GBP and FTSE prices and analysis:

- The British Pound could drop further amid weakness against both USD and EUR.

- The FTSE 100 index and UK Government bond prices are continuing to fall too, suggesting a flight from Sterling assets generally.

GBP/USD and FTSE weak, EUR/GBP climbing

The British Pound, the FTSE 100 and UK Government bond (Gilt) prices continue to fall, suggesting further losses are on the way for Sterling assets generally. In particular, GBP’s weakness against the Euro implies that as traders move into cash amid fears about the coronavirus, Sterling will likely underperform even other assets seen as risky.

As the chart below shows, EUR/GBP is now in an uptrend that as yet shows no sign of faltering.

EUR/GBP Price Chart, Four-Hour Timeframe (February 19 – March 17, 2020)

Chart by IG (You can click on it for a larger image)

Starts in:

Live now:

Mar 17

( 11:03 GMT )

Recommended by Martin Essex, MSTA

Trading Sentiment

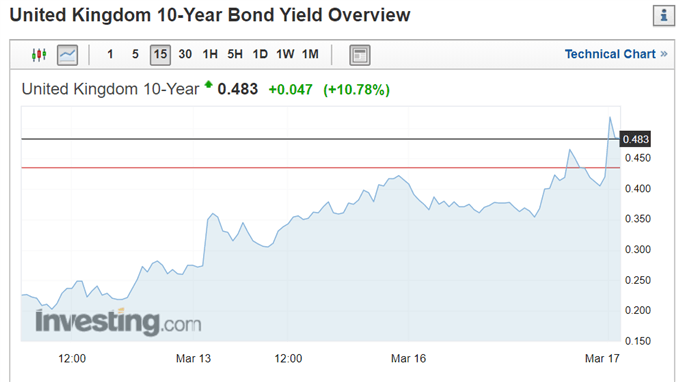

Even though USD is now stabilizing after its recent advance, GBP/USD continues to fall further while the FTSE 100 index of the leading London-listed stocks is down again too and the yield on the benchmark 10-year UK Government bond yield continues to rise.

Source: Investing.com

| Change in | Longs | Shorts | OI |

| Daily | 7% | 7% | 7% |

| Weekly | -21% | 16% | 2% |

Much, though, will depend on whether governments ease fiscal policy in response to the Covid-19 outbreak. A meeting of G7 finance ministers is due to take place Tuesday.

A Brief History of Major Financial Bubbles, Crises, and Flash-crashes

We look at Sterling regularly in the DailyFX Trading Global Markets Decoded podcasts that you can find here on Apple or wherever you go for your podcasts

— Written by Martin Essex, Analyst and Editor

Feel free to contact me via the comments section below

Be the first to comment