SimonSkafar/E+ via Getty Images

Welcome to the May 2022 edition of Electric Vehicle [EV] company news. May saw reports of slower April car sales (both electric and conventional cars) due to the China Covid-19 lockdown and the war in Ukraine. Supply chain issues such as wire harnesses from Ukraine have been a major problem for many OEMs.

Global Electric Car Sales As Of End April 2022

Global electric car sales finished April 2022 with 542,000 sales for the month, up 38% on April 2021, with market share of 10.2% for April 2022, and 11% YTD.

Note: 72% (not updated this month) of electric car sales YTD were 100% battery electric vehicles (BEVs), the balance being hybrids.

In a Covid-19 disrupted month in China, China electric car sales were over 260,000 in April 2022, up 61% on April 2021 sales. Electric car market share in China for April was 29%, and 22% YTD.

Europe electric car sales were 159,000 in April 2022, down 1% YoY, reaching 19% market share and 21% YTD. Norway reached 84% share, Sweden 48.2%, Germany 24%, France 21%, and 16.2% share in the UK in April 2022.

US electric car sales were not readily available.

Note: The above sales include light commercial vehicles.

Note: An acknowledgement to Jose Pontes and the team at CleanTechnica Sales for their work compiling all the electric car sales quoted above and charts below.

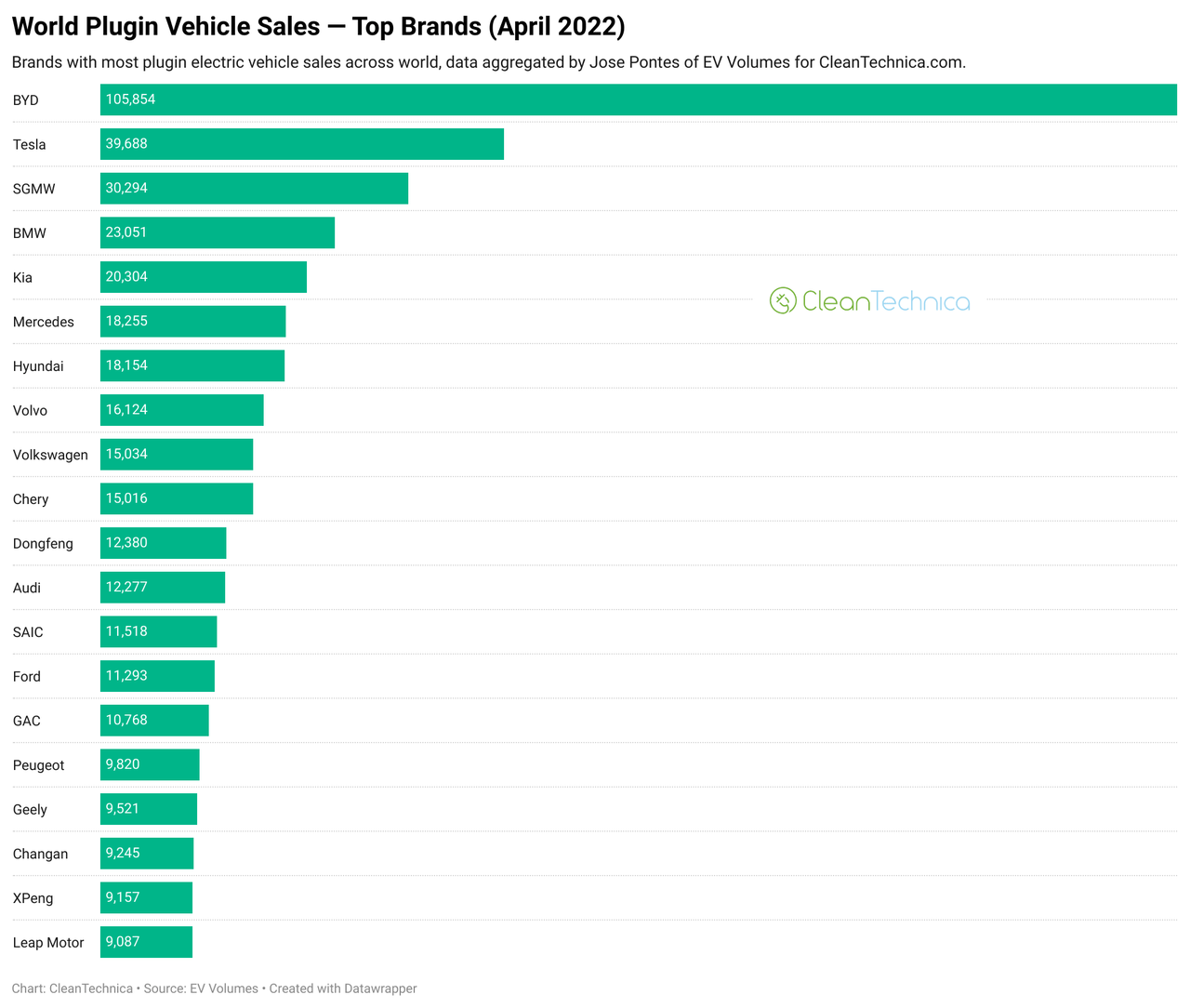

Global plugin electric car sales by brand for April 2022

CleanTechnica

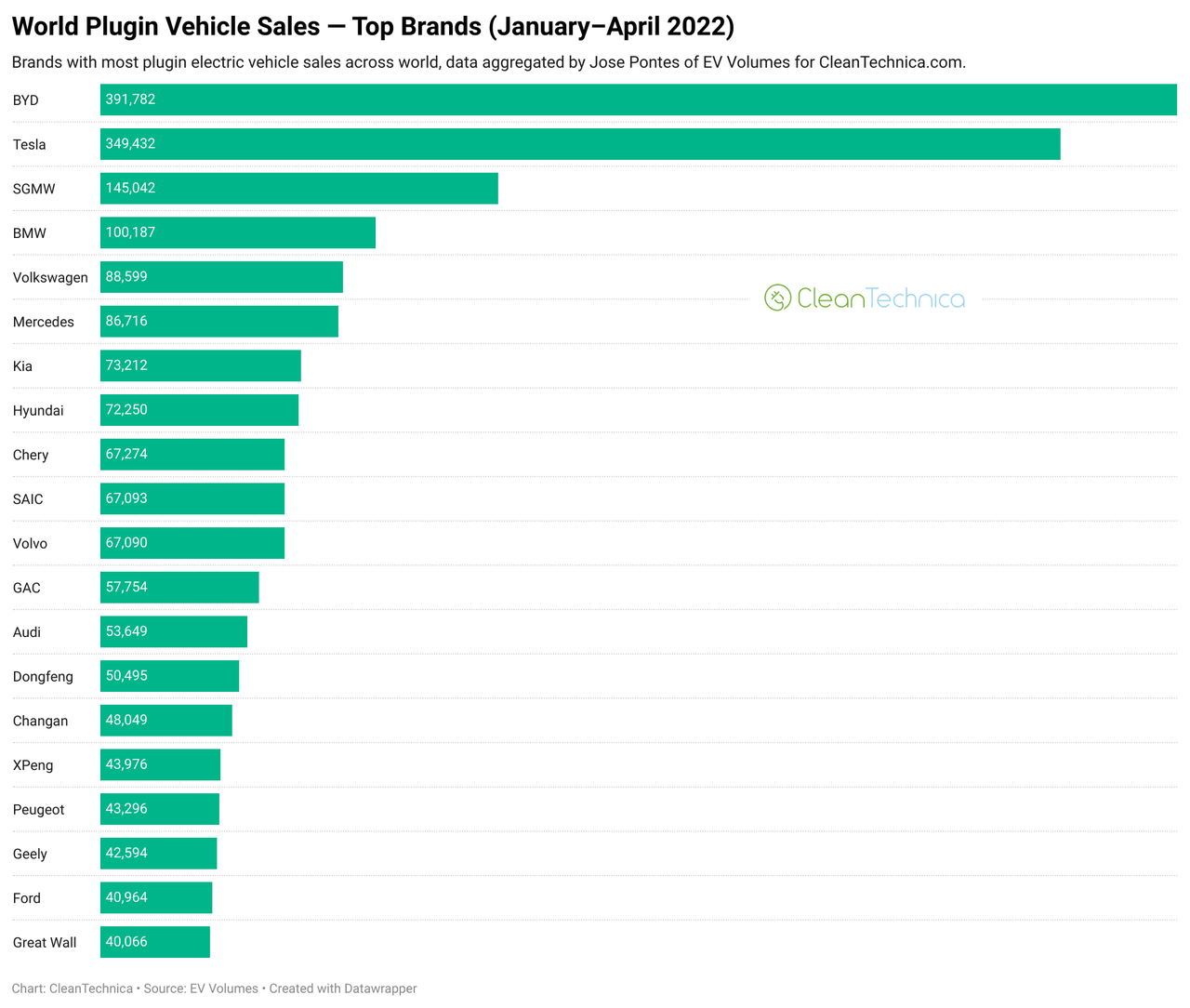

Global plugin electric car sales by brand YTD in 2022

CleanTechnica

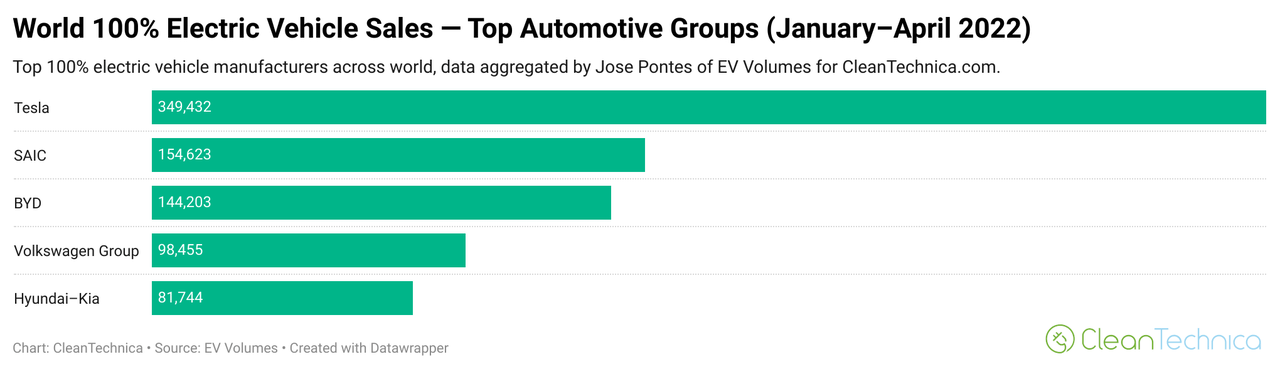

Top 100% electric car sales YTD by auto group

CleanTechnica

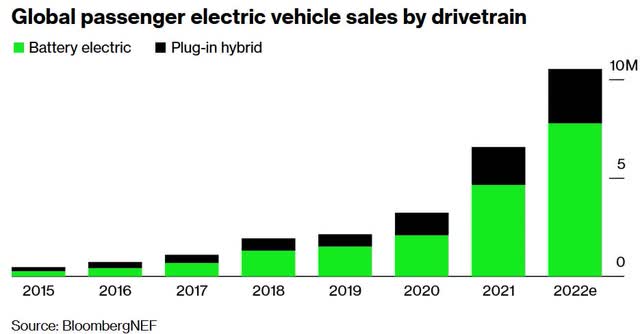

EV sales forecast to really take off from 2022 as affordability kicks in

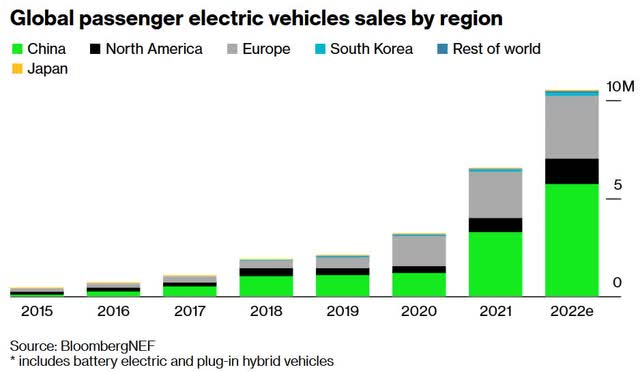

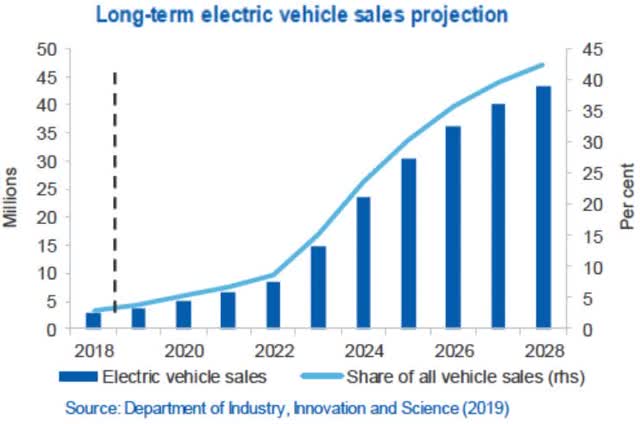

The chart below aligns with my research that electric car sales will really take-off after 2022. It now looks like electric car sales already took off in 2021 with ~6.5m sales and 9% market share.

Bloomberg Hyperdrive BloombergNEF

Bloomberg Electric Vehicle Outlook 2022 (published May 2022)

