NicoElNino

Thesis

Eaton Vance Tax-Managed Buy-Write Income Fund (NYSE:ETB) is an equity buy-write closed-end fund that has current income as a primary objective:

The Fund invests in a diversified portfolio of common stocks and writes call options on one or more U.S. indices on a substantial portion of the value of its common stock portfolio to seek to generate current earnings from the option premium. The Fund’s portfolio managers use the adviser’s and sub-adviser’s internal research and proprietary modeling techniques in making investment decisions. The Fund evaluates returns on an after tax basis and seeks to minimize and defer federal income taxes incurred by shareholders in connection with their investment in the Fund.

The fund has had a much better performance when compared to the underlying index until recently. Much of the CEF’s outperformance was due to the fund moving to a large premium to NAV in 2022. That move has now reverted, in a wild one-month swing.

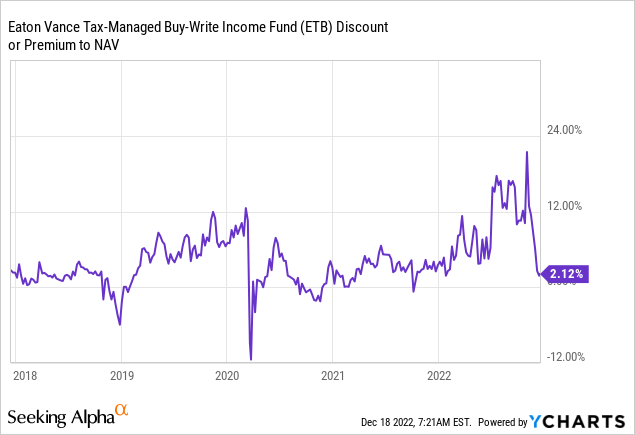

ETB Premium/Discount to NAV

The ETB premium has come down from a historic level:

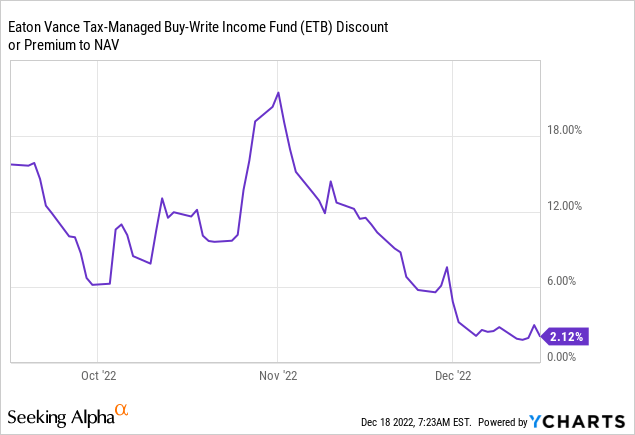

An investor needs to keep a close eye on CEF premiums to NAV. Historic wide levels tend to indicate an instrument is overpriced, and even if you are a true buy and hold investor. Lightening up on exposure at high premium levels is wise. Why? Because the levels tend to mean revert and come back to their historic norms. In ETB’s example we have had a 16% market price move just from the premium narrowing in the past month:

That is a huge number, and it represents almost two years of dividends! As a rule of thumb, never buy a buy-write CEF at a premium which is two standard deviations wide historically. You will always lose money by doing so. We find these premium moves highly unusual, and tradable for shorter term investors. It is interesting to see ETB’s premium now sitting at the lows for the year.

Performance

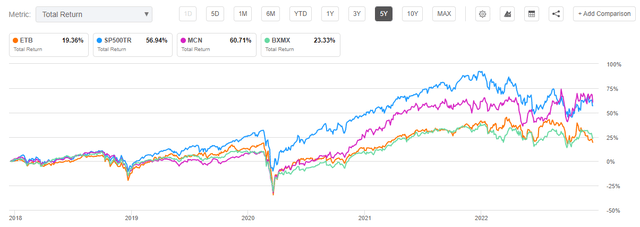

This year has been a very volatile one across the spectrum:

With its premium collapsing, ETB is now closing in on the S&P 500 performance. Surprisingly, the best performing buy-write fund has been MCN, which we covered here. MCN is distinct since it writes some of its options on individual stocks, rather than the index. The fund never really traded at a substantial premium to NAV this year, and has been able to have a flat performance in 2022! Kudos to the MCN management team.

When normalizing the total returns on a 5-year basis MCN still sticks out as the best performing one from the cohort:

2022 has been all about active management, and while ETB is a great fund from a great fund family, it has employed a systematic buy-write strategy. Ultimately the systematic nature provides for predictability (hence the premium to NAV the fund jumped to) but at the same time the performance is not fully optimized.

ETB Holdings

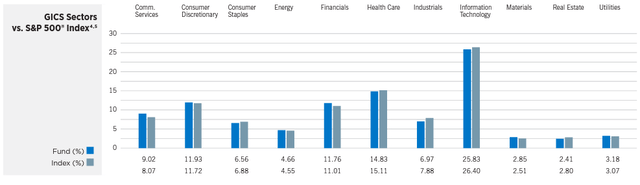

The fund holds a portfolio of equities that tend to mirror the S&P 500:

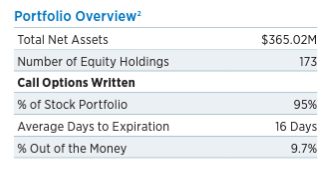

There is a slight basis between the sectoral allocation for the fund and the S&P 500 composition. The fund however holds only 173 stocks in its portfolio:

Options Overlay (Fund Fact Sheet)

We can see the vehicle continues to roll options for around 2 weeks, with a 95% portfolio coverage for written options. The management team does adjust the “% Out of the Money”, which is indicative of market views. The lower the “% Out of the Money”, the more “hedged” the fund is – i.e. the options have a higher delta and if the market tanks more a premium is realized. For systematic funds like ETB this feature is the active lever used by management teams to adjust views. For example if I am to roll covered calls and I believe the market will go down, I will write calls with a very low percentage out of the money. Conversely, if I think the market will rise in the short term, I will write calls with a large percentage out of the money, so that I can keep as much of an upside for the underlying portfolio.

To note, that equity buy-write funds are not an ideal choice in a recovery, specifically because they give up most of their upside via written calls. Agile and well managed funds, are able to dampen the downside in down markets.

Conclusion

ETB is an equity buy-write fund. The vehicle has experienced wild swings in its premium to NAV this year, which has seen historic highs. ETB is a buy-and-hold vehicle through its analytics, but 2022 has shown that even true buy and hold CEFs should be traded in a very volatile environment. ETB’s premium has decreased by 16% in the past month, mean reverting to historic levels. This is highly unusual and unprecedented for the fund. The CEF now exhibits a total return for the year which now more closely matches the one observed for the S&P 500. A savvy buy and hold retail investor needs to understand that in bear markets, especially volatile ones, it is acceptable and more profitable to take a more active approach with certain funds, and divest or cut down some of the exposure when the premiums become too large versus historic norms. Over the long term premiums always mean revert, and sometimes it pays off to be active during years with wild premium swings like 2022.

Be the first to comment