Rixipix/iStock via Getty Images

Investment Thesis

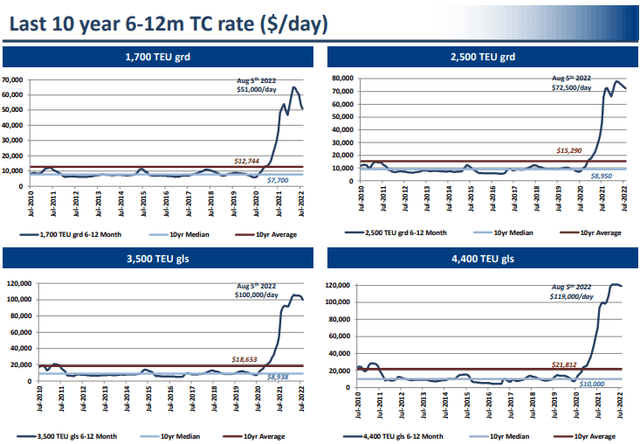

Containership charter rates have been rising since the pandemic and still show no signs of slowing down, facilitating the marine shipping industry to generate healthy shareholder returns. Euroseas Ltd. (NASDAQ:ESEA) has posted promising Q2 revenues, with a tremendous YoY increase of 165% in the MRQ and 187% in the first half of 2022. This significant increase has been driven by the boom in time charter rates since the beginning of 2021 and an increase in fleet size.

