Paul Zimmerman/Getty Images Entertainment

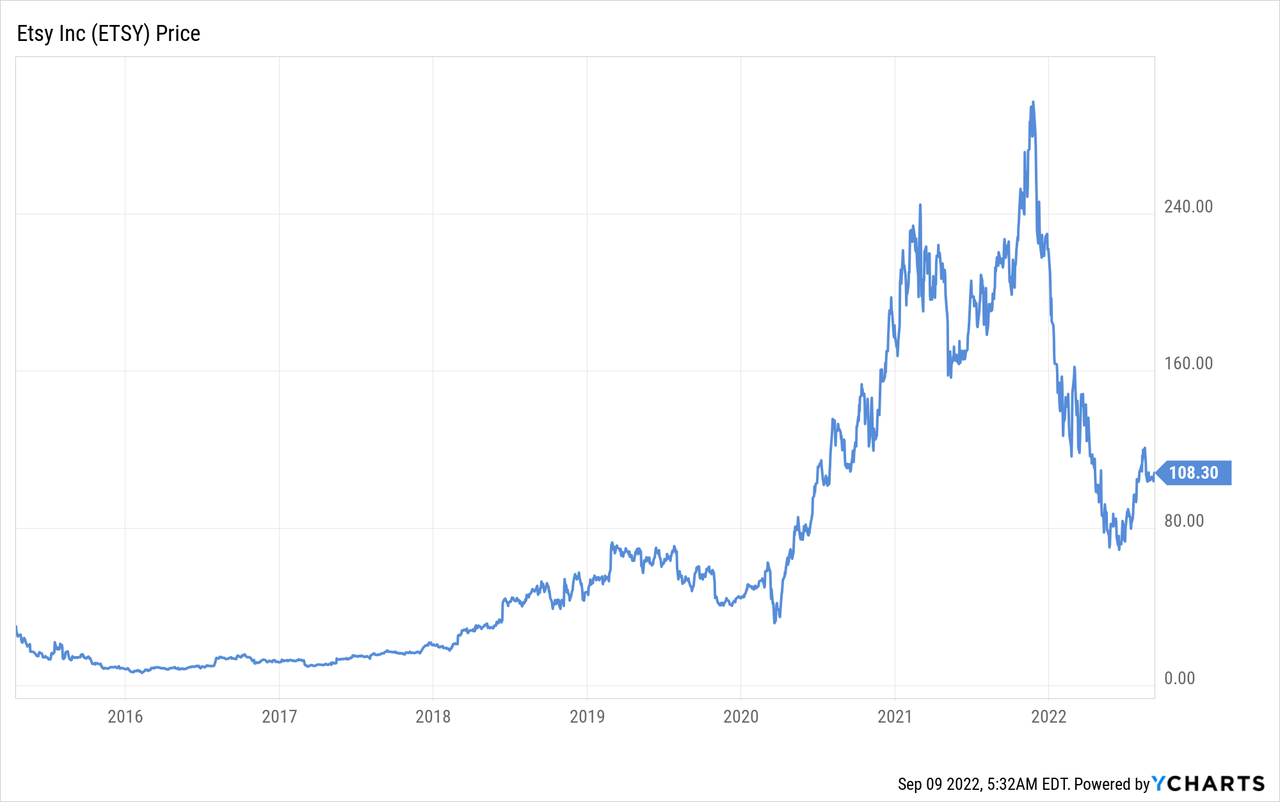

Few companies benefited from the Covid lock-downs more than Etsy (NASDAQ:ETSY), as can be seen on its price graph. After an initial dip shares went on to rise several fold. However, with the economy reopening, growth decelerated and shares gave back most of the gains. We believe that just as shares over-shot to the upside, they have over-shot to the downside as well. They appear now to be trading at an attractive valuation, and we believe the company still has more room to grow.

As we’ll see, what appears to be happening is that the company is adapting to its new reality, finding ways to reignite growth, and returning to trend growth after a period where growth was unexpectedly high.

