Euro (EUR/USD)Price, Chart, and Analysis

- EUR/USD trend lower continues.

- European Central Bank removes ambiguity on their inflation target.

The recent ECB Strategy Review cuts the ambiguity over the central bank’s inflation target, according to ECB President Christine Lagarde with the old ‘below, but close to, 2 per cent’ being replaced by a ‘simple, solid, symmetric two per cent target’. According to President Lagarde in an interview with The Financial Times, posted on the ECB website,

‘the new strategy gives us the ability to be flexible around two per cent, because we recognise that two per cent is not a ceiling and we recognise that there will be oscillation around two per cent. It is more flexible in that we recognise the effect of the effective lower bound and the constraints that it imposes on us. And we define very clearly with the especially forceful or persistent response and the strong response that we are prepared to give. And we also accept that it may imply on a transitory basis, moderate deviations above the target. So in that sense, it is more flexible’.

The latest review suggests that the central bank will be more forceful in dealing with inflation when it is below 2%, while short-term overshoots above 2% will be tolerated, implying that any tightening of monetary policy has been pushed further down the line.

On the other side of the pair, upcoming US inflation data may well prove the catalyst for the US dollar to resume its recent rally. Today’s release is expected to show core y/y inflation (ex-food and energy) rise to 4% – its highest level in nearly three decades – compared to 3.8% in May. Any miss today, or a weaker-than-expected retail sales release on Friday, may give the pair some respite in the short-term before the fade lower continues.

US Core Consumer Prices

For all market-moving economic data and events, see the DailyFX Calendar.

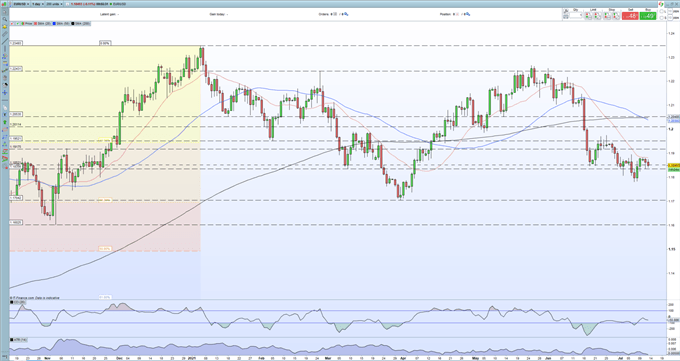

EUR/USD currently trades just below 1.1850 and may look to make a run at the last Wednesday’s 1.1780 low. A break below here would leave the late March low at 1.1704 vulnerable before the 38.2% Fibonacci retracement level at 1.1695 comes into play. The short-term upside is currently capped at around 1.1880/85.

EUR/USD Daily Price Chart (June 2020 – July 13, 2021)

Retail trader data show 53.07% of traders are net-long with the ratio of traders long to short at 1.13 to 1.The number of traders net-long is 10.56% higher than yesterday and 9.95% lower from last week, while the number of traders net-short is 0.05% higher than yesterday and 7.11% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall.Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/USD trading bias.

What is your view on EUR/USD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Be the first to comment