Svitlana Zheltova/iStock via Getty Images

The state is that great fiction by which everyone tries to live at the expense of everyone else.“― Frederic Bastiat

The U.S. based investor has plenty of worries domestically right now. These range from an aggressive monetary policy from the Federal Reserve, two straight quarters of GDP contraction, the highest inflation in over 40 years, a collapsing housing market, and a consumer that is under considerable duress.

However, U.S. investors should not take their eyes off troubles stirring from “across the pond,” as Europe looks heading into a recession, and one that could potentially be long and deep. It is the potential “Black Swan” few are seeing at the moment given the litany of problems at home. This is especially true if we get a repeat of the “Greek Debt Crisis” of a decade ago, but this time involving a much larger economy like Italy.

Cracks in the European economy are getting more evident by the day for anyone that is paying attention. The Euro fell once against the greenback Monday afternoon to below parity. The main cause of European weakness and angst is sanctions against Russian energy and other business concerns as the result of the country’s invasion of Ukraine. In hindsight, those measures were poorly thought out and are having significantly more negative ramifications than European policy makers counted on. The negative impacts from these policies are everywhere at the moment.

Late Friday, Russia’s Gazprom (OTCPK:OGZPY) said it would halt the Nord Stream pipeline for three days of maintenance on August 31st. This is due to the single functioning gas turbine at Portovaya’s compressor station that requires planned maintenance. The announcement pushed the price of natural gas in Europe to yet another a record high. At one point in trading, natural gas prices in Europe reached 15 times their average summertime price. Here at home, U.S. natural gas prices climbed to another 14-year high on Monday but are still dirt cheap compared to levels in Europe.

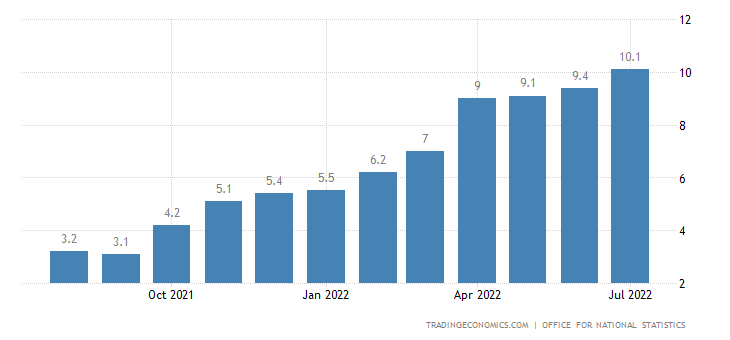

Meanwhile, the chief UK economist at Citigroup (C) told clients Monday that he expects CPI inflation to hit 18.6% in January due to soaring natural gas and power costs. The U.K.’s consumer price index showed a 10.1% year-over-year increase in July, surpassing the previous month’s 9.4% reading. This represented a 40-year high for the nation. Surging energy prices have already pushed the U.K. Misery Index, an economic indicator to gauge how the average person is doing, to three-decade highs. In Spain, the country recently banned the setting of air conditioning below 80 degrees.

UK Monthly Inflation Rate (TradingEconomics)

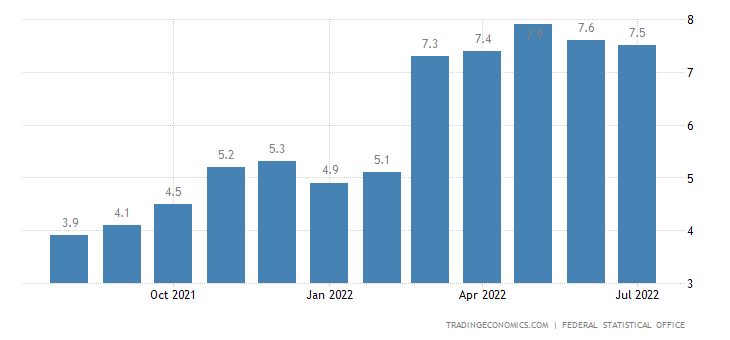

Meanwhile, Germany’s inflation rate could surge above 10% this fall — the highest in seven decades — due to the energy squeeze, the country’s central bank chief told the Rheinische Post on Monday. Last week, the inflation rate in the Euro Area came in at a new record high of 8.9% in July of 2022, compared to 8.6% in June and 2.2% a year earlier.

Germany Monthly Inflation Rate (TradingEconomics)

Soaring energy prices are causing considerable stress across the European consumer sector but as importantly, they are starting to cause considerable negative impacts on industry as well. Recently, Norsk Hydro said it planned to shutter an aluminum smelter in Slovakia at the end of next month according to Bloomberg. The news came one day after zinc prices jumped after one of Europe’s largest zinc smelters said it too would halt production next month as the continent’s energy crisis threatens to hobble heavy industries.

