Leestat

Thesis

EQT Corporation (NYSE:EQT) reported a robust Q2 card on July 27, which was largely expected, given the strength of natural gas prices in the quarter. Notwithstanding, the company also highlighted its concerns with the recessionary theme in its earnings commentary.

Notwithstanding, Russia’s recent move to curb further natural gas flows through the Nord Stream pipeline also propelled NYMEX natural gas prices to new highs. Consequently, it also lifted the buying upside seen in EQT, as buyers chased the momentum.

However, we believe the time to get out of EQT has arrived once more if investors did not manage to exit at the June highs. Our price action analysis suggests that the market has used the Russian debacle to draw investors into another validated bull trap (indicating the market decisively rejected further buying upside) last week.

Concerns about worsening recessionary fears leading to demand destruction could contribute to headwinds in natural gas prices moving forward. Given EQT’s price trend with natural gas prices, we believe investors should use the opportunity to cut exposure markedly, keeping a small exposure as a hedge.

Therefore, we revise our rating on EQT from Hold to Sell. Buyers keen to leverage Europe’s “energy crisis” should first wait patiently for a deeper retracement to shake out weak hands before adding exposure.

Solid Q2. But, Beware Of Peak Growth In FY22

EQT reported another quarter of solid results, as the company delivered an adjusted operating cash flow of $915M and an adjusted free cash flow (FCF) of $543M. The company also improved its debt reduction cadence by raising its debt reduction target to $2.5B through 2023.

The company reported total debt of $5.04B as of Q2. As a result, the debt reduction program would bring its gross debt down to about $3B. Management also believes that the cycle in natural gas could continue. Coupled with its efficient and profitable operating model, management believes that EQT can continue driving solid returns for investors moving forward. CEO Toby Rice accentuated (edited):

We are the largest producer of natural gas in the US with a multi-decade high-return inventory. We can achieve breakeven pricing of our entire 1,800 core Marcellus inventory with every location generating a 10% or higher return at a natural gas price below $3 per Mcf. We believe this combination of depth and quality of our inventory is unrivaled among peers and gives us significant confidence in our ability to generate strong shareholder returns for as far as the eye can see. We are seeing the reality of a world that is undersupplied with hydrocarbons. And the result is this energy crisis we’re facing today, unnecessarily high energy prices, ramped inflation, war in Ukraine and, by the way, emissions around the world are still rising because without natural gas, people are using more coal than they’ve ever used before. (EQT FQ2’22 earnings call)

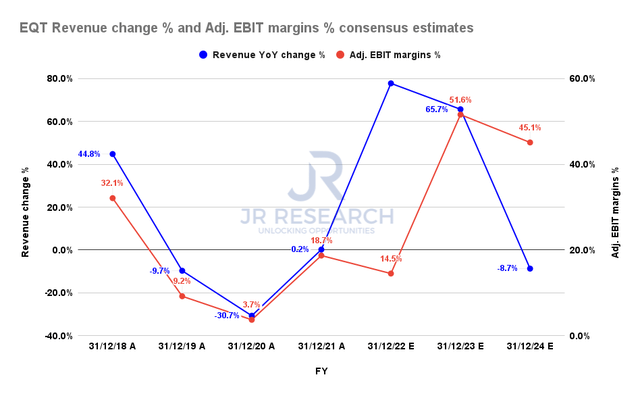

EQT revenue change % and adjusted EBIT margins % consensus estimates (S&P Cap IQ)

Notwithstanding, the consensus estimates (bullish) suggest that EQT’s revenue growth could peak in FY22 before declining to -8.7% YoY in FY24. However, its adjusted EBIT margins are expected to remain robust, even though it’s also projected to fall to 45.1% through FY24.

Does it make sense? We urge investors not to ignore the possibility that the natural gas futures contract pricing is expected to fall to $4.179 by July 2026. Despite deploying hedges to protect against price swings, EQT’s operating results are still susceptible to volatility in the natural gas market. The company also cautioned in its filings (edited):

Our revenue, profitability, future rate of growth, liquidity and financial position depend upon the market prices for natural gas and, to a lesser extent, NGLs and oil. Because our production and reserves predominantly consist of natural gas (approximately 94% of our equivalent proved developed reserves), changes in natural gas prices have significantly greater impact on our financial results than oil prices. (EQT 10-Q)

Furthermore, the company issued cautious commentary regarding worsening macros as a potential recession loomed. Rice articulated (edited):

We saw some early warning signs of recessionary risk, and as such, we temporarily tapped the brakes on our buyback, highlighting that we will remain disciplined on all forms of capital deployment and firmly focused on earning the best risk-adjusted return for our shareholders. As the stock pulled back toward the end of Q2, we started opportunistically retiring our convertible notes, which are trading virtually in parity with our common shares. (EQT earnings call)

Therefore, we believe management sees the potential for a potential fall in its stock price if the recessionary theme plays out. Moreover, given EQT’s significant run-up in 2022, such a possibility cannot be ruled out and is looking increasingly likely. Why?

EQT Formed Another Ominous Bull Trap

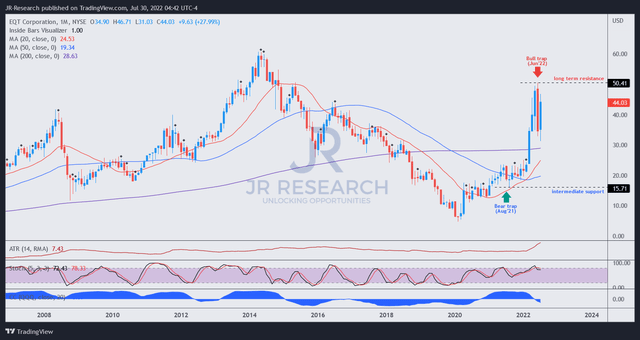

EQT price chart (monthly) (TradingView)

Note the vertical liftoff in EQT in 2022, which formed a bull trap in June 2022. We believe such rapid surges are unsustainable. It also led to a steep sell-off in June before forming a bottom.

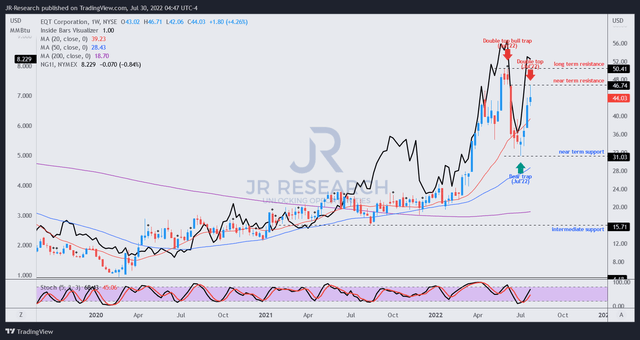

EQT price chart (weekly) (TradingView)

As seen in its medium-term chart, EQT formed another validated bull trap last week (week ending July 29). It attempted to recover all its gains over four weeks, following its medium-term bottom in July.

However, last week’s bull trap has resolved the price action, which is also consistent with the price trend seen in natural gas futures.

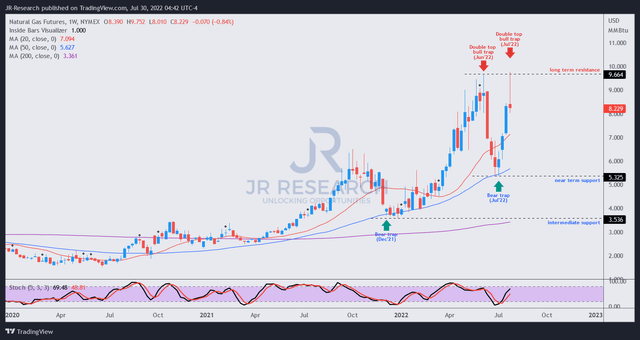

Natural gas futures price chart (weekly) (TradingView)

As seen above, natural gas futures also formed a double top bull trap that was validated. The market has astutely used the escalating energy crisis in Europe to lure in buyers chasing momentum before setting up last week’s rejection of further buying upside.

Therefore, we believe the market has set up another steep fall in natural gas futures moving ahead, which could impact EQT markedly. Accordingly, investors are urged to exercise significant caution at the current levels.

Is EQT Stock A Buy, Sell, Or Hold?

We revise our rating on EQT from Hold to Sell.

We believe the set-up for a steep fall in natural gas futures has been staged, which could markedly impact EQT.

Therefore, we urge investors who missed taking profits in June to leverage the current opportunity to cut exposure significantly.

New investors waiting to add exposure should wait for a steep decline and let EQT find a sustained bottoming process before considering adding.

Be the first to comment