bymuratdeniz/E+ via Getty Images

Thesis

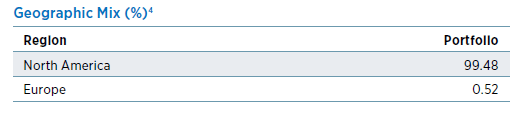

The Eaton Vance Tax-Managed Diversified Equity Income Fund (NYSE:ETY) is an equity focused closed end fund. As described in its fact sheet “The Fund’s primary investment objective is to provide current income and gains, with a secondary objective of capital appreciation”. This means that a retail investor should expect a high dividend yield from this fund (which currently stands at 8.04%) rather than a substantially accreting NAV. The fund is fairly focused with only 59 stocks in the portfolio. Although it has a global mandate the fund is concentrated on North America, with over 99% of the portfolio being composed of U.S. companies. The fund has a written call option strategy overlay as well, which currently represents 48% of the portfolio.

The vehicle is a great performer, with the 5- and 10-year trailing total returns sitting at 14.1% and 13.7% respectively. ETY achieved these results with a 0.82 Sharpe and 13.4 standard deviation as measured on a 5-year basis. The vehicle has a well protected downside as well, with a maximum drawdown of -24.5% achieved during the Covid downturn. The risk/reward analytics are solid for this fund and its written call option strategy allows it to monetize instances of high volatility (usually associated with market sell-offs) thus being able to dampen the downward move.

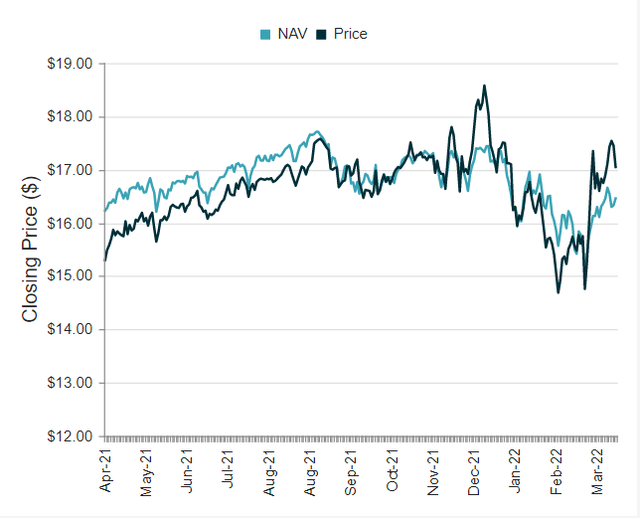

ETY has managed to successfully transform index returns into dividends over the long term, with its 5- and 10-year total returns closely matching what an investor would have obtained by just being long the S&P 500 (SPY) outright. The fund is currently slightly expensive, trading at a small premium to NAV of 3.59%, while historically it has been flat to slightly discounted to its net asset value. We like this fund and its profile, hence for a current investor already long the name we are a Hold, while new money entering the space would do well to wait for a discount to NAV.

Holdings

The fund has a global mandate but is currently overweight U.S. names:

Geographic Mix (Fund Fact Sheet)

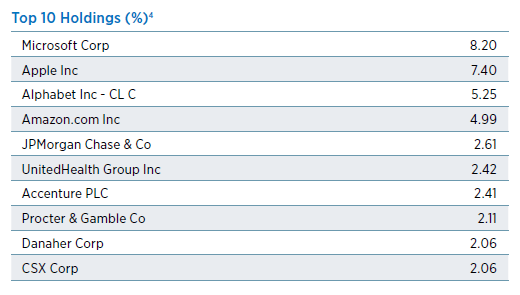

Its top holdings contain well known technology and financial services names:

Top 10 Holdings (Fund Fact Sheet)

Given the weighting in the top 10 names which is close to 40% of the portfolio we consider this fund fairly concentrated. This is compounded by the fact that the overall portfolio has only 59 holdings.

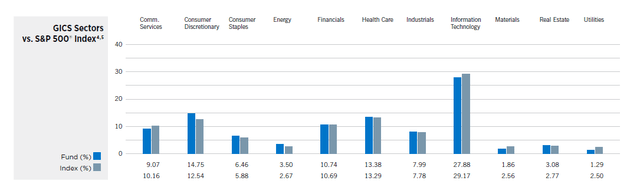

The sector breakdown closely mirrors the S&P 500 composition:

We like this type of straightforward composition. We have seen many CEFs with very granular portfolios where the managers basically try to mirror the number of names in the S&P 500, but the funds usually lack alpha-generating capabilities and post total returns which substantially trail the index. While from an individual names perspective ETY might be considered concentrated, the fund holdings are all very liquid large caps with active option chains across maturity tenors. The fund has proven its ability to perform and its sectoral breakdown closely matches what we see in the index as well.

