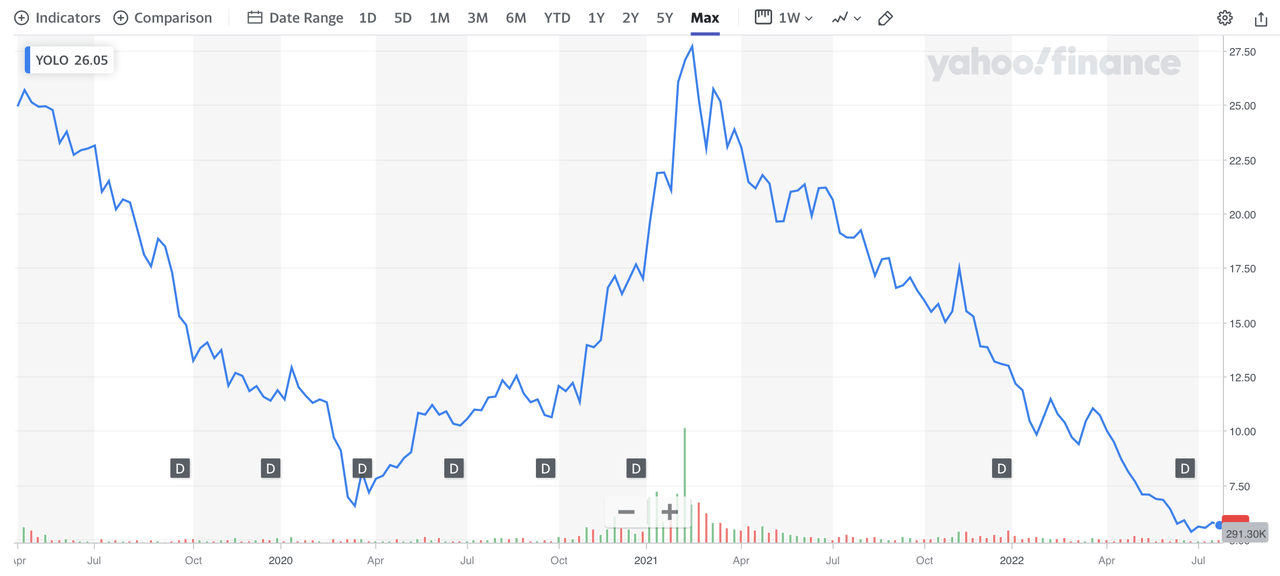

YOLO’s performance has been a wild ride. After an initial drawdown, YOLO rocketed up 542% from 3/19/2020 to 02/10/2021. Since it has dropped over 80% and is bouncing around the lows.

