Ron and Patty Thomas/E+ via Getty Images

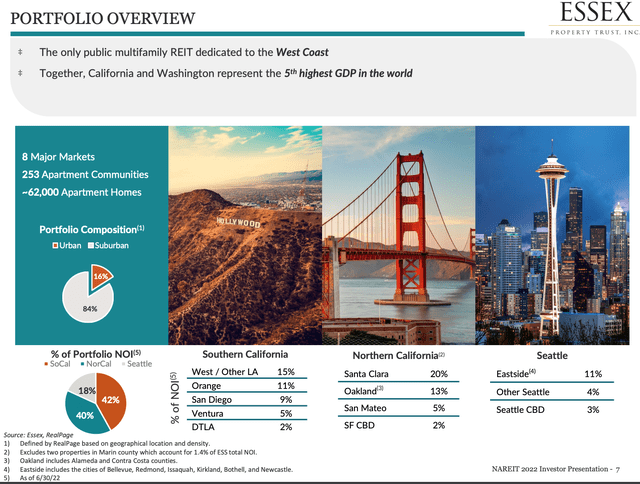

Shares of the west coast apartment giant Essex Property Trust (NYSE:ESS) have declined 36% year-to-date as the rapid increase in interest rates coupled with investor fear over potential declines in technology related employment (ESS properties are mainly located in tech hubs -see below) have led to a dramatic sell-off in the stock. However, long term fundamentals for Essex remain strong and I believe shares represent a bargain for long-term, conservative investors.

Essex Overview (Essex Investor Presentation)

Favorable Supply Dynamics

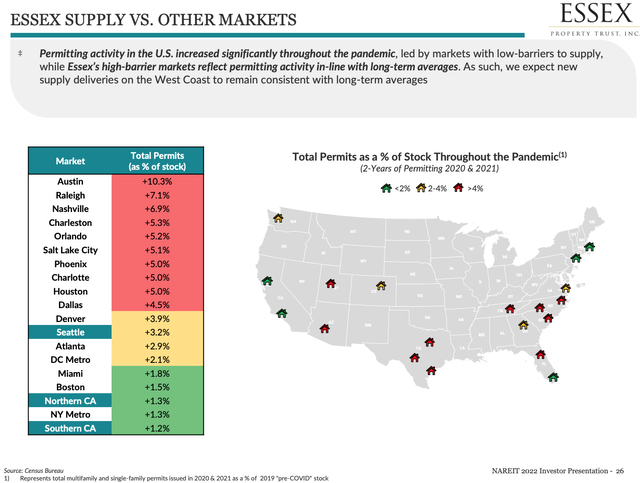

Strong apartment fundamentals coupled with low interest rates (until recently) have led to an apartment building boom with new construction near all-time highs. While national supply growth is near all-time highs, forthcoming supply increases vary widely by region. As shown below, sunbelt markets (Texas, Arizona, Georgia) are set to see large increases in new apartments (on the back of pandemic induced acceleration in migratory trends) whereas supply growth remains muted in Essex’s key west coast markets.

Supply Growth by Market (Essex Investor Presentation)

Essex west coast markets are structurally insulated from new supply due to several factors including:

-Municipal building codes (including restrictions on building height) which prohibit meaningful supply additions.

-Prohibitive environmental & earthquake restrictions which prevent new apartment additions and impose costly delays on projects which are eventually green lit.

-A high cost of land and construction owing to onerous building codes and high labor costs.

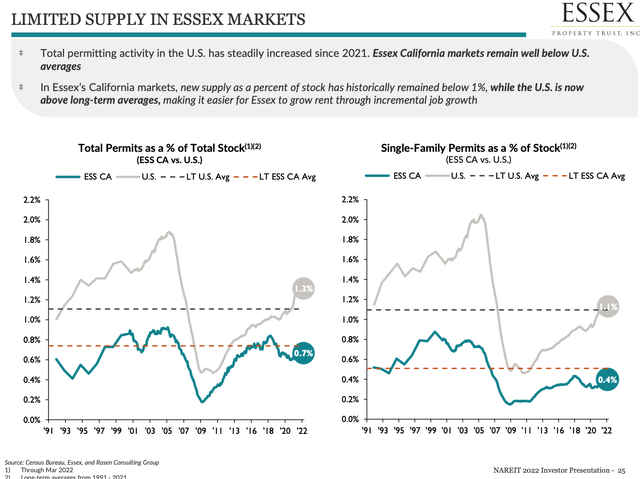

These factors have structurally limited apartment construction in California for decades. As you can see below, permitting in Essex markets has been well below national averages since 1990.

West Coast Apartment Supply since 1990 (Essex Investor Presentation)

Demand – Long-Term Outlook Remains Robust

In addition to favorable supply dynamics, Essex benefits from the long-term growth in technology sector employment given that 85% of its properties are located near or in tech/biotech/entertainment hubs (SF Bay Area, Seattle, LA).

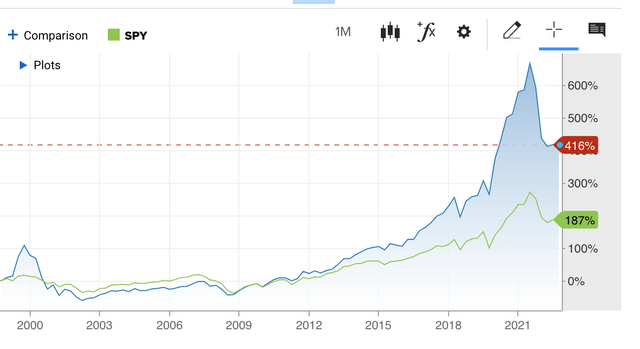

While shares of technology companies have been weak in 2022 with the Nasdaq ETF down 32% year-to-date, over the long term technology shares and employment have experienced tremendous growth. As you can see below, over the past 25 years, the Nasdaq has handily outpaced the S&P500 (even including the tech bust of the early 2000s).

Nasdaq (red) vs. S&P500 (green) (CNBC)

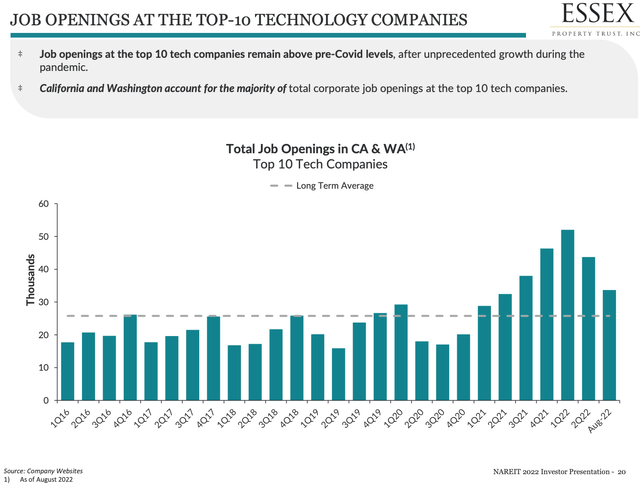

Essex is an indirect beneficiary of tech sector employment growth as California is home to a disproportionate number of large and growing tech companies. While tech sector employment growth is slowing with the economy, large tech companies are still adding jobs at a healthy pace in California as shown below.

Big Tech job openings in CA (Essex Investor Presentation )

Putting It All Together

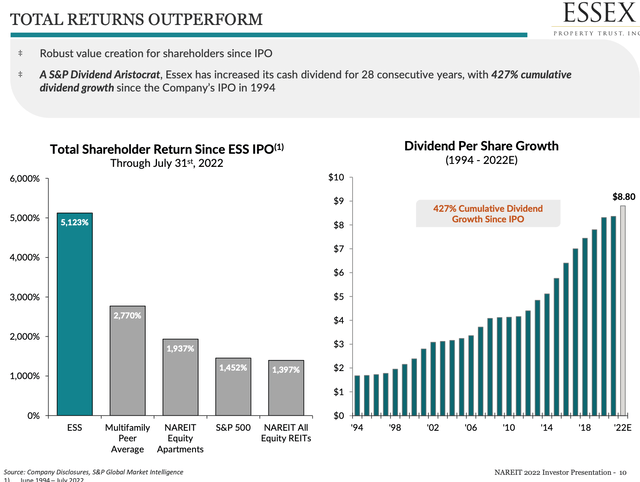

With favorable long-term supply and demand characteristics in its key markets, Essex has proven to be a long term compounder.

Long-term Outperformance (Essex Investor Presentation)

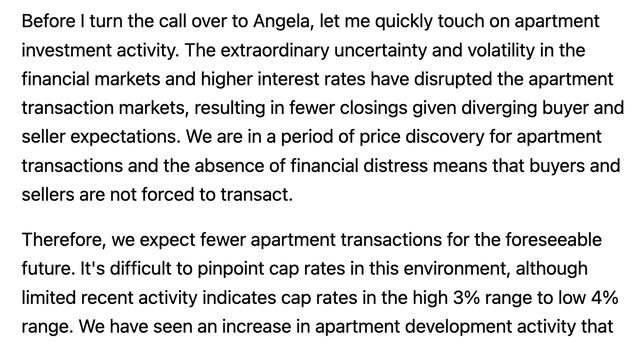

At a recent price of $227/share, Essex trades just 15x 2023e core FFO which is at the low-end of its historical range of 14-25x over the past decade. Similarly, Essex trades at an implied cap rate of 5.6% which is at the high end of not only its long-term range (3.8-5.8% over the past decade) but a large discount to recent private market values in its key markets which management estimated to be at in the high 3s/low 4s on its 2Q conference call (see below).

ESS 2Q22 Management Commentary (Seeking Alpha Transcripts)

As mentioned in the conference call excerpt, transactions in the private market have slowed considerably given the rapid rise in interest rates which suggests we could see some upward pressure on market cap rates. That said, there is considerable cushion between Essex’s implied cap rate of 5.6% and the ~4% cited by management. A 4.25% cap rate implies a per share NAV for ESS of $340, representing 50% upside.

Essex Property Trust is a high quality apartment REIT with favorable long-term supply and demand dynamics trading at the low-end of its historical valuation range and a significant discount to private market values. As such I see it as a very attractive investment opportunity for long-term, conservative investors.

Risks

1/ Management transition – Long-time CEO Mike Schall announced he will retire in March 2023. While Schall has done an excellent job at Essex, his successor, Angela Kleiman has been working side by side with Schall, serving as CFO and COO and I believe the management transition will be smooth.

2/ Continued interest rate increases lead to further near-term declines in REIT prices.

Be the first to comment