EUR/USD Rate Talking Points

EUR/USD extends the series of lower highs and lows from the previous week as European Central Bank (ECB) officials defend the dovish forward guidance for monetary policy, and the exchange rate appears to be on track to test the yearly low (1.1664) following failed attempt to clear the July high (1.1909).

EUR/USD Eyes 2021 Low Ahead of Fed Meeting as ECB Defends Dovish Guidance

EUR/USD is on pace to mark a three day losing streak for the second time this month as the ECB tames speculation for a shift in monetary policy, with Governing Council Isabel Schnabel pledging to “act more patiently” as the central bank struggles to achieve its one and only mandate for price stability.

In a recent speech, Schnabel insists that the ECB needs “to see clearer signs that inflation is reliably moving towards our 2% target” before the central bank switches gears as “inflation is still expected to be below our 2% target in the medium term.” As a result, Schnabel argues that the non-standard tools “will remain crucial in the time to come, paving the way out of the pandemic and towards reaching our inflation target,” and the comments suggest the ECB is in no rush to normalize monetary policy “given the remaining uncertainty regarding the pandemic and the economic and inflation outlook.”

In turn, EUR/USD may remain under pressure ahead of the Federal Reserve interest rate decision on September 22 as Chairman Jerome Powell and Co. appear to be on track to deliver an exit strategy, but a further decline in the exchange rate may fuel the recent flip in retail sentiment like the behavior seen earlier this year.

The IG Client Sentiment report shows 61.27% of traders are currently net-long EUR/USD, with the ratio of traders long to short standing at 1.58 to 1.

The number of traders net-long is 6.63% higher than yesterday and 21.45% higher from last week, while the number of traders net-short is 12.85% higher than yesterday and 24.98% lower from last week. The rise in net-long interest has fueled the flip in retail sentiment as 50.70% of traders were net-long EUR/USD last week, while the decline in net-short position could be a function of profit-taking behavior as the exchange rate extends the series of lower highs and lows from last week.

With that said, the rebound from the August low (1.1664) may turn out to be a correction in the broader trend as the exchange rate trades to fresh yearly lows in the second half of 2021, and the Federal Open Market Committee (FOMC) rate decision may the exchange rate under pressure if the central bank starts to taper its purchases of Treasury securities and mortgage backed securities (MBS).

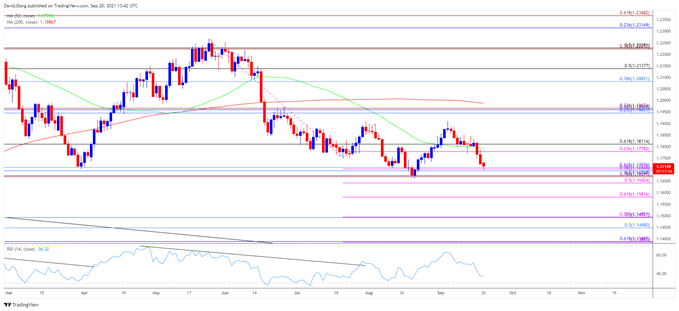

EUR/USD Rate Daily Chart

Source: Trading View

- Keep in mind, EUR/USD sits below the 200-Day SMA (1.1987) for the first time since April as the advance from the March low (1.1704) failed to produce a test of the January high (1.2350), with the exchange rate trading to a fresh yearly low (1.1664) in August as the 50-Day SMA (1.1791) established a negative slope.

- As a result, the advance from the August low (1.1664) may continue to unravel following the failed attempt to clear the July high (1.1909), but need a break/close below the Fibonacci overlap around 1.1670 (78.6% expansion) to 1.1710 (61.8% retracement) to open up the 1.1670 (78.6% expansion) to 1.1680 (50% retracement) region.

- A break of the August low (1.1664) brings the 1.1640 (50% expansion) region on the radar, with the next area of interest coming around 1.1580 (61.8% expansion).

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

Be the first to comment