alfexe/iStock via Getty Images

One thing that many people have in common is a love for sports and outdoors-oriented activities. Due to the significant amount of interest in these things, a variety of companies have developed over the years that are dedicated to offering the goods and services related to them. A great example of this could be seen by looking at Escalade, Incorporated (NASDAQ:ESCA), a producer, importer, and distributor of popular sporting goods brands such as Bear Archery, Ping-Pong, Goalrilla, and more. Recently, however, the company has been hit because of weak financial performance. With sales falling and profits following suit, investors have lost a great deal of optimism they previously had for the firm. Beyond any doubt, this makes sense. But at the end of the day, shares of the company do still look incredibly cheap and, once this downturn comes to an end, the upside potential for shareholders from here could be quite appealing. So while I do recognize that the company may experience a great deal of volatility in the near term, I also think that the long-term picture is strong enough to still warrant the ‘buy’ rating I had on the stock previously.

A hit and a miss… so far

Back in April of this year, I wrote a bullish article about Escalade. In that article, I talked about the strong growth the company had experienced leading up to that point, including not only during the prior fiscal years but also throughout the early stages of 2022. I found myself impressed with the fact that sales and cash flows were performing nicely year over year when looking at data covering only through the first quarter of 2022. Add on top of this the fact that shares of the company looked quite cheap from a valuation perspective, and I could not help but to rate the firm a ‘buy’ to reflect my view that the stock should outperform the broader market for the foreseeable future. Unfortunately, things have not gone exactly as planned. While the S&P 500 is down 9.8%, shares of Escalade have generated a loss for shareholders of 21.7%.

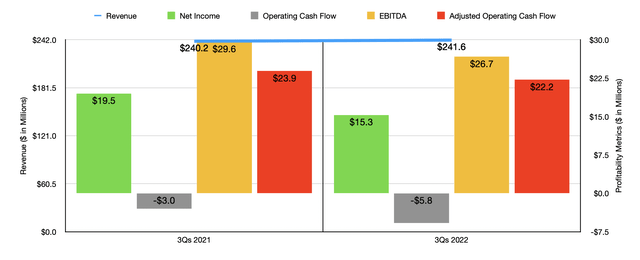

The extent to which this decline is warranted will depend on the lens that you use when looking at the company. For instance, if you look at data covering the full nine months of the company’s 2022 fiscal year so far, you might be perplexed. Revenue during this window of time, for instance, came in at $241.6 million. That’s marginally higher than the $240.2 million generated the same time last year. Yes, net income for the company did manage to fall during this timeframe year over year, dropping from $19.5 million to $15.3 million. In addition to that, operating cash flow went from a negative $3 million to a negative $5.6 million. But on the other hand, other profitability metrics didn’t look so bad. If we adjust for changes in working capital, operating cash flow would have ticked down only modestly from $23.9 million to $22.2 million. Meanwhile, EBITDA dropped a modest amount as well, falling from $29.6 million to $26.7 million.

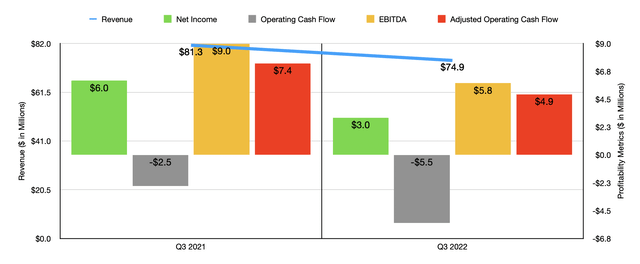

Based on these results alone, things don’t look all that bad, especially considering how volatile the economy has been. But when you look at data that covers a shorter timeframe, such as the third quarter of 2022 as a whole, things look different. And not in a positive way. Revenue in the latest quarter totaled $74.9 million. That’s 7.9% lower than the $81.3 million generated the same time last year. According to management, this sales decline was driven by softening consumer demand and excess inventories in the company’s retail channel. This is not to say that everything was bad. For instance, increases in billiards and pickleball sales were positive for the company, as was the fact that the firm benefited from its acquisition of Brunswick Billiards that was completed in January of this year. But outdoor sales in categories such as archery, games, water sports, and playground activities, all dropped materially year over year.

