Justin Sullivan

Broadcom (NASDAQ:AVGO) is one of our favorite large-cap names in our coverage universe. Broadcom is exposed to both software and hardware sectors and continues to build out its software franchises. We previously recommended readers buy shares. But things have changed since then. In the near term, we believe AVGO will face demand headwinds in the coming quarters. Both data center and enterprise businesses will likely face demand headwinds in coming quarters. Weakening consumer spending has brought down PC and smartphone demand, and we believe data centers, cloud, and enterprises are next. While we are still bullish in the longer term on AVGO, we believe it is better to remain on the sidelines and wait for a more favorable entry point for the stock.

Weak consumer spending is spilling into data center & enterprise businesses

AVGO is heavily exposed to the data center and enterprise markets. AVGO is a global technology company that designs, develops, and supplies a wide range of semiconductor and software solutions. The company operates primarily in the semiconductor industry. We expect AVGO stock to be under pressure in the near term as its data center and enterprise businesses will likely face demand headwinds in the coming quarters due to weakening consumer spending.

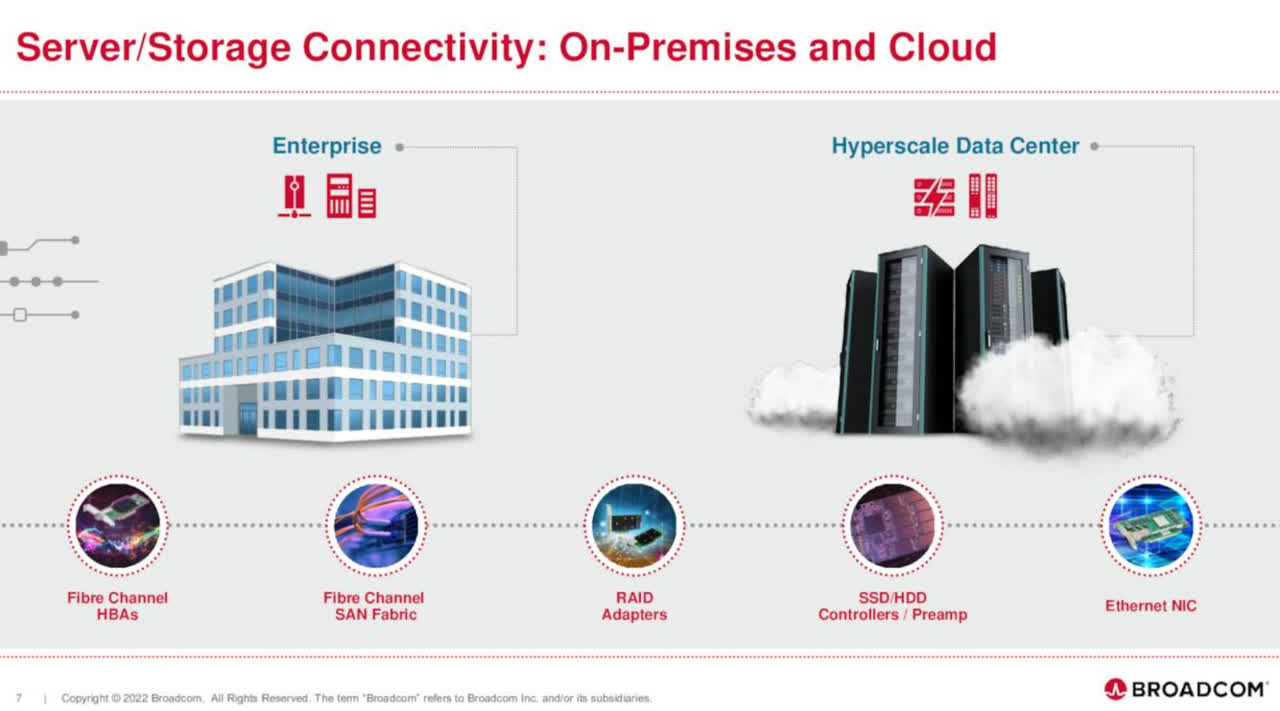

We believe weaker demand for consumer electronics, namely PC and smartphones, will likely weaken demand for data center storage products. Enterprises store large amounts of data both on-prem and in the cloud. We also believe weakened consumer spending will spill into enterprise networking demand.

The following graph from AVGO’s investor presentation outlines the company’s two primary business segments: data center and enterprise.

Broadcom

We expect demand in these sectors to decline somewhat, similar to how PC and smartphone demand declined over the past few quarters. While we don’t believe AVGO will experience a downside similar to Nvidia (NVDA), Micron (MU), Intel (INTC), Western Digital Corp. (WDC), and Seagate (STX), we think AVGO will likely see a material demand softening in its semiconductor business.

AVGO’s enterprise and data center businesses operate with storage sectors or, in other words, Hard Disk Drives (HDDs) and Solid State Drives (SSDs). STX and WDC earnings have reported declines in demand for HDDs and SSDs. We think these declines are the first warning signs of further weakness in the storage sector and, by extension, data centers and enterprises. Aside from the weak consumer demand, we also believe supply chain issues impact AVGO. We believe many of AVGO’s customers are doubled-ordered ahead of actual demand because they are afraid of supply shortages. This double ordering inflated revenue and EPS. We believe the company has supply chain issues and weak demand headwinds to deal with and recommend investors wait for a better entry point.

