Euro Outlook:

Euro Not Struggling Everywhere

Much of the talk around the Euro these days is negative because of the USD-centric bias among market participants. As attention focuses on the gains in the DXY Index, EUR/USD rates have come under scrutiny as it appears a significant technical breakdown may be gathering pace. But the narrative of a weak Euro starts and ends with EUR/USD; both EUR/GBP and EUR/JPY rates appear to have more immediate upside potential given technical studies right now.

EUR/USD RATE TECHNICAL ANALYSIS: DAILY CHART (March 2020 to July 2021) (CHART 1)

As the largest component of the DXY Index, technical weakness in EUR/USD rates reinforces the view that the DXY Index may have more upside left in the tank. EUR/USD rates continue to struggle below the 23.6% Fibonacci retracement of the 2020 low/2021 high range (1.2033) as momentum turns more bearish.The pair is extending its drop below its daily 5-, 8-, 13-, and 21-EMA envelope, which remains in in bearish sequential order. Daily MACD is falling in bearish territory while daily Slow Stochastics are holding in oversold territory. Having broken the June low, it’s possible that a deeper setback towards the March low at 1.1704 may be around the corner.

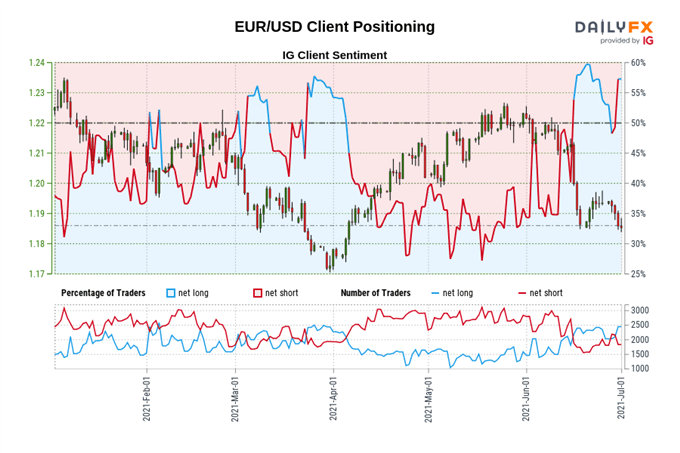

IG Client Sentiment Index: EUR/USD Rate Forecast (July 1, 2021) (Chart 2)

EUR/USD: Retail trader data shows 53.62% of traders are net-long with the ratio of traders long to short at 1.16 to 1. The number of traders net-long is 5.01% higher than yesterday and 6.90% lower from last week, while the number of traders net-short is 3.38% lower than yesterday and 0.84% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall.

Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/USD trading bias.

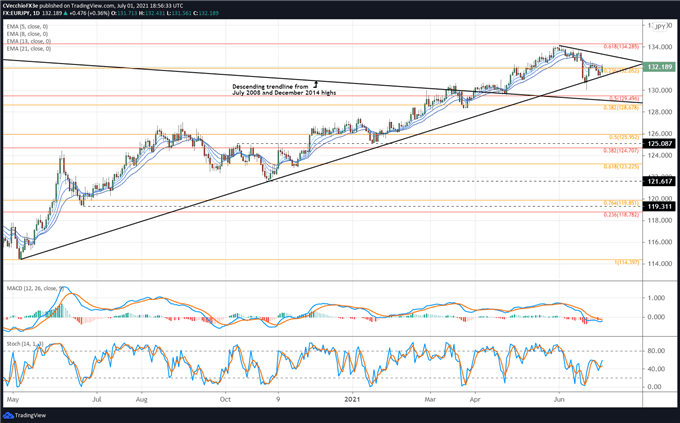

EUR/JPY RATE TECHNICAL ANALYSIS: DAILY CHART (April 2020 to July 2021) (CHART 3)

EUR/JPY rates hit their yearly high at the start of June but have since been trading to slightly lower lows; in context of the uptrend from the May 2020, November 2020, and June 2021 swing lows, it would appear that the pair is consolidating into a symmetrical triangle. The early stages of a bullish turn are emerging. EUR/JPY rates are above their daily EMA envelope, which is in bearish sequential order otherwise. Daily MACD is starting to change course (albeit below its signal line still), and daily Slow Stochastics are turning higher while above their median line. It soon may be the case that the pair makes another attempt at the 61.8% Fibonacci retracement of the 2014 high/2015 low range at 134.29; the technical structure remains bullish.

