Justin Paget

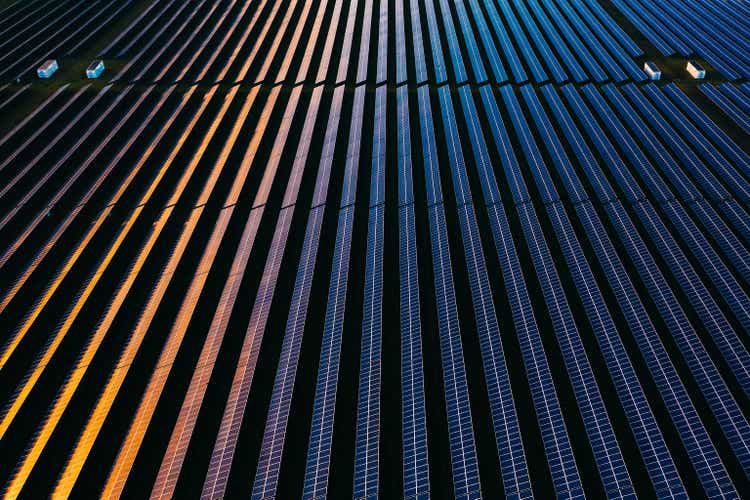

The recently passed Inflation Reduction Act represents an 800-pound gorilla set to further bolster an industry already experiencing long-term structural growth. The IRA allocates $370 billion over 10 years to decarbonization initiatives and is the largest climate and clean energy investment in US history. It will form a crucial part of the US effort to reduce greenhouse gas emissions to 50% below 2005 levels by 2030 and would build on commitments made with the 2015 Paris Agreement. The Act is essentially set to materially ramp the rollout of clean energy in the United States and will catalyze a generational boom in utility-scale energy storage.

To be clear, the US rollout of renewable energy was already undergoing a material ramp and was fast expanding its role in the energy production mix of the United States. The Inflation Reduction Act is set to supercharge an even faster shift to renewables by bringing forward new utility-scale deployments through what is set to be an unprecedented level of government intervention. The Boston Consulting Group has forecasted that the incentives included in the Inflation Reduction Act could increase the deployment of zero-carbon energy to up to 80% of electricity production as soon as 2030. This would be up from around 20% of production currently. Indeed, utility-scale solar deployments are set to increase by 40%, around 62 GW, over pre-IRA projections through 2027.

Wilsonville, Oregon-based ESS (NYSE:GWH) has developed long-duration iron flow batteries that use just water, salt, and iron. This differs materially from the current short-duration lithium-ion battery storage. Long-duration batteries can discharge power over 12 hours which is around 3x longer than present lithium-ion batteries. Apart from the longer duration, it also has a number of other benefits from more optimal performance under different weather conditions, low capacity fade, and an enhanced ESG profile as it does not require mined lithium. This is especially important as lithium prices have spiked over the last year to reach record highs as demand booms and new supply is being blocked around the world on environmental grounds. Current ESS customers have also so far received a 25-year warranty on charging and discharging cycles without deterioration.

A New Macro Environment Begins

The need for a suitable alternative to lithium is now clearer than ever and ESS is the only manufacturer of flow batteries with nontoxic and nonflammable iron and saltwater electrolyte. All these materials are incredibly abundant and can be sourced wholly within the United States. This is important from a geo-political perspective as lithium refining is highly concentrated in China. The company is still a somewhat speculative investment as it recorded near zero revenue when its last released earnings for its fiscal 2022 second quarter. The lack of revenue was odd considering a number of meaningful operational achievements during the quarter.

Post-period end ESS announced a flow battery deal with the Sacramento Municipal Utility District. This will see the deployment of a 2GWh flow battery from 2023 that will support decarbonization efforts by the utility. This is likely set to be the first of many deals that ESS will announce as its ramps its production capacity and its technology is deployed and validated by its utility customers. This comes as the company doubled its annual production capacity to 500 MWh during the quarter with work underway to further increase this to 750 MWh. This would be more than 3x the capacity in started 2022.

The company ended the quarter with cash and equivalents of $192 million as cash burn from operational activities rose 78% year-over-year to reach $15.2 million. With a capital expenditure of $4.4 million, the company has a runway that extends far beyond the next twelve months. This is great as the current market condition has all but destroyed fundraising opportunities for growing yet cash-burning companies.

Battery Storage For The Renewable Energy Rush

ESS is a unique company entering a space set for structural growth. The future is bright with renewable energy set for a near pertinent time in the sun. Hence, I intend to add the company to my watchlist with a potential high-risk purchase plan possible. The company will have to show healthy revenue momentum before I make a decision on whether to purchase its commons. Further, the long-duration energy storage space is still evolving to become more intensely competitive with dozens of companies also developing their own solutions to the intermittency problem. The number of solutions ranges from liquid air to high-density hydro to compressed-air energy storage. There is also gravity and kinetic energy-based long-duration storage from the recently IPOed Energy Vault (NRGV).

Against what can only be described as a generational transformation of the energy production mix, ESS potentially offers investors an alternative way to gain exposure to the Inflation Reduction Act’s enhanced decarbonization wave. Battery storage is critical to make renewables viable and ESS looks like it has placed itself at the center of the long-duration part of the market.

Be the first to comment