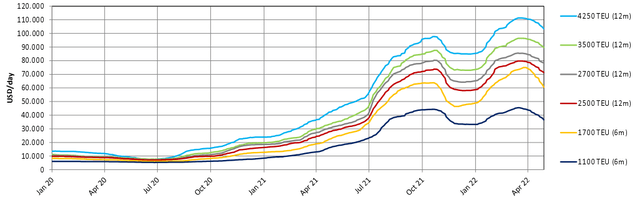

Hellenic Shipping News

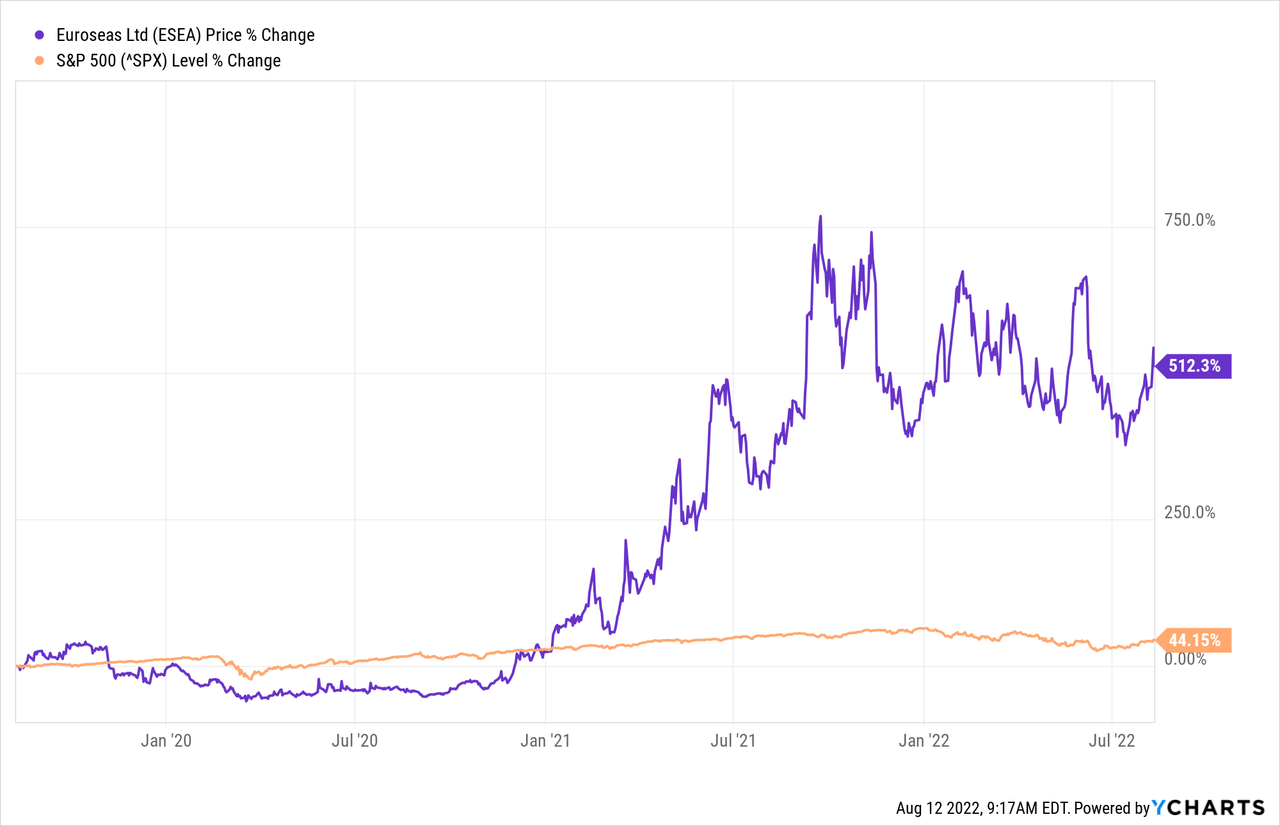

Euroseas has outpaced the S&P 500 by 430% in its three-year returns and 12% YTD by generating positive returns, as the container freight rates have continued to climb in the past two years.

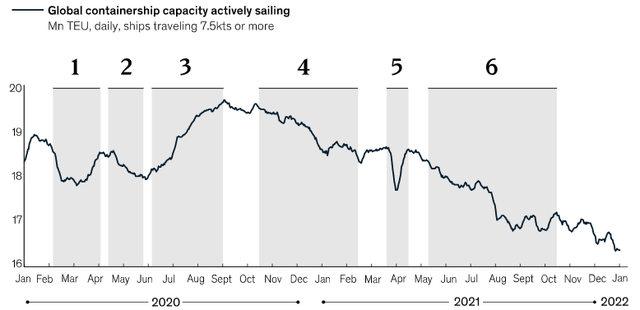

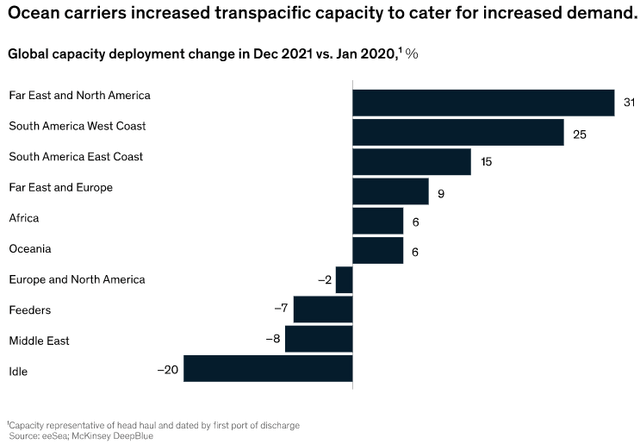

Ocean carriers protected their charter rates by canceling sailings and idling vessels to match the logistics supply with demand. But the recent sharp 35% drop in freight rates on trade routes in Asia and the east coast of South America might flatten the price trend soon.

Despite these challenges, Euroseas is showing no signs of slowing down as the company’s average realized TCE rate increased by 126% YoY in the MRQ, with a fleet utilization of 99.7%.

With efficient performance exhibited by Euroseas over the last couple of years, considerable expansion in its fleet, and promising returns for its shareholders, I rate ESEA as a “Buy.”

Company Overview

The Pitta family has been in the container and dry shipping business for over 130 years. After spinning off its dry bulk business, EuroDry (EDRY), Euroseas completely focused on containerships to cater to the specific demographics and investors. The fourth generation CEO, Aristides J. Pittas, took the company public in 2005.

Euroseas Ltd operates in the container shipping market and has a fleet of 18 vessels, including 10 Feeder containerships and 8 Intermediate containerships. These 18 vessels have a cargo capacity of 58,871 teu, averaging around 3200 teu per vessel.

ESEA Q2 Presentation

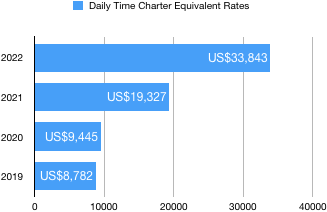

With the expansion in vessels fleet and utilization of current vessels, it operated an average of 16.23 vessels during the first quarter of 2022 as compared to 14 vessels for 2021, with an average time charter equivalent rate of $33,843 per day, an increase of 126% YoY. Euroseas has been achieving economies of scale for the past two quarters.

Data from ESEA

Source: Author

The company recently acquired two new vessels for $37 million. Both of these acquisitions were financed by the company’s funds. These charters are expected to contribute over about $20 million of EBITDA.

More Vessels Delivery in Future

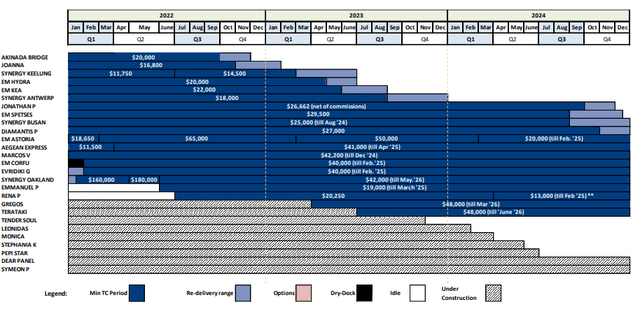

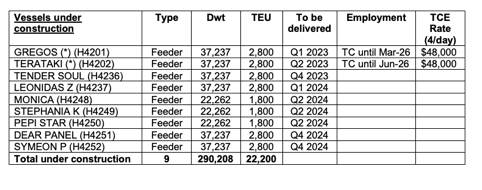

It is imperative for the players in the containership industry to forecast the future to stay in business. The company has already ordered nine feeder containerships for 2023 and 2024. After that, Euroseas’ fleet will consist of 27 vessels. This will significantly increase its capacity to 81,071 teu, an almost 40% higher. Considering high freight rates in the next two to three years, one can predict that Euroseas Ltd might see a significant revenue increase in the next five years.

ESEA

According to McKinsey Report, supply will also increase as ocean carriers invest their record profits in ordering new vessels, with around 5.5 million TEUs of new capacity expected by the end of 2024. Availability of container boxes has already increased, and an additional 4 to 5 million new containers are expected in the coming year.

ESEA Q2 Presentation

Similarly, because the Company has ordered feeders with an average TEU of 2800 per vessel, and the benchmark rate for standard 1,700 TEU ships has been about $40,000 for a 36-month term, Euroseas is expected to perform well above average in the near future.

