PeopleImages

It is not exactly a secret that inflation in the United States is currently running at a higher level than most of us have ever seen. This has forced many people to take on second jobs or look for other sources of income in order to obtain the money that they need to obtain rapidly escalating food and energy costs. Fortunately, as investors, we have other options available to us. There are numerous assets that trade in the market intended to generate income for investors. Some of the best of these are closed-end funds that focus specifically on earning income because these assets provide investors with easy access to a diversified portfolio of assets that enjoys both professional management and the ability to use certain strategies that have the effect of boosting yields far beyond what the underlying assets actually pay. In this article, we will discuss the Eaton Vance Tax-Managed Buy-Write Opportunities Fund (NYSE:ETV), which uses an options strategy to provide investors with a 9.81% yield at the current price. I have discussed this fund before but many months have passed since then so obviously a great deal has changed. This article will specifically focus on these changes and provide an update on the fund’s financial performance. We will also revisit its valuation and see if it makes sense in today’s very different market conditions.

About The Fund

According to the fund’s website, the Eaton Vance Tax-Managed Buy-Write Opportunities Fund has the stated objective of providing investors with a high level of current income and gains. The fund specifically states that long-term capital gains are secondary to the provision of income. This is not exactly unusual for an option-income fund. Indeed, most of them have a very similar objective. It is the general strategy that this fund uses that makes it different from most other funds. Basically, the fund invests its assets in a diversified portfolio of assets and then writes call options against one or more U.S. indices in order to profit from the option premium. The fund is basically betting that the options will expire instead of being exercised, which allows it to keep the money that was paid in premium. It can then write another call option in order to get another call premium, which it hopefully can also keep. This option writing can generate a great deal of income during more volatile markets but it also works during flat markets because in flat markets it is more likely that the option will simply expire unexercised.

It is important to note that the fund is not using a covered call strategy, which is generally considered to be the safest options strategy. A covered call strategy is where the investor is writing call options against a stock or other asset that they already own. If the option does get exercised, the investor simply delivers the assets that they already own. This fund is not exactly doing that, though. It is writing options against an index, which is probably the S&P 500 (SPY) in most cases. However, it does not actually own the S&P 500 index. Its underlying portfolio will likely perform similarly to the index but the fund still potentially could suffer unlimited losses if the S&P 500 were to skyrocket in price for some reason. This is therefore a very different strategy than the Eaton Vance Enhanced Equity Income Fund (EOI) uses as the latter fund is actually writing covered calls. Investors should keep this difference in mind since it does give this fund a very different risk profile than some of the company’s other funds.

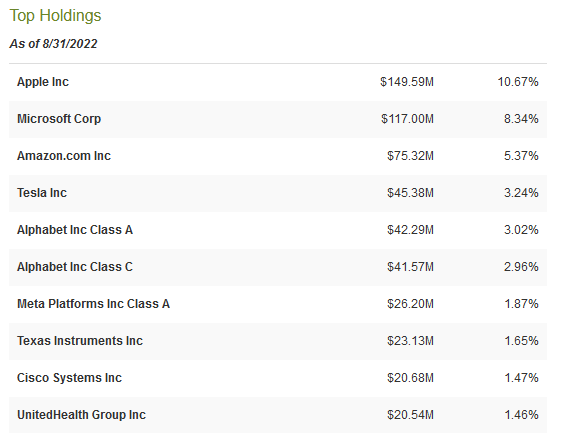

The fund’s portfolio is very different than we would expect from an income-focused fund. Here it is:

CEF Connect

The interesting thing here is that we see several of the major technology companies dominating the fund’s holdings. This is curious because most of them do not pay a dividend. Apple (AAPL) and Microsoft (MSFT) both do have a dividend, however, the yield of both is so low that it is essentially negligible. We also see that only two of the companies, Tesla (TSLA) and UnitedHealth Group (UNH), are not large technology stocks (and I know some people will argue with me about Tesla). This hardly meets my definition of a “diversified portfolio,” as we do not see any companies from several of the other major industries in the United States such as energy or finance.

With that said, there is a bit more diversification than what the fund had the last time that we looked at it. One notable change is that the fund’s exposure to Apple has been cut nearly in half. We also see that Netflix (NFLX) has been completely removed from the list in favor of UnitedHealth Group. We also see that Qualcomm (QCOM) and Comcast (CMCSA) were replaced with Tesla and Cisco Systems (CSCO). Admittedly, I am not a big fan of these changes as most of the technology sector is still substantially overvalued but it is nice to see that the weightings among most of the major positions have been reduced by quite a bit.