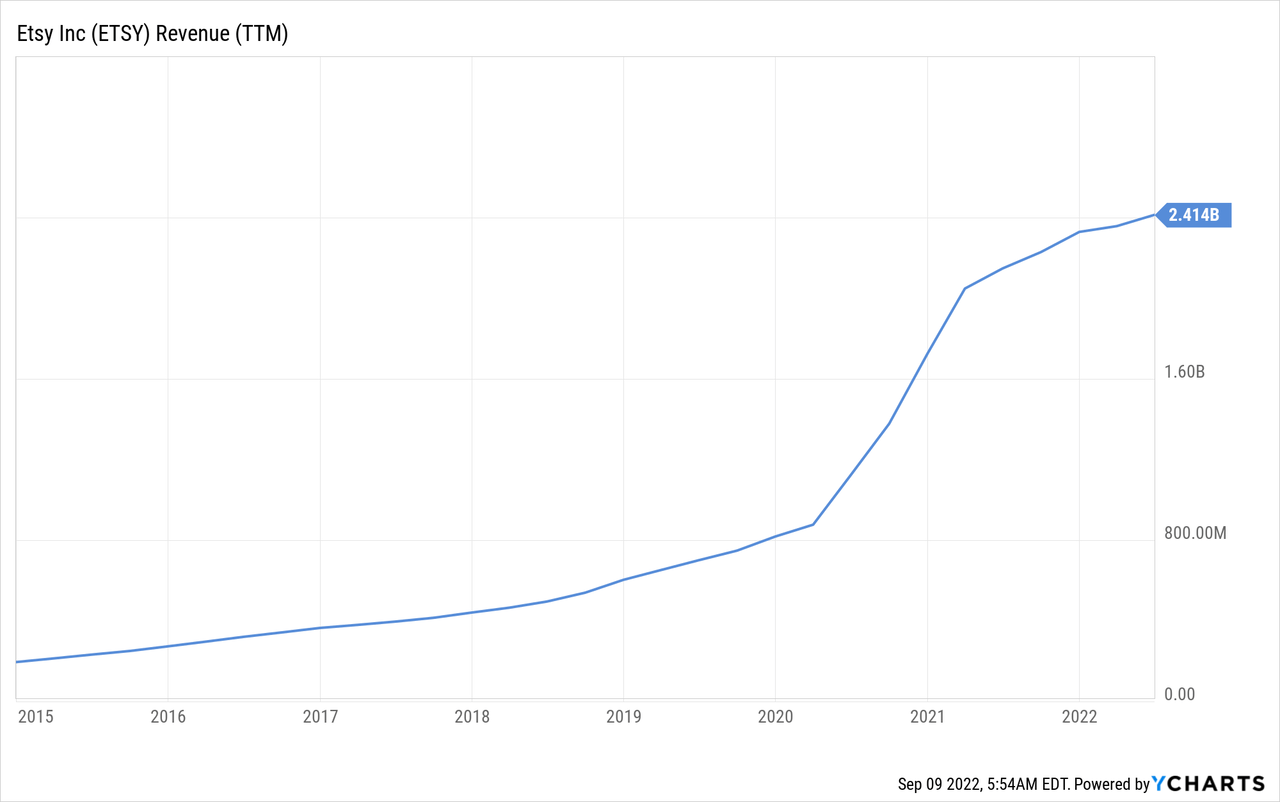

This is clear when looking at the revenue graph, where the inflection points are incredibly clear. One can easily tell where the hyper-growth pandemic period starts, and where it ends. What is important is that after this period of high growth ended, revenue did not decline, it has continued to grow, just closer to the previous trend. Now, revenue is growing faster than the ETSY ecosystem, since the company has been finding ways to increase its take-rate. It has done so with initiatives such as Etsy Ads, and increasing fees. While some of these measures, like increasing fees, were not popular with many sellers, at least the company is reinvesting the revenue in marketing initiatives to bring more buyers to the platform, and the efforts seem to be working. As a two-sided marketplace ETSY has to make sure it adequately balances buyers and sellers, in order to provide the best experience to everyone.