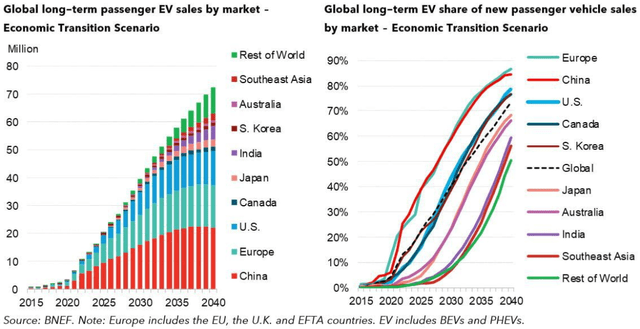

BloombergNEF now forecasts “plug-in electric vehicles sales rise from 6.6 million in 2021 to 20.6 million in 2025” and “by 2025, plug-in electric vehicles represent 23% of new passenger vehicles sales globally, up from just under 10% in 2021”.

BloombergNEF long term EV forecast (global EV share to exceed 70% by 2040)

EV Market News

On May 2, Seeking Alpha reported:

Chinese EV deliveries dive as COVID disruptions come to bear. Chinese electric vehicle manufacturers’ delivery figures fell sharply in April as supply chains were hit hard by Zero-COVID policies. Deliveries for Nio, Inc. (NYSE:NIO), Li Auto (NASDAQ:LI), and XPeng, Inc. (NYSE:XPEV) all reported that they have been hit hard by COVID lockdowns, with monthly delivery numbers diving from February. Indicating the size of the impact, both Nio (NIO) and Li Auto (LI) sales fell by 50% or more while XPeng (XPEV) was only slightly better.

On May 3, seeking Alpha reported: “Apple hires Ford veteran to help boost electric car project: report.”

On May 9, Investing News reported:

Electric Vehicle Market Update: Q1 2022 in Review…production of EVs has suffered from supply-side risks…with a largely global situation where the industry is not capable today of producing enough vehicles, regardless of powertrain, to meet customer demand, sales are limited by supply…Prices for raw materials used in batteries, such as lithium and cobalt, have climbed significantly over the past year…Carmakers have had to act…raising prices.

On May 10, Fully Charged published a very interesting video titled “World’s FIRST Solar Powered Campervan! The van extends out a solar roof and takes about 3 days to charge its 60kWh battery.

On May 12, CarNewsChina reported:

Leapmotor C01 launched with 550 HP and 90kWh battery. Starts at 26,770 USD…The price begins at RMB 180,000 ($26,770) and ranges to RMB 270,000 (39,750 USD). This was shown to the world at a Tuesday launch event in Beijing… Leapmotor may be an EV startup, but it has been proving the naysayers wrong. As of April 2022, the company has delivered 9087 units in China and it shows a year-on-year increment of more than 200 percent.