Profitability, Debt, and Liquidity

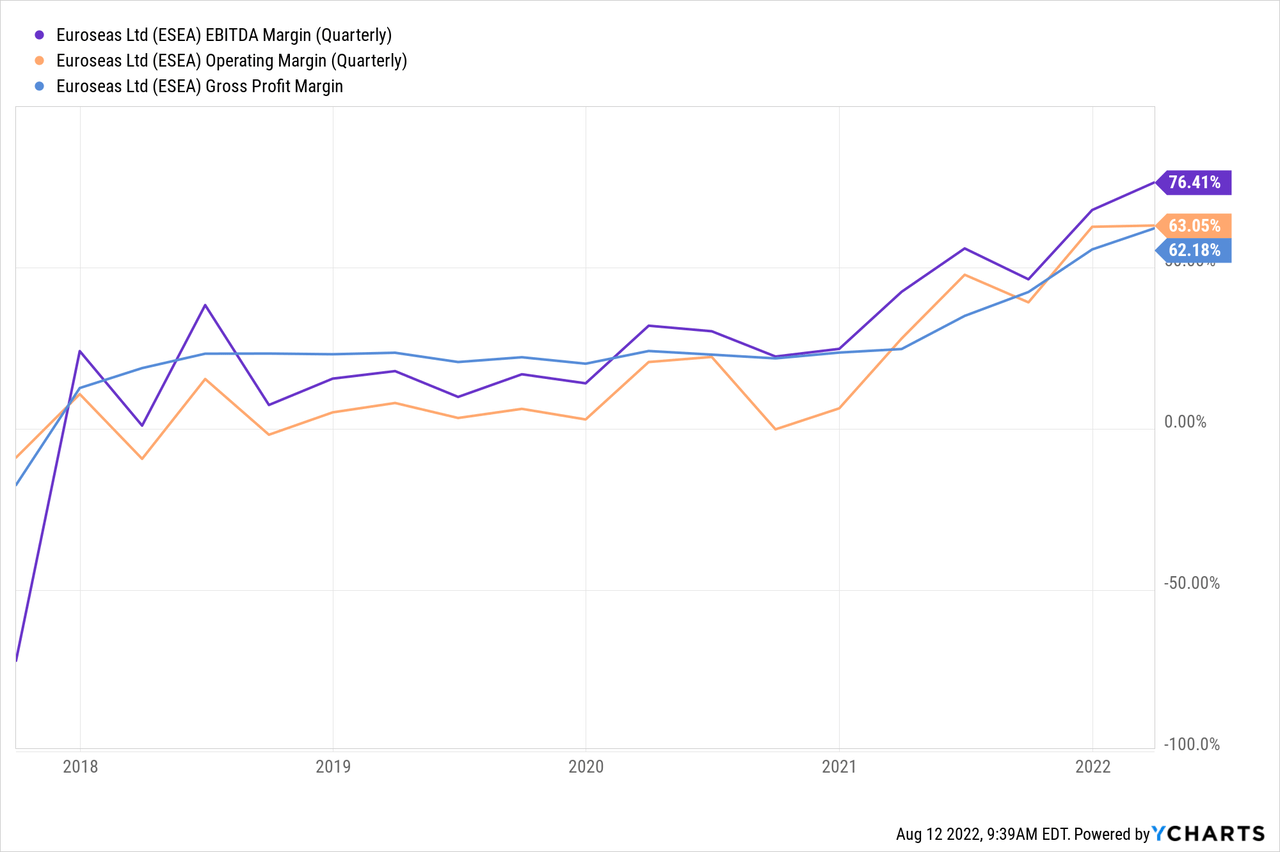

Euroseas’ profitability has consistently risen over the past few years, with the operating margin improving by 46% in the MRQ. This net increase is because of higher charter rates across the industry and lower vessel operating and docking expenses.

Additionally, the depreciation expense has increased by 156% due to the addition of new vessels to its fleet, resulting in higher average daily depreciation charges. Resultantly, the EBITDA margin has also shown consistent improvements along with its other margins.

