Galeanu Mihai

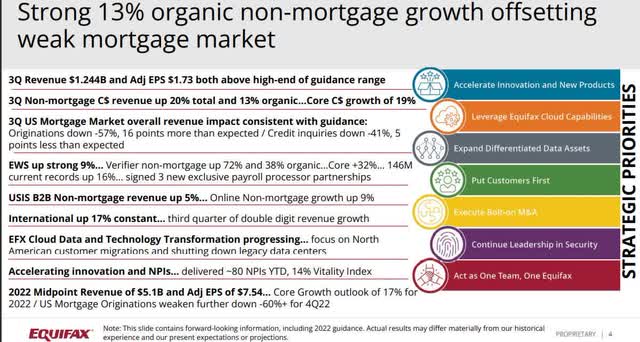

In its latest earnings report Equifax Inc. (NYSE:EFX) reinforced the fact that its strategy to transition to a company delivering a diversity of revenue streams is working, as revenue from non-mortgage businesses accounted for over 78 percent of revenue in the quarter, led by the ongoing strength of its Workforce Solutions segment, which has non-mortgage revenue of about 70 percent as of the latest reporting period.

From my dive into the company, I think a better way of thinking of it is a company that applies its expertise of vetting across a variety of verticals. Among the fastest growing categories in the company are “identity and fraud, talent management, government and employer services.”

The non-mortgage business of EFX has grown by over $1.1 billion since 2019 with a total CAGR of 12 percent since that time. By the end of 2022 the company expects non-mortgage revenue to account for more than 75 percent of all revenue the company generates. For the fourth quarter management guided for it to come in at over 80 percent of total revenue.

I’m focusing on this because many investors still analyze the company as if it still is predominately competing in the mortgage sector, rather than being the diversified company it now is.

That’s not to suggest the performance of its mortgage business won’t have an impact on how the company does, only that the impact is much smaller now than it was in the recent past.

In this article we’ll look at some of its numbers from its latest earnings report and the importance of the company diversifying its revenue streams to produce a more consistent performance in the years ahead.

Some of the numbers

Revenue in the third quarter was $1.24 billion, compared to the $1.2 billion in revenue in the third quarter of 2021.

Net income in the reporting period was $165.7 million, or $1.35 per share, compared to net income of $205.4 million, or $1.68 per share in the third quarter of 2021.

Adjusted EBITDA in the third quarter was $405 million, which was flat compared to the third quarter of 2021. Adjusted EBITDA margin in the quarter was 32.5, a little lower than anticipated, primarily from an increase in sales and marketing expenses associated with the strong performance in its non-mortgage businesses.

At the end of the quarter the company had cash and cash equivalents of $241.7 million, with long-term debt of $4.8 billion.

Some of the high debt level comes from the completion of 12 acquisitions in 2021, all of which are generating solid double-digit growth.

Its mortgage performance and outlook

Although I mentioned earlier that EFX is no longer exposed to the mortgage sector in the way it has been in the past, the fact is it’s still part of its business, and as it continues to erode, it’ll, in the near term, have an impact on its performance.

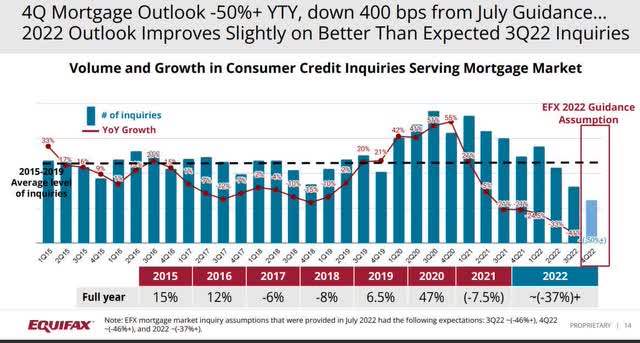

Even with the visibility management had in the mortgage sector, the underperformance was surprising to them, as the rise in interest rates to the highest level since 2008 has the company downwardly revising its fourth quarter expectations for mortgage originations to drop by more than 60 percent.

Consequently, the company expects mortgage revenue to drop by approximately $45 million in the fourth quarter.

It was also noted that as a result of the weak mortgage market, adjusted earnings per share in the fourth quarter of 2022 is projected to drop to somewhere around $33 million, or $0.21 per share.

Again, even though the company is far less exposed to the mortgage market on a percentage of revenue basis, it still will have an impact on its performance until the percentage of revenue from mortgage decreases even more.

Looking ahead, the impact of the mortgage segment will continue to weigh on the company in the next couple of quarters, as interest rates are going to get higher before they level off.

This shouldn’t be considered the major factor when analyzing the company, but I wanted to include the effect on EFX’s performance because it shouldn’t be ignored even as the company continues its transition to compete in a variety of verticals.

Where it can specifically hurt is on the earnings side because mortgage has high margins

Non-mortgage businesses

As mentioned above, non-mortgage business accounted for over 78 percent of revenue in the third quarter, with overall growth of 20 percent and 13 percent of organic growth.

Workforce Solutions led the way here, representing 40 percent of the total non-mortgage revenue and 20 percent of non-mortgage revenue.

USIS B2B non-mortgage was up 5 percent total but came in lower than the company was looking for.

Its International segment grew at a solid 17 percent in constant revenue and 15 percent organically, exceeding expectations for the reporting period.

For all of 2022, the company is guiding for non-mortgage growth to be at about 20 percent. A big part of the company’s strategy in acquisitions is to strengthen its fast-growing Workforce Solutions business, with the company now having acquired 12 businesses since January 2021.

Conclusion

I like what I see in EFX’s strategy, but in the near term there will be some pressure from the declining mortgage business, as well as potential weakness in earnings per share and margins from the high interest rate environment that is going to get worse before it gets better. On the other hand, cloud savings should help mitigate some of that.

In the first half the mortgage business will be a significant headwind, which should alleviate when the Fed stops raising interest rates, which I think is when it reaches around the 5 percent level, or possibly a little higher. I don’t think it will go up much more than that because of how much it’ll cost the U.S. government to pay down the $31 trillion in debt it now has.

So in the near term I’m somewhat bearish on EFX until those headwinds start to subside. Over the longer term though, I’m more bullish on its performance because of not only its successful diversification into other verticals, but because some of those verticals have the potential to grow far into the future.

I tend to think the company will probably take another big dip before finding support. Based upon its share price movement, I’m thinking somewhere around $160.00 per share may be where it’ll level off. I don’t mean by that, that it won’t fall below that mark, but I think once the volatility starts to narrow, that is probably a baseline price to work from once the smoke clears.

The major point to take away from this article is that EFX isn’t primarily in the mortgage business anymore and is far more than a credit agency. That’s take time for the market to get used to, but when investors see this, I think they’re going to start analyzing the company in a different way, and I believe that will, over time, be a positive thing as the company continues to grow non-mortgage revenue as a larger portion of its total revenue.

If it can widen margins while doing so, it’ll be the type of catalyst that could have multi-year tailwinds behind it.

Be the first to comment