mr.suphachai praserdumrongchai

Humility is to make a right estimate of oneself.” – Charles H. Spurgeon

Today, we put the spotlight on a small biopharma concern from north of the border. The stock basically trades at cash value and there has been some recent purchases by a beneficial owner as well. An analysis follows below.

Company Overview:

ESSA Pharma Inc. (NASDAQ:EPIX) is a Vancouver, British Columbia-based clinical-stage biopharmaceutical concern developing therapies that disrupt the androgen signaling pathway with an initial focus on metastatic castration-resistant prostate cancer (mCRPC). The company is essentially a one-compound and one-target concern, with its EPI-7386 undergoing evaluation as both a monotherapy and in combination with other approved therapies in early-stage trials. ESSA was formed in 2009 and went public in 2015, raising net proceeds of $11.3 million via a warrant offering on the Toronto Venture Exchange. It shares listed on the NASDAQ later that same year, with their first trade transacting at $85.40, after giving effect to a 1-for-20 reverse stock split. Shares of EPIX trade just under three bucks a share, translating to a market cap of $125 million.

[Note: Although the company operates on a fiscal year ending September 30th, all references to periods below will be on a calendar basis.]

Opportunity

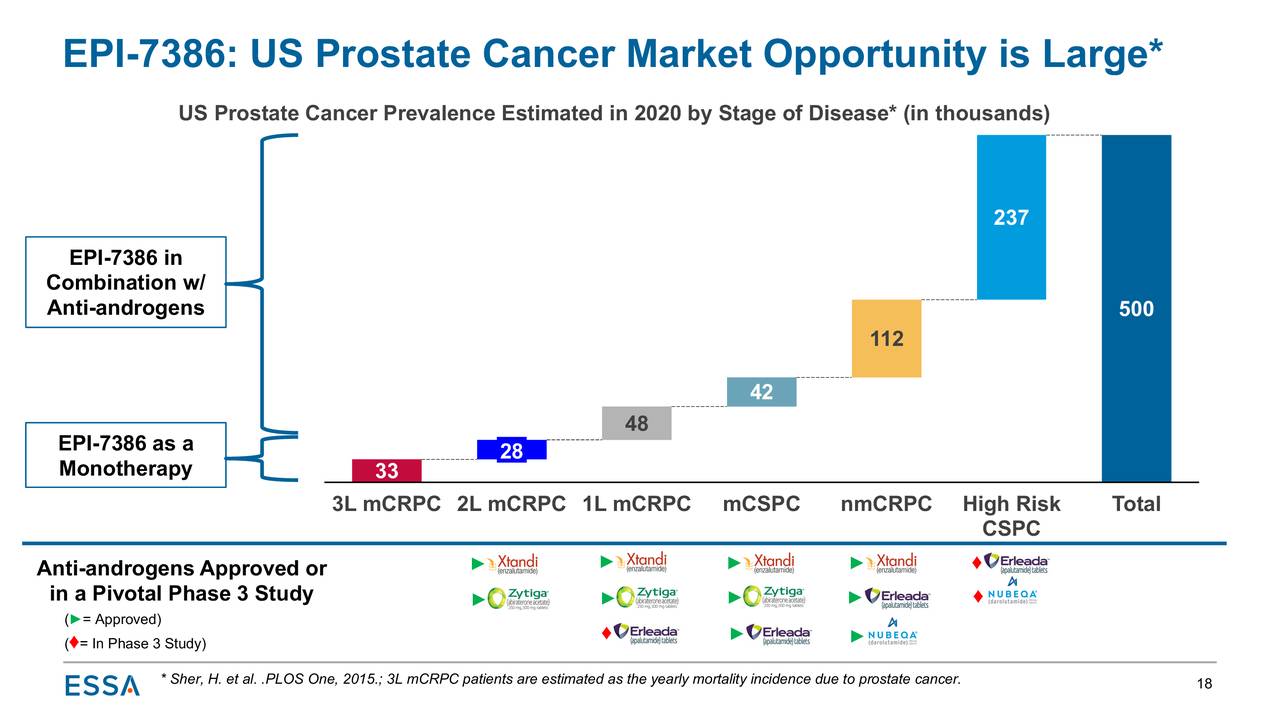

Prostate cancer is the second most common cancer among American men – after skin cancer – with ~268,500 new cases and ~34,500 deaths forecasted in 2022, according to the American Cancer Society. The disease will eventually afflict 1 in 8 males, but if detected early enough, it has a nearly 100% survival rate.