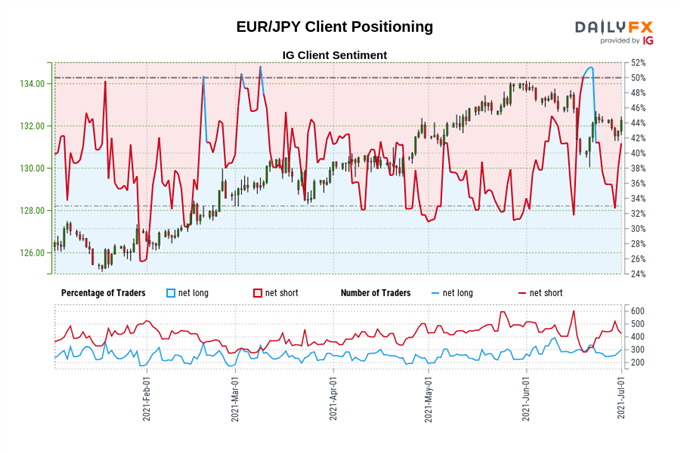

IG Client Sentiment Index: EUR/JPY Rate Forecast (July 1, 2021) (Chart 4)

EUR/JPY: Retail trader data shows 40.69% of traders are net-long with the ratio of traders short to long at 1.46 to 1. The number of traders net-long is 2.42% lower than yesterday and 1.08% higher from last week, while the number of traders net-short is 11.04% lower than yesterday and 8.05% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/JPY prices may continue to rise.

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/JPY price trend may soon reverse lower despite the fact traders remain net-short.

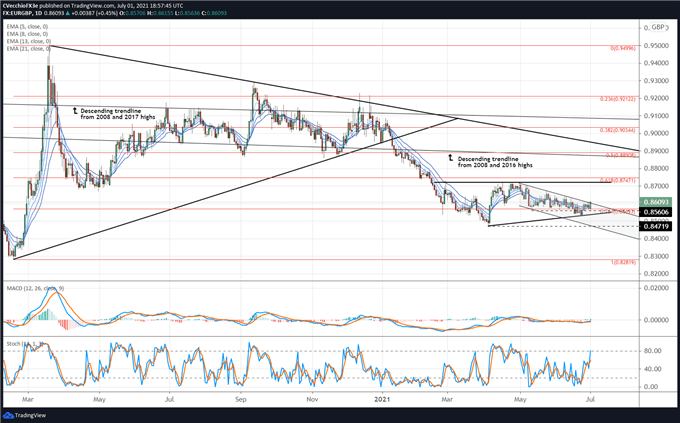

EUR/GBP RATE TECHNICAL ANALYSIS: DAILY CHART (February 2020 to July 2021) (CHART 5)

It’s been previously noted that “EUR/GBP rates have carved out a clearly defined descending channel since the start of May. But the past two weeks, there has been a noticeable lack of follow through lower, insofar as the area between the May low at 0.8561 and the 76.4% Fibonacci retracement of the 2020 low/high range at 0.8569 has served as support. Losing this area (0.8561/69) would suggest that the next leg lower is imminent.” The pair never found much acceleration below this support region, and now it appears a turn higher is transpiring.

EUR/GBP rates have turned higher through the descending channel resistance from the May and June swing highs. The pair is above its daily EMA envelope, which is quickly shifting into bullish sequential order. Daily MACD is turning higher nearing a move above its signal line, while daily Slow Stochastics are close to achieving overbought territory. Ultimately, a move back towards 0.8700 may develop over the coming weeks.

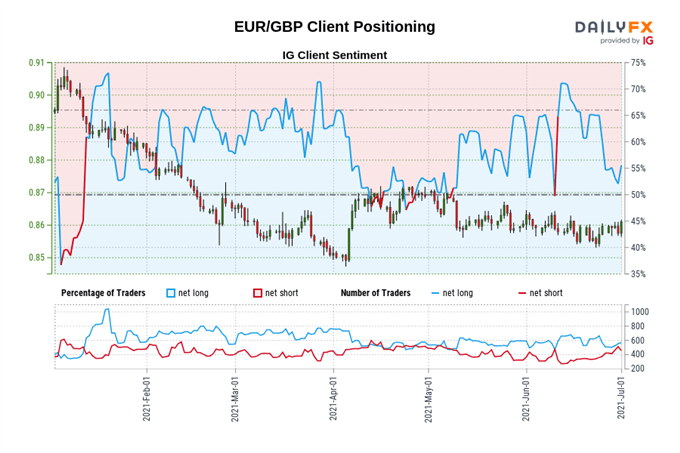

IG Client Sentiment Index: EUR/GBP Rate Forecast (July 1, 2021) (Chart 6)

EUR/GBP: Retail trader data shows 53.97% of traders are net-long with the ratio of traders long to short at 1.17 to 1. The number of traders net-long is 4.96% lower than yesterday and 6.12% lower from last week, while the number of traders net-short is 1.78% higher than yesterday and 14.50% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/GBP prices may continue to fall.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/GBP price trend may soon reverse higher despite the fact traders remain net-long.

— Written by Christopher Vecchio, CFA, Senior Currency Strategist

Be the first to comment