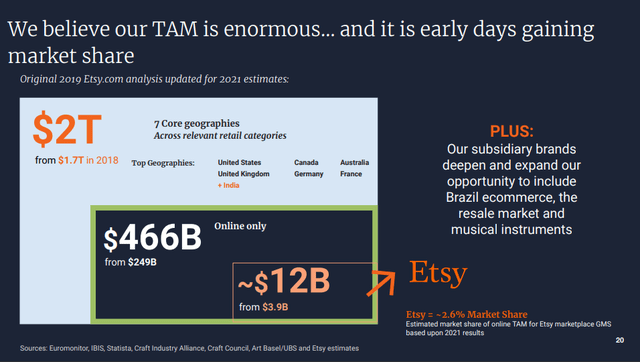

Addressable Market

One of the reasons we are so positive that ETSY’s growth runway is so long is the massive market size for which it is competing and that it continues gaining share. It is important to remember that these are global markets, and that ETSY is growing quickly not just in the US, but also internationally. ETSY estimates it currently has only ~2.6% market share of its TAM.

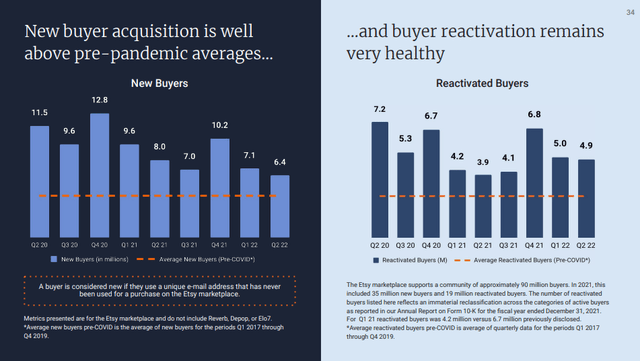

Why should we believe the company can continue to gain market share? The best evidence we’ve seen the company share is that it continues to gain new buyers at a very healthy rate, significantly above the pre-Covid rate. Even if the gain of new buyers has decelerated recently, it remains above the pre-Covid rate by a wide margin. Similarly, the company has been able to reactive buyers at a rate above pre-Covid. This is convincing evidence that ETSY transformed itself into a more relevant company, and that it is not letting its gains during the period fade away.

Cohort Analysis

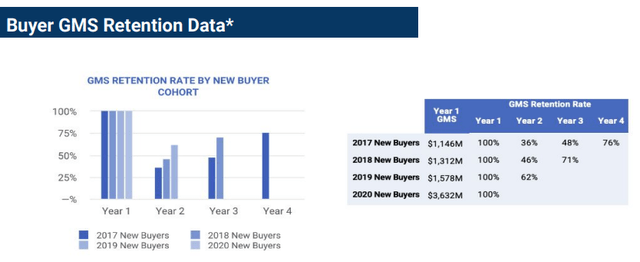

Cohort data is also quite encouraging, with the more recent new customers staying longer than previously. This tells us that ETSY is indeed becoming a more relevant platform, where people return more often and make it part of their shopping habits, whereas before it tended to be more of a one-off place to do just one purchase..

Recent Performance

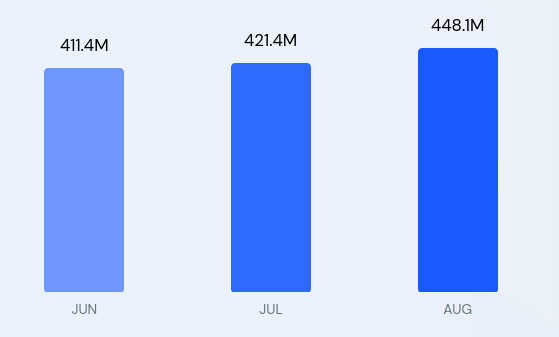

Focusing on more recent performance, we also find reasons to be optimistic. According to data from SimilarWeb, visits to ETSY have been increasing quite significantly. From 411 million in June, to 448 million in August.

