selensergen/iStock via Getty Images

Article Thesis

ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) reported quarterly results that were, despite missing estimates, still pretty strong. The company’s profitability remained massive, and cash flow generation was exceptional.

The company’s new dividend policy results in a hefty dividend yield — investors will get a 10% quarterly dividend for the second quarter, and the company will likely deliver an even bigger dividend at the end of the year which might lift the dividend yield to an even higher level.

ZIM Integrated Shipping’s Second-Quarter Earnings Results

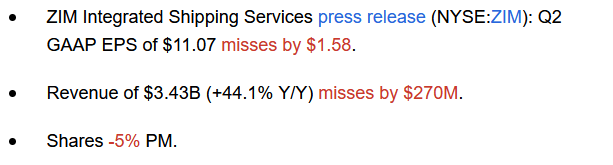

ZIM Integrated Shipping Services Ltd. reported its second-quarter earnings results on August 17. The headline numbers can be seen in the following image:

Seeking Alpha

The company missed estimates on both lines, and shares dropped by several percentage points following the earnings release. That being said, profits were still absolutely massive, despite the fact that analyst expectations were missed. ZIM is having the best time in its history, and the first half of the current year was ZIM’s most profitable such period, ever — the fact that estimates were missed should thus be taken with a grain of salt. One could say that ZIM’s Q2 was exceptional, the analyst community was just believing that it would be even more exceptional. For reference, the company earned around 25% of its market capitalization in a single quarter.

This massive profitability is, of course, the result of distortions in the container shipping market. Shipping rates for containers on all main routes, including China-US, China-Europe, etc. have blown up since the beginning of the pandemic. Current rates are off their highs, but still at very elevated levels, historically speaking. ZIM also had signed contracts with importers (think Walmart (WMT)) at highly attractive prices, which further provides strong profits, independent of how spot rates behave going forward.

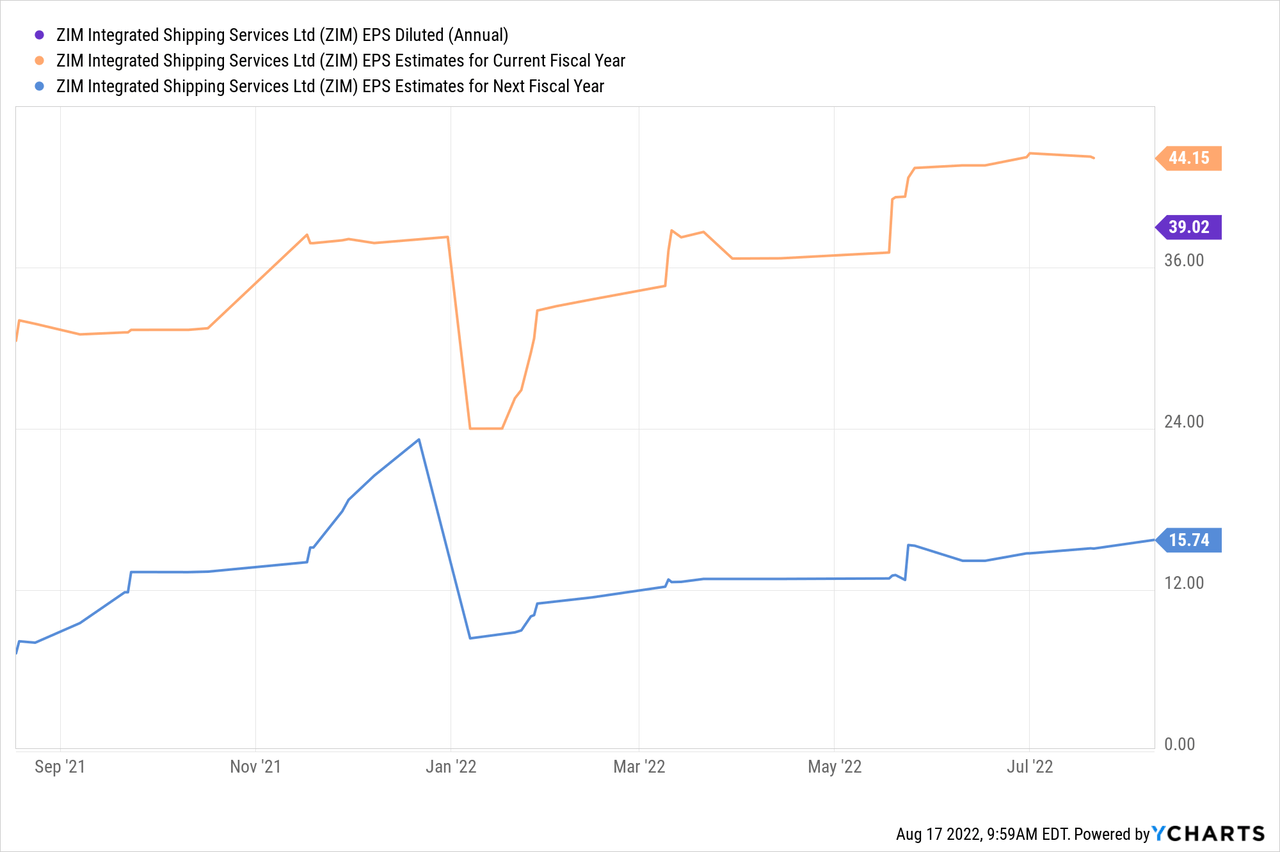

The container demand picture over the last couple of years allowed ZIM to generate hefty profits in 2021, and the same will hold true in 2022:

After earning $4.40 per share in 2020, ZIM saw its earnings per share explode by around 800%, to $39 — which is not too far off the current share price. In 2022, ZIM is expected to earn even more money, as the current analyst consensus estimate stands at $44. With the earnings miss for the second quarter, that estimate will likely get revised in the coming days and weeks, but it is pretty clear that 2022 will nevertheless be another massive year for ZIM — it wouldn’t be too surprising if 2022 was better than 2021, as ZIM has already earned $25 in H1, and another $14, combined, in the remaining two quarters of this year should be achievable unless spot rates fall off a cliff from here.

Estimates for 2023 are considerably lower, at slightly more than $15. But even that would be pretty strong compared to the past and based on the current share price ZIM would still be trading at only 3x next year’s net profit.

ZIM Integrated Shipping’s asset-light business model means that the company is able to generate a very large amount of cash relative to its GAAP profits, as no large capital expenditures are required. During the second quarter, ZIM’s operating cash flow totaled $1.7 billion, while free cash flows, after accounting for some capital investments, totaled $1.64 billion during the quarter. That’s relatively on par with the Q1 level, as free cash flow during H1 totaled $3.12 billion. In other words, ZIM has managed to generate free cash that is equal to 53% of the company’s current market capitalization during the past half year. If ZIM was able to keep that pace, it would generate more than its current market cap in free cash during the current year. Profits will most likely decline in H2 relative to H1, but it is possible that free cash flows hold up better, as receivables are turned into FCF over time.

With all these massive cash flows coming into ZIM’s coffers in the current environment, the company basically doesn’t have any options except for returning a lot of it to its owners. Debt reduction doesn’t make too much sense, as the balance sheet is already very strong. ZIM reports a net debt position of $630 million, but that is calculated very conservatively. ZIM counts lease liabilities as debt, but the company does generate value out of these lease liabilities as the company can use the ships it leases to generate revenue and profit in the future. When we only count traditional debt, ZIM has a massive net cash position. Outstanding loans total just $160 million, whereas the company has a whopping $3.96 billion in cash and investments. In other words, the company has billions in “traditional” net cash before we account for its future lease liabilities.

ZIM has made some investments in smaller companies, primarily logistics startups, in recent quarters. It also acquired a couple of vessels, but the company isn’t able to spend $1.6 billion per quarter on these items. The company thus decided to return a large portion of its profits and cash flows to its owners through dividends — the company isn’t a fan of buybacks, at least for now.

For the second quarter, the company announced a dividend of $4.75. That makes for a 10% yield relative to the current share price, for a single quarter. And yet, the dividend is pretty low relative to the profits and cash flows the company generated during the period. Relative to $11.07 in GAAP earnings per share, the payout ratio is 43%. Even more telling, the dividend will cost the company just 35% of its Q2 free cash flow [$570 million out of $1.64 billion]. In other words, the company still retains more than $1 billion in free cash during a single quarter, despite paying a dividend with an annual yield of 40%.

In the past, ZIM targeted paying out 20% of its net profits per quarter, with a catch-up dividend at the end of the year in order to distribute 30%-50% of the year’s profits. That’s why investors got a hefty $17 per share dividend at the beginning of the current year. The company has now changed its policy and plans to pay out 30% per quarter, with a catch-up following the end of the fiscal year. It is likely, although not guaranteed, that investors will get another big dividend payment at the beginning of next year, as a “catch up” for the current year. If ZIM were to pay out 50% of this year’s expected earnings per share, that would make for a total payment of $22 for the current year. Accounting for the just-announced Q2 dividend, just $7.60 of that has been announced so far, leaving a lot of room for further major dividends over the next six months.

ZIM’s Profits Will Decline, But The Valuation Accounts For That

I believe it is basically set in stone that profits won’t remain this high forever. Spot rates have declined relative to their recent peaks, and an economic slowdown will result in lower demand for shipping. But even if profits drop considerably next year and beyond, ZIM could still be a nice investment.

The company trades at around 1.1x this year’s net profit, while the FCF multiple is even lower than that. At the same time, the company holds billions of dollars in cash, reducing risks tremendously. It’s hard to imagine a scenario where the company’s future cash flows aren’t worth at least $48 per share — after all, the company will generate most of that this year alone, and even based on current estimates for next year, the earnings yield is still in the 30% range.

If management uses these cash flows in a bad way, then that would be a major issue. But as long as ZIM continues to strengthen the balance sheet while returning massive amounts of cash to investors via dividends, not too many things can/should go wrong.

ZIM doesn’t have the most stable cash flows in the shipping industry for sure, but its massive current profitability and dividends make it interesting, even though it is pretty obvious that profits won’t remain this high forever. But luckily, that’s not needed for ZIM to be a good investment at the current price.

Be the first to comment