On May 18, The Economic Times reported:

China is in talks with automakers about extending costly subsidies for electric vehicles (EV) that were set to expire in 2022, aiming to keep a key market growing as the broader economy slows, three people familiar with the matter said…Government departments including the Ministry of Information and Industrial Technology (MIIT) are considering a continuation of subsidies to EV buyers in 2023, said the people, who declined to be named as the discussions were private.

On May 23, eVTOL reported:

Lilium enlists Honeywell, Denso to develop electric motors for eVTOL aircraft…The motor is a proprietary, high-performance system, which has been under development for two years. Initial prototypes have produced over 100 kilowatts of power from a package weighing under nine pounds (four kilograms)…The company also said that it planned to develop aircraft with flexible cabin architecture that can be configured to a premium four-passenger “club cabin,” a six-passenger shuttle cabin, or a cargo cabin…Honeywell is already developing the Lilium Jet’s avionics and flight control systems and invested in Lilium in 2021…The company is working toward getting its eVTOL aircraft type certified with the European Union Aviation Safety Agency (EASA) in 2025, followed by approvals from the U.S. Federal Aviation Administration [FAA] through the European process. In the meantime, the company is continuing its flight test campaign at the ATLAS Test Flight Center in Spain.

On May 22, Auto Connected Car News reported:

US offers $500 million funding for Electric School Buses. The White House announced today the first round of funding for electric school buses [ESBS] as part of the bipartisan Infrastructure Investment and Jobs Act. $500 million will be available to help school districts purchase vehicles and install infrastructure.

On May 23, the IEA reported:

Global electric car sales have continued their strong growth in 2022 after breaking records last year. Policy support and flood of new models underpin sales in major markets, but greater efforts are needed to anticipate supply chain bottlenecks and boost critical mineral production…Sales of electric cars (including fully electric and plug-in hybrids) doubled in 2021 to a new record of 6.6 million…Despite strains along global supply chains, sales kept rising strongly into 2022, with 2 million electric cars sold worldwide in the first quarter, up by three-quarters from the same period a year earlier… Chinese electric cars are typically smaller than in other markets. Alongside lower manufacturing costs, this has significantly reduced the price gap with traditional cars. The median price of an electric car in China was only 10% more than that of conventional offerings, compared with 45% to 50% on average in other major markets. By contrast, electric car sales are lagging in most emerging and developing economies where only a few models are often available and at prices that are unaffordable for mass-market consumers.

On May 24, CNEVPOST reported:

World to see no new ICE vehicle sales by 2035 at latest, says CATL exec. Judging from the new energy vehicle [NEV] development plans released by major countries around the world, there will be no new internal combustion engine [ICE] vehicles on the market by 2030, or 2035 at the latest, according to a Contemporary Amperex Technology Co Ltd (CATL, SHE: 300750) executive. “The trend is already happening,” Ni Jun, CATL’s chief manufacturing officer, said at the World Economic Forum’s annual meeting in Switzerland.

On May 24, CleanTechnica reported:

More electric semi trucks coming to US & Europe. Orders for electric semi trucks are ramping up as the EV revolution moves forward…800 eCascadia Electric Semi Trucks For Sysco…110 Scania Electric Semi Trucks For Einride.

On May 25, Bloomberg reported:

Bank of America doles out additional pay increases and electric-car perks…Bank of America, which employs more than 200,000 worldwide…The company will give a $4,000 reimbursement to employees that buy an electric vehicle, or $2,000 for a new lease, according to a separate memo. The one-time perk will be available starting in July to workers who have served at least three years and have annual salaries of less than $250,000.

On May 27, Electrek reported: In a global tipping point, 52% of car buyers now want to purchase an EV.”

On May 28, Bloomberg reported:

China Covid outbreak wanes, with curbs eased to boost economy…In Shanghai, cases dropped to 67 for Sunday from 122 on Saturday. The financial hub yesterday rolled out a raft of measures to support the lockdown-hit economy, including allowing all manufacturing to restart from Wednesday. In other moves, the city will accelerate approvals for property projects and the quota for car ownership this year will be increased by 40,000. A purchase tax for some passenger vehicles will be reduced and subsidies will be given to electric car buyers…”

On May 31, Bloomberg reported:

China unveils car tax cut details in bid to boost spending…China will cut the purchase tax levied on some low-emission passenger vehicles by half, according to a statement on the finance ministry’s website…It’ll cover cars with no more than nine seats sold from June to December that are low emission and cost 300,000 yuan ($45,000) or less, according to the statement Tuesday.

On June 2, BNN Bloomberg reported:

Beijing plans subsidies for EV buyers to boost Covid-hit economy… Those who retire a car registered in the city more than 1 year ago and purchase a new energy vehicle by the end of 2022 will receive a subsidy of as much as 10,000 yuan ($1,499), according to a plan issued by the municipal government Thursday. The measures follow moves by the central government to halve the purchase tax on some low-emission passenger vehicles and implement tax reductions for cars of 60 billion yuan.

EV company news

BYD Co. [SHE: 002594][HK:1211](OTCPK:BYDDY) (OTCPK:BYDDF)

BYD is currently ranked the number 1 globally with 15.4% market share YTD. BYD is ranked number 1 in China with 27.8% market share in YTD.

On May 3, BYD reported: “Link Transit acquiring eight more BYD battery-electric buses for Central Washington Community.”

On May 4, CNN Business reported:

Warren Buffett-backed electric carmaker shrugs off China’s lockdowns. BYD, the Warren Buffett-backed Chinese electric vehicle maker, had a bumper month in the world’s largest car market, despite strict Covid lockdowns that have disrupted production and sales for many of its major rivals. The company reported Tuesday that its sales of electric vehicles and plug-in hybrids soared 313% in April from the same month a year ago. The Shenzhen-based car maker sold a record number of 106,000 units last month in mainland China. BYD was already off to a strong start to the year. Sales for all its vehicles jumped 423% in the first quarter of this year, according to preliminary figures released last month. It is the second largest carmaker in China in terms of pure-EV sales, just behind Tesla (TSLA).

On May 12, BYD reported: ‘Baton Rouge adds three more BYD 35-foot K8M battery electric buses to its fleet.”

On May 16, CNEVPOST reported:

BYD to start pre-sale of Seal in China on May 20…The company recently shared information that it will unveil its CTB (cell to body) battery technology on May 20…The Seal model, built on BYD’s e-platform 3.0, is seen as one of the strongest challengers to the Tesla Model 3 in China…Seal is expected to be the most important model in BYD’s history, the team said, adding that with reference to Model 3 sales, they expect the model’s steady-state monthly sales to exceed 30,000 units.

On May 18, CNEVPOST reported:

BYD secures $593 million worth of lithium supplies from local producer…BYD (OTCMKTS: BYDDY, HKG: 1211) will buy and commission lithium products from local lithium producer Shenzhen Chengxin Lithium Group (SHE: 002240) for an estimated 4 billion yuan ($593 million) in 2022, according to an announcement today by the NEV maker.

On May 21, Car News China reported:

BYD Seal EV sells over 22,000 units in 6 hours In China. The BYD Seal EV became a massive success in just six hours, with 22,637 pre-sold units. The Seal seems to become a brand’s new top seller with a pleasing appearance, remarkable range, impressive power output, and a price range between 212,800-289,800 RMB (31,890-43,430 USD).

On May 31, Seeking Alpha reported:

BYD expands international ambitions for supply and demand. BYD Company is building its capacities in key battery elements and expanding in the Americas, according to recent reports…Per state-run media outlet The Paper, the manufacturing conglomerate is seeking to acquire six lithium mines in Africa. The mines, in aggregate, are expected to provide 25 million tons of ore with a 2.5 percent lithium oxide grade, amounting to about 1 million tons of lithium carbonate…In firmer plans outlined by the company, the number of franchise dealerships in Brazil is slated to grow to 100 by the close of 2023.