Case in point: there are nearly ~3.1 million men in the U.S. who have been diagnosed with prostate cancer that are still alive today. There are many approaches to treating the localized version of the disease, with surgery and radiation most prevalent. About one-third of these patients will experience recurrent disease, which is sometimes treated with hormone therapy known as androgen deprivation therapy [ADT]. This approach prevents prostate cancer cells access to testosterone and other male sex hormones (i.e. castrate levels), necessary for their growth – and increasingly in combination with therapies known as antiandrogens, which block hormones such as testosterone.

When this treatment fails, patients are deemed to have CRPC, at which point they are treated with one of two second-generation antiandrogens: Johnson & Johnson’s (JNJ) Zytiga (abiraterone acetate); as well as Astellas (OTCPK:ALPMF, OTCPK:ALPMY) and Pfizer’s (PFE) Xtandi (enzalutamide). On the whole, antiandrogens represented a ~$7.5 billion market in 2020.

March Company Presentation

Biology

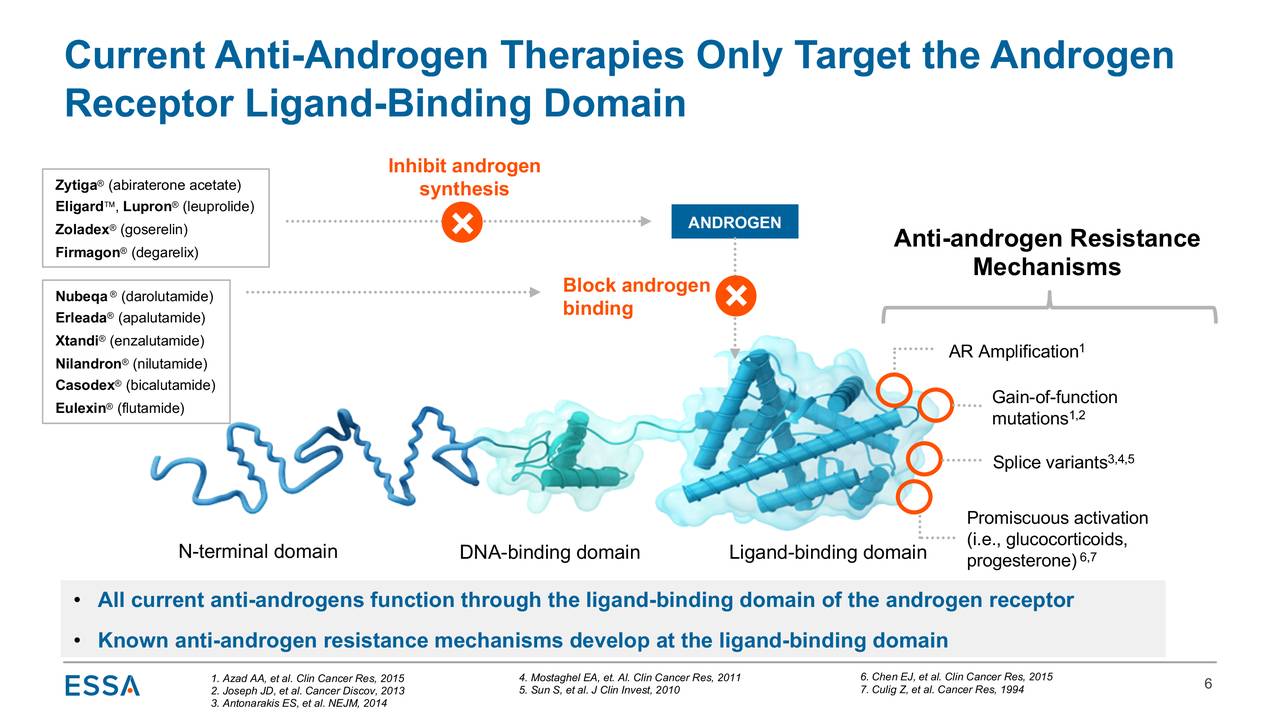

The androgen signaling pathway is the primary pathway that drives prostate cancer growth. Pharmaceutical concerns have targeted different aspects of this pathway, with many employing the aforementioned antiandrogens, which interfere with either androgen synthesis or the binding of androgens to the ligand-binding domain (LBD) of the androgen receptor in patients with CRPC.

Although improvements in survival measures have been achieved employing these second-generation antiandrogens (which also include J&J’s Erleada (apalutamide) and Bayer’s (OTCPK:BAYZF, OTCPK:BAYRY) Nubeqa (darolutamide)) in conjunction with ADT earlier in the disease’s progression, ESSA believes that this approach can be improved upon, focusing rather on the prevention of androgen receptor activation by binding selectively to its N-terminal domain (NTD), which is located at the opposite end of the LBD.

Although this idea has been around for decades, given the physical properties of NTD, creating a compound to bind to it has been viewed as extremely difficult. The company believes it has overcome these binding obstacles, with its therapies (dubbed “Aniten” compounds) inhibiting androgen receptor driven transcription, essentially disrupting androgen-receptor gene expression and thus the prostate cancer pathway. ESSA is the only biotech with a NTD binder in the clinic. Given that currently approved therapies bind to one side of the androgen receptor and the company’s treatments to the other side, the potential for combination therapies exist – more on that dynamic below.

March Company Presentation

Initial Failure

That said, ESSA’s first for foray into a prostate cancer treatment employing this approach was NTD inhibitor EPI-506, a candidate that was studied in mCRPC patients refractory to current standard of care therapies in a Phase 1 trial. Although the compound demonstrated some pharmacokinetic activity in the higher-dose cohorts – with short duration prostate-specific antigen [PSA] declines up to 37% in patients who had failed antiandrogen therapy – it was determined that its inhibition was neither deep nor sustained enough to confer clinical benefit, owing to its rapid metabolization. These outcomes compelled the company to suspend development of EPI-506 in 2017 to concentrate on the development of a more potent compound with a longer half-life.

EPI-7386

After several years back in the lab, the result was EPI-7386, which is EPI-506 with multiple modifications to its chemical scaffolding to overcome the latter’s shortcomings. The oral compound entered the clinic in July 2020, undergoing evaluation in an open-label, dose-finding, two-part Phase 1 study as a monotherapy in refractory mCRPC patients in a third-line or later setting. In the 36-patient Phase 1a portion, in addition to being well tolerated at all doses, the most significant development was that all five patients who were on therapy for more than 12 weeks demonstrated tumor volume decreases. The Phase 1b portion is expected to commence in 3Q22 with two dose cohorts being evaluated.

ESSA has also entered clinical collaborations with all four second-generation antiandrogens to assess EPI-7386 in combination with them in a first or second line setting for patients with mCRPC in Phase 1/2 trials. The most advanced of which is its study in combination with Xtandi, the initial results of which suggested safety, tolerability, and preliminary efficacy. Also, the company anticipates its candidate entering an investigator-sponsored neoadjuvant Phase 2 study evaluating Nubeqa against EPI-7386 plus Nubeqa in patients undergoing prostatectomy for high-risk localized prostate cancer sometime in 2H22.

Stock Price Performance

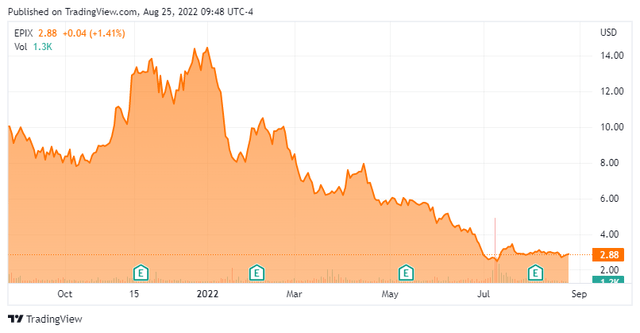

Although the future may hold substantial upside for EPI-7386, the market has tired of ESSA, mostly due to trial delays and cloudy press releases that leave open for interpretation both the effectiveness and the market size for its therapy. It can be argued that these assertions are unfair given that Phase 1 studies are not powered to measure efficacy, but after seven years as a public company with the same concept, ESSA has still not reached a Phase 2 trial.

However, with clinical collaborations encompassing all four second-generation antiandrogens announced during the 1H21, shares of EPIX rallied to $36.00 a share in May 2021, further buttressed by a corporate update stating that additional clinical data from EPI-7386’s monotherapy Phase 1 trial would be forthcoming in 4Q21. However, when management provided another update on August 16, 2021, the timeline for monotherapy data was pushed into late 1H22, excusing the delay to the addition of higher dose cohorts and the filing of a protocol amendment to restrict enrollment to third-line patients (and no later) in whom the androgen receptor pathway is the primary driver of tumor growth.

The market read this development as a potential efficacy issue at worse, a timeline delay at best, and a smaller addressable market in the middle. With no conference call on which management could further expound, shares of EPIX cratered 34% from $11.92 to $7.81. Curiously, ESSA had already fallen out of favor with investors in July and early August 2021, prior to the nosedive in the broader biotech sector. Its stock plunged 43% in the week prior to the data delay announcement on extremely high volume, as if someone just wanted out, price be damned. Speculation aside, it was the right call as the stock is now down 90% since its May 2021 high as its June 27, 2022 update (that referenced the five of five patients demonstrating tumor reductions) also alluded to possible ineffectiveness due to many late-stage mCRPCs not being driven by the androgen receptor. Furthermore, with Phase 1b trials not scheduled to initiate until this quarter, when would efficacy-measuring Phase 2 trials actually begin?

Balance Sheet & Analyst Commentary:

Before the first shoe dropped in mid-2021, ESSA leveraged its clinical collaboration news, conducting a secondary offering in February 2021, raising net proceeds of $140.8 million at $27 per share, providing it with a cash runway through 2024. As of the end of the second quarter, the company held cash and investments of $174.6 million and no debt with a quarterly burn of ~$10 million.

Despite its wretched stock price performance driven by skepticism as to the efficacy and market opportunity for EPI-7386, the four Street analysts who follow ESSA remain constructive, albeit with significant egg on their faces. They have not said much in 2022, featuring two buy and two outperform ratings, although Piper was forced to significantly revise its price target from $50 to $20 in May 2022.

After pushing below $2.50 on July 12, 2022, shares of EPIX received a boost when it was revealed that beneficial owner Biotech Growth NV added over 888,000 shares to its position during the July 14th, 15th, and 18th trading sessions at an average price of $3.01. Those transactions upped its ownership interest to more than 13%.

Verdict:

The issue with ESSA is transparency. Press releases are worded in a way that are open to interpretation, which could be construed as the company purposely being vague. With no conference calls to clear the air, the market is left with no alternative but to doubt the messaging. That said, (again) Phase 1 trials are not powered for efficacy determinations but when no Phase 2 trials have been conducted in seven years, the investment community cannot be blamed for trying to render efficacy determinations from Phase 1 tealeaves. In theory, its approach represented by EPI-7386 makes plenty of sense, especially in combination with second-generation antiandrogens. However, uncertainty abounds and will likely continue into its next corporate update sometime in mid-August.

That criticism notwithstanding, ESSA is trading at a significant discount to cash and investments on the balance sheet, providing would-be investors with significant insulation to any additional vague updates. If the next update is positive and clearly stated, its stock has significant upside and becomes a possible takeout candidate. With ~$175 million in cash, a market cap of $125 million, and an antiandrogen market of $7.5 billion, this perpetually early-stage, high-risk company is worth the gamble for high-risk tolerant investors. And then only within a very small “watch item” holding for now.

He that is proud eats up himself: pride is his own glass, his own trumpet, his own chronicle.” – William Shakespeare

Be the first to comment