FabrikaCr/iStock via Getty Images

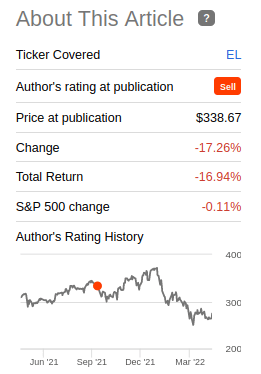

In September of last year, we wrote an article expressing how much we like Estée Lauder (NYSE:EL) as a company, however, shares at the time were just too expensive. Since then shares have come down ~20% and we are revisiting the company to see if they are now in ‘Buy’ territory.

Seeking Alpha

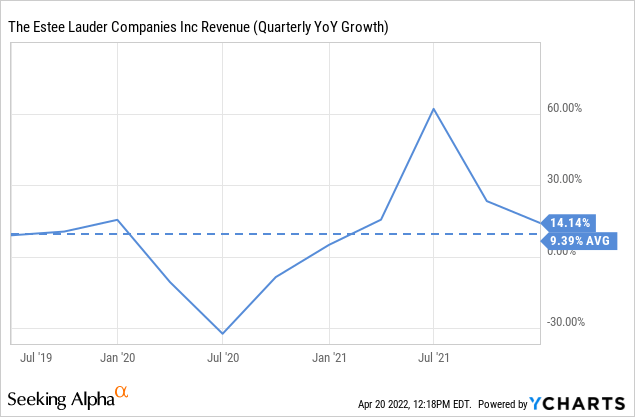

There has been a noticeable price correction in 2022 as some growth companies have had their valuations re-adjusted with the higher interest rates. We think shares are starting to look reasonably valued again and we might invest in the company soon.

Positioning

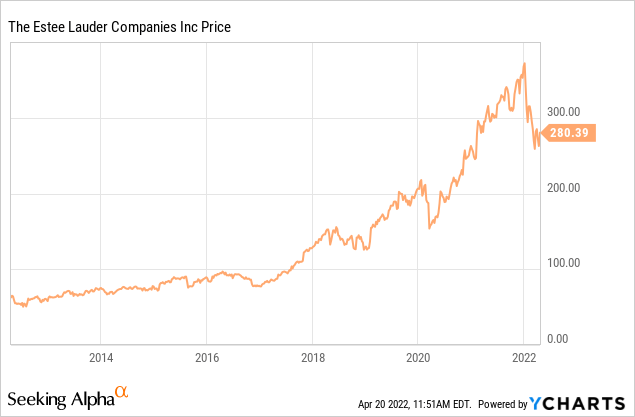

Estée Lauder has proven very resilient in part thanks to its strategy of catering to a wide array of consumer preferences and tastes through an ensemble of brands. Each brand has a single global image that is promoted with consistent logos, packaging and advertising designed to enhance its image and differentiate it from other brands in the market. Beauty brands are differentiated by numerous factors, including quality, performance, a particular lifestyle, where they are distributed (e.g., prestige or mass) and price point. Below is a chart showing most of the brands that they sell and where they stand based on lifestyle and price point:

Estée Lauder Annual Report

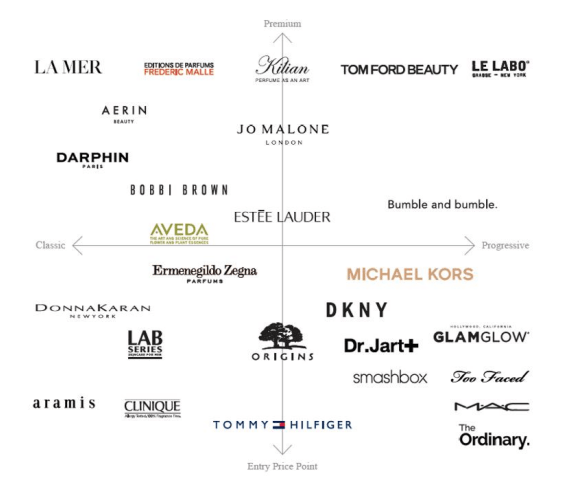

Estée Lauder Financials

Estée Lauder was one of the companies that was severely impacted by the COVID crisis, as can be seen below with its growth rate becoming significantly negative during the worst of that period. There was then a quick recovery, and now growth is returning to closer to its long-term average of ~9%.

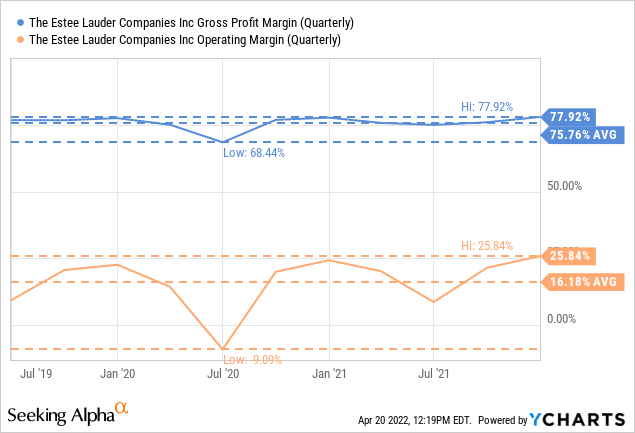

The same dynamic can be seen with its gross profit margin and operating margin, which are now returning to pre-pandemic levels. Other than the pandemic period, and the normal yearly cyclicality of the industry, margins are quite high and stable, a reflection of the company’s strong pricing power.