To make matters worse, the picture might be even more painful in the near term. As of the end of the latest quarter, the company had nearly $135 million in inventories. That was up from the $92.4 million reported at the end of the firm’s 2021 fiscal year and compares to the $91.8 million reported in the third quarter of last year. Finished goods inventory over the past year rose significantly, climbing from $77.7 million to $120.4 million. When inventories become bloated and the demand for those types of goods drops, it can be problematic because it can force the company to sell off this excess inventory at significant losses. And with inventory gluts existing across many aspects of the retail space, the end result could be painful for all parties involved.

On the bottom line, we also saw some additional pain. The company’s net income was cut in half, falling from $6 million to $3 million. Operating cash flow worsened from a negative $2.5 million to negative $5.5 million. Even if we adjust for changes in working capital, it would have plunged from $7.4 million to $4.9 million, while EBITDA tanked from $9 million to $5.8 million. Although the company did well to cut costs in some categories, such as selling, general, and administrative expenses, which collectively dropped from 12.6% in the third quarter of 2021 to 11.7% the same time this year, other areas proved problematic. The company’s gross profit margin, for instance, dropped from 22.5% to 18.2% during this same window of time. This was due to a number of factors, such as lower sales, unfavorable product mix, supply chain constraints and expenses, and some non-recurring recall expenses associated with certain products.

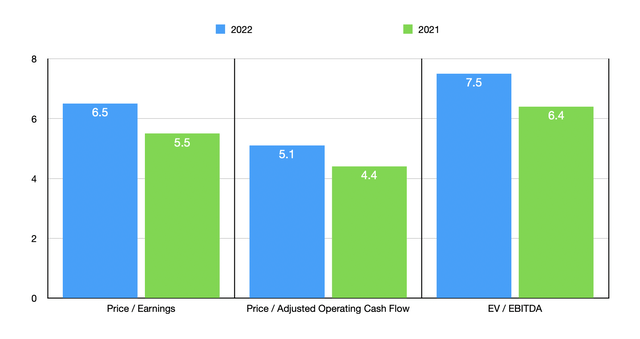

We don’t really know what to expect when it comes to the rest of the 2022 fiscal year. If we assume that the final quarter looks a lot more like the third quarter did, then we might anticipate net income of $20.7 million, adjusted operating cash flow of $26.4 million, and EBITDA of $31.3 million. Based on these figures, the company would be trading at a forward price to earnings multiple of 6.5, a forward price to adjusted operating cash flow multiple of 5.1, and a forward EV to EBITDA multiple of 7.5. Although these numbers look cheap on an absolute basis, they are more expensive than if we were to use data from the 2021 fiscal year. This can be seen in the chart above. As part of my analysis, I also compared the company to five similar firms. As you can see in the table below, when it comes to the price-to-earnings approach and the price to operating cash flow approach, Escalade was cheaper than all but two of the companies in the group. But when it comes to the EV to EBITDA approach, four of the five were cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Escalade, Incorporated | 6.5 | 5.1 | 7.5 |

| Vista Outdoor (VSTO) | 3.6 | 4.0 | 4.0 |

| Big 5 Sporting Goods (BGFV) | 6.3 | 5.0 | 3.2 |

| Sturm, Ruger & Company (RGR) | 9.1 | 9.3 | 4.7 |

| Topgolf Callaway Brands Corp. (MODG) | 19.9 | 61.8 | 10.5 |

| Johnson Outdoors (JOUT) | 13.6 | 119.2 | 6.2 |

Takeaway

Clearly, the fundamental picture for Escalade is in the process of worsening. This is problematic for shareholders and could continue to create pain for the company and its investors moving forward. In truth, I wouldn’t be surprised to see the company take some sizable losses on its inventories over the next 6 to 12 months. Eventually, though, it’s likely that the picture will improve and, should this come to fruition, the stock will look rather appealing even if we end up with a new normal that is more similar to what this year is looking to be as opposed to what the past couple of years have been.

Be the first to comment