These challenges in Europe is a key reason the IMF just took down their projections for global growth yet again. This world body now expects the world economy to grow 3.2% in 2022 before slowing to a 2.9% GDP rate in 2023 – marking a downgrade of 0.4 and 0.7 percentage points, respectively, from April.

I could spend the next few pages posting negative economic headlines from Europe, but I think everyone gets the picture. So what are the ramifications for the U.S. economy and markets as that continent plunges into recession? I see several obvious impacts.

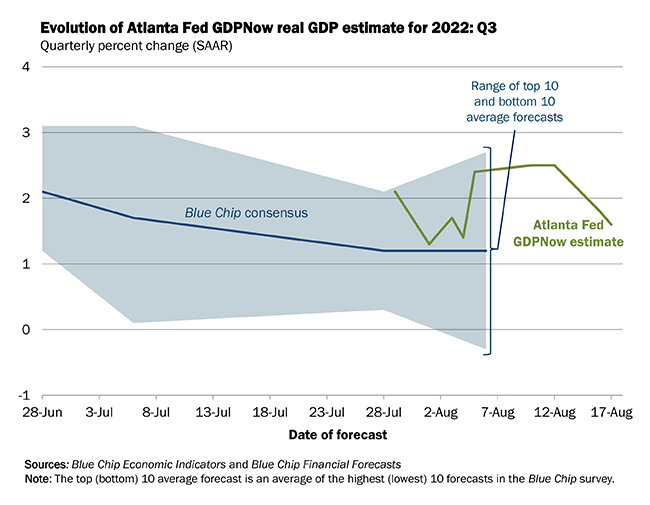

Despite the huge amount of monetary creation by the Federal Reserve since the pandemic and the massive amount of government largess, the dollar will continue be much stronger than it normally would given these circumstances. Put simply, the country is best house is fast deteriorating neighborhood. Europe is heading toward recession. Japan did grow at 2.2% in the second quarter after no growth in the first quarter. However, that was lower than expected 2.5% GDP growth and mostly a result of the country finally lifting some remaining Covid-19 restrictions. The Atlanta Fed’s GDPNow is currently predicting 1.6% third quarter GDP Growth in the U.S. Not anything to write home about historically, but levels Europe will envy in coming quarters.

Atlanta Fed’s GDPNow

However, given fast-slowing growth in Europe and a strong dollar, American multinationals getting a significant amount of their overall sales from Europe are going to face significant headwinds to profit margins in the coming quarters. Obvious names like Caterpillar (CAT) and McDonald’s (MCD) come to mind. However, smaller names have considerable exposure to Europe as well. According to a recent article, The Estée Lauder Companies Inc. (EL), The Cooper Companies, Inc. (COO), DXC Technology Company (DXC), International Flavors & Fragrances Inc. (IFF), and Autodesk, Inc. (ADSK) all get approximately 40% of their overall revenues from Europe.

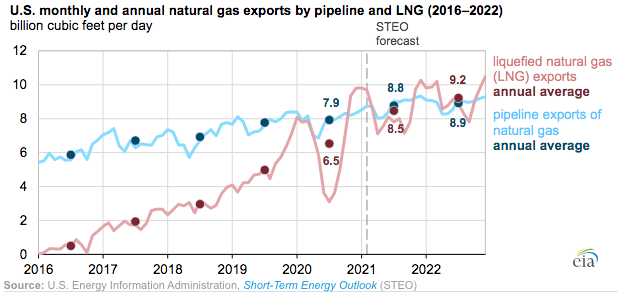

Finally, Europe’s problems will impact U.S. exports to the continent. Aerospace products and parts were our largest exported good to Europe in 2020 at just over $35 billion and Texas exported more goods to Europe ($37.9 billion in 2020), than any other state. Fortunately for the Lone Star State, a large chunk of that was for mineral fuels like LNG which will remain in high demand given the cutoff of most Russian energy supplies to Europe. Overall U.S. LNG imports to the EU and United Kingdom increased by 63 percent during the first half of 2022 on a year-over-year basis to an average of 14.8 Bcf/d. The United States has already sent more gas to Europe during the first six months of 2022 than it did in all 12 months of 2021.

U.S. EIA

Obviously, this is good news for large LNG exporters like Cheniere Energy Inc. (LNG), which was already benefiting from the growth in LNG exports over the past half decade before the conflict in Ukraine. However, Europe looks heading for a long, dark and cold winter and this contraction is likely to cast a chill on some parts of the U.S. economy. The eroding economic picture in Europe is just one more worry for U.S. investors to keep track of, unfortunately.

A breath of laughter will blow a Government out of existence in Paris much more effectually than a whiff of cannon-smoke“― Robert Barr

Be the first to comment