On June 2, Seeking Alpha reported:

BYD May deliveries grows over 8% sequentially. BYD sold 114,943 vehicles in May, up 8.39% from 106,042 units sold in April and 250.44% Y/Y. The Chinese automaker exceeded the 100K delivery mark for the third consecutive month.

Tesla Inc. (NASDAQ:TSLA)

Tesla is currently ranked the number 2 globally YTD with 13.7% global market share. Tesla is number 3 in China with 7.8% market share YTD. Tesla is still the number 1 electric car seller in the US by far.

On May 4, Electrive reported:

Tesla confirms plans for second plant in Shanghai…This is to be located near the existing Giga Shanghai…a new production facility with an annual capacity of 450,000 vehicles is planned near the current plant.

On May 10, Seeking Alpha reported:

Tesla’s China-made sales in April dropped drastically due to Shanghai lockdown…Tesla delivered just 1,512 vehicles from its Shanghai plant, according to data from the China Passenger Car Association vs. 65,814 units in March…After reopening, the factory produced 10,757 vehicles by the end of April and sold only 1,512 of them. The company did not export any China-made Model 3s and Model Ys from the Shanghai plant in April.

On May 12, Torque news reported:

Elon Musk reveals Tesla Cybertruck is sold out until 2027. After several delays, the Cybertruck is currently not expected to begin deliveries until late 2023 or early 2024. And now, in a new interview, Elon Musk says Tesla has enough Cybertruck reservations to fill 3 years of production. This pushes deliveries for new reservations as far out as 2027.

On May 13, Reuters reported:

Exclusive: Tesla puts India entry plan on hold after deadlock on tariffs…The decision caps more than a year of deadlocked talks with government representatives as Tesla sought to first test demand by selling electric vehicles (EVs) imported from production hubs in the United States and China, at lower tariffs. But the Indian government is pushing Tesla to commit to manufacturing locally before it will lower tariffs, which can run as high as 100% on imported vehicles…

On May 15, Review geek reported:

Tesla Semi truck orders open as release date looms…Along with the reservation system, Tesla also shared more information about its two Semi models. The company initially plans to release two variants, one with 300 miles of range for $150,000 and a secondary option for $180,000 that can go nearly 500 miles on a single charge.

On May 16, CARSCOOPS reported:

Tesla stops taking Cybertruck orders from Europe and China, but continues in North America… According to Electrek, in May 2021 the Cybertruck forum released a crowdsourced reservation tally that showed over one million reservations for the electric pickup, and at the time of writing that number is reportedly close to 1.5 million, though this isn’t something that Tesla has confirmed.

On May 20, Inside EVs reported:

Tesla said to build battery and electric vehicle plant in Indonesia. Indonesia’s Investment Minister said the project might begin this year, although an agreement hasn’t been signed yet.

On May 26, Seeking Alpha reported:

Tesla already wants more space for the Berlin Gigafactory… Tesla has submitted an application to build on a further 100 hectares east of its plant in Germany, expanding the site’s area by a third, local newspaper rbb reported on Thursday, citing the local mayor.

On May 30, Reuters reported: “Tesla Shanghai plant restores weekly output to 70% of pre-lockdown level -sources.”

Investors can read a past article: “Tesla – A Look At The Positives And The Negatives“, where we rated the stock a buy. It was trading at USD 250 (post 5:1 stock split is equivalent to USD 50). Investors can also read the latest Tesla Trend Investing article: “A Brief Update On Tesla And What Is A Fair Valuation Today Plus PTs For The Years Ahead.”

Wuling Automobile JV (SAIC 51%, GM 44%, Guangxi 5.9%), SAIC Motor Corporation Limited [SAIC] [CH:600104] (SAIC includes Roewe, MG, Baojun, Maxus), Beijing Automotive Group Co. (BAIC)(includes Arcfox) [HK:1958) (OTC:BCCMY)

SGMW (SAIC-GM-Wuling Automobile) is number 3 globally with 8.3% market share year to date. SAIC/GM/Wulin JV (SGMW) is 2nd in China with 13.4% share YTD.

On May 18, Inside EVs reported: “China: Wuling Hong Guang MINI EV notes its first sales drop…”

On May 25, BAIC reported:

BAIC Star Promoter | Launching Arcfox αS HI — High-end smart pure electric car jointly developed by BAIC and Huawei. On May 7, the launch event of Arcfox αS HI was held in Beijing under the theme of “Epoch Maker”. As a high-end smart car deployed by BAIC Group in the field of pure electric cars, Arcfox αS HI is the first mass-produced car equipped with HI Huawei’s full-stack smart car solution. Since its debut at the Shanghai Auto Show last year, Arcfox αS HI has attracted much attention.

The BAIC/Huawei Arcfox αS HI

BAIC website

Volkswagen Group [Xetra:VOW](OTCPK:VWAGY) (OTCPK:VLKAF)/ Audi (OTCPK:AUDVF)/ Lamborghini/ Porsche (OTCPK:POAHF)/ Skoda/ Bentley

‘Volkswagen Group’ is currently ranked the number 4 top-selling global electric car manufacturer with 7.6% market share YTD, and 1st in Europe with 17.4% market share YTD.

On May 4, Volkswagen reported: “Volkswagen improves cost efficiency and economic efficiency in a tough environment.” Highlights include:

- “…Electric mobility strategy on track: 74 percent more all-electric cars delivered.

- Demand remains high – backlog of orders at all-time high…”

On May 4, Volkswagen reported: “Volkswagen Group bolsters expansion in global growth markets after strong Q1 results…Outlook for 2022 confirmed.”

On May 5, Volkswagen reported: “Volkswagen Group and SEAT S.A. to mobilize 10 billion euros to electrify Spain.”

On May 5, Electrive reported: “Volkswagen already sold out of electric cars for 2022.”

On May 7, Inside EVs reported:

Volkswagen Group: EVs are basically sold out in Europe and US for 2022. Volkswagen Group CEO Herbert Diess recently told the Financial Times that BEVs are basically sold out for 2022 in Europe and the US, as the order backlog in Western Europe alone reached 300,000: “We have very high order books and… order intake on electric vehicles,”. “We are basically sold out on electric vehicles in Europe and in the United States. And in China, it’s really picking up,”.

On May 7, Inside EVs reported:

In Q1 2022, Audi increased all-electric car sales by 66%. The year-over-year progress is clear, but the results were lower than in the previous quarter.

On May 11, Volkswagen reported: “Volkswagen Group to launch all-electric pick-up and rugged SUV in the United States.” Highlights include:

- “Volkswagen Group plans to electrify iconic U.S.-brand Scout.

- Independent company to be founded to design, engineer, and manufacture pick-up and rugged SUV (R-SUV) for the U.S. market.

- Start of production planned for 2026…”

On May 19, Volkswagen reported: “Volkswagen and Mahindra sign Partnering Agreement for MEB electric components in Chennai.”

On May 18, Volkswagen reported: “The wait is finally over! – Start of ID.01 Buzz pre-sales.”

Start of pre-sales for the new ID. Buzz Pro and ID. Buzz Cargo.

Volkswagen website

On May 19, Volkswagen reported: “Volkswagen’s global production network for electric vehicles grows with the launch of a second German site in Emden.”

On May 25, Whichcar reported: “Volkswagen Group aiming to beat Tesla’s EV sales by 2025.”

Hyundai (OTC:HYMTF), Kia (OTC:KIMTF)

Hyundai-Kia Group is currently ranked number 5 in the global electric car manufacturer’s sales ranking with 5.7% market share. Hyundai-Kia Group is ranked 3rd in Europe with 11.8% market share YTD.

On May 18, Kia reported: “Kia to establish its first electric PBV plant in Korea, as it accelerates electrified mobility.” Highlights include:

- “Kia will establish its first manufacturing facility dedicated to producing electric Purpose Built Vehicles (PBVs)…

- Construction of new facility to begin in the first half of 2023; production to start in the second half of 2025…

On May 20, CNBC reported:

Hyundai to invest $5.5 billion to build EVs and batteries in Georgia. Hyundai Motor on Friday confirmed plans to spend $5.54 billion to build its first dedicated electric vehicle and battery manufacturing facilities in the U.S. The operations are expected to open during the first half of 2025, with an annual production capacity of 300,000 vehicles.

