EURO, EUR/USD PRICE CHART, ECB RATE DECISION, CHRISTINE LAGARDE – Talking Points

- Euro may fall if European Eentral Bank slashes interest rates, hints at other expansionary policies

- European politics at a critical juncture: how to reconcile fiscal prudence with emergency stimulus?

- Trump coronavirus speech failed to calm market anxiety as equity selloff deepened in Asia-Pacific

ASIA-PACIFIC RECAP: CORONAVIRUS SPREADS, EQUITIES PAY THE PRICE

The Japanese Yen surged against its G10 counterparts but with particular vigor against the petroleum-linked Norwegian Krone after the dark session in Wall Street infected Asian stock markets. The selloff deepened after US President gave announced measures to counter the effect of the coronavirus. However, subsequent price action suggests markets did not find his words to be a source of reassurance – but rather one of panic.

CAD/CHF, NOK/JPY, Crude Oil Prices, S&P 500 Futures – Daily Chart

S&P 500 futures chart created using TradingView

ECB RATE DECISION, LAGARDE OUTLOOK: WHAT TO EXPECT

Overnight index swaps show markets are fully baking in a 10-basis point rate cut from the ECB after the Fed and Bank of England both unexpectedly slashed borrowing costs by 50 bps over the past two weeks. Analysts are also expecting for the European Central Bank to introduce other targeted measures in addition to traditional easing measures.

On Wednesday, central bank president Christine Lagarde warned that Europe is at risk of a 2008-style crisis as the spread on credit default swaps for ensuring corporate debt widen to their highest points since the Eurozone crisis. In the spirit of Mario Draghi, German Chancellor Angela Merkel also said Germany will do “whatever is necessary” to counter the economic impact of the coronavirus.

However, it appears the Chancellor’s reassurance failed to quell market anxiety. Considering the circumstances Europe finds itself in now and the available set of tools at its disposal relative to before, officials have limited room to implement effective countervailing measures. With rates already in negative territory and a growing balance sheet, investors are questioning how effective additional rate cuts can be.

Starts in:

Live now:

Mar 16

( 03:03 GMT )

Recommended by Dimitri Zabelin

Geopolitical Risks Affecting Markets in the Week Ahead

On the fiscal side, policymakers will have to reconcile the circumstantial urgency to introduce stimulatory measures with compliance to strict budgetary guidelines outlined the Growth and Stability Pact. Reformed after the sovereign debt crisis, the rules of the framework aim to preserve financial stability and to prevent member states from spending beyond their means and putting the state’s ability to repay its debt in question.

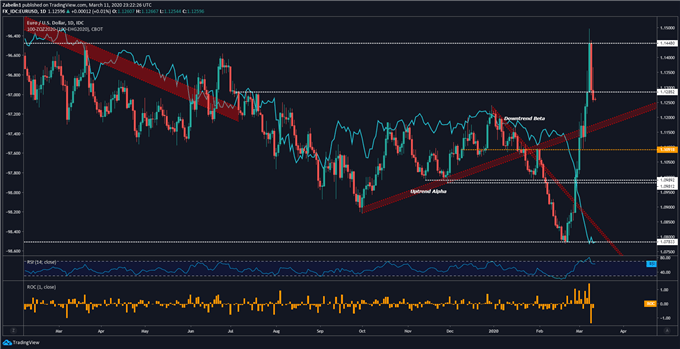

EUR/USD PRICE CHART

EUR/USD’s impressive rally from the multi-year low may be coming to an end after it failed to clear 12-month resistance at 1.1448. The pair may now test oscillating support/resistance – labelled as “Uptrend Alpha” along its descent which may be accelerated by the ECB rate decision. The next major floor to monitor will be support at 1.1091 which may act as the last stronghold before EUR/USD’s downtrend resumes.

EUR/USD, Federal Funds Futures Contract (December-March) – Daily Chart

EUR/USD chart created using TradingView

EURO TRADING RESOURCES

— Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitrion Twitter

Be the first to comment