Spencer Platt/Getty Images News

Summary

I recommend a BUY rating on Ermenegildo Zegna (NYSE:ZGN). As they say, the clothes make the man. Humans ooze confidence when they feel good about themselves. This is why ZGN has set out to reach the billions of people in the world with its luxury. I believe the brands under the ZGN portfolio are built to last, and their moat compounds over time, which is music to long-term investors’ ears.

Company overview

Renowned all over the world for its Zegna and Thom Browne brands, ZGN specializes in designing, manufacturing, marketing, and distributing men’s wear, footwear, leather goods, and other accessories that are dripping with luxury. It provides elegant women’s wear and children’s wear under the Thom Browne brand. Following closely behind all these is the vast array of accessories: eyewear, cufflinks, jewelry, wristwatches, underwear, and beach wear, all manufactured by third parties under license. ZGN’s operations stretch into every step of the value chain because of its role in design production and distribution.

The business is classified into two segments: The Zegna segment and the Thom Browne segment.

A strong brand is one of the strongest business moat

A moat is a layer of protection, filled with water, that was dug around cities in ancient times. Any invader will find fording through the moat a nigh impossible task. This is why Zegna has stood tall for the past 110 years. A strong market presence is, most of the time, the best defence of a brand.

Starting out as a fabric-producing business, Zegna has gradually morphed into a global luxury brand, its products enjoying a reputation for style, quality, and innovation. A century and a decade later, the founder’s vision, like a genetic trait, has been passed down through the generations. The founder’s legacy is of a sustainable business, where giving back, social responsibility, and community wellbeing are vital parts of the brand’s existence. From production technology to brand-consumer relationships, sustainability has been the watchword.

Now, there is a new development. In the 4th quarter of 2021, Zegna unveiled a rebranding strategy. From the winter/fall of 2022, the Ermenigildo Zegna, Z Zegna, and Ermenigildo Zegna XXX brands will be consolidated into a single brand. This union will be consummated with a new logo, designed to be iconic and easily recognizable. With this, ZGN can focus its attention on its collection and make the new leisure wear more popular.

Luxury goods have low price sensitivity

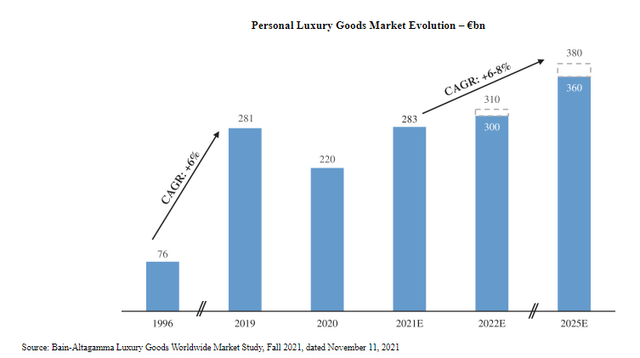

One advantage Zegna possesses as a luxury brand is its low sensitivity to changes in price. Demand is driven by quality and the reputation of the brand selling the goods. This is why one will buy a wristwatch produced by a big brand for thousands of dollars without hesitation. The reputation justifies the price. Also, the goods produced by a luxury brand stand out among others, unable to be confused for lower-tier products. The global luxury goods market was valued at €283 billion in the year 2021, after growing steadily for about two decades with a CAGR of 6% from 1996 to 2019.

Vertically integrated business model

ZGN reaps the fruits of a vertical supply chain as a result of its insightful acquisitions over the years. It deploys the service of an in-house laboratory that allows its experts to focus on innovation and research of the finest products. It also helps them make their manufacturing process more flexible and efficient by making it more modular.

Due to the profitable relationships they have had with their suppliers, they have been able to enjoy the highest quality of fibers and fabrics. With the competence of ZGN’s personnel, it has been able to manage the production process across the various stages, either in the firm’s laboratory or through the network of trusted external harnesses.

The quality Zegna provides is the reason it is able to meet the demands of the market and other luxury brands affiliated with it.

Innovative new products to capture new customers

ZGN continues to evolve, launching new, superior products that can be easily recognized. The Triple Stitch shoes are one such product. Management has been able to identify significant opportunities to exploit the brand’s reputation and customer base. This is achievable when it enhances the current products and introduces new product categories that will attract new customers and appeal to the needs of a younger, more diverse audience.

Digitization is the norm these days

Digital technology has been an integral part of ZGN’s operations since day one. It has proven vital to strengthening processes and brands, attracting new customers and retaining the present customer base. The Zegna segment has a DTC channel, with an e-commerce store that operates in different countries under the aegis of the website (www.zegna.com). There are also other ways for customers to interact with the company, such as through sales and warehouse management systems that work together.

Also, the Thom Browne segment has its own DTC channel that includes an e-commerce shop operated from the website www.thombrowne.com. This brand is especially skilled at using its huge digital market presence to attract traffic to its physical stores.

As time goes on, ZGN’s digital capabilities are bound to skyrocket, ensuring effective customer service and direct messaging, and being used to support data-driven marketing activities and customer service. By improving this digital capability, ZGN will be able to reach a wider range of people while still sharing its identity and values.

Valuation

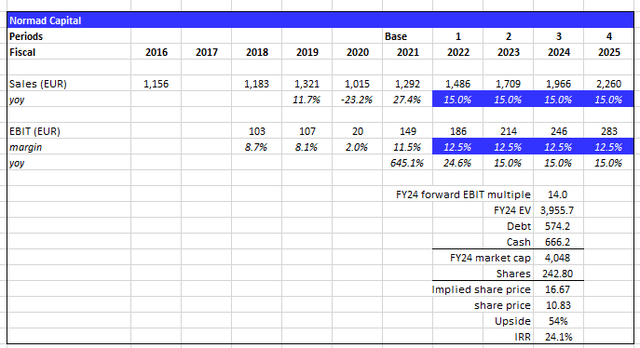

At the current stock price of $10.83 and 242.8 million shares, the market cap is ~$2.6 billion. I believe the current valuation is an attractive entry point for investors as my model suggests >50% upside. I want to highlight that my model did not factor in major inflections in margin, which could happen due to the initiatives set out by management.

I believe ZGN will make $2.3 billion in sales and $283 million in EBIT in FY25. This will be driven by mid-teens revenue CAGR until FY25 supported by growth initiatives and recovery from luxury consumption estimates in China. EBIT margin to increase by 100bps from FY21, as guided by management in 2Q22 earnings, giving it a market cap of $4 billion and a stock price of $16.7 in FY24, assuming it trades at 14x EBIT in FY24.

Assumptions:

- Sales: to follow management’s guidance in FY22 and continue growing at similar pace

- EBIT: to expand as management guided and stay stagnant moving forward

- Valuation: I assume no change in valuation and that it should continue to be valued using the current forward EBIT multiple of 14x in FY24.

Risk

Fashion trend is hard to predict

ZGN’s continued success relies greatly on its ability to anticipate and exploit fashion trends in the market, as well as being able to adapt to customer preferences in time. The difficulty of appealing to a diverse audience with a vast array of preferences cannot be underscored. If ZGN is unable to predict and respond to new trends or changes in preferences, the brand could find itself going downhill.

Huge exposure in China

A huge portion of Zegna’s sales come from the Greater China region, where a direct retail presence has been built since 1991. Demand has increased in recent years due to a long streak of economic growth. However, there is no way to guarantee such growth (as seen from COVID). Any problems along these lines will see sales drop off rapidly.

Conclusion

ZGN is worth investing in as I believe it is undervalued. ZGN is a flexible company that is constantly adapting to the market structure, creating new products to meet customers’ needs. This means it is poised for any market change in the future. Also, it will not suffer from any change in price because of the nature of its business. This makes it the best business model to invest in.

Be the first to comment