Geely Automobile Holdings Ltd. (OTCPK:GELYY, HK:0175), Volvo Cars, Kandi Technologies Group (NASDAQ:KNDI), Proton, Lotus,

Geely/Volvo is currently ranked number 6 in the global electric car manufacturer’s sales ranking with ~5.5% (not updated this month) global market share.

On May 4, Volvo Cars reported:

Volvo Cars reports sales of 47,150 cars in April, share of electrified cars increased to 38.4%. Volvo Cars reports sales of 47,150 cars in April, down 24.8 per cent compared with the same month last year. Demand is still strong, especially for Volvo Cars’ electrified vehicles and the share of Recharge models as part of total sales continues to increase…

On May 9, GlobeNewswire reported:

Kandi Technologies reports first quarter 2022 financial results. Revenue of $24.9 million, up nearly 56% year-over-year. Off-road vehicles and lithium-ion cells were primary revenue contributors. Quarter-end cash balance1 of $229.2 million.

On May 24, Volvo Cars reported: “Volvo Cars raises EUR 500m for electrification through new green bond.”

On May 24, CarNewsChina reported:

Geely begins second giant 12 GWh power battery project…This is being done in partnership with Farasis Energy, one of the largest power batteries manufacturer in China…plans to begin trial production in late 2023.

On May 25, Volvo Cars reported: “Fully electric C40 Recharge continues Volvo Cars five-star streak in Euro NCAP safety testing.”

On May 30, Geely Automobile Holdings Ltd. reported:

Geely Automobile Holdings Limited sets 5-year carbon reduction target of more than 25% and carbon neutrality target by 2045 aiming to become an ESG leader in China’s automotive industry.

Stellantis N.V. (NYSE:STLA) (merger Fiat Chrysler Group (FCA) and the Peugeot Group (PSA)) Ferrari

Stellantis Group is currently ranked the number 7 in the global electric car manufacturer’s sales with ~5% (not updated this month) global market share. Stellantis is ranked 2nd in Europe with 15.3% market share YTD.

On May 24, Stellantis N.V. reported: “Stellantis and Samsung SDI to invest over $2.5 billion in joint venture for lithium-ion battery production plant in United States.” Highlights include:

- “Joint venture to build electric-vehicle battery plant in Kokomo, Indiana, U.S. to support Stellantis’ North America electrification ambitions outlined in “Dare Forward 2030” strategic plan.

- Plant targeted to start in 2025 and create 1,400 new jobs.

- Facility to have an initial annual production capacity of 23 gigawatt hours with an aim to increase up to 33 gigawatt hours.”

BMW (OTCPK:BMWYY), Mini, Rolls-Royce

BMW Group is currently ranked the number 8 global electric car manufacturer with 3.9% global market share. BMW Group is ranked ~4th in Europe with 11.1% (not updated this month) market share YTD.

On May 5, BMW Group reported: “Strong increase in earnings and margin following full consolidation of China joint venture.” Highlights include:

- “…BEV sales increased by almost 150%.

- Guidance confirmed despite high volatility.”

On May 17, BMW Group announced: “BMW i Ventures announces lead investment in green lithium refining technology, Mangrove Lithium.”

On May 25, BMW Group reported: “BMW Group creates closed recycling loop for high-voltage batteries in China.”

Daimler-Mercedes (OTCPK:DDAIF, OTCPK:DDAIY) (Smart – 50% JV between Daimler & Geely) (NB: A proposal to rename Daimler to Mercedes Benz)

Daimler-Mercedes is ranked number 9 globally with 3.4% market share.

On May 9, Reuters reported: “Mercedes-Benz CEO sees soaring demand, teases electrified AMG platform…”

On May 11, Mercedes Blog reported: “Mercedes electric cars are sold out for the year, CEO says.”

On May 18, Mercedes Blog reported:

Mercedes EQG with silicon battery From 2025. Mercedes is investing in the development of new battery technologies. In anticipation of solid-state batteries, the electric version of the G-Class, the Mercedes EQG, will receive anode batteries with a high proportion of silicon instead of graphite in 2025.

GAC Group (Guangzhou Automobile Group Co. Ltd.)

On May 3, Just Auto reported:

GAC Group to switch to NEVs by 2025. Chinese state owned automaker GAC Group plans to switch its entire product range to new energy vehicles, either fully electric or hybrid, by 2025, according to local reports citing a senior executive at the company. Feng Xingya, president of the Guangzhou based automaker, said, starting this year, his company planned to launch “at least two electric models each year” by the middle of the decade.

XPeng Inc. (Xiaopeng Motors) (XPEV) [HK:9868]

On May 1, Xpeng Inc. reported:

XPeng announces vehicle delivery results for April 2022. 9,002 vehicles delivered in April 2022, a 75% increase year-over-year.

On May 23, Xpeng Inc. reported: “XPeng reports first quarter 2022 unaudited financial results.” Highlights include:

- “Quarterly total revenues reached RMB7,454.9 million, a 152.6% increase year-over-year.

- Quarterly vehicle deliveries reached 34,561, a 159% increase year-over-year.

- Quarterly gross margin reached 12.2%, an increase of 100 basis points year-over-year.”

On May 23 Seeking Alpha reported:

Xpeng non-GAAP EPS of -$0.28 beats by $0.02, revenue of $1.18B beats by $70M…Q2 Outlook: Deliveries of vehicles to be between 31,000 and 34,000, representing a year-over-year increase of approximately 78.2% to 95.4%…

Great Wall Motors [HK:2333] (OTCPK:GWLLF) (OTCPK:GWLLY) [Ora]

On May 5, Autovista 24 reported: “Great Wall Motor’s ORA Cats set to become a challenger in Europe.”

On May 10, CNEVPOST reported:

Great Wall Motor’s Ora brand sells 3,088 vehicles in April, down 78% from March. In the January-April period, Ora sales were 36,842 units, down 3.5 percent from 38,159 units in the same period last year.

Ford (NYSE:F)

On May 4, Ford reported:

Electric Vehicle sales increased 139 percent on strength of Mustang Mach-E and E-Transit – First F-150 Lightnings now shipping to dealers; Improved inventory flow delivered April share gains despite semiconductor chip challenges…

On May 9, Ford reported: “Ford Pro reveals exciting next phase of electrification journey with all-new, all-electric E-Transit custom (van).

- …Further details to be announced in September, with production beginning in 2023 at upgraded Ford Otosan facility in Kocaeli, Turkey.”

Ford Pro all-electric E-transit custom

On May 13, The Economic Times reported: “Ford drops plans of making EVs in India.”

On May 17, Ford reported: “Ford joins appeal to the EU for 100% all-electric vehicle sales by 2035.”

On May 25, Ford reported: “Ford joins First Movers Coalition, announces commitment to help commercialise zero-carbon technologies.”

Li-Auto (LI)

On May, 1 Li-Auto reported:

Li Auto Inc. April 2022 delivery update. Li Auto Inc…delivered 4,167 Li ONEs in April 2022. Cumulative deliveries of Li ONE have reached 159,971 since the vehicle’s market debut in 2019.

On May, 10 Li-Auto reported: “Li Auto Inc. announces unaudited first quarter 2022 financial results.” Highlights include:

- “Quarterly total revenues reached RMB9.56 billion (US$1.51 billion).

- Quarterly deliveries reached 31,716 vehicles.

- Quarterly gross margin reached 22.6%.”

NIO Inc. (NIO)

On May 1, NIO reported: “NIO Inc. provides April 2022 delivery update.” Highlights include:

- “NIO delivered 5,074 vehicles in April 2022.

- NIO delivered 30,842 vehicles year-to-date in 2022, increasing by 13.5% year-over-year.

- Cumulative deliveries of vehicles as of April 30, 2022 reached 197,912.”

On May 20, NIO reported: “NIO Inc. successfully listed on the Main Board of the Singapore Exchange.”

On May 22, NIO reported: “NIO to be added to The Hang Seng TECH Index as a Constituent Stock.”

Renault [FR:RNO] (OTC:RNSDF)/ Nissan (OTCPK:NSANY)/ Mitsubishi (OTCPK:MSBHY, OTCPK:MMTOF)

On May 10, Renault Group reported: “Geely Automobile Holdings to acquire 34.02% of the shares of Renault Korea Motors.”

On May 16, Renault Group reported: “Renault Group signs agreements to sell Renault Russia and its controlling interest in AVTOVAZ.”

On May 20, Nissan Motor Corporation reported:

Nissan unveils all-new, all-electric mini vehicle in Japan…Sakura’s affordable price provides more consumer choice in the EV market.

Nissan Sakura EV

Nissan Motor Corporation website

On May 20, Bloomberg Hyperdrive reported:

The $15,000 EV is here and it’s cute. But only in Japan for now. Nissan, Mitsubishi make first major push with new mini EV. Popular minicar segment is seen as challenging to electrify…Marking a key push into a less-served part of the EV market that could help spur wider adoption, the chiefs of the two carmakers took the wraps off Nissan’s Sakura and Mitsubishi’s eK X EV on Friday. The two small, boxy EVs are set to go on sale in Japan this summer at a starting price of less than $15,000.

General Motors/Chevrolet (NYSE:GM)

On May 16, General Motors reported:

2023 Cadillac LYRIQ drives closer to delivery. Cadillac’s first fully electric vehicle — offering an EPA-est. 312 miles of range on a full charge1 — starts at $62,990…

On June 2, CNBC reported:

GM slashes prices of Chevy Bolt electric vehicles despite rising commodity costs…The Detroit automaker cut the price of the Bolt EV by $5,900 and of the larger Bolt EUV by $6,300.

Toyota (NYSE:TM)/ Lexus

On May 12, Car Expert reported:

Toyota bZ4X EV delayed until 2023. High global demand has forced Toyota Australia to push back the launch of its all-electric bZ4X until 2023, with further details to be announced.

On May 12, Reuters reported:

Toyota rolls out first battery electric car in cautious debut as rivals go full-throttle. Toyota Motor Corp rolls out its first mass-produced battery electric car in Japan on Thursday for lease only, a strategy the automaker says will help ease driver concerns about battery life and resale value but has raised analysts’ eyebrows.

Rivian Automotive (RIVN)

On May 11, The New York Times reported:

Rivian shares surge after the E.V. maker affirms its 2022 production goal. The company encountered supply-chain problems and investor concern after its initial public offering last year gave it a huge market value…

On May 12, Reuters reported:

EV maker Rivian stands by production target despite supply-chain snarls. Rivian Automotive Inc (RIVN.O) on Wednesday reaffirmed its annual production forecast of 25,000 units, saying ongoing supply chain disruptions and material costs prevented the electric vehicle maker from reaching its original target of 50,000 vehicles.

Lucid Group (LCID)

On May 5, Lucid Motors reported: “Lucid reports first quarter 2022 financial results.” Highlights include:

- “Q1 revenue of $57.7M driven by customer deliveries of 360 vehicles in the quarter.

- Strong demand with more than 30,000 customer reservations as of today, reflecting potential sales of $2.9B.

- Production volume outlook for 2022 remains on track at 12,000 to 14,000 vehicles.

- Announces new pricing effective June 1 while honoring current pricing for all existing reservation holders.”

On May 5, CNBC reported:

Lucid reports 30,000 EV reservations and raises prices on its Air sedans. Customers reserving a Lucid Air in June or later will pay 10% to 12% more for their vehicles.

On May 9, Lucid Motors reported: “Lucid Motors announces launch plans for Europe…”

Lucid Air Dream Edition Model

On May 18, Lucid Motors reported: “Lucid advances global sustainability vision, announcing new details for first overseas manufacturing facility with partners in Saudi Arabia.” Highlights include:

- “Lucid’s new factory to bring advanced electric vehicle manufacturing to Saudi Arabia for the first time with a local capacity of 155,000 units.

- New Saudi factory expected to address growing global demand for Lucid electric vehicles by increasing Lucid’s global production capacity mid-decade to 500,000 EVs per year…

- Signing ceremony celebrates agreements estimated to provide financing and incentives to Lucid of up to $3.4 billion in aggregate over the next 15 years.

- Government of Saudi Arabia reaffirms commitment to purchase up to 100,000 Lucid electric vehicles over a ten-year period.”

On May 26, Lucid Insider reported: “Lucid Motors delivery 1,117 electric vehicles through mid-May 2022.”

Polestar Automotive Holding UK Limited (PSNY) via SPAC Gores Guggenheim Inc. (GGPI)

On May 19, Polestar reported:

Polestar reports strong start to 2022 with record sales, continued growth and market expansion…In the first four months of the year, vehicle sales more than doubled to approximately 13,600 and the Company’s order take more than tripled to nearly 23,000 compared to the same period in 2021. During the period, Polestar increased its global presence to 23 markets, up from 19 at the end of 2021, putting the company on track to meet its target of 30 markets in aggregate by the end of 2023. New markets in the Middle East and Europe will be joined by Spain and Portugal imminently. Plans are underway to begin operations in Israel and Italy later in 2022. In addition, Polestar has announced a global partnership with the car rental company Hertz to supply 65,000 cars over the next five years.

On May 24, Polestar reported: “Polestar invests in extreme fast charging battery company StoreDot; unlocks access to advanced battery technology.”

Tata Motors (TTM) group (Jaguar, Land Rover)

On May 20, Tata Motors reported: “Tata Motors bags an order for 50 EVs from M/s ANERT through EESL.”

On May 30, Tata Motors reported:

Tata Motors signs Memorandum of Understanding for the potential acquisition of Ford India’s Sanand plant.

On May 30, Tata Motors reported: “Tata Motors delivers 51 EVs in Nagpur in one day.”

GreenPower Motor Company Inc. [TSXV:GPV] (GP)

On May 17, GreenPower Motor Company Inc. reported:

GreenPower’s all-electric Type D and Type A school buses are eligible for rebates of up to $375,000 and $285,000 respectively under the EPA’s Clean School Bus Program…

On May 23, GreenPower Motor Company Inc. reported:

GreenPower enters into Joint Venture with Jupiter Group in India to market the right hand drive EV Star Cab and Chassis…

Investors can also read my Trend Investing article on GreenPower here.

Workhorse Group Inc. (WKHS)

On May 10, Workhorse Group Inc. reported: “Workhorse Group reports first quarter 2022 results.” Highlights include:

Workhorse delivered on its stated priorities from the first quarter by enhancing its team and strengthening its financial and operational position in the following key areas:

- “…Made significant progress transforming Workhorse’s Union City plant to become a world class manufacturing center with the goal of starting production in the facility in Q3 2022.

- Entered into previously announced deleveraging transaction with High Trail Capital to exchange outstanding notes for Workhorse’s common stock, eliminating the remaining debt on Workhorse’s balance sheet.”

On May 10, Workhorse Group Inc. reported: “Amerit and Workhorse announce purchase order for 10 all electric EVolution mobile service centers.”

Lion Electric (LEV)

On May 3, Lion Electric reported: “Lion Electric announces first quarter 2022 results.” Highlights include:

“Q1 2022 Financial Highlights

- “Delivery of 84 vehicles, an increase of 60 vehicles, as compared to the 24 delivered in the same period last year.

- Revenue of $22.6 million, up $16.4 million as compared to $6.2 million in Q1 2021.

- Gross loss of $0.9 million, as compared to a gross loss of $1.8 million in Q1 2021.

- Net earnings of $2.1 million, as compared to a net loss of $16.1 million in Q1 2021…

- As of March 31, 2022, Lion had $155.5 million in cash, and access to a committed revolving credit facility in the maximum principal amount of $200 million, as well as available support from the Canadian federal and Quebec governments of up to approximately C$100million (amounting to approximately C$50 million each) in connection with the Lion Campus…“

Nikola Corporation (NKLA)

On May 2, Nikola Corporation announced:

Nikola announces $200 million Convertible Senior Notes investment. Funds advised by Antara Capital LP have agreed to purchase $200 million aggregate amount of 8.00% / 11.00% Convertible Senior Notes due 2026 (the “Notes”)…

On May 4, Drive.com.au reported:

Controversial Nikola electric truck goes into production – with a catch…Controversial US start-up Nikola has begun production of an electric truck dubbed the Tre, according to its CEO. However, there’s a catch – the small print reveals it’s actually an Iveco chassis paired with a third-party electric powertrain…Voltage is drawn from a mammoth 753kWh lithium-ion battery pack – approximately 15 times bigger than that in a standard Tesla Model 3.

On May 5, Nikola Corporation announced: “Nikola Corporation reports first quarter 2022 results.” Highlights include:

- “Began serial production of the Nikola Tre BEV on March 21.

- Received Purchase Orders [POS] for 134 Tre BEVs utilizing California’s HVIP1 incentive through April.

- Shipped 11 saleable production trucks to dealers in April for customer delivery.

- Completed Tre FCEV alpha pilot testing with Anheuser-Busch (A-B) in Southern California operations in April.

- Completed Phase 1 of Coolidge, Arizona manufacturing facility in March…”

Near-Term Potential EV Producing Companies

Faraday Future Intelligent Electric Inc. (FFIE)

On May 6, Faraday Future reported: “Faraday Future reports financial results for third quarter 2021.” Highlights include:

- “Successfully Completed Public Listing, Securing Gross Proceeds of ~$1.0 billion.

- 2,270 Mile Test Drive Confirmed Market-Leading Performance and Technology.

- Hanford Facility Build Out on Track.

- FF 91 Production Launch Expected Q3 2022.”

On May 12, Faraday Future reported: “Faraday Future marks production milestone #5 at its Hanford, Calif. Manufacturing Facility, remains on schedule to launch in Q3 2022.”

On May 18, Faraday Future reported: “Faraday Future announces its first, flagship brand experience center in Beverly Hills, selects ASTOUND Group for experience design and execution.”

On May 23, Faraday Future reported: “Faraday Future reports financial results for first quarter 2022.” Highlights include:

- “Unveiled the First Production-Intent FF 91.

- Signed Contract Manufacturing Agreement with Myoung Shin.

- Completed Additional Investigation Work of the Special Committee.

- Announced 401 Preorders as of March 31, 2022.”

Lordstown Motors (RIDE)

On May 9, Lordstown Motors reported: “Lordstown Motors reports first quarter 2022 financial results.” Highlights include:

- “Ending cash balance of $204 million; in excess of $300 million pro forma for Foxconn transaction…

- Endurance PPV test results correlating well with CAE predictions.

- Continued progress preparing the Lordstown facility for commercial production launch.

- Successful trade shows driving continued engagement and interest from fleets.

- Continued supply chain and raw material challenges largely contained.

- Received $50 million purchase price down payments under APA in January and April.

- Progress on the terms of a contract manufacturing agreement and product development agreement with Foxconn; received Committee on Foreign Investment in the United States (CFIUS) approval of the APA.”

Outlook

- “Reaffirming third quarter 2022 target for start of commercial production of the Endurance and initial production of approximately 500 units; commercial deliveries expected in Q4…”

On May 11, Lordstown Motors reported: “Lordstown Motors and Foxconn close asset purchase agreement and enter into JV Agreement for MIH Based EV Development.” Highlights include:

- “Asset Purchase Agreement closing results in approximately $260 million in proceeds to LMC, in addition to prior $50 million common stock purchase.

- Contract manufacturing of the Endurance by Foxconn at Lordstown facility with no interruption in operations.

- Creation of $100 million joint venture, MIH EV Design LLC, to develop electric vehicles for the global market.

- Foxconn and LMC to share expertise and resources to accelerate EV adoption.”

Arrival (ARVL)

On May 6, Arrival reported:

Arrival achieves EU bus certification milestone…the Arrival Bus has achieved EU certification and received European Whole Vehicle Type Approval (EUWVTA)…This major milestone is the critical step towards Arrival Buses carrying passengers on public roads in Europe and the UK.

On May 10, Electrek reported: “Arrival updates following Q1 report: Bus and Van on track for production in 2022.”

Fisker Inc. (FSR)

On May 4, Fisker Inc. reported:

Fisker announces its third product, Project Ronin, an innovative, high-tech electric GT Sports Car. The all-electric sport Grand Tourer will feature innovations such as a battery pack integrated with the vehicle’s structure. Fisker is designing and engineering Project Ronin to deliver the longest range of a production EV with the ultimate in high performance.

Fisker Project Ronin

On May 4, Fisker Inc. reported: “Fisker inc. announces first quarter 2022 financial results.” Highlights include:

- “Q1 2022 operating results consistent with company expectations and full-year total spending guidance unchanged.

- Test and validation phase progressing well, 23 out of 55 complete Fisker Ocean prototypes built.

- 2022 retail reservations continue at an elevated pace. Fisker Ocean reservations total more than 45,000 as of May 2, 2022, including 1,600 fleet reservations. This represents approximately 50% growth since last earnings call.

- Unveiled the Fisker Ocean to the European market at Mobile World Congress in Barcelona.

- Fisker will open pre-orders for the limited-edition Fisker Ocean One on July 1, 2022.

- Hyderabad in Telangana State selected as headquarters for Fisker’s operations in India. The Hyderabad office will contribute to software and virtual vehicle development.“

On May 12, Fisker Inc. reported: “Fisker and Foxconn confirm Fisker PEAR production in Ohio.” Highlights include:

- “Fisker partner Foxconn has completed its acquisition of an operational 6.2 million–square–foot vehicle manufacturing facility in Ohio.

- Fisker and Foxconn will build Fisker’s second vehicle, the Fisker PEAR, at the factory.

- The Fisker PEAR will start production in 2024andhavean expected base price below $29,900.

- Fisker and Foxconn intend to build a minimum of 250,000 PEAR vehicles a year once the plant ramps up production.”

On May 24, Fisker Inc. reported: “Fisker announces launch of its $350 million at-the-market equity program…”

Note: A 2020 Reuters article quoted: “Fisker is targeting initial sales of 8,000 SUVs in 2022, 51,000 in 2023 and 175,000 in 2024.”

You can read a Trend Investing article on Fisker Inc. here, or the European reveal of Fisker Ocean video here.

Three Wheel EV Companies

Arcimoto Inc. (FUV)

On May 16, Globe Newswire reported: “Arcimoto announces first quarter 2022 financial results and provides corporate update.” Highlights include:

- “In Q1, sold 24 new customer vehicles while shifting manufacturing operations from the AMP to the RAMP.

- Launched operations at RAMP, a 250,000 square foot scale manufacturing facility designed for mass production of the Company’s EVs. At full capacity, the RAMP is expected to have a production capacity of 50,000 vehicles per year. A grand opening event was held on-site on February 22, 2022.

- Unveiled the Mean Lean Machine [MLM], a radically new high-performance e-bike designed with Arcimoto’s patented three-wheeled tilting technology, currently available for preorder.

- Demonstrated the Faction D1, a next-generation driverless delivery vehicle with the potential to dramatically reduce the cost of last-mile logistics for delivery and rideshare.

- Initiated new rental partner programs in Marco Island, Fort Lauderdale, and St. Petersburg, Florida; Friday Harbor, Washington…

- Launched a partner pilot program with Directed Technologies to introduce FUVs and Deliverators to the Australian market with potential use-cases in tourism, delivery, and emergency services…

- Welcomed favorable new legislation in several states. Alabama bill HB 37, Utah bill HB391, and New York bill A7192A/S6335 bring those states in line with other states that do not require a motorcycle license to operate an autocycle such as those built by Arcimoto. Maryland passed Clean Cars Act of 2022, renewing EV tax credits and allowing three-wheeled autocycles to be operated without a motorcycle license.

- Raised an additional $4.5 million via a long-term convertible note with Ducera Investments LLC dated April 25, 2022.

- Announced Deliverator pilot program with JOCO for last-mile delivery in Manhattan, New York.”

Electrameccanica Vehicles Corp. (SOLO)

No news for the month.

