Diy13/iStock via Getty Images

Investment Thesis

EQT (NYSE:EQT) is well positioned for arbitrage between US natural gas prices and prices in Europe.

It appears that with the onset of the cold, investors have been reminded that households will need to turn on the heat in the winter.

Looking out to 2023, EQT is approximately 45% hedged. These hedges have a strike price of $5.65 per mmtbu. That means that at least half of its production is attractively priced.

But what I’m particularly bullish about is the portion of EQT’s unhedged book.

To put it succinctly, there are short-term and medium-term bullish catalysts here.

How Fast Things Are Moving

I wrote my previous EQT article at the end of October. At the time, natural gas prices were sliding lower and lower. With that in mind, the bull case wasn’t as strong as it could have been. After all, despite all my bullish contention, natural gas prices were struggling to find a floor.

Today, natural gas prices are moving higher. Why? Because natural gas prices in Europe have started to move higher. And there’s the expectation that the US will benefit from exporting volumes to Europe.

So, with that in mind, there are two considerations here. In the first case, let’s discuss the obvious.

In winter, households turn on the heat. It’s trite to even mention these considerations as facts. That being said, given that up to a few days ago, the natural gas spot market appeared to have forgotten this ”fact”, I believe it’s my job to remind people of the blatantly obvious.

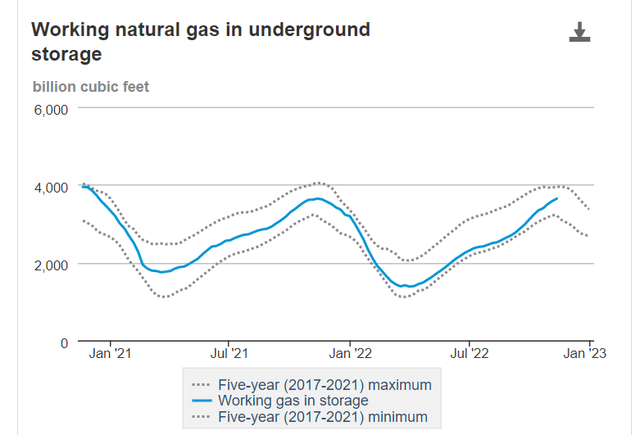

Along these lines, I note that despite all the fears of there being an overabundance of natural gas in the US, as the Freeport LNG is undergoing maintenance repairs, natural gas storage levels are simply average. Again, despite Freeport LNG not reopening yet.

Secondly, and significantly more bullish for the medium-term, it’s the secular growth story at hand.

Once again, we have to keep in mind, that the Freeport LNG facility still has not reopened. It will partially reopen in about two weeks.

That means that although natural gas prices in the US are high right now, even though there’s a ”relative” overabundance of natural gas, given that the other exporting facilities are already at maximum capacity, prices will go higher still into the peak of winter.

Simply put, as soon as the spot market sees that Freeport LNG resumes its exports, I believe that natural gas prices will move higher.

Along these lines, I want to remind readers that Europe’s storage facilities were filled up this summer, allowing countries to get over this winter period. But what happens next winter?

I don’t believe that Germany and other countries will suddenly return to purchase natural gas from Russia. So, starting in early spring, Europe will have to aggressively compete with Asia for LNG imports.

So, starting in early spring, there are going to be countries in Europe and Asia all scrambling for US natural gas, which is around 5x to 6x cheaper, including freight, than what they can get hold of.

And EQT will be one of the top players of natural gas ready to service that demand.

Next, let’s discuss EQT’s valuation.

EQT Stock Valuation — 4x Free Cash Flow

2023 is finally upon us. How many times did I hear in 2022, that 2023 would see natural gas prices turn lower? And up until a few days ago, it didn’t matter how much one postulated over 2023 natural gas prices. The natural gas spot market simply didn’t agree with my bullish point of view.

However, today that’s clearly not the case right now.

EQT is approximately 45% hedged at an average strike price of $5.65 per mmtbu. According to my estimates, EQT is going to make around $3.5 billion of free cash flow next year.

And my conviction continues to increase, as long as natural gas prices remain around $5 per mmbtu or higher.

The Bottom Line

The one blemish in my bull case is this. EQT has just under $5 billion of net debt. Even if that debt isn’t a huge problem for EQT, it is still ”a problem”.

That means that rather than EQT dramatically increasing its base dividend from approximately 1%, it still needs to chip away at its debt for at least another two or three quarters.

Indeed, EQT recently declared that it will raise its debt reduction into year-end from $2.5 billion to $4 billion.

However, for patient investors, paying 4x free cash flow is cheap enough that they can afford to wait around for another few quarters, to see their capital return program ramp up.

Be the first to comment