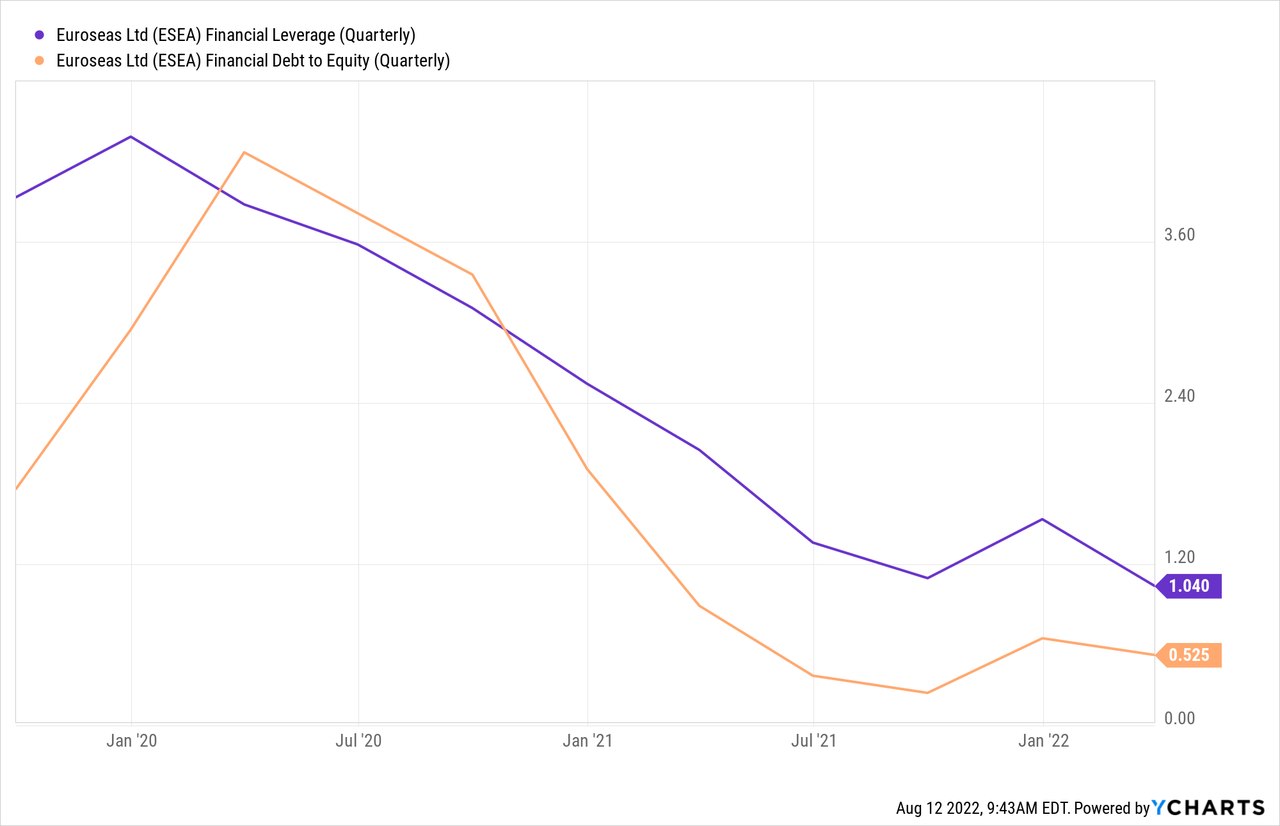

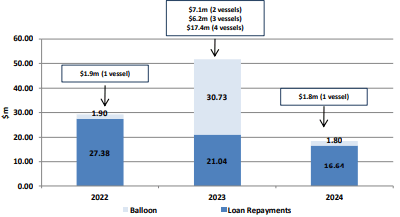

Euroseas currently holds a total debt of about $111 million on its balance sheet but is proactively working to reduce its leverage through the cash generated by expanded margins.

Its debt repayment calls for a reduction of 24.6% of the debt in FY 2022 and an additional reduction of 43.5% in FY 2023. The financial leverage is relatively high as the company has ordered nine more vessels to be financed with a combination of debt and equity. Three of these vessels will be delivered in 2023.

ESEA Q2 Presentation

The company’s liquidity shows a healthy, sustainable increment of 85% in the MRQ. This increased liquidity amply covers the short-term obligations, with a current ratio of 1.32x and an interest cover of over 54x.