Performance

On a 5-year basis ETY does a good job of matching the index total returns:

5-Year Total Returns (Seeking Alpha)

We can see that the 5-year total returns for ETY are approximately 89% while the index has posted approximately 110%. This is a fairly close match that was much narrower up to the 2020 Covid market sell-off.

A 10-year total trailing returns picture paints a very similar story:

10-Year Total Returns (Seeking Alpha)

Ultimately this is the type of graph we should expect from a good buy-and hold CEF that does its job of transforming equity capital gains into dividend yields.

Premium/Discount to NAV

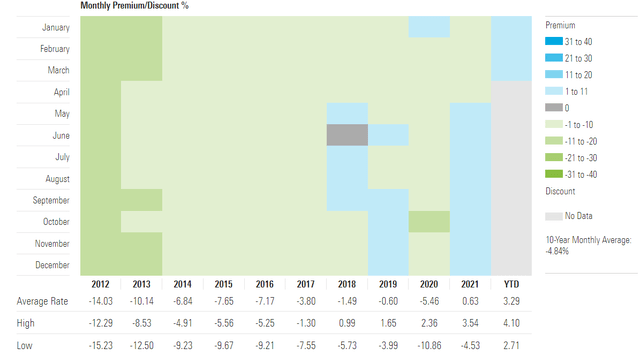

The fund has historically traded at a discount to NAV:

Premium/Discount to NAV (Morningstar)

We can see that outside brief periods in 2018, 2019 and 2021 the fund has traded at a discount to NAV which has kept a -4% to -10% range. Just like other CEFs that saw a massive surge in interest on the back of a zero rates environment, ETY saw a substantial premium to NAV in 2021. Surprisingly the fund has kept the premium to NAV in 2022 as well. Our assumption is that the high VIX levels which we have seen this year have kept investor interest in short vol equity strategies, thus keeping the premium in the fund elevated.

The premium/discount levels have nevertheless been fairly volatile as seen in the last 12 months:

Premium/Discount to NAV (CefConnect)

Distributions

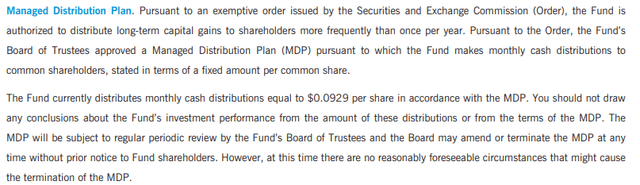

The fund has had a fairly stable distribution history, and is currently under a managed distribution plan:

Managed Distribution Plan (Annual Report)

Basically the fund will keep monthly distributions of $0.0929 per share as long as the market does not experience a severe and protracted downturn. We can see from the historic NAV of the vehicle that the management team does not over-distribute (stable NAV over time) hence only a deep and protracted recession would result in a shrinkage of the distribution level.

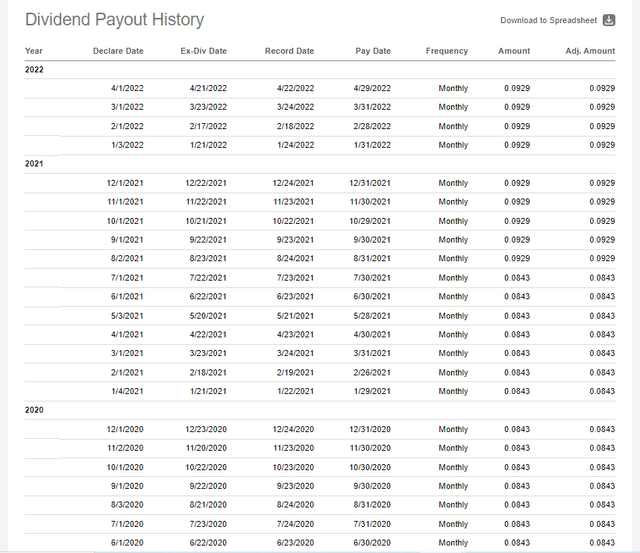

We can see the payout history has been consistent throughout time:

Payout History (Seeking Alpha)

Conclusion

ETY is a CEF focused on equities. The vehicle closely trails the index total returns on both a 5- and 10-year basis and does it with a high Sharpe ratio and index comparable standard deviation. The fund has an 8.04% yield and has proven through its stable NAV its ability to correctly transform equity capital gains into dividend yields. The fund is currently slightly expensive, trading at a small premium to NAV of 3.59%, while historically it has been flat to slightly discounted to its net asset value. We like this fund and its profile, hence for a current investor already long the name we are a Hold, while new money entering the space would do well to wait for a discount to NAV.

Be the first to comment