The fact that there have been few changes in the fund’s major positions over the past eighteen months could lead one to think that the Eaton Vance Tax-Managed Buy-Write Opportunities Fund does not have a particularly high turnover rate. This is indeed the case as the fund’s annual turnover is only 9.00%, which is the lowest of any closed-end fund that I have ever seen. Generally, we prefer a low turnover to a high one because it costs money to trade stocks or other assets, which are billed to the investors. This is one of the reasons why index funds have become so popular over the years as they almost never do any trading and their expenses tend to be very low. This does not necessarily mean that a fund that does a lot of trading will underperform, of course. However, it does create a hurdle that management needs to jump over in order to deliver the returns that investors have come to expect.

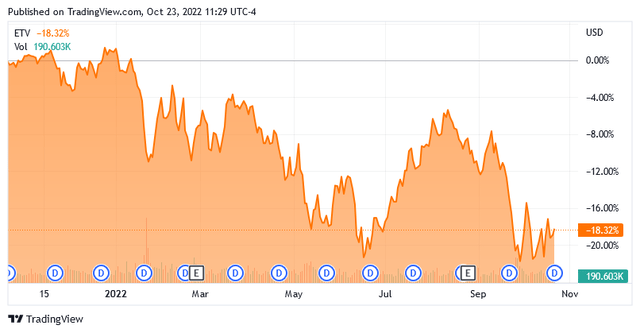

Unfortunately, the Eaton Vance Tax-Managed Buy-Write Opportunities Fund has not delivered particularly good performance over the past year. As of the time of writing, the fund is down 18.32% over the trailing twelve-month period:

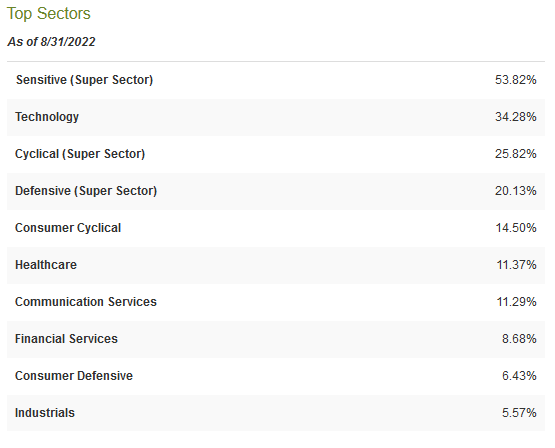

This is a bit worse than the 17.48% loss that the S&P 500 index suffered over the same period, although the fund did actually beat the index by quite a bit when we consider the distributions that it paid out over the same period. This may be due to its oversized exposure to the technology sector, which has performed much worse than a few other sectors in the economy. In fact, the fund has absolutely no exposure to the energy sector, which has been the best-performing over the period:

CEF Connect

The technology sector only accounts for 23.67% of the S&P 500 index so we can clearly see that this fund is overexposed to the sector. This is a problem because of the fact that it is writing options on the index, not on the individual companies that it is invested in. Thus, we cannot expect the portfolio to perform similarly to the options, and thus the fund’s options strategy is not nearly as risk-free as many investors assume.

Distribution Analysis

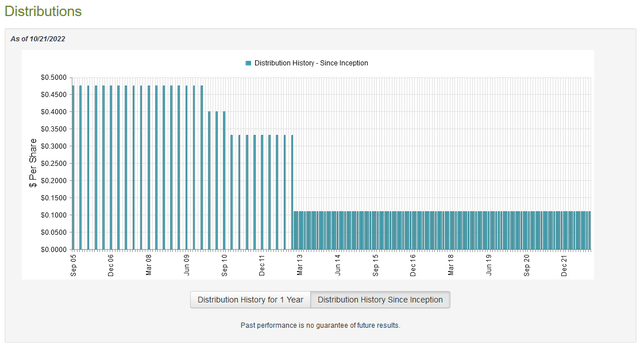

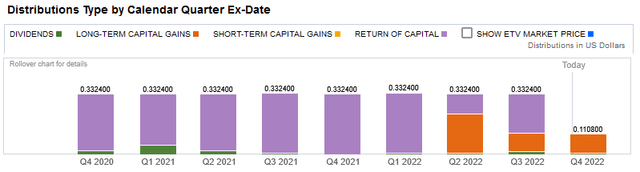

As stated earlier in the article, the Eaton Vance Tax-Managed Buy-Write Opportunities Fund has the stated objective of providing current income and gains to its investors. Thus, we can assume that it boasts a fairly substantial distribution yield. This is indeed the case as the fund pays a monthly distribution of $0.1108 per share ($1.3296 per share annually), which gives the fund a 9.81% yield at the current price. The fund has been remarkably consistent about this distribution over the years as it has maintained it since 2013:

This remarkably long track record of consistency will undoubtedly appeal to any investor that is seeking a steady and secure source of income to finance their lifestyles. Admittedly, it might be preferable if the distribution would be growing given today’s inflation, however, an investor can always reinvest some of the distribution in order to keep the amount that they receive growing and maintain their purchasing power. However, these same risk-averse conservative investors may be a bit put off by the fact that a significant percentage of the fund’s distribution is considered a return of capital:

The reason why this may be concerning is that a return of capital distribution can be a sign that the fund is returning the investors’ own money back to them. This is obviously not sustainable over any kind of extended period. However, there are other things that can cause a distribution to be considered a return of capital. Two possibilities are that the fund is distributing unrealized capital gains or distributing money generated by options strategies in certain situations (notably, option income can be considered a return of capital or a realized gain). Thus, we should investigate the fund’s ability to make its distributions and determine exactly how it is financing them. After all, we do not want it to suddenly have to reduce course and cut the distribution since that would reduce our incomes and almost certainly cause the fund’s share price to decline.

Fortunately, we do have a relatively recent report to consult for that purpose. The fund’s most recent financial report corresponds to the six-month period ending June 30, 2022. This is obviously a substantially newer report than we had available last year and it should give us a pretty good idea of how well the fund performed during the volatile market that we had during the first six months of this year. During the six-month period, the fund received $10,369,746 in dividends from the assets in its portfolio. The fund paid its expenses out of this amount, leaving it with $2,168,708 available for the shareholders. This was nowhere close to enough to cover the $71,374,074 that it actually paid out in distributions. At first glance, this is likely to be highly concerning.

There are other ways in which the fund can generate the income that it needs to cover its distributions. One method is through capital gains. Unfortunately, the fund failed miserably at this during the period, which may be partly due to its technology-heavy portfolio. During the six-month period, the Eaton Vance Tax-Managed Buy-Write Opportunities Fund posted a total of $82,856,570 in realized capital gains but this was more than offset by the $377,484,846 net unrealized capital losses that it suffered. Overall, the fund’s assets under management decreased by $309,308,996 during the period. Thus, the fund obviously did not generate enough money to afford the distribution. With that said though, the fund’s income and realized capital gains were enough to cover its outflows and expenses. This is probably sustainable but we will want to keep an eye on it as it will get harder and harder for the fund to sustain its options income if its portfolio keeps declining in value.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the Eaton Vance Tax-Managed Buy-Write Opportunities Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of the fund’s assets minus any outstanding debt. This is therefore the money that the investors would receive if the fund were immediately shut down and liquidated.

Ideally, we want to buy shares of a fund when we can acquire them for a price that is less than the net asset value. That is because such a situation implies that we are obtaining the fund’s assets for less than they are actually worth. That is unfortunately not the case right now. As of October 20, 2022 (the most recent date for which data is available as of the time of writing), the fund had a net asset value of $12.02 per share but it actually trades for 13.55 per share. This gives the fund a very high 12.73% premium to the net asset value. That is a bit higher than the 12.11% premium that the shares have had on average over the past year. However, that is an incredibly high premium to pay for any fund and it may be best to avoid it until the price becomes more reasonable, despite the fact that the fund does look like a fairly good one overall.

Conclusion

In conclusion, the Eaton Vance Tax-Managed Buy-Write Opportunities Fund is one asset that investors can purchase in order to increase their incomes to help afford the things that are rapidly climbing in price due to inflation. However, the fund’s technology-heavy portfolio does expose it to certain risks as it does not match the performance of the broader S&P 500 that the fund is writing call options against. The fund does appear able to maintain its distribution though, at least for now. The major problem here is that the valuation is far too high for me to even be willing to consider this fund. Although it is a good one, buying any fund with a premium that high can be a poor value proposition.

Be the first to comment