Growth drivers

We believe Estée Lauder can continue to grow at 7-9% CAGR for many more years given that all of its categories are growing, and Estée Lauder is in general taking market share so it should grow above its markets.

| Market Segment | Estimated CAGR |

| Skin Care | Estimated to grow at a CAGR of 7.1% |

| Makeup | Estimated to grow at a CAGR of 3.8% |

| Fragrance | Estimated to grow at a CAGR of 5% |

| Hair Care | Estimated to grow at a CAGR of 5.47% |

Besides the inherent growth of the markets it serves, we think the company has some opportunities like focusing more on the online sales channel, digital initiatives, and executing on the revival of its travel retail channel.

The company also has some specific opportunities to accelerate the growth of some of its brands. For example, MAC doesn’t enjoy as wide a distribution as its other brands, with just 10% of the reach of Estée Lauder and Clinique, and only around half the distribution of several direct competitors.

Estée Lauder used the COVID crisis as a catalyst to aggressively reduce its brick-and-mortar exposure and to shift its resources to the more profitable e-commerce channel, which is taking market share and should accelerate its growth and profitability.

EL Stock Valuation

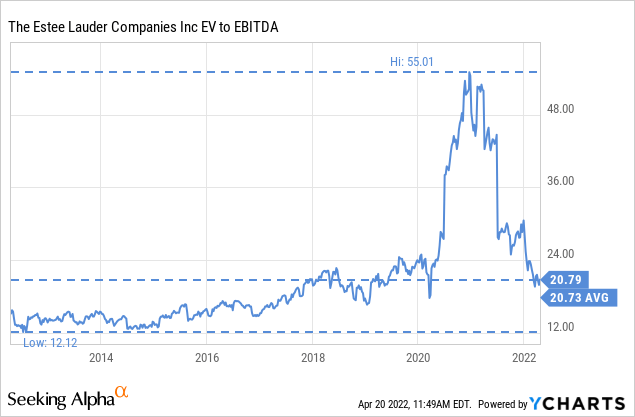

After the recent price correction that has taken place in the last 4 months, shares are now trading at more reasonable levels, with the EV/EBITDA close to its 10-year average.

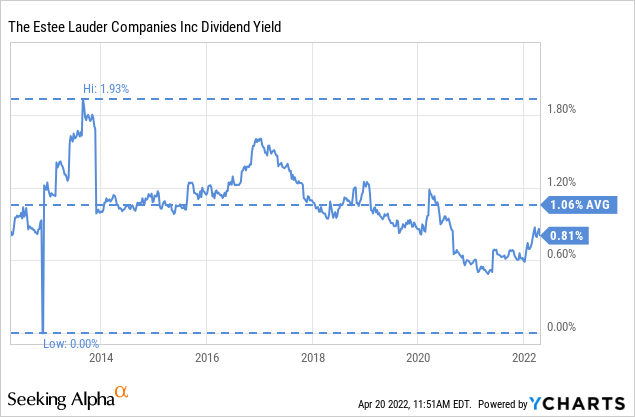

We can also get an idea of the valuation by looking at the dividend yield, which historically has been low but averaged at least ~1% yield. After the price correction, the dividend yield increased to ~0.81%, and it is getting closer to its ten-year average of 1%. We are looking to buy if shares go down a little bit more and make the dividend yield get close to the 1% level.

Risks

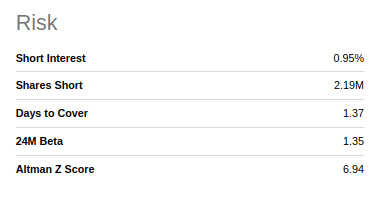

We do not see too many risks at the moment with Estée Lauder, probably the biggest one would be a return of the strict lock-downs that affected sales so much in 2020. Other than that the typical risks for this type of company are potential market share loss, product recall or product quality issues, and potential financial accounting problems. In any case, we do not think any of these risks have a high probability of materializing, and the low level of short interest reflects this feeling by the market. Estée Lauder’s Altman Z-Score is significantly above 3.0, which means the company is not considered at risk of bankruptcy.

Seeking Alpha

Conclusion

Estée Lauder is a wonderful company that became a tad too expensive but is now again in ‘Buy’ territory. With its powerful ensemble of brands, we believe the company can continue to gain market share and grow a few points above its markets. Now that its growth rate and margins are again close to pre-COVID levels, and with a much more rational valuation, we’ll consider buying some shares. Especially if the dividend approaches its long-run average of ~1%.

Be the first to comment