Valuation

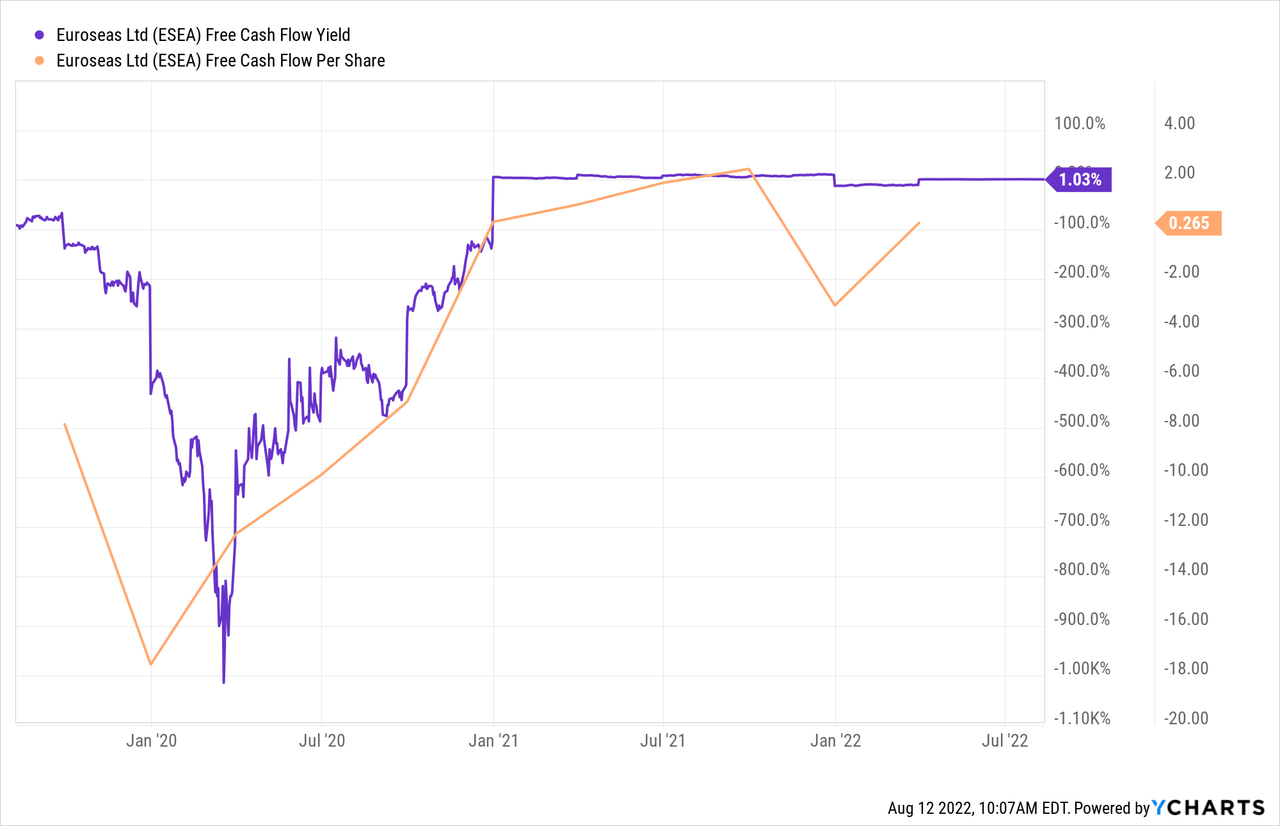

The company has recently announced a dividend of $0.50, yielding about 7.4%, higher than the sector median of 5.4%. This is led by the company’s significant margin expansion, leading to improved cash flows. This improved liquidity and positive working capital have also led to a share repurchase program of up to $20 million of the company’s common stock, of which $0.9 million has already been bought back in the MRQ.

The company has iterated a NAV of $66 per share in its MRQ presentation, which would mean that the stock is currently trading at a massive discount to its NAV. This is likely one of the major reasons for the stock repurchase program.

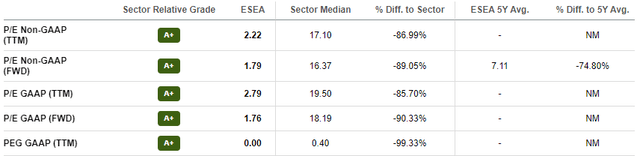

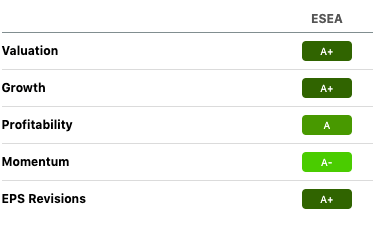

To further solidify the case for ESEA’s undervaluation, a simple relative valuation analysis will suffice as the company’s relative valuation metrics are an oasis of green.

The 1.76x forward P/E and 2.57x forward P/CF multiples are exceptionally higher than the sector medians of 18.19x and 16.5x. Similarly, the forward P/B and P/S ratios are also favorable.

Seeking Alpha

Risks

Euroseas Ltd’s high 24-month beta of 1.37, compared to its peer average of around 0.67, also indicates that the volatility of the stock is still high due to the uncertainty in the markets amid soaring inflation, rising interest rates, pandemic-related lockdowns, and the Russia-Ukraine conflict.

Similarly, hesitancy is also shown by the charters as some soft lockdowns have been observed in parts of China. There are indeed question marks on how the market will develop in 2023 and 2024 as various contradicting forces come into play.

McKinsey & Company

Conclusion

The container shipping industry is cyclical depending on many factors, such as consumer buying power, fuel costs, and other macroeconomic and political factors. Analysts believe volumes will pick up once again after China resumes work, with U.S. importers seeking to restock depleted inventories during the spring. After this, the 2022 peak season will keep rates elevated into Q4 2022.

Euroseas will become a major benefactor from these higher charter rates as it expands with nine more containerships. The industry’s cyclical nature raises a question mark on the sustainability of the profits as the fuel costs, uncertain political situation, and various macro and political factors can harshly affect the industry.

McKinsey & Company

The Company believes it is well prepared for any uncertainty in upcoming years as its balance sheet looks stronger than ever with a healthy amount of cash. With regards to countering unforeseen events, the CEO said:

We intend to use the cash flow we are generating not only to reward our shareholders via our ongoing dividend and share repurchase program but also to fund the equity portion of our nine-vessel newbuilding program and still have a significant war chest to pursue investment opportunities in an accretive way to our shareholders.

The decision to acquire nine small vessels with an average teu of 2800 will let Euroseas be more versatile and able to operate in more ports in the future. If the Company achieves its expansion of 83,000 teu by 2024, provided that we have a relatively strong world economy, the future revenue growth will be higher than expected, consequently bringing in more cash, hence improving dividend-paying ability and share return.

Seeking Alpha

Similarly, a significantly lower P/E multiple for a low market cap company can indicate strong future growth prospects. And if the markets remain stable, one can expect that the Company will achieve its true valuation sooner than later.

Vessel charter rates have declined by 10-20% in recent months. Still, Euroseas has shown phenomenal results with significant growth in its revenue by 165% YOY in the MRQ and expanding its fleet size by operating an average of 16.46 vessels during the second quarter of 2022, earning an average time charter equivalent rate of $33,714 per day. For these reasons mentioned above, I rate this stock as a “Buy.”

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment