Khanchit Khirisutchalual/iStock via Getty Images

If you are interested in ESG investing, you may be wondering if you are going to pay a performance penalty for doing so. In order to look back and compare the performance of traditional investments versus those that are better in terms of their “ESGness”, you will need to do some historical comparisons. But what investments are considered “ESG” and to what extent? For this, we look to ESG ratings, and this can be complicated.

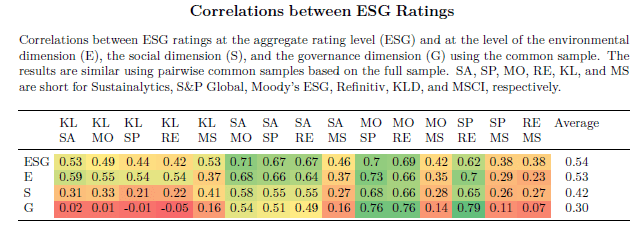

In a white paper first distributed in 2019, researchers looked at the divergence of ratings from the most well-known ESG raters in the world. U.S. Investors may be most familiar with Sustainalytics (Morningstar), S&P Global, MSCI, and Moody’s ESG. What they found was that the correlation between the ratings was not very strong. In fact, frequently the ratings disagree – sometimes materially. The researchers found that each rating agency selected its own set of attributes. Secondly, when they did agree on attributes, they may have different criteria for measurement. And lastly, they each ascribed their own weighting to the resulting criteria.

This table from the paper shows that the correlations between the ratings agencies rarely went above 0.7, and also that those correlations were best for the “E” in ESG and worst for the “G.”

Author

As the paper notes, the ratings’ lack of coherence will be confusing for investors trying to choose investments with the highest level of positive Environment, Social, and/or Governance characteristics. Also, it may lead to unintended consequences, as CEOs or other decision-makers are incentivized to hit targets based on the metrics of a particular rater, which may or may not lead to the better outcomes investors are striving for.

The paper does an excellent job of describing the problem. What about solutions? It is tempting to say that is it all so complicated and confusing that there is no point in trying to rank or distinguish the companies on these metrics. The paper goes on to say “ESG rating divergence does not imply that measuring ESG performance is a futile exercise.” The paper suggests that what is needed are objective standards, more transparency in data, and a regulatory framework on what is included and measured in ESG ratings.

The Securities and Exchange Commission has indicated it is very interested in increasing the quality of information that is disclosed to investors. On May 25, 2022, the SEC released a 362-page document for comment to improve disclosure and terminology. We are sure it will not be the last word on improving the standards in this area.

Source: MIT Sloan/ University of Zurich White Paper “Aggregate Confusion: The Divergence of ESG Ratings January 14, 2022 (Original Version August 15, 2019)”

Sources of Information: Certain of the economic and market information contained herein has been obtained from published sources and/or prepared by third parties. While such sources are believed to be reliable, none of the Firm or their respective affiliates, employees, and representatives assume any responsibility for the accuracy of such information.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment