J2R

Since our initiation of coverage, EssilorLuxottica (OTCPK:ESLOF) is already up by more than 5% at the stock price level. Our buy case recap was based on eight positive implications. Let’s review some of them and add some company comments.

In our last publication, we said that:

- we were positive about the FX development – this checked out;

- we were forecasting a more challenging quarter in North America. Indeed, the region recorded an inferior performance compared to the other area signing a plus 2.4%. EMEA and LatAm regions recorded a higher growth rate of 12.4% and 23.9% respectively;

- our internal team was forecasting higher GrandVision’s integration synergies;

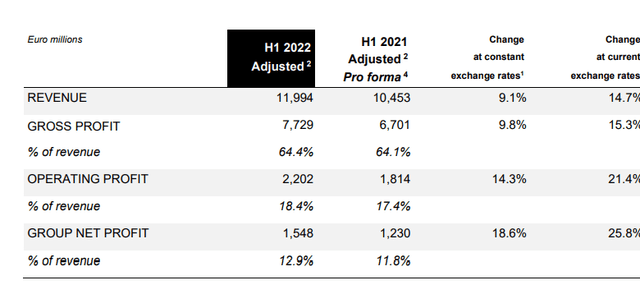

- being vertically integrated, we were optimistic about margin recovery. Coupled with point 3) we can report that the company is delivering with GrandVision integration. Adjusted EBIT margin reached 18.4% with an increase of over 100 basis points compared to the same period one year ago. Thus, the operating leverage is working (see the snap below).

EssilorLuxottica financial snap

Source: EssilorLuxottica Q2 press release

Q2 results

EssilorLuxottica nearly delivered €12 billion in half-yearly revenues up 9.1% at constant exchange rates. The group was able to translate the growth in turnover into a margin expansion, exploiting the vertically integrated business model. Going down to the P&L, a double-digit jump in net profit was achieved.

Looking more in detail, revenues were supported by double-digit growth in sales in the North America and EMEA region. A more contained growth was recorded in the Asia Pacific segment (+1.7%), due to the restrictions imposed in China to stem the expansion of COVID-19. There was also a strong business development in Latin America where sales increased by 23.9%. As for Russia, Putin’s country had an insignificant financial impact, considering that in 2021 the area accounted for about 1% of revenues and the group has currently reduced its activity over there.

More in specifics, it can be seen that sales through e-commerce platforms represented only 7% of revenues, this result was both delivered in Q1 and Q2, demonstrating a customer preference for purchasing in-store (and also confirming another of our buy case assumptions). In terms of product categories, luxury brands such as Ray-Ban and Oakley have maintained the solid positive trend of the previous months.

Conclusion and Valuation

We expect an upgrade in Wall Street consensus estimates (we were already above their expectation). The company delivered solid three-month accounts and the 2022-2026 guidance was left unchanged supporting our positive company view. Thus, we confirm our previous valuation.

Be the first to comment