SimilarWeb

Financials

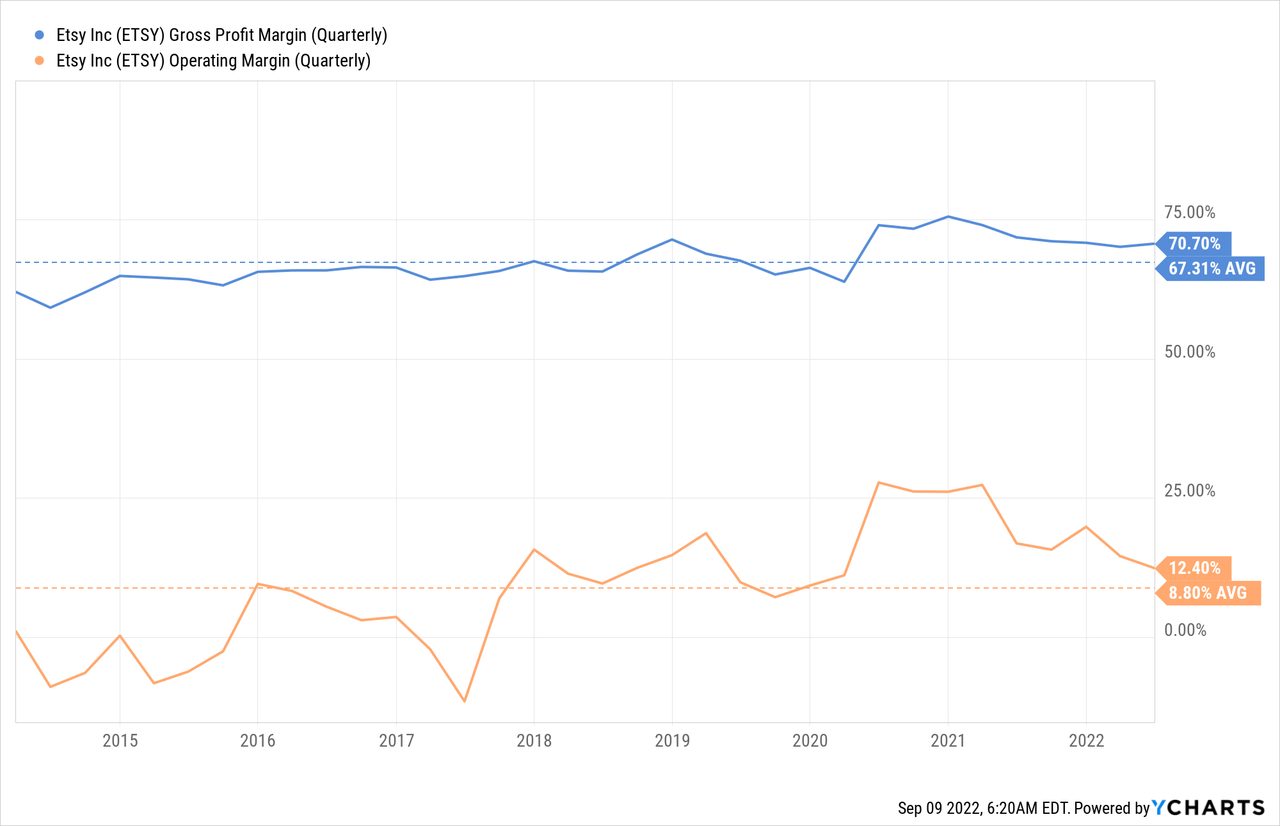

One of the things we particularly like about ETSY compared to other e-commerce and technology companies, is that it is solidly profitable. It operates with a high gross margin and operating margin, and the operating leverage can clearly be seen with the clear operating margin improvement, even if the last couple of quarters it has gone into reverse as the company increased investments in its growth.

Balance Sheet

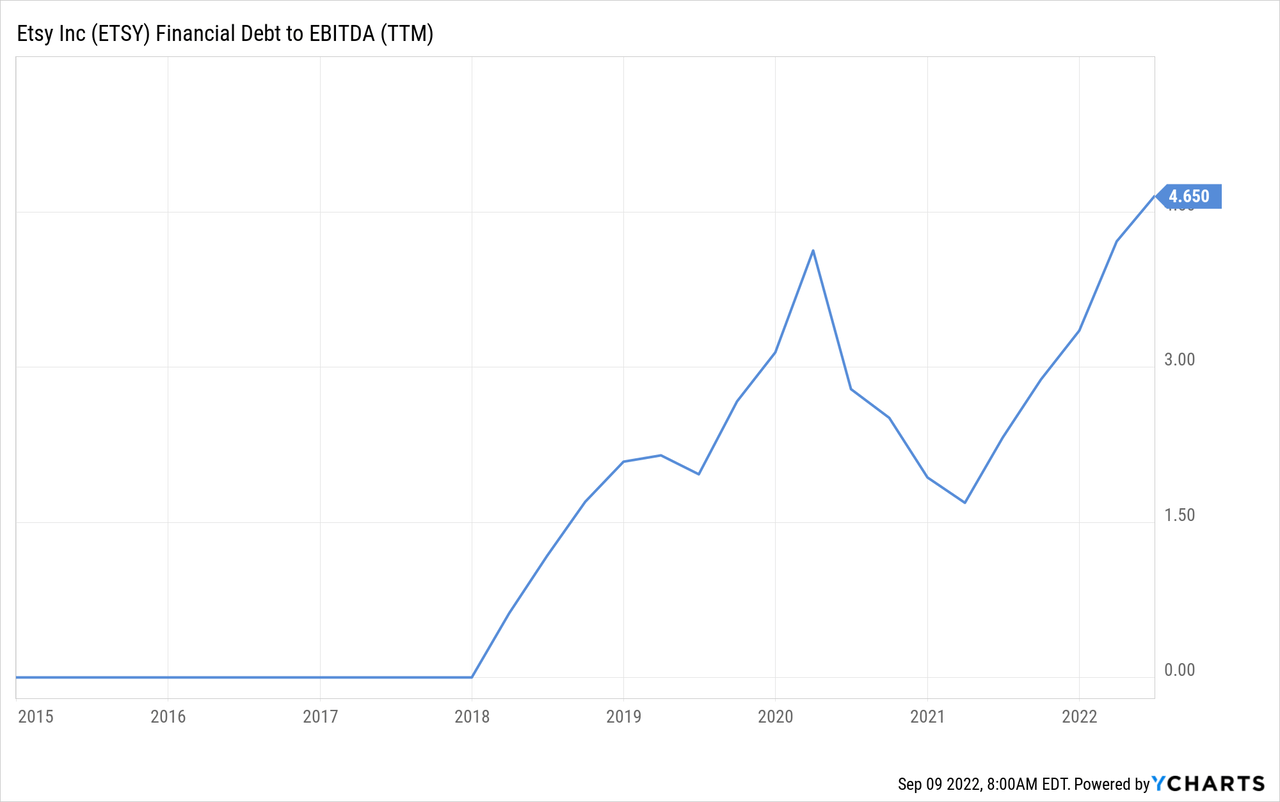

ETSY has a decent balance sheet, although we do wish it was carrying a little less debt. It has ~$2.2 billion in debt, and about $1 billion in cash and short term investments.

Valuation

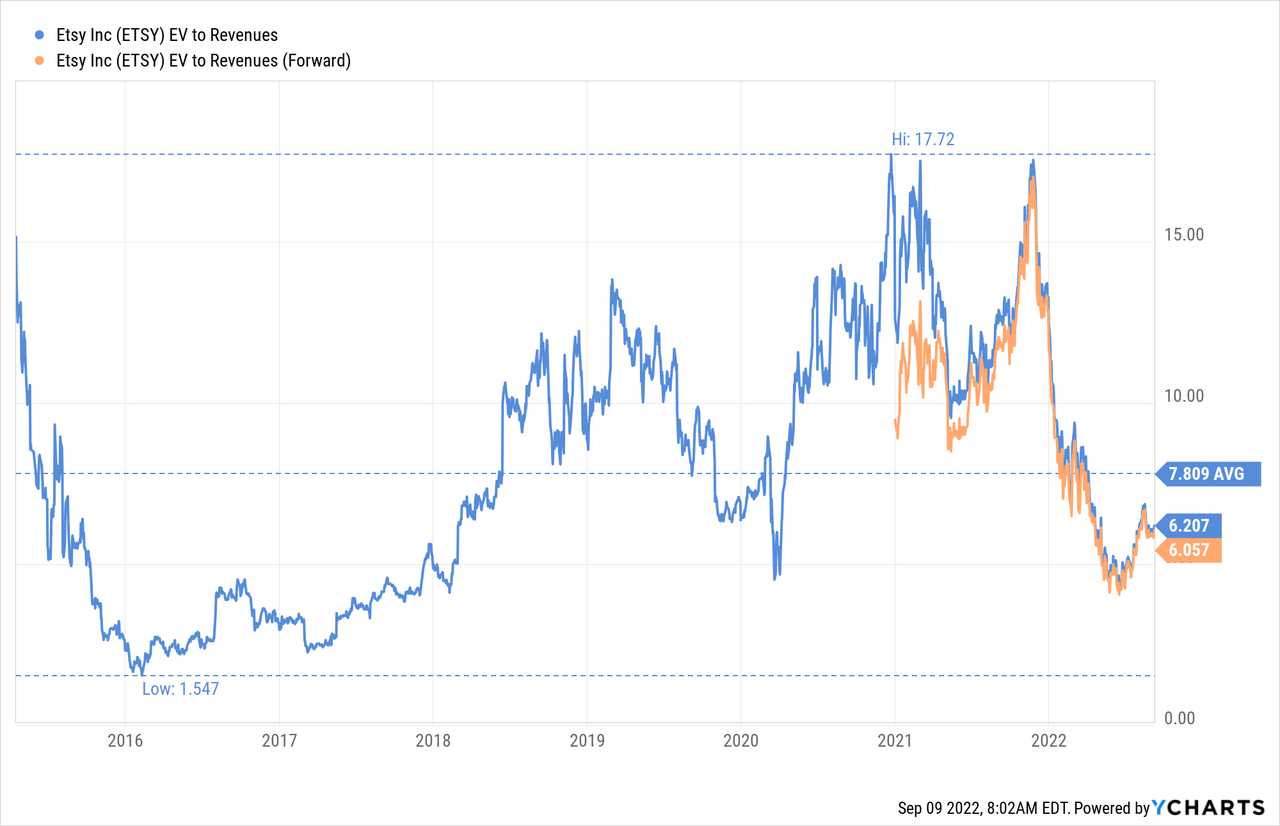

Recently when shares were trading around $80, they reached an EV/Revenues multiple that was close to what the company reached during the initial Covid crash. That was probably a good signal that shares had gotten too cheap. While they have somewhat rebounded since, we believe they are still very attractive at the moment, currently trading with an EV/Revenues of ~6.2x, considerably below their historical average of ~7.8x.

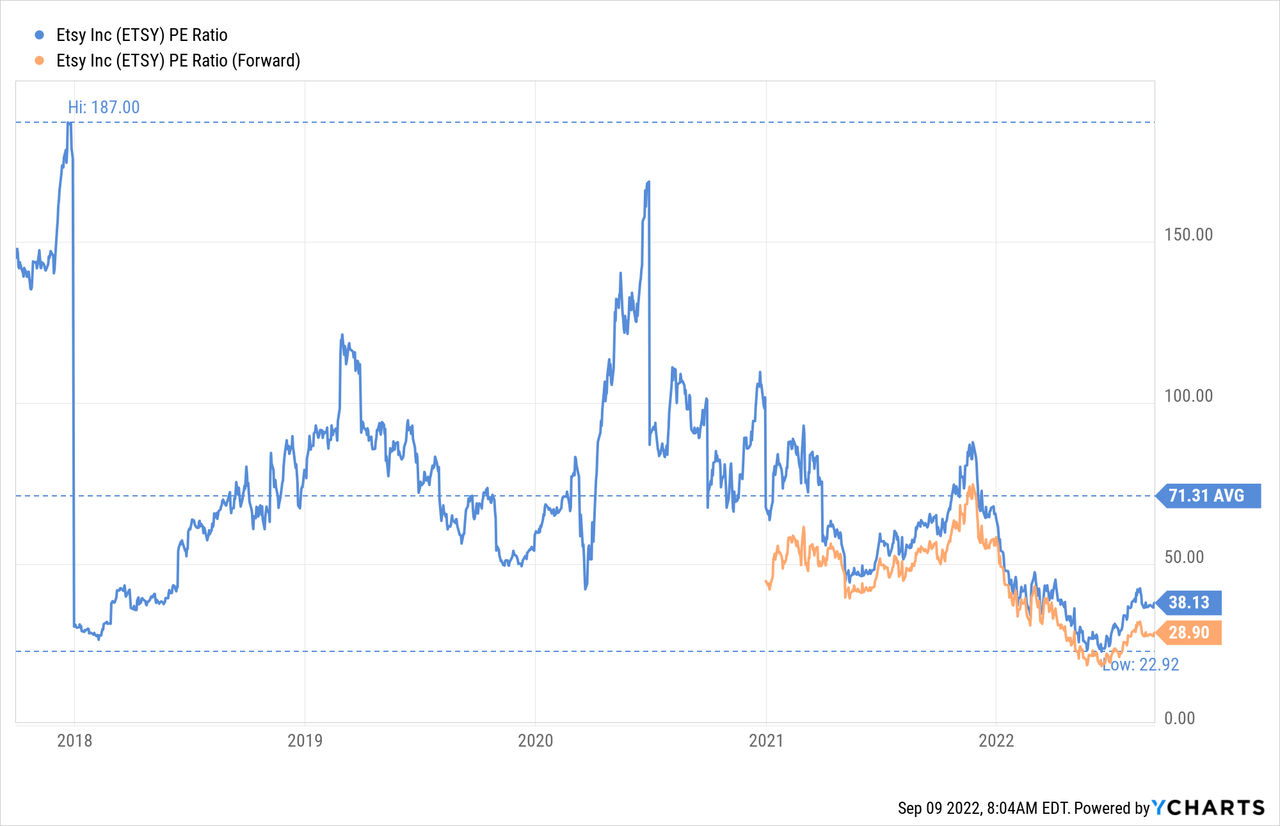

In terms of the price/earnings ratio, shares have rarely been as cheap. The current p/e is almost half the historical average, and not too far from the all-time low they reached of ~22x. The forward p/e is currently ~28x, which we view as attractive for a high-quality growth platform business.

Risks

An investment in ETSY is not without risks, especially when it has many well-funded competitors such as Amazon (AMZN) and eBay (EBAY). Still, the company has so far shown that it can compete and even gain market share. We are also a little worried by the debt the company carries, and while it currently is quite manageable, it could become a problem in a severe downturn.

Conclusion

Shares of ETSY are currently trading at very attractive valuation multiples compared to its historical averages. We believe that investors got too excited about the abnormal growth due to the pandemic, and are now getting too pessimistic about the future growth of the company. The company has shown that its new customer cohorts are being more attractive than previous generations, the company is gaining significant new buyers, and getting better at reactivating previous buyers. The addressable market is enormous and global in nature, and for all these reasons we believe the company can continue growing at a nice pace going forward.

Be the first to comment