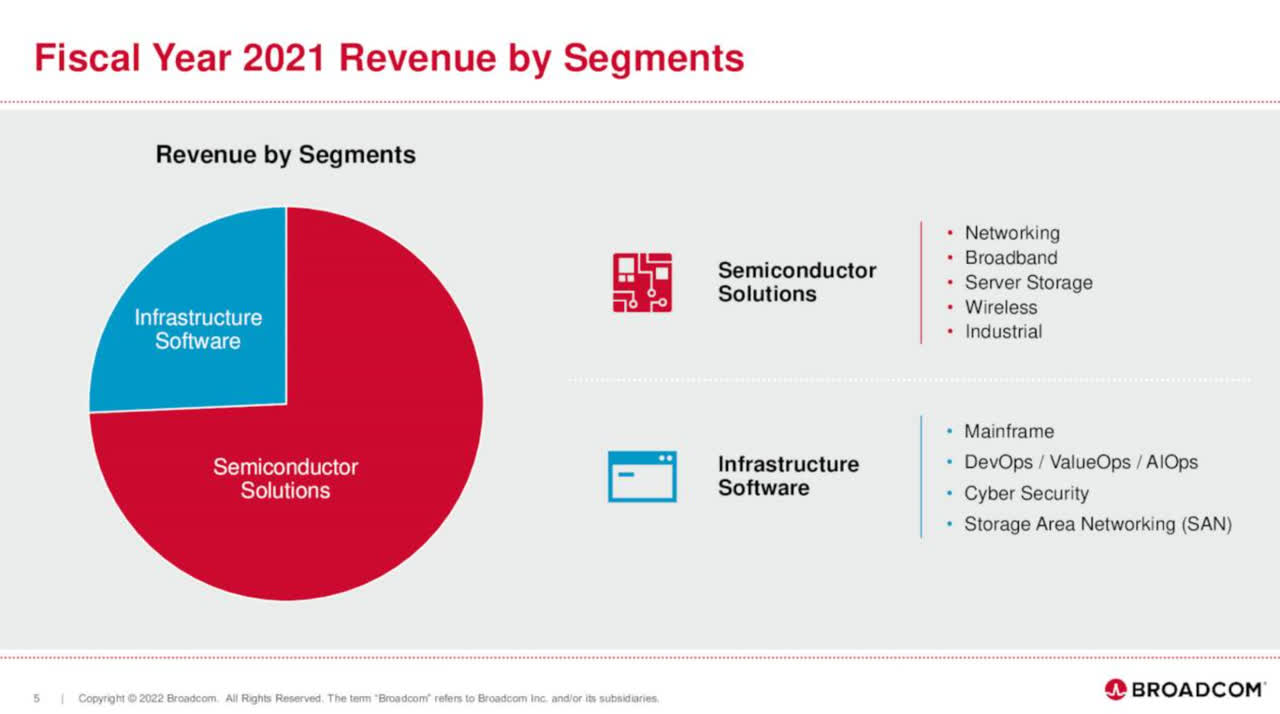

The software segment is holding the roof

AVGO’s software business is the company’s safety net when semiconductor headwinds hit. We believe the stock will hold up better than other pure semiconductor players since the software business will provide the company with some revenue/earnings stability in the near term. We expect its software business to remain stable, partially offsetting the weaker demand in the data center and enterprise networking markets. Yet, we do not believe the stock will work in the short term and advise investors to be patient until semiconductor headwinds ease.

The following graph from the investor presentation outlines AVGO’s software and semiconductor segments.

Broadcom

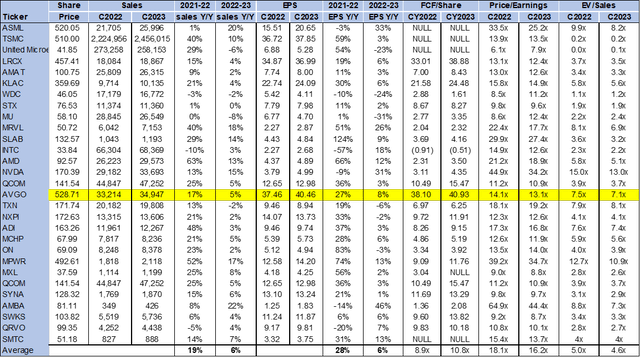

Valuation

AVGO is trading at around $529. The stock is relatively cheap compared to the peer group. On a P/E basis, AVGO is trading at about 13.1x C2023 EPS of $40.46 compared to the group average of 16.2x. However, on an EV/Sales basis, the stock is more expensive than the peer group. The stock is trading at 7.1x C2023 on an EV/Sales basis compared to an average of 4.6x. The following chart illustrates the semiconductor peer group valuation.

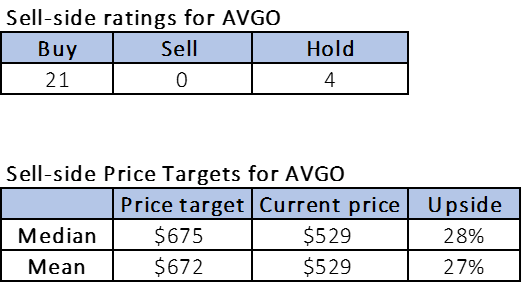

Word on Wall Street

Wall Street is overwhelmingly buy-rated on AVGO. Of the 25 analysts, 21 are buy-rated, and the remaining are hold-rated. The stock is currently trading at around $529. The sell-side median price target is $675, while the mean is $672, leaving room for a 27-28% possible upside. The following chart indicates AVGO sell-side ratings and price targets:

Refinitiv & Techstockpros

What to do with the stock

We believe AVGO does not offer a favorable risk-reward profile in the near term. We expect demand headwinds to spill over into AVGO’s cloud and enterprise businesses. We are still optimistic about AVGO because its software business stabilizes the company during semiconductor headwinds. We also believe orders will begin to normalize as supply catches up to demand and feel demand will also likely soften into 2023. Nevertheless, we do not believe the stock will grow meaningfully in the near term and recommend investors wait out the near-term volatility.

Be the first to comment