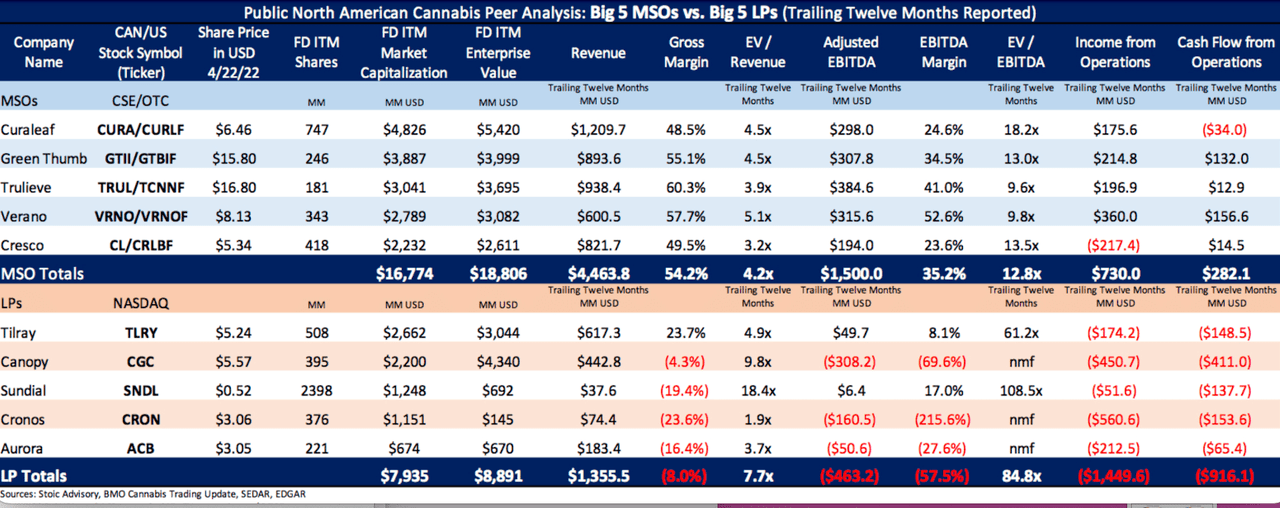

The remaining 60% of YOLO is Canadian LPs and several ancillary stocks. These names are already uplisted, will not benefit (as much) from SAFE Banking and the state-driven growth story does not apply to the Canadian names. In addition, the Canadian names are wildly overvalued when compared to the US MSOs. Below is a table showing that the top five MSOs trade at a 45% discount on EV/Revenue and an 85% discount on EV/Adj. EBITDA.

I believe the greatest opportunity lies in MSOs. They are far cheaper than their Canadian counterparts or ancillaries and have more catalysts to unlock. For this reason, YOLO is my least favorite of these three offerings.

For those interested in global exposure, YOLO has a net expense ratio of 0.76% and trades on the NYSE Arca exchange.

AdvisorShares Poseidon Dynamic Cannabis ETF (PSDN)

PSDN is AdvisorShares Poseidon Dynamic Cannabis ETF. This is a newer offering that launched in November of 2021. It is managed by Poseidon Asset Management, one of the longer-running cannabis-focused investment managers. They are well known for their successful hedge fund and venture funds. Poseidon’s cannabis roots date back to 2013.

PSDN has a flexible mandate that allows portfolio managers to hunt for values around the globe. More than 70 countries offer legalized medical cannabis, providing a broad opportunity set. Today, the US and Canada dominate the headlines, but Germany and other major European markets are coming online and the fund can allocate to them as opportunities arise.

The fund also can invest in sub-sectors. Examples include ancillary stocks like WM Technology or a REIT like Innovative Industrial Properties. Some investors like these “pick and shovel” stories that will benefit as cannabis becomes more widely adopted, but are not plant-touching operators.

Currently, the team sees the best opportunities in US multi-state operators and has a focused portfolio comprised of the ten largest MSOs. As of 07/30/22, 77% of the portfolio is in the top five holdings. While this may sound concentrated, these are the largest cannabis companies in the US and are often diversified across ten states or more. Plus, cannabis stocks tend to be highly correlated, so the marginal benefit of adding new names declines substantially after the first five or ten positions.

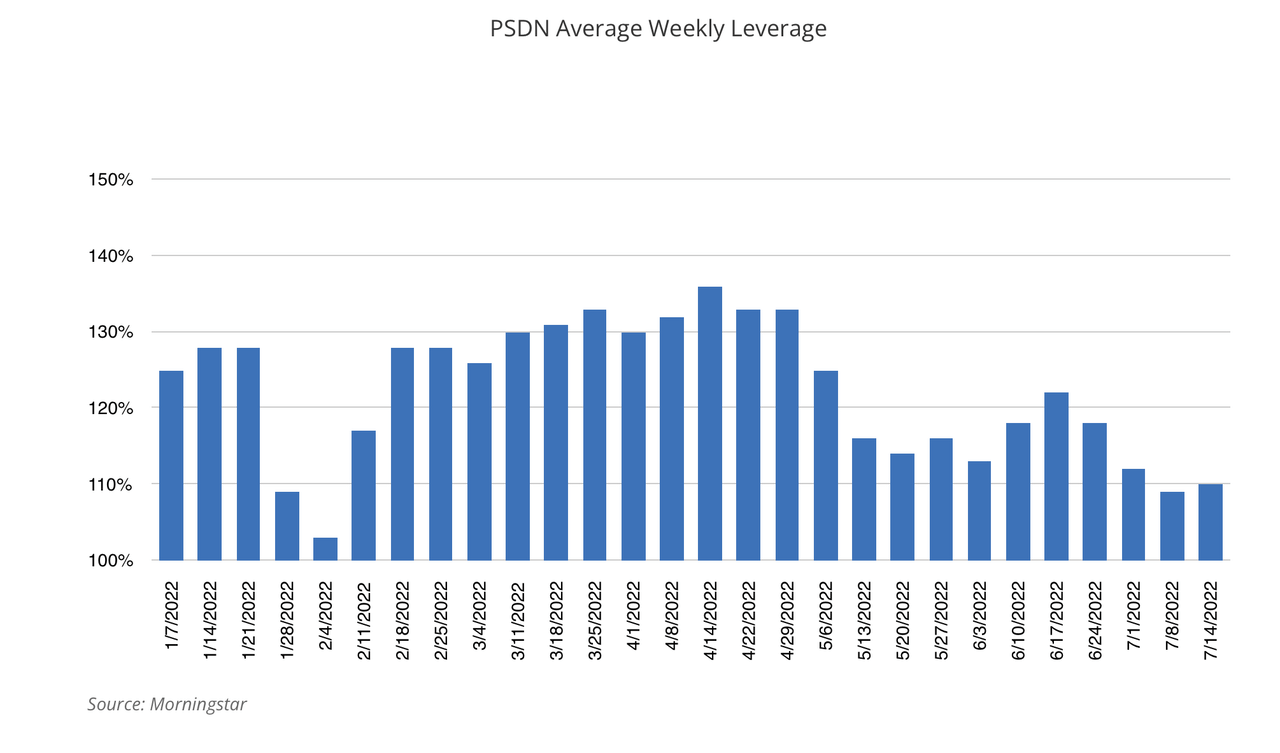

The ability to dynamically deploy leverage is another differentiator. PSDN can go up to 1.5x, meaning for each dollar of investor equity, they can allocate up to $1.50. While the leverage can be used to express a tactical bullish or bearish view, historically it has run around 1.25x. Poseidon is bullish on cannabis, particularly in the US, and wants to capture as much of the upside as possible.

Below is a chart showing weekly leverage changes.

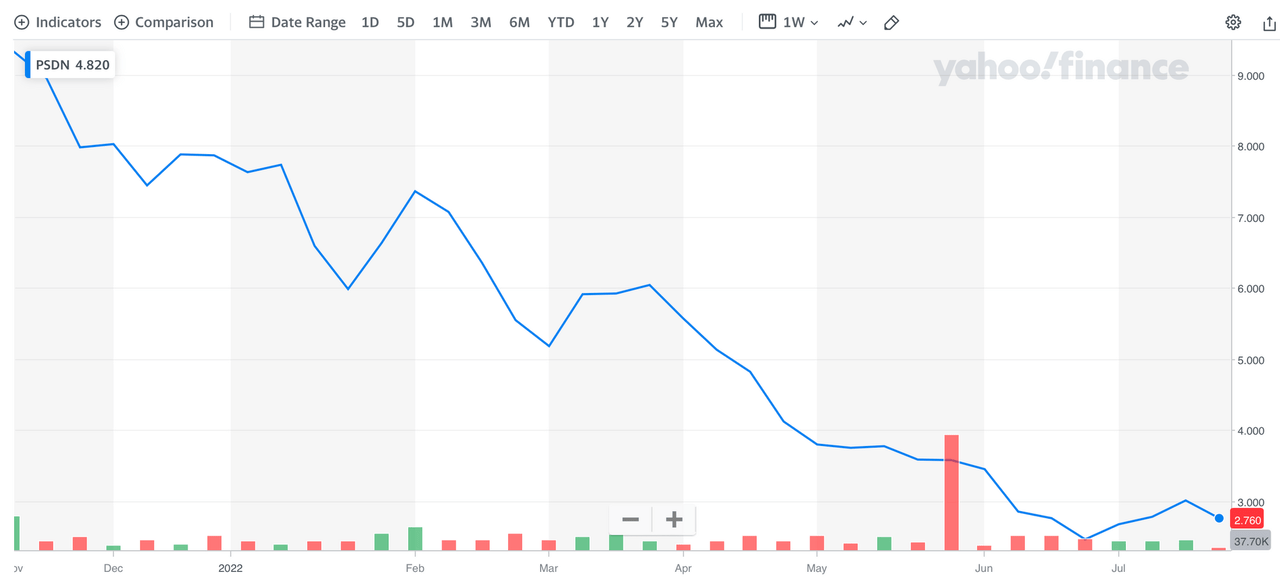

Leverage cuts both ways, and since launching in November cannabis stocks have been in a one-way bear market. Consequently, PSDN performance has been below average. I would not call it outside of expectations given the environment, but painful nonetheless. Below is a graph of PSDN since inception.

Due to the focused portfolio and leverage, I would recommend PSDN for highly aggressive investors with long time horizons—a minimum of 3 to 5 years. If you are concerned about the leverage, you can control the risk with position sizing. For example, rather than investing $1 in MSOS, you could invest $0.75 in PSDN and end up with similar notional amounts. Plus, you could allocate the extra 25% to another strategy, or keep it in cash to dampen the volatility. It’s a capital-efficient vehicle.

When the market turns, I think this will be the best-performing cannabis ETF. Due to the MSO-focused portfolio, proven team, and ability to use leverage, I find this to be the most exciting cannabis ETF.

PSDN has a net expense ratio of 0.92% and trades on the NYSE Arca exchange. Note that the fees are charged on investor equity, not notional exposure. So, when taking leverage into account it is priced very similar to MSOS on an exposure basis.

Potential Risks

All three AdvisorShares ETFs are risky investments. They are concentrated in stocks, focused on small caps, and only in cannabis-related names. As we have seen, cannabis can endure long and deep drawdowns. Add in leverage with PSDN and this could turn into an even bigger loss.

On the flip side, we have also seen incredible pockets of upside. Due to the extreme volatility, you need to enter with appropriate expectations, or you may get shaken out at the wrong time.

Another risk is that all three funds use total-return swaps to get exposure to US MSOs. This structuring is what allows them to be NYSE listed while holding US plant-touching operators. Without this financial engineering, these ETFs would be stuck on the OTC or another lower exchange. Until uplisting is allowed, this is a necessary compromise.

Finally, I worry Dan Ahrens, portfolio manager of MSOS and YOLO, is spread too thin. In addition to MSOS and YOLO, he manages five more ETFs: BEDZ (hotels), EATZ (restaurants), DRONE (drone technology), VICE (vices), and PSIL (psychedelics). He does all this without any internal analyst support.

Meanwhile, PSDN has a three-person team dedicated to an ETF that is a fraction of the size that Dan is managing. I would like to see Dan either get more support or just focus on the cannabis-related funds. I don’t believe you can simultaneously be a master across six sectors.

Cool Story, But Why Now?

The entire cannabis space has been hit extremely hard. Investors are frustrated with slower-moving federal regulatory changes, delays in new states coming online, and slower top-line growth as the lockdown-fueled cannabis-buying surge has worn off. This, coupled with MSOs trading on the less-liquid OTC exchanges has led to an extended drawdown.

New States Opening

The state situation is starting to pick up. New Jersey opened for adult-use sales on April 21st, with New York and Connecticut not far behind. The initial New Jersey stores that opened have reported insane demand. Headset estimates New Jersey’s total cannabis sales will be in the range of $1.3 – $2.9 billion annually. The entire East Coast is just starting a legalization wave, similar to what we experienced on the West Coast five years ago.

New Jersey is putting pressure on neighboring states to open or lose their tax revenue to buyers traveling across state lines to buy legal cannabis. New York is a monster market that has voted for adult use. While most have assumed this would be a 2023 event, regulators recently affirmed their goal is to have the program launched in the fall of 2022. Similarly, Connecticut also voted for adult use and is hoping to open by year-end.

While the market is most keen on seeing federal progress, in the long term new states opening and existing markets moving to adult-use sales is the most important component. This is what will drive revenues, create scale and push the movement forward.

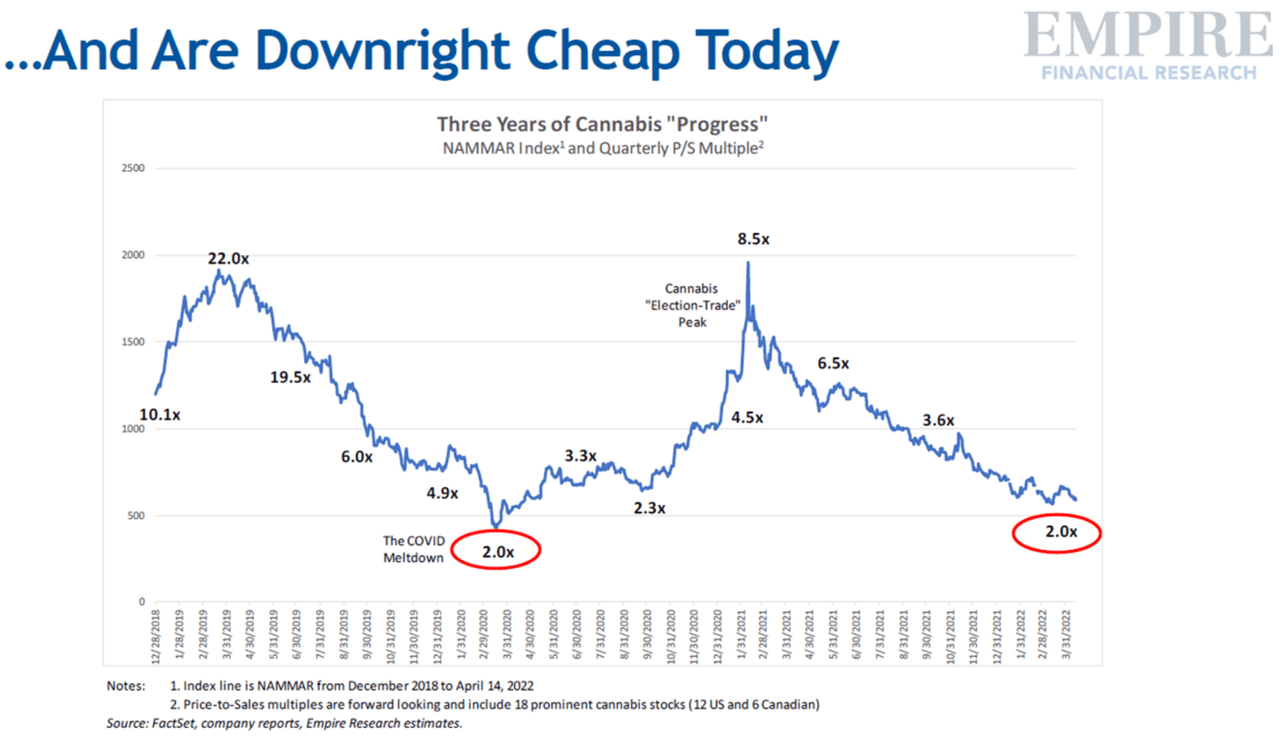

Compelling Valuations

One day it will matter that these are great businesses trading at very low valuations. The graph below from Empire Financial Research shows how cheap cannabis stocks are today. It’s always possible we trend lower, but historically buying businesses that are growing sales at 24% (average for tier one basket from 2022 to 2023) and trade at 2.3x next year’s sales is a winning recipe.

Lowered Expectations

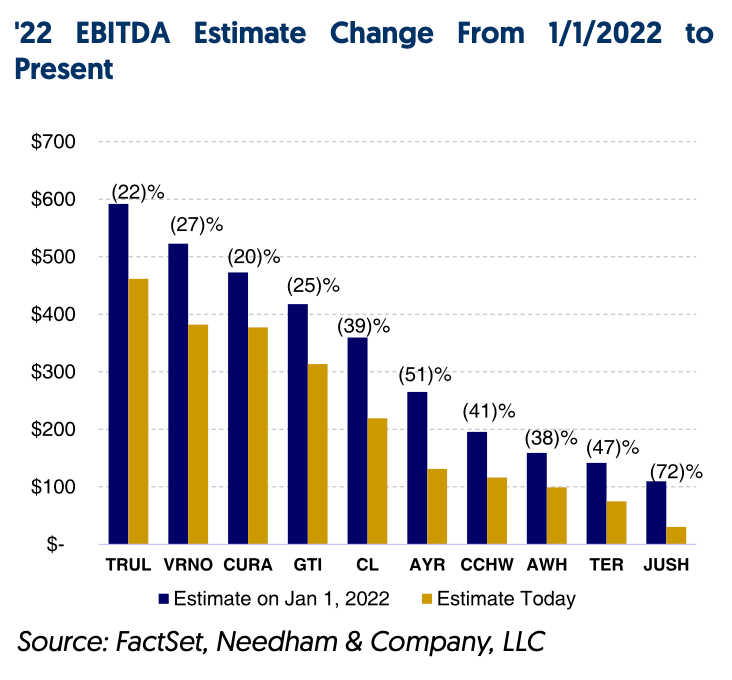

You can have a compelling case, but if expectations are too high the good news is already priced into the stocks. Cannabis sales and prices have seen a slowdown post COVID. People have not been home as much, stimulus checks have dried up and inflation has surged. This combination has hurt most industries, cannabis included.

Analysts were late to cut estimates, but this has changed. Below is a chart showing how 2022 EBITDA estimates have changed since the beginning of the year through August 1st.

Potential For Political Progress

Federal progress is hard to forecast, but the cannabis-investing community is excited about the prospects of SAFE Banking passing late this year. After being removed from the America Competes Act, the latest hope is to have it included in the year-end NDAA bill.

As more large and politically important states open for adult-use sales, the pressure for SAFE also increases. It is hard to imagine New York and New Jersey converting to adult use without SAFE Banking. This may pose too much political risk.

President Biden is also sitting on numerous unfulfilled cannabis campaign promises. With his approval rating at all-time lows, perhaps now would be a good time to make good on these proposed changes. I don’t have an edge in forecasting political progress, but do know any incremental movement in these areas will make a massive difference in sentiment

The backdrop of lowered expectations, reduced valuations, improving earnings as new states open, and the potential for political progress leads me to believe now is a good time to be accumulating cannabis stocks.

Summary

ETFs are popular for almost all sectors, but due to cannabis being a complicated plant and the maze of country and state-specific regulations, ETFs are even more relevant. Outsourcing expertise makes the most sense when it is harder and more time-consuming to take it on yourself.

Within the cannabis-investing universe, the greatest value lies with US multi-state operators. Many of the other major ETFs, including YOLO, MJ, and CNBS, are plagued with suboptimal Canadian LPs. Avoid these and get exposure to US multi-state operators. AdvisorShares MSOS and PSDN are the best cannabis ETFs.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment