BackyardProduction

Ethereum (ETH-USD) was the clear leader in July among the large-cap altcoins and also well outpaced Bitcoin (BTC-USD). Macro drivers have been and remain a primary determiner of price. But the successful merger on the Sepolia testnet, along with talk of the tentative date of September 19th for The Merge on the Mainnet, were key to the 50% rally over the past month. However, for the Grayscale Ethereum Trust (OTCQX:ETHE), the end of June saw the SEC disapprove the ETF transition for its sister fund the Grayscale Bitcoin Trust (GBTC). The disapproval has knock-on effects for thinking about the Ethereum Trust because of the changed timing for when its discount to NAV may dissipate.

The article below goes over the major changes of The Merge and reasons it may be a buy the rumor, but sell the news type event. It also looks closely at Jerome Powell’s FOMC press conference with an eye toward how much the tone returned to the Committee’s dovish roots. Last is a recap of the SEC’s rejection of Grayscale’s “arbitrary and capricious” legal argument and how it undermines using their Ethereum Trust for exposure to Ethereum.

The Merge

On Wednesday, developers announced the Ethereum platform’s final test merge of the Goerli testnet with its Beacon Chain should occur between August 6th and 12th. Barring an insufficient test or any large issues in the days following this testnet merger, a date range will be given for The Merge on the Mainnet. This is presumably at the end of September.

After several devnets, shadow forks and merges on deprecated testnets, Sepolia was recently transitioned to proof-of-stake. Now, only one more testnet remains: Goerli, and its associated Beacon Chain, Prater.

Goerli/Prater Merge Announcement, blog.ethereum.org, 7/27/2022

Long-term The Merge will have a range of positive effects on the Ethereum platform and likely the coin’s price. For instance, ESG concerns will be lessened with its transition to the substantially more energy efficient proof-of-stake.

A recent estimate suggested that The Merge to proof-of-stake could result in a 99.95% reduction in total energy use, with proof-of-stake being ~2000x more energy-efficient than proof-of-work. The energy expenditure of Ethereum will be roughly equal to the cost of running a home computer for each node on the network.

ETHEREUM ENERGY CONSUMPTION, ethereum.org, updated 3/29/22

Note both the European Parliament’s economic and monetary affairs committee and Biden’s Executive Order on Ensuring Responsible Development of Digital Assets have suggested some preference to proof-of-stake over proof-of-work. Along these lines, overtime institutional investors may increase allocations to Ethereum over Bitcoin due to ESG and regulatory concerns.

The Merge also looks to take Ethereum from a few percentage points of total supply inflation per year, to basically a flat total supply. There will no longer be a two ETH issuance per block to the miners of the proof-of-work system. The new rewards for the stakers securing the network will be a small fraction of those under the proof-of-work regime. Depending on the gas prices, with base fees now being burned, the system could be slightly deflationary. This aspect is of importance to the large and vocal sound money faction in the crypto space and will positively build sentiment.

Following The Merge there will be a cleanup upgrade that will enable the withdrawing of staked ETH. Once there is no lock-up in the staking mechanism, a larger portion of institutional investors are likely to consider capturing yield with their holdings as the liquidity problem is removed. This will increase demand for ETH and de facto tighten supply.

As the likely scenario during the last weeks of August, I see ETH-USD reacting well following the merger on the Goerli testnet, as well as when The Merge’s September date range is officially set for the Mainnet. If successful, we could also see positive price action just following The Merge and the first few post Merge blocks produced by the Beacon Chain. Put differently, there is still some concern of a major issue at The Merge that is weighing on the price.

However, the positives discussed above don’t reach full force immediately upon The Merge. The change in the tokenomics will not substantially change supply on day one. Regulatory actions are moving slowly and any preferential treatment for proof-of-stake platforms is still months off. And staked ETH will remain locked for a period until the cleanup upgrade. For these reasons, traders may sell the news following the initial excitement of The Merge’s successful implementation.

The Fed Takes A Back Seat, Maybe

The Federal Reserve doves may not be back in full force, but Chair Powell’s recently hawkish tone was more muted on Wednesday in his press conference following the FOMC meeting. He presented what could be called a balanced outlook for Fed policy for the remainder of the year.

As has been seen at recent meetings, Powell did stress that the Committee is focused on the inflation problem. But looking at a slightly different nuance, note that Powell’s tone, manner and prepared responses seem overly planned to always project resolve in returning inflation to a 2% longer-run average. This makes it somewhat hard to find strong dovish points. But below are a few quotes that jumped out at me and indicate a pivot to a more measured tightening policy going forward.

While another unusually large increase could be appropriate at our next meeting, that is a decision that will depend on the data we get between now and then.

And it’s also worth noting that these rate hikes have been large and they’ve come quickly. And it’s likely that their full effect has not been felt by the economy. So, there’s probably some additional tightening, significant additional tightening in the pipeline.

We’re not trying to have a recession. And we don’t think we have to.

…now that we’re at neutral, as the process goes on, at some point, it will be appropriate to slow down. And we haven’t made a decision when that point is, but intuitively that makes sense, right? We’ve been front-end loading these very large rate increases, and now we’re getting closer to where we need to be.

As I mentioned in my remarks, I think you pretty clearly do see a slowing now in demand in the second quarter. Consumer spending, business fixed investment, housing, places like that.

There’s some evidence that wages, if you look at average hourly earnings, they appear to be moderating.

But the slowdown in the second quarter is notable. And we’re going to be watching that carefully.

The extremes of the two most recent rate hikes and high expectations in the market of continued harsh tightening to tackle the entrenched energy inflation have undoubtably pressured markets. But Friday saw a three-month low in the U.S. 10 Year Treasury yield at 2.61% as investors digested Powell’s words. If economic indicators continue to weaken, as was seen with Thursday’s first look at Q2 GDP, risk-on assets may get a reprieve on the interest rate front. And Ethereum prices should get some breathing room over the next two months while macro factors take a back seat to The Merge.

SEC Litigation And The Discount To NAV

At the end of June, the SEC rejected the Grayscale Bitcoin Trust’s proposed rule change to convert to a spot-backed Bitcoin ETF. Looking to other SEC litigation in the crypto sector, the lawsuit filed by Grayscale to appeal the decision likely does not receive a quick and easy resolution. One estimated timeline presented by Bloomberg has no initial court ruling until the end of 2023.

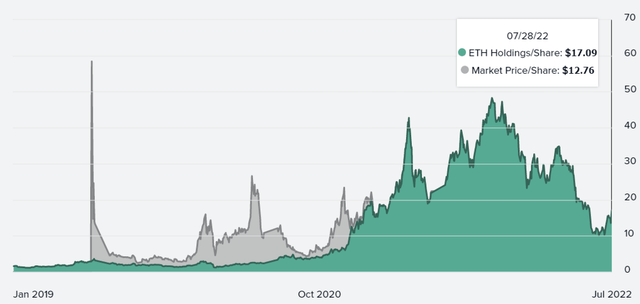

Because the discount to NAV of the Bitcoin Trust would dissipate upon conversion to an ETF, I felt there would be a meaningful reversal in the discount to NAV for Grayscale’s Ethereum Trust as well. So from my perspective, in the months leading up to the SEC decision on the Bitcoin product, the Ethereum Trust’s near-term expected value was higher than other Ethereum assets that were not trading at a large discount to NAV.

ETHE Discount to NAV (grayscale.com)

But the SEC has maintained its prior position concerning the Bitcoin Trust’s ability to deter fraud and manipulation. The Commission reasons the proposed surveillance sharing agreement with the CME Bitcoin futures market does not meet requirements. Put somewhat simply, the Commission does not believe the CME Bitcoin futures market has been shown to be adequately related to spot-backed Bitcoin products to deter and detect fraud relating to them. For a more full look at the arguments consider my recent article.

At the end of last year, the Grayscale Ethereum Trust was a preferable means to gain exposure to Ethereum because it invests on-chain, has quality custody arrangements, and traded at over a 20% discount to its held assets. However, despite the apparent moderation in Fed policy and the short and long-term positives of The Merge, the uncertainty and timeframe surrounding Grayscale’s litigation with the SEC now makes the Ethereum Trust a hold rather than a buy. This is especially true as it is unlikely the Trust will capture yield though staking its holdings, something institutions will be looking for following the removal of the lock-up in the months after The Merge.

Summary

Ethereum prices should react positively in August to the Goerli testnet merger, as well as when The Merge’s date range is officially set for the Mainnet. If The Merge is successful, we could also see positive price action with the announcement, as there remains a degree of skepticism the change to the proof-of-stake consensus will go smoothly. Following an initial period of excitement, I expect a sell the news pullback.

If economic indicators continue to weaken, risk-on assets should get a reprieve from expectations in the market of continued harsh tightening by the Federal Reserve. Medium-term The Merge provides strong, positive catalysts for the platform and ETH-USD. But the uncertainty and long timeframe surrounding Grayscale’s GBTC litigation with the SEC now makes their Ethereum Trust a hold rather than a buy.

Be the first to comment