EV & Battery ETF

- The Amplify Lithium & Battery Technology ETF (BATT) is a broad based EV related fund worth considering. It is currently a trading on a PE of 19.86. On their website they state: “BATT is a portfolio of companies generating significant revenue from the development, production and use of lithium battery technology, including: 1) battery storage solutions, 2) battery metals & materials, and 3) electric vehicles.

Other EV Or EV Related Companies

Other EV companies I am following include Envirotech Vehicles (OTCQB:EVTV) (formerly ADOMANI Inc., Atlis Motors, Ayro, Inc. (AYRO), Blue Bird Corporation (BLBD), Blink Charging (BLNK), Byton (private), Canoo Holdings (GOEV), China Evergrande New Energy Vehicle Group [HK:3333], Chery Automobile Co. Ltd. (private), Didi Chuxing, Dyson (private), Electric Last Mile Solutions Inc. (“ELMS”) (ELMS), Guangzhou Automobile Group Co., Honda [TYO:7267] (HMC) (OTCPK:HNDAF), Hyliion Holdings (HYLN), Ideanomics Inc. (IDEX), Mahindra & Mahindra (OTC:MAHDY), Mazda (OTCPK:MZDAY), Niu Technologies (NIU), Proterra (PTRA), Qiantu Motor, Sono Group N.V (SEV), (Subaru (OTCPK:FUJHY), Suzuki Motor Corp. [TYO: 7269] (OTCPK:SZKMY) (OTCPK:SZKMF), Tata Motors (TTM) group (Jaguar, Land Rover), WM Motor, and Zhi Dou (private).

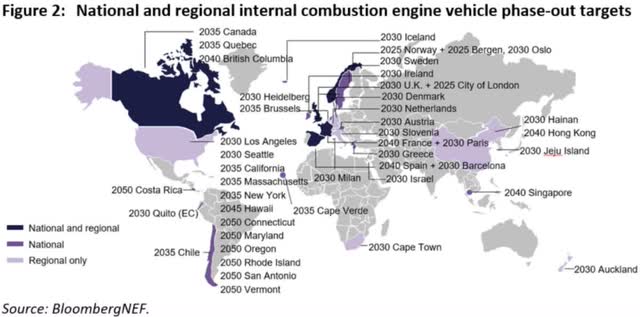

The list of countries and cities banning (or planning to ban) petrol and diesel vehicles include at least:

- Norway (2025); UK, Netherlands, Denmark, Sweden, Iceland, Greece, Ireland, Israel (2030); Scotland (2032); Hong Kong (2030-40); EU, Germany, Japan, Canada (2035); France, Spain, Egypt, Taiwan, Singapore, India, New Zealand and Poland (2040).

- Rome (2024); Athens, Paris, London, Stuttgart, Mexico City, Madrid (2025); Amsterdam, Brussels, Hainan (2030); California, New York, Quebec Province (2035); Sao Paolo, Seoul (2040).

Note: Wikipedia has an excellent list showing the phase out of fossil fuels in various cities and countries.

ICE Vehicle Phase-Out Target Dates

Autonomous Driving/Connectivity/Onboard Entertainment/Ride Sharing [TaaS]/ EV leasing/Renting

On May 3, BMW Group reported: “BMW Group and Mercedes-Benz Mobility intend to sell their car-sharing joint venture SHARE NOW to Stellantis.”

On May 5, BNN Bloomberg reported: “Uber’s CEO explains how the ride-hailing pioneer is electrifying.”

On May 17, The Driven reported:

Elon Musk sets new target for self-driving EVs by end 2022…Talking in an interview at the All-In Conference in Florida on Monday (US time), Musk said Tesla will probably be “expanding FSD (Full Self-Driving) Beta to 1 million users by end of the year.”…Currently, Tesla has about 100,000 drivers on the Tesla FSD beta program. Most of these drivers are in the US and there are a small number in Canada.

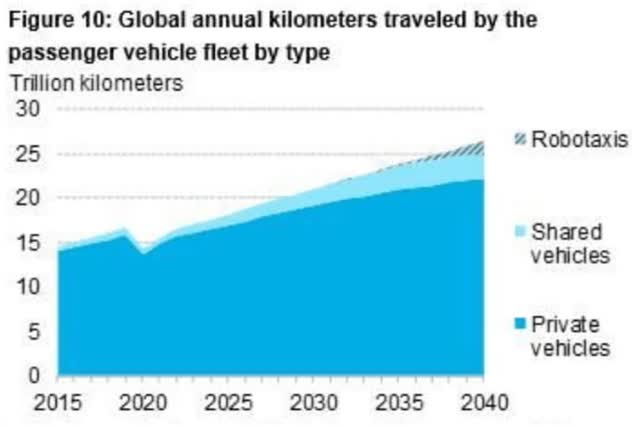

BNEF 2020 forecasts by fleet type

Conclusion

April 2022 global electric car sales were up 38% YoY and reached 10.2% global market share; 29% share in China, 19% in Europe, and no figures for the USA. It should be mentioned that all car sales have been negatively impacted the past 1-2 months by Covid-19 lockdowns in China and the war in Ukraine in Europe.

Multiple OEMs are now reporting they are now sold out for electric cars in 2022. Electric car orders are now well over 3m globally, showing that electric car demand is running well ahead of supply in 2022.

BYD and Tesla are the two leading electric car sellers with a gap to SGMW (SAIC-GM-Wuling Automobile) in third place.

Highlights for the month were:

- Chinese EV deliveries in April dive for some OEMs as COVID disruptions come to bear.

- Apple hires Ford veteran to help boost electric car project: report.

- Q1, 2022 EV market review – EV sales are limited by supply.

- World to see no new ICE vehicle sales by 2035 at latest, says CATL exec.

- IEA: Global electric car sales have continued their strong growth in 2022 after breaking records last year.

- More electric semi trucks coming to US & Europe.

- Bank of America doles out electric-car perks to employees.

- In a global tipping point, 52% of car buyers now want to purchase an EV.

- China is in talks with automakers about extending subsidies for EVs in 2023, that were set to expire in 2022. China reduces purchase tax by half on low emissions vehicles up to 300,000 yuan ($45,000) in H2, 2022.

- Beijing plans subsidies for EV buyers to boost Covid-hit economy.

- Tesla confirms plans for second plant in Shanghai. Elon Musk reveals Cybertruck sold out until 2027. Tesla Semi truck orders open as release date looms. Tesla already wants more space for the Berlin Gigafactory.

- BYD to start pre-sale of Seal in China on May 20.

- Volkswagen already sold out in Europe and US of electric cars for 2022. Volkswagen launches second all-electric car plant in Germany, plans to scale to 1.2m BEVs pa starting from the end of 2022 from 6 factories. Plans to launch all-electric pick-up and rugged SUV in the United States.

- Geely begins second giant 12 GWh power battery project.

- Hyundai to invest $5.5 billion to build EVs and batteries in Georgia, USA.

- Stellantis and Samsung SDI to invest over $2.5 billion in joint venture for lithium-ion battery production plant in United States.

- Geely Automobile Holdings to acquire 34.02% of the shares of Renault Korea Motors.

- Nissan, Mitsubishi make first major push with new mini EV in Japan, priced under US$15,000.

- GAC Group to switch 100% to NEVs by 2025.

- Ford Pro reveals exciting next phase of electrification journey with all-new, all-electric E-Transit custom (van).

- Lucid reports 30,000 EV reservations and raises prices on its Air sedans, announces launch plans for Europe, new EV factory planned for Saudi Arabia.

- Polestar increased its global presence to 23 markets.

- Controversial Nikola electric truck goes into production.

- Lordstown Motors and Foxconn close Asset Purchase Agreement and enter into JV Agreement for MIH based EV development.

- Arrival Bus and Van on track for production in 2022.

- Fisker announces its third product, Project Ronin, an innovative, high-tech electric GT Sports Car. Confirms production of 2nd model at Foxconn factory in Ohio in 2024. Ocean reservations total more than 45,000.

- Musk said Tesla will probably be “expanding FSD (Full Self-Driving) Beta to 1 million users by end of the year.”

As usual all comments are welcome.

Be the first to comment